Why does Xiaomi adjust its net profit?

![]() 09/20 2024

09/20 2024

![]() 513

513

Written by: Poetry and Starry Sky

ID: SingingUnderStars

Xiaomi Group recently released its quarterly report for the second quarter of 2024. The data is divided into two parts: quarterly report data and semi-annual report data.

In the second quarter of 2024, the company achieved revenue of RMB 88.9 billion, a record high, representing a year-on-year increase of 32.0%. Adjusted net profit reached RMB 6.2 billion, a year-on-year increase of 20.1%.

In the first half of the year, the company achieved revenue of RMB 164.4 billion, a year-on-year increase of 30%, and adjusted net profit reached RMB 12.7 billion, a year-on-year increase of 51%.

When reporting, most media outlets used the term "adjusted net profit." According to the company's financial report, the unadjusted net profit was RMB 9.28 billion, more than RMB 3 billion less than the adjusted figure of RMB 12.7 billion.

Not only Xiaomi, but many Hong Kong and US-listed companies, including JD.com and Meituan, use the concept of "adjusted net profit."

This raises two questions: why does Xiaomi adjust its net profit, and what exactly is being adjusted?

I. Conflicting Basic Principles in Accounting

To ensure the rationality of accounting, there are eight basic principles in accounting:

Reliability, Relevance, Understandability, Comparability, Substance over Form, Materiality, Conservatism, and Timeliness.

However, some of these principles may conflict under certain circumstances.

For example, the principles of conservatism and matching can clash.

The principle of conservatism requires reasonable estimates of potential losses and expenses in accounting practice, while minimizing or avoiding estimates of potential income or gains. This principle aims to safeguard the interests of investors and the enterprise by taking a "prudent" approach to risk avoidance. However, this tendency may lead enterprises to adopt accounting methods that favor themselves, potentially resulting in distorted accounting information and deviation from actual business conditions. Additionally, the application of conservative estimates often results in conservative financial statements, which may hinder optimal decision-making by managers who rely on these reports.

The principle of matching requires that income be matched with related costs and expenses. When applying conservative estimates to uncertain factors, it is advisable to overestimate losses and underestimate gains to ensure safety. However, this approach can conflict with the principle of matching, which emphasizes the reasonable allocation of income and expenses.

In cases of conflict, the accounting standards tend to favor the principle of conservatism.

Common adjustment items include:

1. Share-based compensation

2. Net change in fair value of investments

3. Amortization of acquired intangible assets

4. Changes in the fair value of financial liabilities to fund investors

5. Impact of non-IFRS adjustments on income tax

Share-based compensation (equity incentives), for example, must be expensed in the current period according to accounting standards. Xiaomi's initial public offering granted a RMB 9.9 billion equity incentive to its chairman, significantly reducing net profit. To align net profit with actual business performance, adjustments are made when reporting data, a common practice among Hong Kong and US-listed companies.

II. Xiaomi's Adjustments to Net Profit

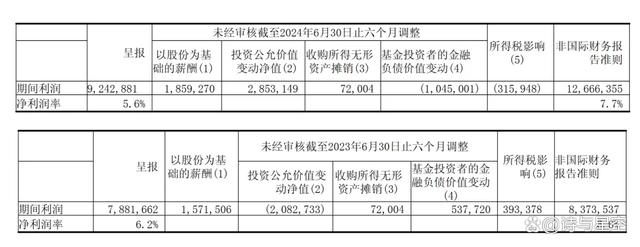

Based on Xiaomi's semi-annual report, the main adjustments include share-based compensation (RMB 1.859 billion), net change in fair value of investments (RMB 2.853 billion), and changes in the fair value of financial liabilities to fund investors (-RMB 1.045 billion).

1. Share-based compensation, or equity incentives, are primarily granted to senior executives or key personnel. Since they typically do not immediately sell their shares for cash, these incentives do not impact the company's actual operating performance.

2. The net change in fair value of investments roughly corresponds to fair value changes in A-share listed companies, mainly resulting from changes in the market value (or appraised value) of invested companies. Xiaomi's semi-annual report shows investments in approximately 430 companies with a total book value of RMB 65.4 billion.

3. Changes in the fair value of financial liabilities to fund investors represent interest calculations on convertible bonds. As these bonds are likely to be converted into shares, the interest does not impact the company's operating performance.

Amortization of intangible assets and income tax impacts are relatively minor and largely consistent with A-share financial reporting items, requiring little additional explanation.

III. Differences in Adjustments Across Companies

Xiaomi states in its financial report:

Adjusted net profit is not required or presented in accordance with International Financial Reporting Standards (IFRS). We believe that presenting non-IFRS measures alongside IFRS measures eliminates the potential impact of non-operating performance indicators (such as certain non-cash items and investment transactions) identified by management, providing investors and management with useful information on financial and business trends related to financial position and operating performance. We also believe that non-IFRS measures are suitable for evaluating the Group's operating performance. However, these non-IFRS measures are intended solely as analytical tools and should not be considered separately or as a substitute for IFRS-based financial performance or position. Furthermore, the definition of these non-IFRS financial measures may differ from similar definitions used by other companies, limiting comparability.

It is important to note that these non-IFRS measures may not be directly comparable to similar measures used by other companies.

Upon reviewing Meituan's financial report, the adjustments include three main categories:

1. Certain non-cash or one-time items, including share-based compensation expenses, amortization of intangible assets acquired through acquisitions, and certain impairment and provision expenses

2. Net gains/(losses) from certain investments

3. Related income tax impacts

Compared to Xiaomi, Meituan's adjustments are largely similar, with the addition of "impairment and provision expenses," indicating adjustments for impairments of fixed assets and construction in progress acquired through acquisitions. Conversely, there is no adjustment for changes in the fair value of financial liabilities to fund investors, suggesting no adjustments for convertible bond movements.

This implies that while Hong Kong and US-listed companies commonly disclose "adjusted net profit" to present more reasonable operating results, there are subtle differences in their specific adjustment items.

- END -

Disclaimer: This article is based on the publicly available information disclosed by listed companies in accordance with legal requirements (including but not limited to interim announcements, periodic reports, and official interaction platforms). Poetry and Starry Sky strives for fairness and impartiality in its content and opinions but does not guarantee their accuracy, completeness, or timeliness. The information or opinions expressed herein do not constitute investment advice, and Poetry and Starry Sky assumes no responsibility for any actions taken based on this article.

Copyright Notice: The content of this article is originally created by Poetry and Starry Sky and may not be reproduced without authorization.