Flashback Technology's second bid for a Hong Kong listing: Did Lei Jun misjudge?

![]() 09/20 2024

09/20 2024

![]() 568

568

The lifecycle of a mobile phone begins on the production line and ends in disposal.

Disposal marks the final stage in the lifecycle of consumer electronics, but in the past, no player in the industry chain considered this step as an integral part of the chain. Commercial opportunities, however, often lurk in such 'counter-intuitive' areas.

Data from the China Association of Circular Economy indicates that there are currently over 2 billion obsolete mobile phones in China, with an average of over 400 million new ones entering the waste stream annually. Among these, only around 10% of used phones with remaining value are recycled.

As the concept of circular economy gains traction, a crop of 'Internet+' second-hand recyclers have seized the potential opportunities in the second-hand mobile phone market, positioning themselves at the forefront. In 2021, Aihuoshou (Wuxinsheng) officially listed on the NYSE, becoming the first Chinese company to prioritize ESG in its IPO.

Three years later, Flashback Technology, another leading player, is also eyeing a Hong Kong listing. On September 17, Flashback Technology updated its prospectus, continuing its push for a main board listing on the Hong Kong Stock Exchange, with Zero2IPO Capital serving as the sole sponsor.

Image source: Hong Kong Stock Exchange

Amidst favorable times and business opportunities, how is Flashback Technology faring in its current development, and what are its future growth prospects?

Positioned in the 'aftermarket' of consumer electronics, experiencing high revenue growth

Riding on the wave of circular economy, the second-hand consumer electronics trading market is rapidly expanding.

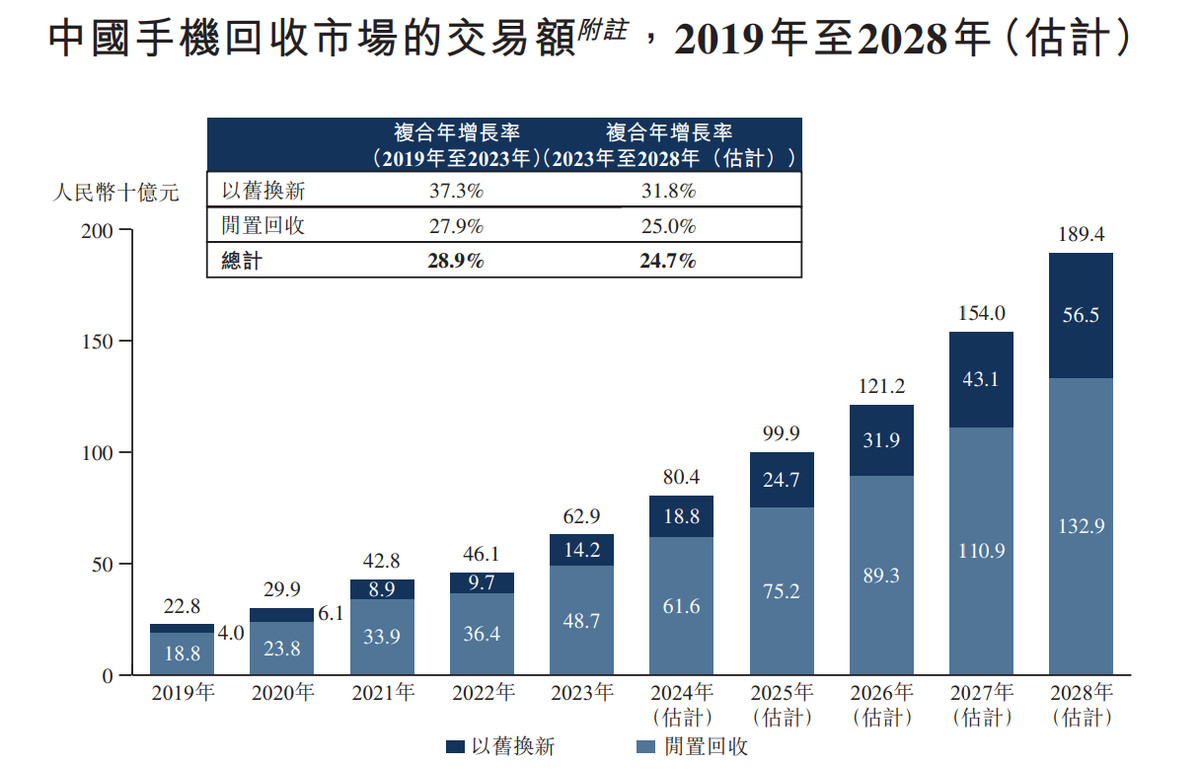

Taking mobile phones as an example, their recycling and reuse not only facilitate investment and consumption but also serve as an important lever for industrial upgrading and carbon neutrality. The Chinese mobile phone recycling market has continued to expand at a CAGR of 28.9% over the past five years and is projected to further grow to approximately RMB 56.5 billion by 2028, with a CAGR of around 24.7%.

The commercial potential of circular reuse of pan-consumer electronics terminals is evident.

Building on this foundation, Liu Jianyi, the founder of Flashback Technology, who has 18 years of experience in the telecommunications industry, caught the eye of Lei Jun. According to Tianyancha, Xiaomi Group and Shunwei Capital participated in Flashback Technology's Series A funding round in 2018. Currently, Tianjin Jinmi Investment Partnership (Limited Partnership), which is effectively controlled by Xiaomi Group, is the company's second-largest institutional shareholder with a 6.83% stake. Additionally, Shunwei Capital holds a 3.9% stake.

Image source: Tianyancha

Selected by the 'invisible investment tycoon' Lei Jun, Flashback Technology boasts its own highlights, maintaining relatively rapid revenue growth over the past few years. From 2021 to 2023, Flashback Technology achieved revenues of RMB 750 million, RMB 919 million, and RMB 1.158 billion, respectively, with an average annual compound growth rate of approximately 26%. In the first half of this year, the company recorded revenues of RMB 577 million, a year-on-year increase of 11.3%.

Specifically, Flashback Technology's business can be divided into two main segments:

First, the recycling brand 'Flashback Recycling'.

At the upstream end of the recycling business, Flashback Technology sources second-hand mobile phones from consumer electronics manufacturers, retailers, operators, and individual consumers through Flashback Recycling. Currently, Flashback Technology has established partnerships with six major consumer electronics manufacturers, accounting for nearly 60% of total domestic mobile phone shipments. Simultaneously, the company has procurement collaborations with 49,000 offline stores.

Second, the second-hand mobile phone and recyclable product trading brand 'Flashback Quality'.

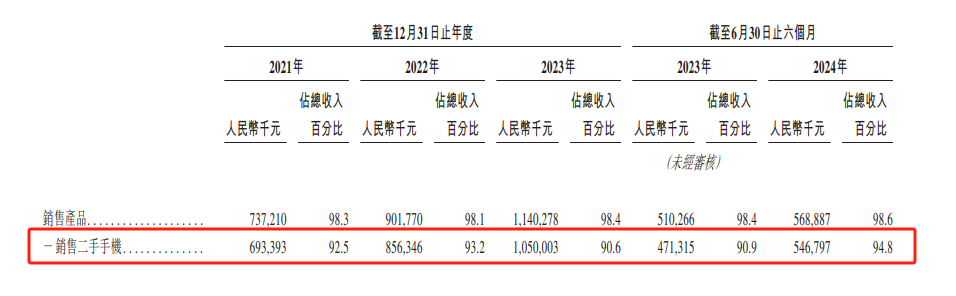

At the downstream sales end, Flashback Technology markets second-hand and new mobile phones to B-end merchants and consumers through 'Flashback Quality', contributing nearly 90% of the company's revenues.

As the concept of green consumption and low-carbon lifestyles gains popularity, consumer demand for second-hand mobile phones continues to grow. Riding this trend, Flashback Technology has achieved year-over-year high growth.

Now, as Flashback Technology carries this momentum of high growth towards a Hong Kong listing, will it win favor in the capital markets?

Contradictions emerge amidst growth

As Howard Schultz, the founder of Starbucks, once said, 'Growth is seductive. It can mask mistakes.' This statement aptly describes Flashback Technology's situation.

Behind Flashback Technology's rapid revenue growth lie four major issues:

1. Middleman in second-hand mobile phones, with a singular business model.

A closer look at the prospectus reveals that over 90% of Flashback Technology's revenues come from the sale of second-hand mobile phones. Simultaneously, the company heavily relies on upstream procurement partners for a stable supply of second-hand consumer electronics. Flashback Technology notes, 'Should our relationship with these upstream procurement partners deteriorate, it may have a material adverse effect on our business, operating results, and financial condition.'

While mobile phone manufacturers on the B-end serve as a significant driver of Flashback Technology's high growth, the company lacks bargaining power in the face of powerful phone manufacturers and must pay hefty deposits and promotional service fees. In 2023, Flashback Technology advanced promotional discounts of up to RMB 330 million and paid promotional service fees of RMB 30 million on behalf of upstream mobile phone manufacturers.

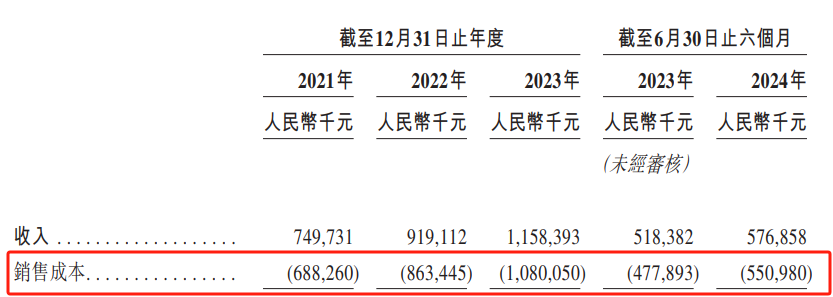

Dependence on a single supply source leads to stable but low-margin business operations.

2. Accumulated net losses of RMB 250 million over three and a half years, with profitability challenges.

As a middleman, Flashback Technology's profit model is straightforward: earning the difference between the recycling price and the selling price.

However, as the smartphone industry matures and prices become increasingly transparent, Flashback Technology struggles to achieve significant premiums. Coupled with rising procurement costs, the company's selling expenses remain high, resulting in consistently low gross margins. Moreover, Flashback Technology must prepay upstream partners for promotional discounts offered to individual consumers to promote trade-ins.

Under these circumstances, Flashback Technology has incurred cumulative net losses of RMB 250 million over the past three and a half years, with no signs of a profitability inflection point in sight.

3. Cash flow pressure and heightened valuation adjustment risks.

Sustained losses have strained Flashback Technology's financial position. As of the end of the first half of this year, the company had cash and cash equivalents of only RMB 79 million on hand.

Simultaneously, the company's redemption liabilities amounted to RMB 751 million, potentially facing significant valuation adjustment repurchase pressures from primary investors.

4. Industry chaos and questionable operational quality.

Parallel to high growth is a proliferation of issues in the second-hand recycling business, including malicious price suppression, suspected phone swaps, misrepresentation of second-hand phones, and forced transactions.

These issues are widespread within the industry. As of August, there were over 9,000 complaints related to 'Aihuoshou' on the Black Cat Complaints Platform. Additionally, according to Sina Finance's Listed Company Research Institute, complaints and warnings about the Flashback Recycling brand are prevalent on platforms like Xiaohongshu and Black Cat Complaints.

Clearly, Flashback Technology's growth trajectory is fraught with uncertainties. So, how can Flashback Technology address these issues?

Overvalued Flashback Technology, following in the footsteps of Wuxinsheng?

Just as Xiaomi learned from its competitors in automobile manufacturing, Flashback Technology, as a Xiaomi-invested company, can do the same.

First, addressing dependency on mobile phone manufacturer supply sources, the key lies in 'recycling from more C-end users and selling to more C-end users'.

Establishing branded retail stores is a common trend among second-hand recyclers. Wuxinsheng first ventured into offline stores in 2014 and had 1,819 stores by the end of 2023. Another second-hand recycler, Zhuanzhuan, has also deployed over 300 stores nationwide. In comparison, Flashback Technology only opened two stores last year, lagging significantly behind its peers.

Branded stores not only help recyclers attract more C-end customers but also provide more immediate service experiences, enhance product and service standardization, and build brand images, contributing to the companies' long-term operations.

Flashback Technology's slow offline expansion may be constrained by financial constraints. If the company succeeds in going public, it is imperative to drive offline channel construction.

Second, to improve operating profit margins, 'multi-category recycling' is a crucial direction.

In contrast to Flashback Technology's heavy reliance on mobile phone recycling, both Wuxinsheng and Zhuanzhuan have expanded their business scope to include clothing, shoes, and accessories, mother and baby products, furniture, home appliances, and even luxury items like gold and fine wine, many of which offer more profitable margins. Consequently, while Flashback Technology's gross margin has remained in the single digits for years, Wuxinsheng's has reached 20%.

Image source: Aihuoshou official website

With the release of the 'Action Plan for Promoting Large-scale Equipment Upgrades and Trade-ins of Consumer Goods,' consumer acceptance of second-hand goods is expected to continue rising. Exploring recycling services beyond mobile phones and 3C products will activate more latent market potential. This trend is already evident in Wuxinsheng's financials, with multi-category recycling transactions reaching nearly RMB 900 million in the second quarter, a nearly fourfold year-on-year increase.

Expanding the business scope can not only drive traffic to low-margin businesses and monetize high-margin ones but also optimize operating expenses by scaling up transaction volumes, offering a 'best solution' for Flashback Technology to turn around its losses.

Furthermore, in the face of widespread industry chaos, platforms must consider consumers' perspectives, continuously refine details within standardized service processes, and achieve sustainable and healthy development. For instance, a major concern for consumers in second-hand mobile phone transactions is privacy security. While effective privacy erasure may not directly enhance sales value, it contributes to consumer rights protection and industry growth, ultimately translating into positive consumer sentiment and enhancing platform competitiveness.

In summary, no matter how many problems arise, there are always solutions. Flashback Technology's primary focus now is to clear the hurdle of going public and raise sufficient funds to optimize and adjust its operations with confidence.

The IPO represents a 'make-or-break' moment for Flashback Technology. The secondary market does not seem to favor second-hand recycling businesses, and Flashback Technology runs the risk of being overvalued.

As the industry's 'first stock,' Wuxinsheng's share price has plummeted by 80% since its listing, leaving it with a market value of just USD 500 million. In contrast, Flashback Technology's latest valuation, based on its Series D funding round, stands at USD 343 million.

While the valuations (market values) are not vastly different, their market positions are poles apart. According to Frost & Sullivan data, based on GMV (Gross Merchandise Value) in the mobile phone recycling market in 2023, Wuxinsheng holds a 9.1% market share, ranking first, while Flashback Technology has a 1.4% market share, ranking third. Simultaneously, while Wuxinsheng has maintained profitability alongside revenue growth, Flashback Technology has yet to shake off its losses. In the first half of this year, Wuxinsheng's total revenue exceeded RMB 7 billion, achieving profitability for eight consecutive quarters, whereas Flashback Technology's revenue was just RMB 577 million, with a loss of RMB 40 million.

As the industry leader, Wuxinsheng, with its superior operating performance, has failed to ride the wave. How can Flashback Technology avoid a similar fate? Will the company successfully complete its listing journey and undergo a 'transformation'? Time will tell.

Source: Hong Kong Stocks Research Society