Chengdian Guangxin Submits Registration: High Customer Concentration

![]() 07/25 2024

07/25 2024

![]() 439

439

Bay Harbor Business Observer - Shi Zifu and Wang Lu

On June 17, Chengdu Chengdian Guangxin Technology Co., Ltd. (hereinafter referred to as Chengdian Guangxin) passed its IPO review. On July 23, Chengdian Guangxin submitted its registration draft, indicating that the company is one step closer to being listed on the Beijing Stock Exchange.

Chengdian Guangxin's main business involves the research and development, production, and sales of network bus products and special display products, which are currently primarily applied in the national defense and military industries. As of the end of the reporting period, the company held 30 invention patents and several utility model and design patents.

01

Strong Business Growth with High Customer Concentration

From 2021 to 2023 (during the reporting period), the company's operating revenues were 121 million yuan, 169 million yuan, and 216 million yuan, respectively, with net profits attributable to shareholders of 20.8714 million yuan, 33.6216 million yuan, and 45.0447 million yuan, respectively.

From January to March 2024, Chengdian Guangxin achieved operating revenue of 77.686 million yuan, an increase of 591.31% year-on-year. The net profit attributable to the parent company's owners was 18.9128 million yuan, up 1461.87% year-on-year. After deducting non-recurring gains and losses, the net profit attributable to the parent company's owners was 18.1495 million yuan, an increase of 738.37% year-on-year. The company's performance improved significantly, mainly due to increased demand and the delivery of LED dome projection systems.

The company forecasts its operating revenue, net profit, and net profit after deducting non-recurring gains and losses attributable to the parent company's owners for 2024 to be 271 million yuan, 51.4457 million yuan, and 50.7073 million yuan, respectively, representing increases of 25.52%, 14.21%, and 20.52% year-on-year.

During the reporting period, the company's main business gross margins were 45.91%, 44.53%, and 50.40%, respectively. The comprehensive gross margin remained relatively stable in 2021 and 2022, while the comprehensive gross margin in 2023 increased by 5.87 percentage points year-on-year, primarily due to the increase in gross margin for network bus products. Special display products and network bus products are the main sources of the company's gross profit, and changes in their gross margins and sales structures significantly impact the company's overall gross margin.

Among the risk factors, Chengdian Guangxin reminds that during the reporting period, the company's major customers were subsidiaries of large domestic state-owned enterprises such as AVIC, CSSC, and CETC. The top five customers accounted for 98.07%, 97.08%, and 95.77% of the company's operating revenue, with the largest customer, a subsidiary of AVIC, accounting for 79.83%, 78.25%, and 85.42%, respectively. The A1 unit of AVIC accounted for 65.42%, 57.86%, and 53.92%, respectively. The company faces the risk of high customer concentration. The company's products are primarily used as supporting components for its customers' products, and adjustments to their product directions, changes in demand, and internal management changes may affect the progress and scale of their procurement of the company's products. Given the company's concentrated customer base, significant changes in procurement progress or scale by key customers could significantly impact the company's performance.

Additionally, currently, there are no A-share listed companies whose main business involves the research and development, production, and sales of network bus and special display products. When selecting comparable companies, the company has fully considered their financial and business comparability, primarily selecting listed companies in the electronic information sector with similar products. However, there are still varying degrees of differences between the company and relevant companies in terms of product usage and specific segments. Therefore, some business information and financial indicators in the company's prospectus are less comparable to those of relevant companies, and investors may not be able to accurately assess the company's position in the industry through comparisons within the same industry, which may affect investors' accurate judgment of the company's value.

02

Negative Cash Flow, Warned Three Times Last Year for Self-Discipline Supervision

It is worth noting that at the end of each reporting period, the company's accounts receivable book values were 31.7596 million yuan, 55.8127 million yuan, and 125 million yuan, respectively, with accounts receivable turnover rates of 4.52, 3.86, and 2.39, respectively. The company's inventory book values were 65.1441 million yuan, 85.2485 million yuan, and 112 million yuan, accounting for 40.39%, 41.97%, and 38.37% of total current assets at the end of each period, respectively, with inventory turnover rates of 1.28, 1.25, and 1.08, respectively.

During the same period, Chengdian Guangxin's net cash flow from operating activities was 7.3189 million yuan, -13.8444 million yuan, and -27.8630 million yuan, respectively. The company stated that the negative cash flow from operating activities in multiple periods was primarily due to large procurement and inventory amounts, high inventory capital occupation, and increasing accounts receivable balances. The company's downstream customers are primarily subsidiaries of large domestic state-owned enterprises with good operating conditions. The company targets a one-year credit management period for accounts receivable and accepts payment terms proposed by customers based on different contracts. As the company's operating revenue increases, its accounts receivable balances continue to rise. Due to the company's relatively weak position in the industry, its collection methods are limited, adversely affecting its operating cash flow.

Although Chengdian Guangxin has not yet listed on the Beijing Stock Exchange, its executives have been subject to multiple self-discipline supervision measures in recent years while listed on the New Third Board.

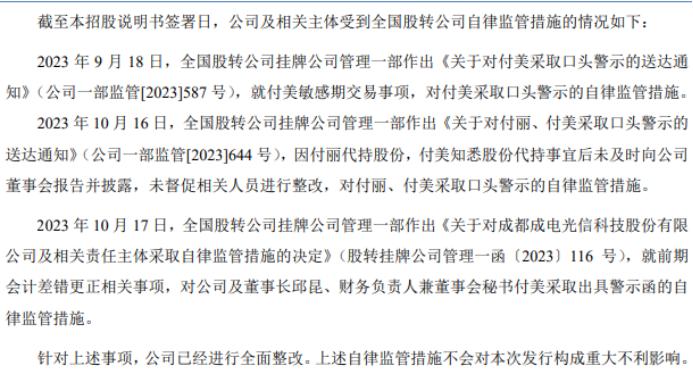

On September 18, 2023, the Listing Company Management Department of the National Equities Exchange and Quotations issued a "Notice of Oral Warning to Fu Mei" regarding her sensitive period trading matters.

On October 16, 2023, the Listing Company Management Department of the National Equities Exchange and Quotations issued a "Notice of Oral Warning to Fu Li and Fu Mei" due to Fu Li's shareholding on behalf of others, and Fu Mei's failure to promptly report and disclose this matter to the company's board of directors and urge relevant personnel to rectify, resulting in oral warning self-discipline supervision measures against Fu Li and Fu Mei.

On October 17, 2023, the Listing Company Management Department of the National Equities Exchange and Quotations issued a "Decision on Taking Self-Discipline Supervision Measures against Chengdu Chengdian Guangxin Technology Co., Ltd. and Relevant Responsible Entities" regarding previous accounting error corrections, imposing self-discipline supervision measures of issuing warning letters against the company and its chairman Qiu Kun, as well as its financial officer and board secretary Fu Mei.

The prospectus also shows that Chengdian Guangxin has no controlling shareholder, and its actual controllers are Qiu Kun, Xie Jun, and Fu Mei. Among them, Qiu Kun directly holds 10.8784 million shares, accounting for 20.46% of the company's total pre-IPO share capital; Xie Jun directly holds 7.1645 million shares, accounting for 13.47%; and Fu Mei directly holds 6.6963 million shares, accounting for 12.59%. The three have further consolidated their joint control over the company by signing the "Unanimous Action Agreement," its supplementary agreement, and the second supplementary agreement, collectively controlling 46.53% of the company's pre-IPO share capital. After this issuance, the proportion of shares controlled by these three actual controllers will further decrease.

It is understood that Chengdian Guangxin plans to raise 150 million yuan, of which 40.7489 million yuan will be used for the FC network bus and LED dome projection industrialization project, 47.0036 million yuan for the headquarters building and R&D center project, and 62.2475 million yuan for supplementary working capital.