Are young people's "poverty" hidden in Bilibili's commercialization?

![]() 07/22 2024

07/22 2024

![]() 490

490

When Alibaba turned a profit, Bilibili didn't panic because it hadn't even been born yet;

When Douyin became profitable, Bilibili still remained calm, as anime and games were still entertaining at that time;

But when news of "text-based Bilibili" Xiaohongshu's profitability arrived, Bilibili finally got anxious!

Not only because its valuation has lagged behind by nearly $10 billion, but also because it seems that only a handful of leading internet companies, including Bilibili, have yet to figure out the path to profitability...

Thus, Chen Rui, Chairman and CEO of Bilibili, had no choice but to issue a military order: Bilibili is confident in achieving positive adjusted operating profit and starting to make a profit in the third quarter of 2024.

However, soon after, a bad news and a good news arrived.

The bad news is that in the first quarter of this year, Bilibili lost money again, and the loss was even greater than the same period in 2023.

The good news is that in June, the once "drag" of a game business seemed to have produced a new hit, promising a "turnaround." Coupled with the battle for traffic among e-commerce platforms during this year's 618 shopping festival, the possibility of Bilibili turning around its losses into profits in the third quarter is quite high.

But on the other hand, if Bilibili truly profits based on this, doesn't it seem a bit like relying on luck? Is there any long-term certainty for investors?

All the questions seem to come back to the logic of Bilibili's commercialization and profit model.

Uncertain games, mixed blessings in advertising

Currently, there are two main points of anticipation for Bilibili's commercialization and turnaround:

The first is the once fundamental business – games. The reason it's valued is that as long as a company can launch a hit game, it can enjoy the benefits for years. Like Bilibili, which is still reaping the rewards from its exclusive agency of "Fate/Grand Order" and "Azure Lane" from 8 years ago.

But even so, from a long-term investment perspective, I think this is too unpredictable. No one knows when the next hit game will come. Moreover, judging from the past, Bilibili and its management's obsession with the "anime" game style has somewhat limited their potential.

For example, at the end of 2022, Chairman Chen Rui personally took over Bilibili's game business, seemingly poised for a big push.

And the result? The 7 games released by Bilibili in the second half of 2023 were essentially all failures, with the "station-wide hope" "Shining! Uma Musume Pretty Derby" being pulled from public beta after just 9 days. Corresponding game business revenue also declined for multiple consecutive quarters, with the revenue share in the first quarter of this year dropping to just 17%!

But unexpectedly, after shedding the anime youth label, a recent SLG (strategy game) launched by Bilibili – "Three Kingdoms: The Art of War" – showed signs of being a hit. According to media data, since its launch, "Three Kingdoms: The Art of War" has generated over RMB 250 million in revenue on the IOS platform alone.

But that said, although "Three Kingdoms: The Art of War" has successfully climbed the charts, whether it can maintain its popularity like "Fate/Grand Order" remains to be seen. After all, on the crowded SLG track, there have been too many games that collapsed halfway. For instance, "Sanguo Zhizhi: Chess Edition," which debuted at fifth place on the iOS bestseller list in 2023, fell out of the top 100 a year later...

In conclusion, Bilibili now essentially has only one sector with certain growth potential and astonishing imagination – the advertising business, more specifically, e-commerce and live streaming sales.

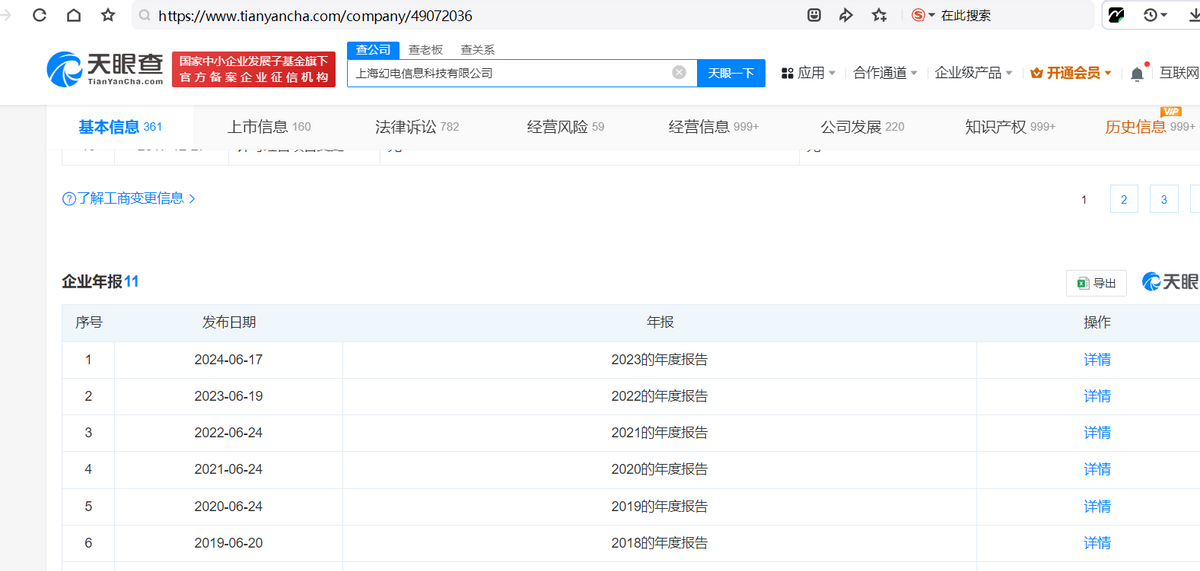

According to Tianyancha APP, in the first quarter of this year, Bilibili's advertising revenue was RMB 1.67 billion, a year-on-year increase of 31%, with games, digital appliances, e-commerce platforms, automobiles, and beauty being the top five vertical business areas.

Focusing on Bilibili's e-commerce, unlike the closed-loop e-commerce platforms of Taobao and Douyin, Bilibili pursues an "open-loop" e-commerce strategy. Simply put, instead of building its own supply chain to sell products, Bilibili opens up its content ecosystem traffic to top e-commerce platforms, helping Taobao and JD.com attract traffic and sell products.

So essentially, this is "selling traffic," making Bilibili proactively become the second advertising department of Taobao and JD.com.

And to sell more traffic, Bilibili not only included Vipshop, Depp, and Xianyu in its cooperation landscape but also began to focus on live streaming sales, allowing UP masters to broadcast on Bilibili with direct links to Taobao for purchases.

The advantage of this e-commerce advertising model lies in two aspects: firstly, the input cost is low, leading to high-quality advertising revenue for Bilibili; secondly, content-wise, due to the strong professional advantages of many Bilibili UP masters' content, theoretically, everyone can become the second "Dong Yuhui" of content-based live streaming sales. Even if not a top UP master, as long as the content is vertical and professional, there's still a chance to generate impressive GMV.

But the disadvantages are also evident: one is the old problem of the contradiction between commercial monetization and platform content ecology.

Bilibili's core competitiveness lies in its unique community culture and user stickiness, consisting of a group of young people pursuing individualized expression. Do young people like watching ads? The answer is self-evident. Therefore, the platform and UP masters must consider the risk of various e-commerce ads potentially causing反感 among users and fans, leading to the loss of core users.

The second is that for UP masters, creating video content and live streaming sales are two completely different forms of expression. Bilibili UP masters skilled in content creation may not necessarily be suited for live streaming sales. This can be seen from the sporadic live streaming frequencies of top 100 UP masters like "DaoYueShe."

Moreover, even if UP masters are willing to step out of their video sales comfort zone and choose live streaming sales, since the platform itself does not control the supply chain and is barely involved in the entire live streaming sales process, it relies solely on UP masters to negotiate prices, quality control, and after-sales with brand parties, which poses a high market threshold.

For instance, in April this year, during a live streaming sales event by a Bilibili UP master, it was discovered that the discount coupon for the Hince blue cushion could also be used on the official link, and using it on the official link would result in an additional sample. The double-ended lip gloss in the live stream was also priced higher than on the official link. Upon being reminded by fans, the UP master posted a response on their personal account, stating that they had engaged in a verbal spat with the brand and Bilibili.

It's clear that there are too many uncertainties in Bilibili's live streaming sales, easily eroding fans' trust in UP masters unknowingly. So even though Bilibili is now pushing live streaming sales, it's foreseeable that top UP masters' enthusiasm for sales remains low...

Bilibili, caught between idealism and realism

In fact, not only are UP masters observing live streaming sales, but Bilibili itself seems to have some reservations.

Even from a practical perspective, it seems that Bilibili hasn't yet reached the stage of deciding whether or not to excel in live streaming sales, but is still stuck on whether to do it and how much effort to put into it.

If you don't believe me, open Bilibili now, and the only thing related to e-commerce sales on the homepage is a small number of IP derivatives and other "Member Purchases."

Regular video e-commerce sales are mostly interspersed within content videos, with shopping links pinned at the top of the comment section.

As for live streaming sales, there are only two secondary entries under the "Shopping" tag, which is the last entry under the primary live streaming entry. But when you click in, it's not purely live streaming sales, but more entertainment-oriented live streams.

In other words, Bilibili's live streaming sales still occur within UP masters' private domains, following a blogger-centric fan economy route, without a dedicated new public display platform.

Yet last year, Bilibili announced the integration of multiple teams to form a new first-level department, the Transaction Ecosystem Center, directly overseen by Vice Chairman and COO Li Ni. This decision was interpreted by outsiders as a further elevation of Bilibili's e-commerce status.

However, at the same time, the weak e-commerce infrastructure has even led Mr. Mi Deng, a home furnishing UP master who generated RMB 3.3 billion in GMV last year, to express that due to the overall underdeveloped ecosystem, Bilibili is lacking in terms of supply sources, service agencies, and even the internal drive of UP masters themselves...

In a nutshell, while seemingly hesitant about e-commerce and live streaming sales, strategically, Bilibili is impatient, yet practically, it has been slow to increase investments.

The root cause of this complex contradiction in Bilibili's performance likely stems from hesitation in balancing platform content quality and commercial atmosphere, or being stuck in the divide between past ideals and present realism.

In fact, regarding this issue, I believe Bilibili is overly concerned.

It's important to note that when Bilibili transformed from an initial anime community into a comprehensive content platform and was accepted, it proved that Bilibili's users were also growing, expanding their interests, and becoming more tolerant of many changes on the platform.

Yet Bilibili's perception of users seems to be stuck in the era when it actively abandoned pre-roll ads to retain core users, giving up a stable cash flow source and setting the "may close down but will not compromise" ancestral rule.

But it's crucial to understand that even ignoring annoying redirect ads, the current mainstream in-video ads by Bilibili UP masters are hardly any better, if not worse, than pre-roll ads.

After all, who wouldn't get annoyed when watching an intense movie commentary by an UP master and suddenly a 30-second ad for an eye massager or a used phone pops up?

Interestingly, despite the numerous complaints about in-video ads, judging from Bilibili's continuously growing user base in recent years, everyone seems to be adjusting and accepting them. In the first quarter of this year, Bilibili's monthly active users reached a new high of 341.5 million, an 8% year-on-year increase.

In other words, in the face of commercialization, only Bilibili is still holding onto the veil of pre-roll ads while exposing other parts.

Yet users, it seems, are no longer as sensitive. As long as useful and good content is provided, ads are not unacceptable.

This also reminds me of KuGou Music, where users can listen to half an hour of premium songs by watching a 15-second ad.

From the user's perspective, is it a loss? Definitely not.

Similarly, the same applies to Bilibili. The quality of UP masters' content is related to the platform's commercialization level, but not to a great extent.

As long as Bilibili can ensure high-quality content output, and only high-quality content can secure ads, then perhaps its commercialization level can be pushed further ahead...