After the "mishap" with its new NAS product, Ugreen Technology is heading for an IPO

![]() 07/19 2024

07/19 2024

![]() 701

701

Amidst the resurgence of the consumer electronics market, another renowned consumer electronics company is set to debut on the A-share market.

Recently, Shenzhen Ugreen Technology Co., Ltd. (hereinafter referred to as "Ugreen Technology") has opened its subscription period, aiming for a listing on the ChiNext. For this IPO, Ugreen Technology's offering price is set at 21.21 yuan per share, with a total of 41.5 million shares being issued, raising approximately 880 million yuan in total.

According to Pinecone Finance, this does not align with Ugreen Technology's earlier fundraising plan of 1.504 billion yuan.

However, there are currently numerous positive developments for consumer electronics listed companies. The consumer electronics industry is in a recovery momentum. According to Cinda Securities statistics, the consumer electronics sector achieved revenue of 332.29 billion yuan in the first quarter of 2024, an increase of 14% year-on-year; net profit attributable to shareholders was 13.49 billion yuan, an increase of 50% year-on-year. From the data disclosed in the prospectus, Ugreen Technology has closely grasped market demand in the past three years, with steadily improving performance.

So, what factors will influence Ugreen Technology's future market pricing? Can the company continue to grow rapidly?

I. Marketing Pro in 3C Digital Products, Yet a "Mishap" in New Product Promotion

As a company focused on the 3C consumer electronics market, Ugreen Technology has expanded its business boundaries since its inception, with digital cables as its core product. It has formed a diversified 3C digital ecosystem consisting of transmission products, charging products, audio-visual products, mobile peripherals, and storage products.

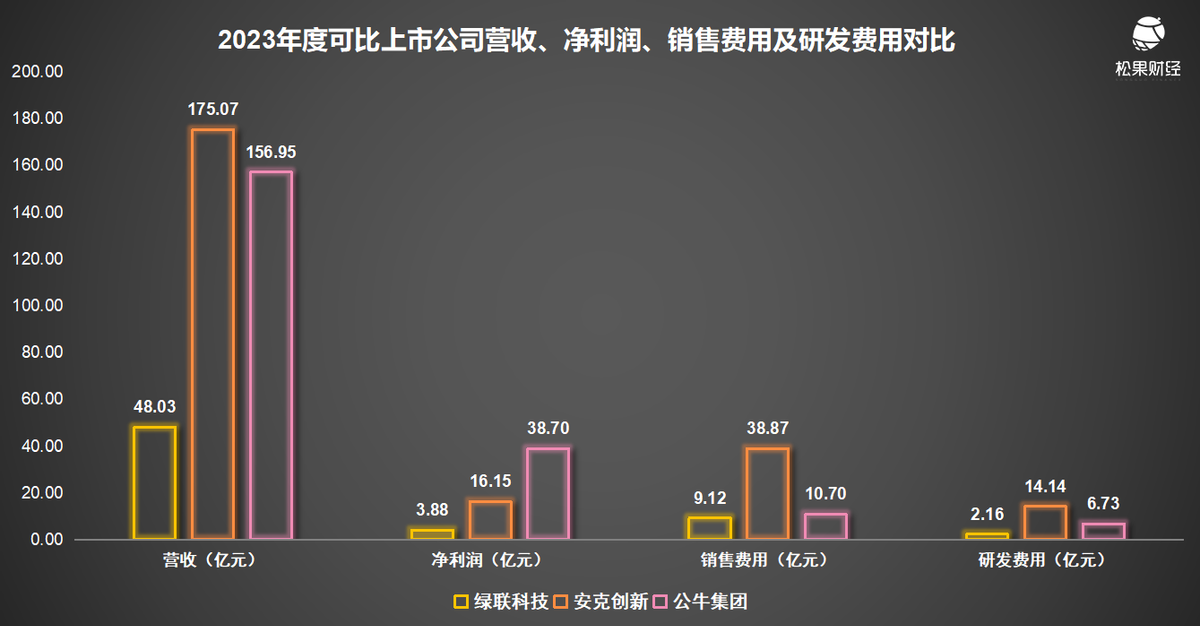

The prospectus shows that from 2021 to 2023, Ugreen Technology's operating revenue was 3.446 billion yuan, 3.839 billion yuan, and 4.803 billion yuan, respectively, with an average annual compound growth rate of 18.05%; net profit attributable to shareholders was 297 million yuan, 327 million yuan, and 388 million yuan, respectively. Compared to the persistent downturn in the consumer electronics market over the past two years, the company has demonstrated good operational resilience.

In the first half of this year, with the arrival of the inflection point in the consumer electronics cycle, Ugreen Technology's management preliminarily estimates that the company's overall performance will continue to maintain a good growth trend.

If we only look at the main operating data, Ugreen Technology is a rapidly growing listed company. A comparison with the two major listed leaders in the industry also proves that the company still has considerable room for improvement in terms of scale, volume, and profitability.

The question is, can Ugreen Technology maintain its upward trend and become a high-quality growth stock?

In this regard, Pinecone Finance has conducted an analysis from aspects such as channel promotion, supply chain model, and scientific research capabilities:

In terms of channels, Ugreen Technology adopts an online sales-driven sales model, primarily selling on globally renowned e-commerce platforms such as Tmall, JD.com, and Amazon. From 2021 to 2023, the revenue generated by the company through online e-commerce platforms accounted for 78.14%, 75.98%, and 74.77% of its main business revenue, respectively. The combined revenue from these six platforms accounted for 98.31%, 97.12%, and 95.96% of the company's online sales revenue, respectively.

It can be said that Ugreen Technology's main business growth prospects are largely dependent on the operation of e-commerce platforms. In the prospectus, the company also stated that it expects to continue using e-commerce platforms as its primary channel for online sales, and that there are related business risks associated with the company's sales activities through these platforms.

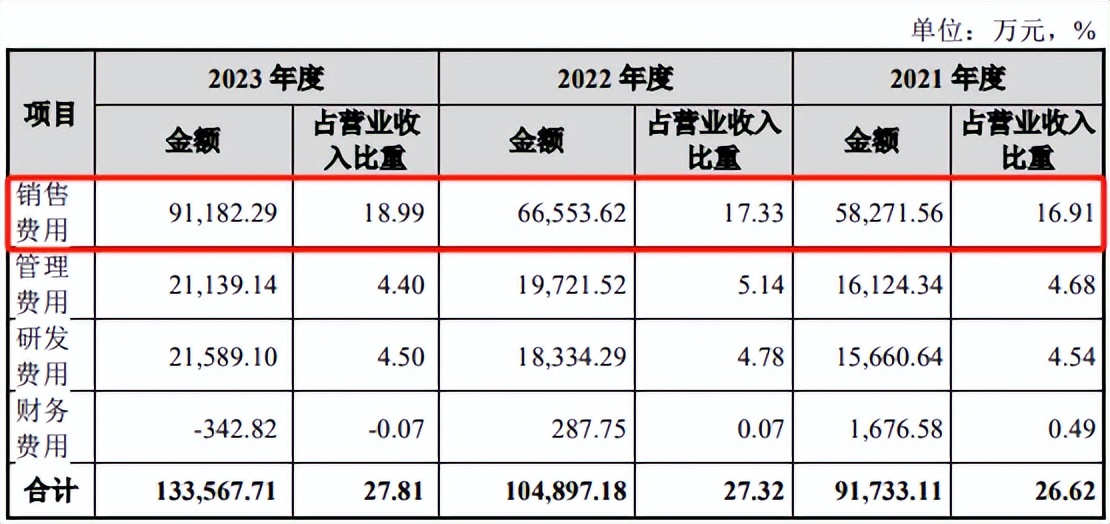

To this end, Ugreen Technology has made great efforts in online channel marketing and promotion. The prospectus shows that the company's sales expenses as a percentage of revenue have increased year by year and are higher than other expense items.

Ugreen Technology's sales expenses mainly consist of platform service fees, promotion fees, and employee compensation. In the past three years, the company has continuously increased its investment in promotion on e-commerce platforms, media advertising online channels, and other scenarios to boost sales growth. The proportion of promotion fees in sales expenses has increased from 35.64% to 39.66%.

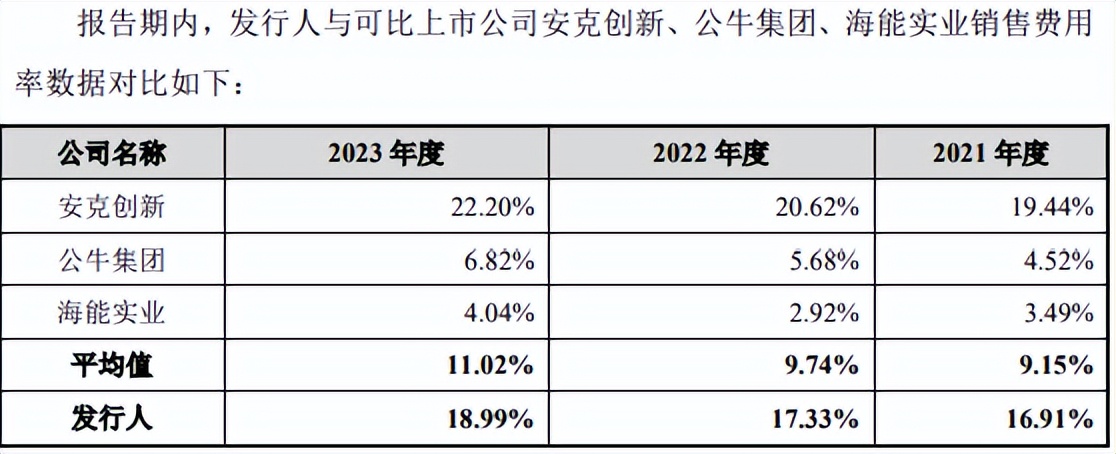

On the other hand, compared to other listed companies in the industry, Ugreen Technology has also demonstrated its emphasis on marketing, with its sales expense ratio far exceeding the industry average.

However, despite attaching great importance to channel promotion and brand building, Ugreen Technology encountered a "mishap" at its own new product launch event.

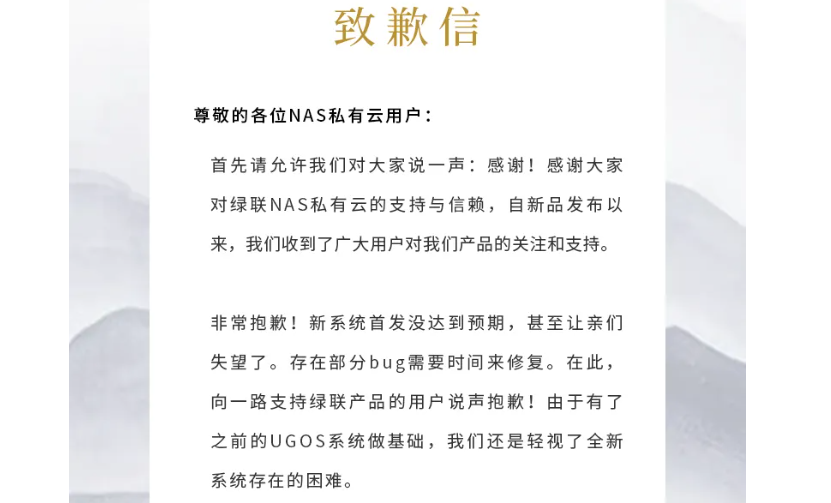

In May this year, Ugreen Technology held a press conference titled "New Generation of Storage Methods · The Future is Here," unveiling its latest DXP series private cloud products and the accompanying UGOS Pro system, attracting significant attention from NAS enthusiasts. However, just three days after the official launch, a large number of users reported that the actual products were severely inconsistent with the parameters and contained numerous "bugs," prompting the company to remove the products from shelves and issue an apology letter.

Image Source: Ugreen Private Cloud

Logically speaking, as a digital brand with years of operation, Ugreen Technology should have conducted rigorous testing before launching its new products, and such a "low-level mistake" should not have occurred. Especially considering that Ugreen Technology relies primarily on outsourced production with supplementary self-production, more resources should have been allocated to technology/product research and development and brand management. According to the prospectus, the company's outsourced production accounted for 75.62%, 76.12%, and 78.31% of total production from 2021 to 2023, respectively, showing a continuous upward trend.

Outsourced production is not a consensus in the industry. Another leading enterprise, Bull Group, relies primarily on self-production based on "market forecasting + safety stock," achieving precise control in the production process and building a safe boundary. In contrast, Ugreen Technology's reliance on outsourced production means that technological innovation and brand management capabilities determine the stability of its operations.

So, why did Ugreen Technology encounter a "mishap" in such an important new product launch?

II. A Strongly Cohesive Management Team and the "Junior College Graduates" Shouldering R&D

The core of business operations lies in people, and the logic of employing talent largely determines the company's underlying character.

After Ugreen Technology opened its IPO, it became the focus of the industry, with many media outlets pointing out its strong family business characteristics. For example, Beiduo Finance mentioned that many core managers of Ugreen Technology have kinship ties with the founder. Zhang Qingsen's sister, Zhang Bijuan, serves as the senior sales service supervisor, while Zhang Bijuan's spouse, Li Qingzhen, serves as the warehousing manager. Zeng Qiuyang, the spouse of supervisor Lei Shubin, is the foreign trade operation supervisor, and these individuals are responsible for Ugreen Technology's after-sales, supply chain, and overseas business sectors.

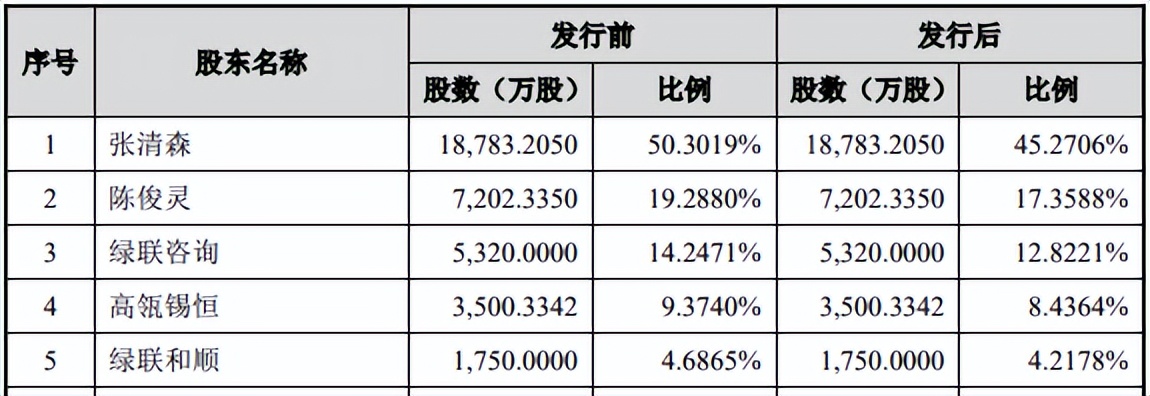

At the same time, Ugreen Technology's management and equity are firmly in the hands of the founding team. According to the prospectus, after the issuance, the founder Zhang Qingsen holds 45.27% of the equity, Chen Junling holds 17.36%, Ugreen Consulting holds 12.82%, and Ugreen Heshun holds 4.22%.

In this regard, some media outlets believe that family-style management is a hindrance to Ugreen Technology's development.

However, in our view, this management model does not necessarily have more disadvantages than advantages. Especially during the company's rapid growth phase, a strongly cohesive management team can facilitate the execution of strategies. Moreover, people are constantly growing. Emperor Liu Bang of Han Dynasty also proved that the talent resources needed for great achievements can sometimes be found among "talented individuals from a single county." Among Liu Bang's founding team in Pei County, Xiao He, Cao Can, Ren Ao, Fan Kui, Zhou Bo, and Guan Ying were once just county officials, jailers, dog meat stall owners, folk musicians, and small silk merchants.

However, in terms of talent utilization, it is crucial to know how to recognize and make the best use of people.

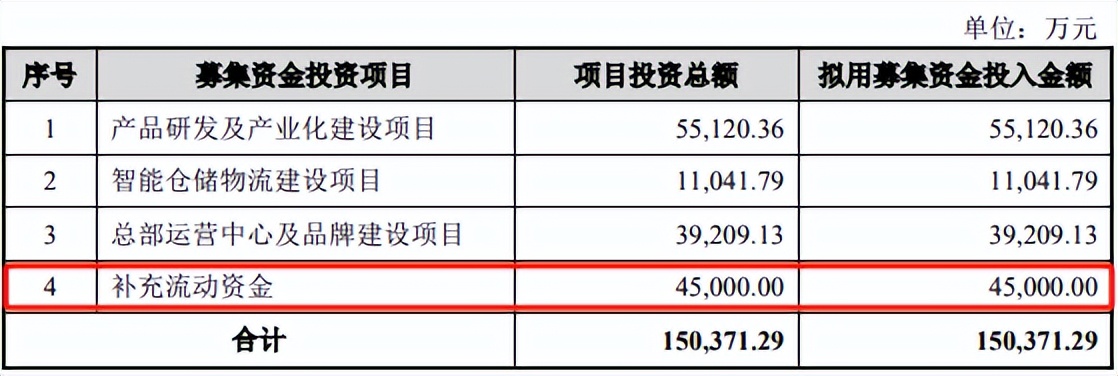

Undoubtedly, Ugreen Technology has a group of managers who prioritize "shareholder returns." It is reported that in the four years leading up to its IPO, Ugreen Technology distributed dividends generously, totaling nearly 400 million yuan, with the dividend amount in 2020 alone accounting for 55.55% of that year's net profit. Subsequently, in the prospectus submitted, the company disclosed its intention to use 450 million yuan of the raised funds to supplement working capital.

While it is reassuring that Ugreen Technology values shareholder returns, the management team should embrace a long-term perspective, driving the company's development with long-term strategic thinking to achieve sustainable shareholder returns.

And the best manifestation of a company's long-termism is its research and development (R&D). From the prospectus, it can be seen that there are certain issues with Ugreen Technology's R&D team building. As of the end of 2023, 49.25% of Ugreen Technology's R&D personnel held a junior college degree or below, close to half of the total team, and among the three core technical personnel, one holds a bachelor's degree and two hold junior college degrees.

While not advocating for a "degree-based" approach, the issues with the DXP series new products may have been foreshadowed. We compared the patent situations of three comparable listed companies:

As of the end of 2023, Bull Group had a cumulative total of 2,686 valid patent authorizations, with invention patents accounting for 22.27%, utility model patents accounting for 47.67%, and design patents accounting for 30.06%, according to Tianyancha's disclosure of patent type distribution;

As of the end of 2023, Anker Innovation had obtained 173 invention patents, 848 utility model patents, and 594 design patents globally;

As of the signing date of the latest prospectus, among Ugreen Technology's over 800 domestic patents and over 700 overseas patents, there were only 17 invention patents, while design patents numbered as high as 1,200.

It is evident that Ugreen Technology's R&D team focuses primarily on design patents, and the quality of its patents needs improvement. This is obviously different from what is mentioned in the prospectus: "The company focuses on product technology research and development, product innovation, and brand management, and collaborates with excellent outsourced factories to provide users with high-quality products with market competitiveness."

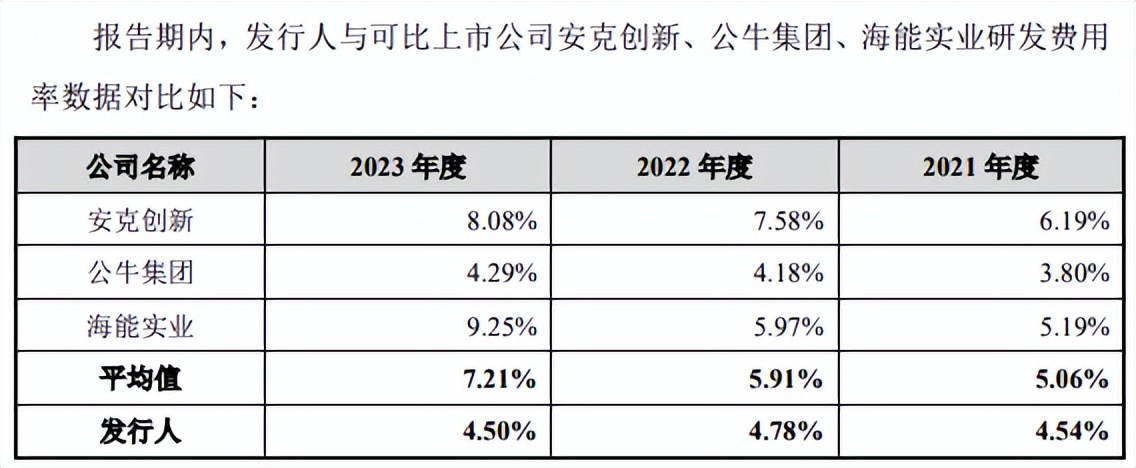

In fact, R&D expenses also reflect this. In the past three years, Ugreen Technology's cumulative R&D investment was approximately 556 million yuan, with annual R&D expenses accounting for 4.54%, 4.78%, and 4.50% of operating revenue, respectively, lower than the industry average.

Obviously, after its IPO, Ugreen Technology needs to pay more attention to R&D team building and investment.

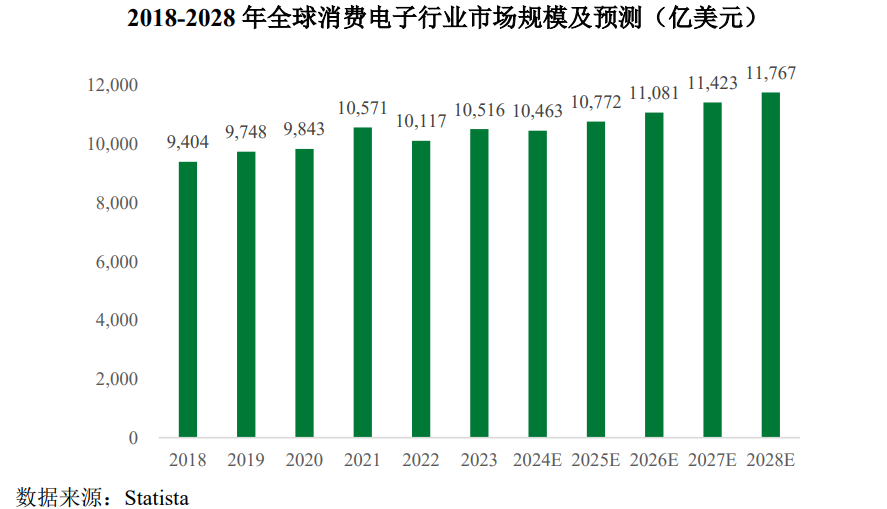

Because a new wave of technological innovation is on the horizon. In recent years, the consumer electronics industry has gradually entered a stage of single-digit growth, and the supply side is looking forward to technological innovation bringing new growth momentum. According to Statista data, the global consumer electronics market size reached 1,051.6 billion US dollars in 2023 and is expected to grow to 1,176.7 billion US dollars by 2028.

At this stage, leading consumer electronics companies are increasing their investments in technological research and development, iterating products towards intelligence (large models), high energy efficiency, and safety. Innovation has become the main theme of the development of the consumer electronics industry. As mentioned in Ugreen Technology's prospectus, brand barriers, technological barriers, scale barriers, talent barriers, and capital barriers are gradually forming, and industry resources are gradually gathering towards consumer electronics leaders with technological innovation capabilities, global operational capabilities, and brand reputation.

After going public, Ugreen Technology must consolidate stronger "research power" and organizational capabilities, continuously explore new innovation points, and avoid a recurrence of the NAS new product incident, in order to navigate the new cycle of consumer electronics steadily and achieve long-term success.

Source: Pinecone Finance