In the wave of digitization, why have seasoned software "veterans" fallen on hard times?

![]() 07/25 2024

07/25 2024

![]() 499

499

Neusoft Group, once hailed as the "elder brother" of the domestic software industry, this enterprise that started with software outsourcing and created "firsts" in multiple fields, has struggled in recent years on the path of growth, sinking into a "quagmire" of sluggish growth from which it is difficult to extricate itself.

In recent years, Neusoft Group has continuously adjusted its business structure, hoping to rejuvenate itself through business transformation and spin-offs and listings. However, judging from the current results, these efforts have yet to fundamentally reverse the decline in operations, and performance in the capital market remains sluggish.

As it moves out of Liaoning and sets up in the Wuhan Industrial Park, will Neusoft Group's future withstand the test of the market and time?

Growth Dilemma

Neusoft Group, once a leader in China's software industry, is now mired in sluggish growth, with financial performance far from optimistic.

Neusoft Group's financial reports show that from 2019 to 2023, the company's operating revenue fluctuated from 7.6 billion yuan to 10.5 billion yuan, demonstrating a certain ability to expand its market.

However, in stark contrast to the revenue growth, the company's net profit performance is worrying, especially the deducted net profit. From 2019 to 2023, except for a slight profit in 2021, the company incurred losses in all other years.

Especially in 2022, Neusoft Group's deducted net loss reached 530 million yuan. In 2023, the deducted net loss was still 147 million yuan. In the first quarter of 2024, the deducted net loss was 8.67 million yuan. The continuous downturn in deducted net profit reflects the relatively weak profitability of the company's main business.

Government subsidies have to some extent become a "crutch" for Neusoft Group to support its performance. In 2023, the company received 167 million yuan in government subsidies, an increase from 2022, plus tax incentives totaling 273 million yuan. This to some extent masks the company's actual profitability, so over-reliance on government subsidies is not a long-term solution for healthy corporate development.

At the same time, Neusoft Group's accounts receivable and notes receivable balances remain high, reaching 1.801 billion yuan at the end of 2023, with bad debt amounting to 286 million yuan, highlighting potential cash flow risks.

In addition, inventory balances have continued to remain high, reaching 5.155 billion yuan at the end of 2023, accounting for 54.08% of the company's net assets. The provision for inventory depreciation amounted to 208 million yuan, of which the provision for contract fulfillment cost depreciation was as high as 170 million yuan, indicating inadequacies in cost control and risk management during contract execution.

Since 2015, Neusoft Group's share price has continued to decline, with its market value evaporating by more than 75%, reflecting capital markets' concerns and lack of confidence in the company's future development prospects.

As the share price fell, Neusoft Group's major shareholders also began their share reduction and cash-out journey. Over the past nine years, the top three shareholders of Neusoft Group, Northeast University Science and Technology Industry Group Co., Ltd., Alpine Electronics, and Baosteel Group, have successively reduced their shareholdings on a large scale, accumulating reductions of over 300 million shares, accounting for nearly 25% of the company's share capital.

Frequent cash-outs by major shareholders have not only cast doubts on investors' views of the company's governance structure and future strategy but have also further weakened market confidence in the company, exerting enormous pressure on share price stability.

Faced with the growth dilemma, Neusoft Group has not been without attempts to break the deadlock, seeking to revitalize itself through a series of strategic adjustments and business optimizations, but the restoration of investor confidence is not an overnight process.

In recent years, from software outsourcing to digital transformation and then to actively布局ing emerging fields such as healthcare and smart car connectivity, each transformation of Neusoft Group has been accompanied by significant capital investment and market expectations. However, the growing pains of transformation have also ensued, with increased R&D investments, intensified market competition, and exploration of business models posing unprecedented challenges for Neusoft Group.

Starting with Outsourcing

Neusoft Group initially started with outsourcing business, which was an innovative move in China's software industry at the time.

Neusoft Group's entrepreneurial story began in 1989, when it partnered with Japanese Alpine Electronics to develop automotive software, successfully obtaining its "first pot of gold." In 1991, Neusoft Group's predecessor, Dongda Development Software Systems Co., Ltd., was established.

In an era when software copyright awareness was weak and piracy rampant, Neusoft Group, with its forward-looking strategic layout, successfully flourished in the software outsourcing business through cooperation with foreign enterprises.

In 1996, Neusoft Group successfully listed on the A-share market, becoming the first listed software company in China, marking its official debut in the capital market.

Neusoft Group's outsourcing business mainly focused on providing software development and technical services to international clients. Especially after 2000, amidst the tide of globalization and the Internet, Neusoft Group's outsourcing business reached its peak, becoming the first software enterprise in China with outsourcing revenue exceeding 100 million USD in 2006, occupying over 7% of the domestic software outsourcing market.

However, as times changed, software labor costs rose and market competition intensified, eroding the dividends of the software outsourcing business, leading to bottlenecks in Neusoft Group's traditional advantageous business.

Faced with difficulties in its main business, Neusoft Group no longer satisfied with a single business and began布局ing in multiple fields such as healthcare, smart car connectivity, smart cities, and enterprise digital transformation, seeking to build a diversified development pattern in the hope of finding new growth drivers.

However, Neusoft Group's performance in these fields has not been outstanding. That is to say, although the company has gained a certain market share in certain sub-sectors, it still lags far behind industry leaders.

For example, in the field of smart car connectivity, Neusoft Group has also invested significant resources in research and development and promotion. Although Neusoft's smart cockpit platform based on Qualcomm chips has achieved mass production and market launch, it faces numerous competitors, including strong rivals such as Huawei, Tencent, and Baidu, limiting the company's market share and making it difficult to form a clear competitive advantage.

In the field of medical imaging equipment, Neusoft Medical ranks among the top domestic manufacturers, but compared with competitors like United Imaging Healthcare, it still lags behind in market share and profitability.

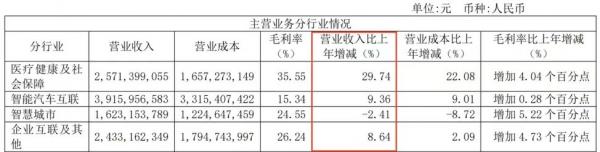

The multi-field layout has not brought Neusoft Group the expected high-speed growth but instead exposed its deficiencies in core competitiveness. Financial data shows that in 2023, the revenue of Neusoft Group's smart city business, which was highly anticipated, was the only one among the four major business segments to decline year-on-year, by 2.41%; the smart car connectivity business contributed the most to total revenue but had a relatively low gross margin.

At the same time, Neusoft Group's R&D investment is still relatively low compared to leading enterprises in the same industry, with R&D expenses accounting for 10% of total revenue in 2023, lower than Yonyou's 32.80% and Kingdee's 25.4%.

Insufficient R&D investment may lead to lagging product innovation capabilities. In an era of rapid technological development, if a company cannot keep pace with industry developments, it is easily eliminated by the market. Meanwhile, the multi-field layout strategy has also led to resource dispersion, affecting its in-depth exploration and competitiveness enhancement in any one field.

With the acceleration of artificial intelligence and digital transformation, competition in the software industry has intensified, and Neusoft Group faces the "siege" of emerging technology enterprises. In its first-quarter 2024 financial report, Neusoft Group established the strategy of "Next-generation Intelligent Solutions," focusing on AI and data elements, and vigorously promoted significant changes in line with the company's new strategy.

The "Neusoft System" Difficult to Form

Judging from its industrial layout over the years, Neusoft Group has always harbored a dream of building a "Neusoft System" consisting of multiple listed companies. Neusoft Group's spin-off and listing plan is an important step in its strategy to build a cluster of "Neusoft System" listed companies.

The original intention of this strategy was to achieve business specialization and capital market diversification by spinning off different business segments. However, in practice, this plan has not achieved the expected results.

Three years after Neusoft Group's successful listing, it spun off its IT higher education services business segment. After three applications, in September 2020, Neusoft Education was listed on the Hong Kong Stock Exchange, with a market value of 4.5 billion Hong Kong dollars on its first day. However, its subsequent share price performance was not ideal, with a market value far below expectations.

After the first successful attempt, Neusoft Group accelerated its spin-off pace. From 2014 to 2016, Neusoft spun off Neusoft Medical, Neusoft Xikang focusing on medical software, and Neusoft Wanghai (later renamed "Wanghai Xikang") engaged in hospital big data operations and supply chain management.

After four applications, Neusoft Xikang, known as the "first Internet nursing stock in Hong Kong," was finally listed on the Hong Kong Stock Exchange in September 2023. However, it opened below its issue price on the first day, closing at 2.72 Hong Kong dollars per share, a nearly 43% drop from the issue price of 4.76 Hong Kong dollars.

Neusoft Medical, known as the "domestic CT king," has also faced challenges on its path to listing, with no latest progress after four IPO attempts. Although Neusoft Medical holds a place in the domestic CT machine market, its revenue and profit growth are sluggish, and its reliance on government subsidies has made its listing journey particularly difficult. Additionally, competitors like United Imaging Healthcare have successfully listed on the STAR Market and are experiencing rapid growth, undoubtedly putting more pressure on Neusoft Medical.

After completing its final round of financing in 2017, Wanghai Xikang signed a counseling agreement in 2020 to prepare for an IPO on the STAR Market. However, there has been no recent progress in the application process.

In July 2015, Neusoft jointly invested with Alpine Electronics and Shenyang Furui Chi to establish Neusoft Ruichi to develop autonomous driving. In October 2021, it received its first round of funding of 650 million yuan. The 2021 financial report showed that this business brought 1.01 billion yuan in investment income to the group, enabling the company's net profit attributable to shareholders to exceed 1.1 billion yuan for the year. However, after the transaction was completed, Neusoft Ruichi was no longer consolidated into the group's financial statements. Some media speculate that Neusoft Ruichi may be preparing for a listing.

That is to say, after years of meticulous planning, Neusoft Group has only successfully listed two companies on the Hong Kong Stock Exchange. Financial reports show that Neusoft Education's revenue in 2023 was 1.806 billion yuan, with a profit of 430 million yuan, and a market value of 1.939 billion Hong Kong dollars as of June 20; Neusoft Xikang's total revenue in 2023 was 538 million yuan, with a loss of 155 million yuan, and a closing price of 0.99 Hong Kong dollars per share as of June 20, with a market value of 833 million Hong Kong dollars.

Behind this lies multiple issues with Neusoft Group's spin-off and listing plan. Firstly, some subsidiaries rely heavily on government subsidies and lack profitability, making it difficult to meet the profitability requirements of the capital market. Secondly, Neusoft Group has failed to effectively address issues such as related party transactions and horizontal competition during the spin-off process, creating obstacles to the listing process. Furthermore, changes in the market environment have also adversely affected Neusoft Group's spin-off and listing plan, such as tightened regulatory policies and capital market volatility.

Facing sluggish growth in its Northeastern base, Neusoft Group decided to leave its comfort zone and establish a new R&D base in Wuhan. On May 25 this year, Wuhan Neusoft Software Park officially opened, seeking new growth points by leveraging Wuhan's abundant educational resources and automotive industry advantages.

Against this backdrop, the success of the Wuhan layout appears more delicate. On the one hand, Wuhan boasts a vast talent pool and automotive industry ecosystem, providing Neusoft with potential cooperation opportunities and market space. On the other hand, the profitability challenges, insufficient R&D investment, and questions about core competitiveness that Neusoft Group itself faces make the Wuhan layout more of an exploration amidst difficulties. Whether it can truly translate into growth momentum remains to be seen over time.

As a former leader in China's software industry, Neusoft Group's rise and fall reflect not only the vast expanse of industry development but also the difficulties of corporate transformation and upgrading. Finding its place in the new wave of technology, enhancing its profitability, and shaking off its reliance on government subsidies will be crucial for Neusoft Group to emerge from its growth slump.