The Fed's Interest Rate Cut on the Agenda: Can Bilibili Repeat Its Capital Miracles of the Past?

![]() 07/24 2024

07/24 2024

![]() 636

636

As inflation data in the US continues to decline, interest rate cuts are gradually being added to the Fed's agenda. Some friends around me have come up with the following logic:

1) The Fed's interest rate cut is equivalent to reducing financing costs and alleviating market liquidity pressure;

2) When liquidity improves, it will also synchronize changes in market risk appetite, and the market will re-screen companies;

3) Following this logic, the bull stocks from the Fed's quantitative easing four years ago will "shake up" again;

4) Among Chinese companies listed overseas, Bilibili's market value swelled by over 10 times during the last round of unlimited quantitative easing. If the interest rate cut cycle arrives, it will undoubtedly be a major positive for Bilibili.

For financial beginners, the above logical chain is undoubtedly correct and self-consistent. However, if one takes an extra step and considers: Is Bilibili today qualitatively the same as Bilibili four years ago? Many friends will become confused. Using past market trends to measure today's enterprises is akin to marking a boat to find a lost sword.

In this article, we will take Bilibili as an example to sort out the company's transformation journey over the past four years, providing a more objective judgment on enterprises during interest rate cut cycles:

First, from a commercial model and operational efficiency perspective, Bilibili today is clearly a different company from four years ago;

Second, over the past four years, Bilibili has completed the entire transformation process from gaming to value-added services and then to advertising, transitioning from aggressive expansion to prudence, which is no easy feat;

Third, despite improvements in operational efficiency, it will be difficult for Bilibili to replicate its previous capital market miracle after the Fed's interest rate cut.

The Long Video Path Isn't Viable

Distinct from other UGC platforms, Bilibili started with anime content, which is relatively niche. It then began to expand around various topics of interest to younger generations (entertainment, sports, games, etc.), forming a video platform with a unique culture.

At this time, industry insiders generally compared it to YouTube, believing that its distinct content attributes would build a solid moat, leading to a bright future.

However, this comparison overlooked two crucial details:

1) At that time, Bilibili was still a niche platform for post-90s and post-00s generations, while YouTube across the ocean was a mass platform. The ceiling for the former was almost within reach;

2) Bilibili's initial business model was primarily gaming, followed by the introduction of live streaming, with advertising accounting for a relatively low proportion, which is significantly different from YouTube.

The core audience is not mass, and the business model is not attractive. If Bilibili wants to live up to the title of China's YouTube, it must first address its over-reliance on its core community and break out of its niche.

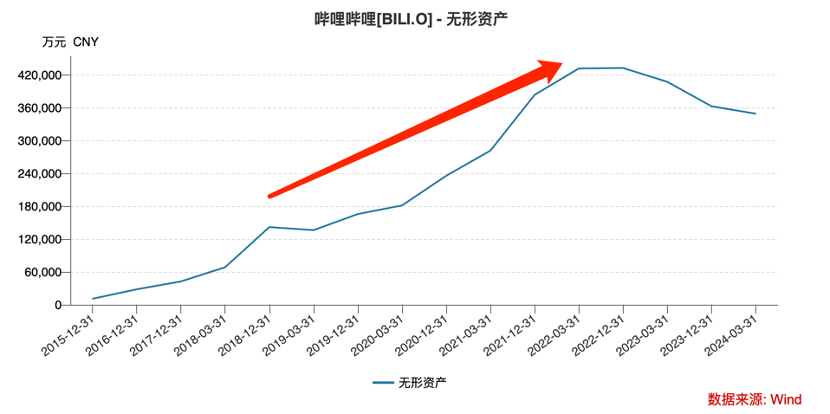

After completing its IPO in the US in 2018, Bilibili made up its mind to break out of its niche, and its intangible assets rapidly expanded. After 2020, the slope of the above graph steepened significantly, and copyright purchases began to "leap forward."

It's worth noting that at this time, Bilibili's reference point had shifted from YouTube to long-video platforms such as the established "iQIYI, Tencent Video, and Youku" in China. The company began to purchase a large number of film and television copyrights, securing first-run rights to major films like "Dune," "James Bond: No Time to Die," and "Once Upon a Time in Hollywood" (at a higher acquisition cost).

The reason why "iQIYI, Tencent Video, and Youku" were so enthusiastic about purchasing copyrights before was that their positioning as "players" made copyrights an absolute condition for acquiring users. At the same time, copyright costs were shared through membership fees and advertising, but as long-video enterprises competed to drive up film and television copyright prices (also fueling the film and television industry bubble), both advertising and membership income struggled to cover costs, and industry losses became the norm.

In contrast, Bilibili's aggressive breakout moves posed significant challenges to its income statement. In Q2 2023, its paid memberships just surpassed 20 million, while iQIYI's long-video paid memberships had already exceeded 100 million. It would be quite difficult for Bilibili to profit from a model already proven in long-video.

Moreover, Bilibili's primary business model at that time was gaming, distinguishing it from mainstream long-video platforms. Generally speaking, the latter still focused on "traffic business," attracting users with content and distributing traffic through advertising and membership mechanisms, earning the price difference in traffic. In a gaming-centric business path, while the number of users is directly related to revenue, considering the process includes user downloads, paid recharges, etc., it has drawbacks such as long cash conversion cycles. Coupled with the gaming industry's low point at that time, the pace of game development slowed, further elongating the entire chain.

This requires Bilibili to re-examine its business model, reduce the weight of gaming, and improve cash conversion quality.

Taking 2020 as the dividing line, before that, Bilibili was an unapologetic gaming company that acquired users through content. Afterward, it adjusted its business strategy, increasing the proportion of value-added services and advertising, especially the former, which supported almost half of the company's revenue over the past three years (primarily from live streaming tips and paid memberships).

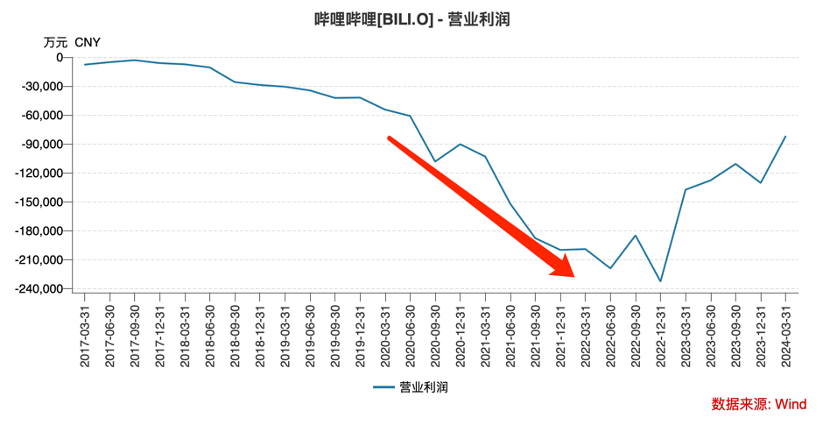

However, this still failed to fundamentally address the balance between copyright expansion, breaking out of its niche, and the income statement. Bilibili's operating losses peaked in 2022. Although the growth of value-added revenue filled the void left by declining gaming revenue, it did not fundamentally improve the company's operational quality.

Since 2018, Bilibili has been striving to prove that it is a unique enterprise with strong growth potential, maintaining over 50% year-on-year growth in total revenue. In the liquidity-flooded year of 2020, this hit the market's sweet spot, with funds pouring into high-growth potential enterprises, creating a market legend.

However, when we set aside the capital market and observe from an efficiency perspective, we find that Bilibili harbors various crises internally. Therefore, after the Fed raised interest rates in 2022, Bilibili's capital market miracle came to an end.

Focusing on Short Videos, Advertising Finds a New Outlet

The preceding text briefly outlined Bilibili before 2022. Next, let's return to the opening question: If market liquidity improves again, can Bilibili repeat its miracles?

If Bilibili before 2022 expanded by benchmarking YouTube and iQIYI, Tencent Video, and Youku, hoping to tell the market a growth story, investing in copyrights to increase content richness was the only choice.

Then, after 2022, Bilibili began to "shed its long robe" and rediscover its original aspirations.

After 2022, Bilibili implemented a series of drastic reforms internally, cutting costs in gaming, OGV (professionally produced videos), and film and television copyrights, eliminating redundant and inefficient businesses, and bidding farewell to the rapid expansion of intangible assets.

So how to address growth issues? Management refocused on advertising.

Previously, considering factors such as user experience, Bilibili took a very conservative approach to advertising (Chen Rui even stated that the platform would not introduce pre-roll ads), and relying on UP masters and long videos for advertising incremental space was clearly limited.

Short-video feed ads emerged as the answer. In 2021, Bilibili launched its Story-Mode, officially entering the short-video sector.

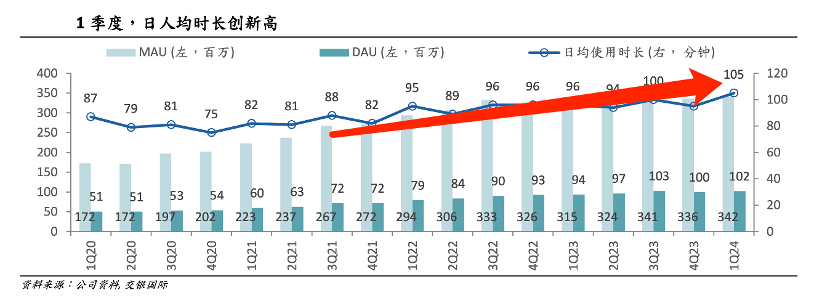

Highly immersive short videos have stronger user stickiness, leading to accelerated growth in Bilibili's average user time after 2021.

In the preceding text, we briefly commented on some constraints in Bilibili's business model exploration (such as the contradiction between user experience and advertising revenue), forcing the platform to move towards long-chain gaming and live streaming businesses, far less agile than other platforms focused on selling traffic, which also limited the company's operational efficiency.

Short videos are different. Their advertising presentation has minimal impact on user experience (roughly one ad every 7-8 short videos) and can motivate UP masters through short videos. There have been frequent rumors of UP masters leaving Bilibili.

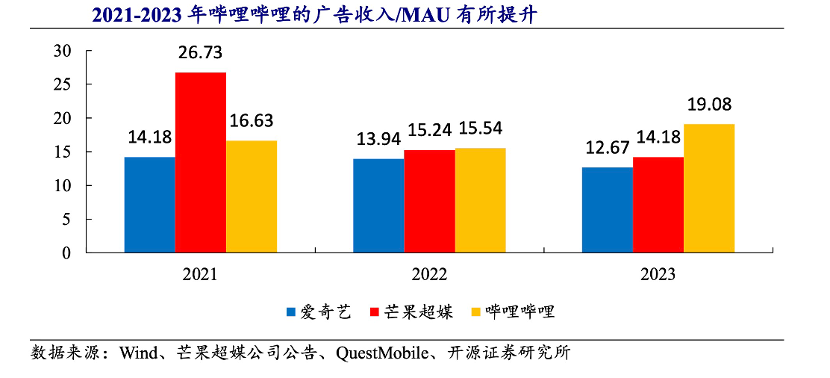

Short videos drive total user time and open up new advertising inventory, leading to a sharp increase in the platform's advertising monetization efficiency. In 2023, Bilibili's advertising ARPU significantly surpassed that of iQIYI and Mango TV, with advertising revenue reaching 1.669 billion yuan in Q1 2024, a year-on-year increase of 31%.

At this point, Bilibili has effectively transitioned to a traffic-selling business, no longer a content or gaming company as before.

Many may dismiss advertising as a business that impacts experience and is primitive. Innovators at home and abroad have tried to disrupt the advertising business, such as Netflix's paid viewing and China's knowledge paywalls, hoping to break the path dependence on advertising and charge users directly. However, Netflix has since abandoned its ad-supported tier, and knowledge paywalls are no longer popular. Only the advertising business endures.

Perhaps Bilibili's management was initially uninterested in advertising, but from a business model perspective, it is indeed one of the easiest, most efficient, and fastest-growing industries (compared to advertiser-paid memberships, which are much harder to acquire). Precisely this business supported Bilibili through its toughest times.

Having analyzed this far, we understand that today's Bilibili is almost like a different company from four years ago. The company has completed its transformation from gaming to value-added services and then to advertising, although the first two businesses are still operational (the first SLG game "Three Kingdoms: Strategy Under Heaven" has also achieved good results). However, the trend of increasing advertising weight is certain.

So, what impact will the Fed's interest rate cut have on Bilibili?

First, an interest rate cut is undoubtedly positive for a company's market value. Changes in liquidity facilitate the market's reassessment of investment targets, and Bilibili's previous transformations can "fetch a good price";

Second, hoping that Bilibili can repeat its capital market miracles will be in vain;

In 2020, Bilibili raised market expectations for its future growth by "paying tribute to long videos." Bulls believed that the collision between the platform's unique culture and long videos would create a hybrid of Netflix and YouTube, offering many opportunities despite risks. However, after discovering that this path was unfeasible, despite Bilibili's improving operational efficiency, the market remained indifferent, primarily because "expectations" were no longer present.

Since the advertising industry is highly mature, the correspondence between the number of users, their time spent, and revenue is clear. Bilibili now operates within market expectations, leading to more cautious pricing. It's crucial to understand: In an easy monetary policy environment, the market is generous in pricing unknown and potentially high-growth enterprises but relatively conservative in pricing certain enterprises (with lower P/E ratios, etc.);

Third, Bilibili should not overly concern itself with market performance but consider:

1) The issue of differentiated operation in short videos, deviating from the rhythm of "Douyin and Kuaishou";

2) Maintaining a prudent attitude and avoiding expansion after times get easier.