Xiaohongshu's Local Life: A Matter of Lifestyle or Business?

![]() 09/20 2024

09/20 2024

![]() 627

627

In August, Xiaohongshu, which had been quiet for a long time, suddenly became active in the local life scene. On August 23, Xiaohongshu added new management regulations and entry rules for local life service providers, and officially announced the opening of the catering group purchase category in 49 cities nationwide ten days later. Additionally, the technical service fee was adjusted from 0.6% to 2.6%, effectively completing the closed-loop transaction for catering businesses in these 49 cities.

Xiaohongshu's commercialization has long been hindered by three major obstacles: advertising, e-commerce, and local life. After 11 years, the platform has finally found the right approach to community e-commerce. In the past six months, while Douyin's e-commerce GMV growth slowed down, Xiaohongshu's e-commerce performance shone brightly. In the first half of 2024, the number of small and medium-sized businesses on Xiaohongshu surged by 379% year-on-year, and their total transaction value (GMV) increased by 436% year-on-year.

The robust growth of Xiaohongshu's e-commerce business significantly improved its profitability in 2023. Revenue increased by 85% year-on-year to $3.7 billion, with a net profit of $500 million. In comparison, in 2022, Xiaohongshu's revenue was approximately $2 billion, with a loss of $200 million.

Riding on the wave of e-commerce growth, Xiaohongshu raised a new round of funding in July 2024, valuing the company at $17 billion. While this valuation marks a recovery, it still falls short of the peak valuation of $20 billion.

This indicates that beyond advertising and e-commerce, Xiaohongshu needs more commercialization stories. It's time to tackle the last major obstacle for Xiaohongshu's commercialization: local life services.

01 Navigating the Local Life Landscape with Lessons from Meituan and Douyin

Meituan boasts tens of thousands of BD (Business Development) professionals, while Douyin appeals to people of all ages with its inherent traffic. How can Xiaohongshu carve out a path in local life?

First, by standing on the shoulders of giants. According to Ipsos' consumer research in the catering industry, more people now seek catering information online than offline. This has shifted consumers' dining decisions earlier in the process, with more people being influenced by online recommendations. Often, content that casually catches their attention can later influence their decisions.

Today, consumers' online group-buying habits have been largely shaped by Douyin and Meituan. Xiaohongshu's entry into this space comes at a time when user education costs are significantly lower. Hu Lin, who runs a Xiaohongshu local life merchant agency business in Zhengzhou, notes that acceptance of Xiaohongshu among northern merchants has gradually increased in recent years, with "restaurant owners under 40 generally being very open to Xiaohongshu."

Since testing local life services in April last year, Xiaohongshu's progress has been modest. In late April 2023, the platform launched a coffee category group-buying event, with its official account "Tubo Potato" becoming active. This was seen as the starting point for Xiaohongshu's local life efforts. In May of the same year, group-buying packages were piloted in Shanghai and Guangzhou, focusing on coffee and tea. In July, the official store exploration cooperation center was launched in Beijing, Shanghai, Guangzhou, and Shenzhen, extending the platform's content from mere store explorations to transactional links.

Industry insiders view this opening as a small product interface in Xiaohongshu's local life sector, still in the internal testing phase with targeted invitations from service providers to merchants. It is far from competing head-to-head with Douyin. However, long-term local life agents and service providers on various platforms disagree. They see the invitation to 49 cities' catering merchants as a strong signal that Xiaohongshu's local life commercialization is accelerating.

Second, relying on agents to pave the way. Hu Lin, who was once a designated agent for Xiaohongshu's real estate business in a second-tier city, told "City Vision" that he plans to focus his team's efforts on Xiaohongshu's local life business this year. Although his official agency qualifications are still under review, he has already started recruiting for Xiaohongshu's local life business and media positions. He believes Xiaohongshu represents the last untapped gold mine after Meituan and Douyin in the local life sector, and he intends to capture the market before more agents secure agency qualifications. "Now is the perfect time to hunt prey; we must recruit and mobilize our forces," he said.

As a well-known platform for recommendations, Xiaohongshu has been trying to complete the business loop from "recommendation" to "purchase" in recent years. However, the inherent contradiction between "traffic-driven e-commerce" and "a community with equal traffic distribution" has always constrained Xiaohongshu's commercialization efforts. In the local life battle, other platforms have demonstrated their strategies: leveraging traffic, low prices, and a robust salesforce to launch aggressive campaigns. Applying this logic, Xiaohongshu faces significant challenges in developing its local life business.

First, pursuing low prices contradicts Xiaohongshu's long-standing platform tone. Second, compared to the Shanghai and Guangzhou group-buying pilot in May last year, Xiaohongshu has not mentioned any traffic tilt after opening up to 49 cities this time. This may be related to the fact that it is still in the internal testing phase. Moreover, Xiaohongshu has not opted to directly deploy a robust salesforce similar to Meituan's BD army.

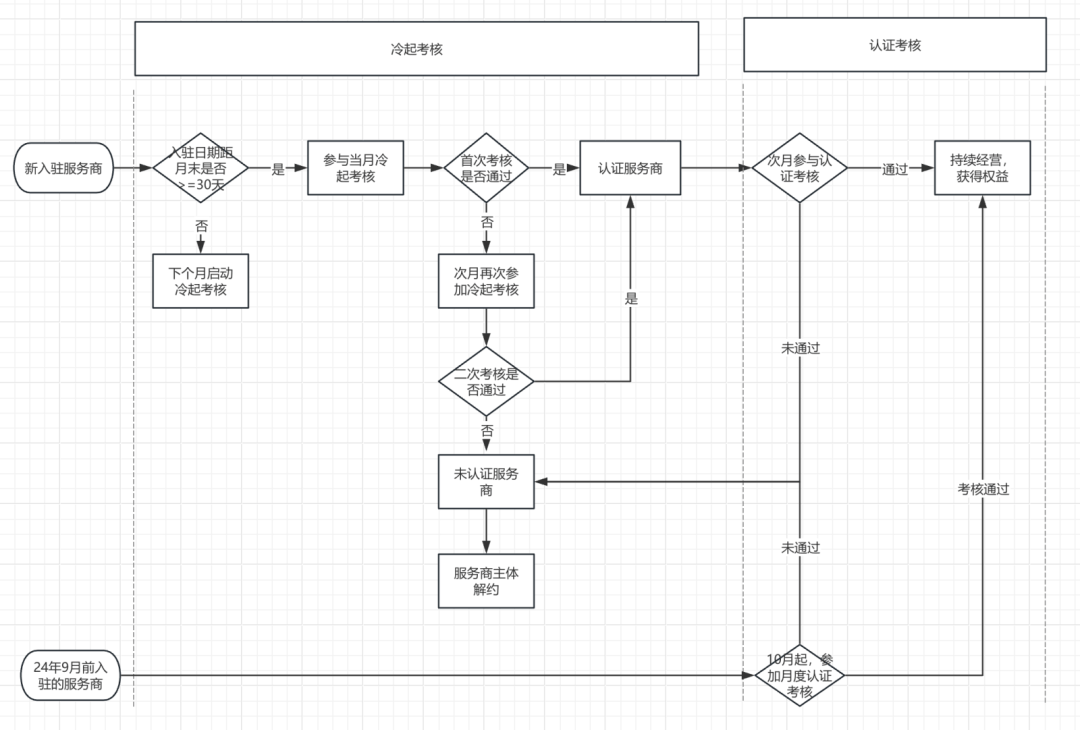

However, industry insiders believe that relying solely on service providers could lead to chaos for Xiaohongshu. Service providers, driven by profit, may resort to unethical practices to meet performance targets. Xiaohongshu's local life service provider guidelines establish a data-driven elimination system, including monthly new POI coverage (>=20), monthly order volume (>=600), and merchant complaint rate. While the assessment of new launches and order volume aims to incentivize service providers to sign up more catering outlets quickly, failing to meet the average platform complaint rate may still result in failure to pass the assessment.

(Reference diagram for Xiaohongshu service provider assessment process)

Shortly after Xiaohongshu announced the opening of Zhengzhou's catering group-buying service in early September, Hu Lin began leading his team to visit catering merchants in the city one by one. Since Xiaohongshu has not set a uniform service fee for service providers to charge merchants, "City Vision" found that Xiaohongshu's local life agents charge varying fees and set different thresholds for merchants.

Hu Lin told "City Vision" that they charge each signed merchant a service fee of around RMB 2,500 (including RMB 600 for Xiaohongshu's official professional account certification fee). They will also take a commission from merchants and charge for agency operations. Some Guangzhou service providers, aiming to quickly meet their signed store targets, offer zero-threshold services without service fees but charge a commission of over 5% upon order verification. "Service fees and commissions cannot be too high or too low; otherwise, we'll be seen as scammers," they noted.

To ensure a high order verification rate, Hu Lin instructs his team to be flexible when listing packages, ensuring that Xiaohongshu's agency fees, commissions, and group-buying package prices are cheaper than those of Meituan and Douyin, even if it's just by a yuan. If merchants refuse to adjust package prices, "we'll subsidize them from our commission," he said.

What if you fail to obtain agency qualifications? Hu Lin replied, "There's no 'what if.' If we don't pass the first application, we'll just improve our qualifications and reapply." Despite knowing that Xiaohongshu's approach is "two steps forward, one step back," he's determined to move quickly, believing that speed equals money at this stage.

02 Is Xiaohongshu's Strategy a "Pretty Meal"?

Douyin and Meituan represent two different business models for local life: one based on content recommendation and the other on search. For the former, merchants need to continuously produce content to attract traffic, posing a barrier for small merchants. Meituan, on the other hand, operates on a search logic, where merchants only need to wait to be searched.

In its 2024 catering industry methodology report, the head of Xiaohongshu's marketing lab, Sheng Xiang, proposed a new solution for local life using the "Pretty Meal" cycle. The "Pretty Meal" encompasses not just visually appealing food but any dish that inspires sharing and photo-taking, be it aesthetically pleasing, fun, unique, eye-catching, or emotionally resonant.

Xiaohongshu hopes the "Pretty Meal" cycle starts with sharing, where users find motivation to post and embed it into products or services. Their genuine sharing then inspires more people to see, be influenced, purchase, and share again. The second step involves creating marketing nodes to generate buzz. The third step brings daily recommendations closer to transactions, facilitating direct platform purchases. Finally, turning fans into posters ignites a ripple effect of sharing, viewing, buying, and sharing again.

This official "Pretty Meal" solution tests catering merchants' content interaction capabilities and Xiaohongshu's marketing team's ability to inspire sharing. Such an approach requires collaboration between merchants and platform marketing activities, which may be time-consuming and energy-draining for small and medium-sized merchants.

According to research from Dongwu Securities, Douyin and Meituan differ significantly in their merchant structures. Based on GTV estimates, over half of Meituan's merchants are small and medium-sized, while 80% of Douyin's GTV comes from chain merchants. Meituan is more friendly to small and medium-sized merchants, while Douyin has an irreversible traffic advantage for top merchants.

Meituan distributes traffic based on merchants' service levels, while Douyin relies on content capabilities. Merchants on Meituan need to maintain good service and positive reviews to gain higher traffic weights, while merchants on Douyin need to consistently produce high-quality content to achieve the same. In this system, only chain merchants with large budgets and numerous stores can sustainably receive positive feedback.

If Xiaohongshu's local life business revenue also requires a series of collaborations, it's likely that only chain merchants with large budgets and many stores can afford to participate, such as Burger King and Blueglass Yogurt, which are already in Xiaohongshu's beta testing. Ultimately, competition between these platforms will still boil down to price.

Moreover, differences in platform merchants do not necessarily reduce competitive pressure. Before Xiaohongshu's entry, Douyin and Meituan were already fiercely competing in the local life sector. From 2022 to the first half of 2023, Meituan executives initially dismissed Douyin as a threat, but Douyin delivered a stinging blow: In 2023, Douyin's pre-verification GMV tripled, with a 125% year-on-year increase in cooperating stores and an 80% increase in average single-store transaction value.

Analysts attribute Douyin's success to its mature infrastructure, well-developed ecosystem, and the fact that local life is one of the few markets with visible growth potential in recent years. According to iMedia Research, the domestic local life services market is expected to exceed RMB 250 billion by 2025, with significant untapped potential in lower-tier markets.

According to LatePost, Douyin's local life services sales exceeded RMB 100 billion in the first quarter of 2024, a year-on-year growth rate of over 100%. By 2023, Douyin had captured 30% of the on-site group-buying market. Currently, Meituan and Douyin's market shares in on-site and local life services stand at 7:3, with Meituan aiming to maintain a 2:1 ratio (double that of Douyin) in the long run.

With a user base half the size of Douyin, Xiaohongshu stands a good chance of carving out a slice of the RMB 2.5 trillion local life market pie.

03 What's the Xiaohongshu Solution?

Tapping into non-chain, personalized local catering merchants could be Xiaohongshu's key to success in local life services.

It's evident that low prices, a robust salesforce, and efficiency are out of place on this platform. Without a competitive advantage, Xiaohongshu may have to follow the path of buyer-centric e-commerce. Imagine a future where, in addition to buyer-centric e-commerce, there could also be "foodie restaurants."

The key difference is that on shelf e-commerce platforms like Meituan, merchants are presented without filters. However, Xiaohongshu's community content inherently comes with a 45-degree angle. Once local catering group-buying is opened up, how thick a filter will be applied to influencer restaurants through shared posts? This directly determines how far Xiaohongshu's local life services can go.

On September 6, 2023, Xiaohongshu announced the closure of local life categories related to camping, exhibitions, markets, hobby experiences, and performances. Following homestays, categories that align with the platform's ethos have also failed their local experiments. Compared to the fake influencer filters prevalent in Xiaohongshu's ecosystem two years ago, more users are becoming rational today. Life on Xiaohongshu is no longer something that requires a 45-degree angle to reach; it demands authenticity.

At this stage, local life services also need to move away from traditional Dianping-style review mechanisms and embrace more authentic sharing, warnings, and debunking. For example, instead of posting filtered photos of lavish meals, restaurants could livestream their kitchens, showcasing their real environments. Or chefs could share the stories behind each dish, transforming the sharing mechanism into a more subtle persuasion tactic.

Industry insiders believe that if Xiaohongshu doesn't follow the "traffic + low price" group-buying strategy of other platforms, its ambitions in local life may lie in advertising rather than transactions.

Consumption is one of the most defining characteristics of modern life, and Xiaohongshu has emerged as China's foremost platform for showcasing consumption, perhaps unrivaled. If society is compared to a living organism, Xiaohongshu might be seen as the DNA expressing consumer snippets. While it's just an app, its creators, users, and those influenced by it are intricately intertwined.

To a certain extent, the ecosystem on Xiaohongshu transcends its commercial aspects. While slow growth in local life services is acceptable, maintaining the unique Xiaohongshu flavor is paramount.