Cainiao vs. Hive Box: The Duel of the Delivery Giants and the Race for IPO

![]() 09/23 2024

09/23 2024

![]() 676

676

Fengchao and Cainiao have been in intense competition with each other, from disputes over data interfaces to shareholders' choice and then to the IPO race. Fengchao rushed to IPO but suffered a loss of nearly 4 billion yuan, and even after going public, it still faces the challenge of profitability.

When Cainiao withdrew its IPO application at the end of March this year, it could not have imagined that its rival Fengchao would rush to go public so urgently. Recently, SF Express's Fengchao Smart Locker officially submitted its IPO prospectus to the Hong Kong Stock Exchange, with a valuation of approximately 25 billion yuan.

As the two giants in China's "last mile" delivery market, Fengchao and Cainiao have been engaged in intense competition, from disputes over data interfaces to shareholders' choice and then to the IPO race. Over the past decade, they have alternated in leading the way.

However, with Fengchao preparing to ring the bell, the story has finally reached a turning point. After a moment of excitement and regret, both parties must face thorny issues: Fengchao suffered a loss of nearly 4 billion yuan, and even after going public, it faces the challenge of profitability. Cainiao is in an even more constrained position, with losses exceeding 7 billion yuan. It relies heavily on its parent company, Alibaba Group, and its fate is tied to that of Alibaba.

Both giants are trying to prove that last-mile delivery is a good business, but not everyone can easily make it to the end.

01 The Past of Competition Between the Two Giants

Although Fengchao has taken the lead in going public over Cainiao, historically, Cainiao has been a predecessor to Fengchao in terms of size and positioning.

A decade ago, e-commerce was booming, and Alibaba's market share was at its peak. However, as it grew rapidly, it was plagued by a problem: as transaction volumes surged, the quality of Alibaba's delivery services came under scrutiny. To address this issue, Cainiao was launched in 2013.

Initially, Alibaba joined forces with express delivery companies such as SF Express, YTO Express, ZTO Express, STO Express, and Yunda Express, as well as large conglomerates like Intime Retail Group, Fosun Group, and Fuchun Group, to jointly fund the venture. Among them, Tmall contributed 2.15 billion yuan, accounting for 43% of the shares; Intime Retail Group invested 1.6 billion yuan, accounting for 32%; Fosun Group invested 500 million yuan, accounting for 10%; Fuchun Group invested 500 million yuan, accounting for 10%; and SF Express, YTO Express, ZTO Express, STO Express, and Yunda Express each invested 50 million yuan, accounting for 1% of the shares each.

This initial shareholder lineup encompassed upstream and downstream industries, and it was precisely because of this that Cainiao's initial positioning was as a comprehensive information-based logistics network rather than a single express delivery network.

Fengchao, on the other hand, had a more vertical positioning. To solve the problem of the "last 100 meters" in express logistics delivery, SF Express, STO Express, ZTO Express, Yunda Express, and GLP jointly invested 500 million yuan to establish Fengchao in June 2015. Among them, SF Express held 35% of the shares, while STO Express, ZTO Express, and Yunda Express each held 20%, and GLP held 5%.

Clearly, the differences in size and shareholder composition between the two companies have doomed them to have vastly different business logics: Cainiao Network follows a logistics technology approach, with buyers and sellers, e-commerce platforms, Alipay, Cainiao Network, and logistics companies forming a complete chain. Fengchao, on the other hand, provides a comprehensive solution for the last mile, primarily in the form of smart lockers, which interact with customers through human-machine interfaces.

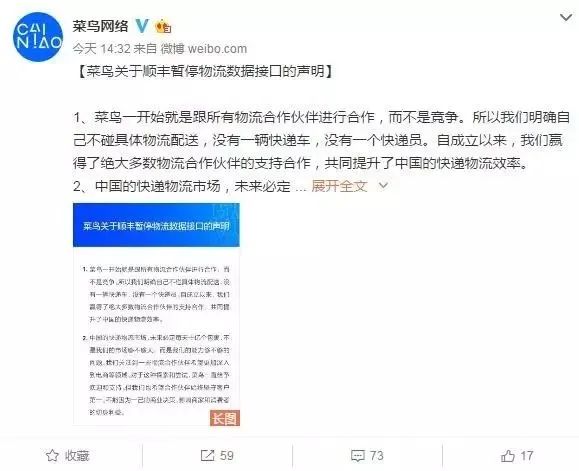

Strictly speaking, in their early days, Cainiao and Fengchao were upstream and downstream partners, but a conflict over control in 2017 drove them apart.

In June 2017, Cainiao Network's official Weibo account issued a statement claiming that SF Express had suspended its data interface with Cainiao. The consequences of this suspension fell on customers, as packages stored in Fengchao lockers could no longer be viewed through Cainiao's services.

Subsequently, SF Express's official Weibo account immediately responded to Cainiao, claiming that Cainiao, motivated by its own commercial interests, had demanded that Fengchao provide customer privacy data unrelated to its operations in May 2017. Fengchao, however, refused this request out of respect for customer privacy, and the disconnection of the interface was actually initiated unilaterally by Cainiao.

Clearly, both sides were trying to position themselves on the moral high ground, but behind the scenes, it was all about conflicts of interest and the struggle for discourse power.

At that time, Cainiao had already accessed the information of all logistics and express smart lockers except for Fengchao, but Fengchao refused to comply. For Fengchao, data was a core business secret, and handing it over would be like leaving oneself vulnerable. As giants from two different business systems, e-commerce and logistics, they were bound to clash.

The dispute was eventually mediated by the State Post Bureau, but Cainiao quickly struck back, forcing shareholders with close ties to both Cainiao and Fengchao, known as the "Tongda" group, to take sides.

In Cainiao's first round of capital increases in 2016, YTO Express and ZTO Express became shareholders. In late 2017, during Cainiao's second round of capital increases, STO Express and Yunda Express joined the shareholder ranks. Then, in June 2018, ZTO Express, STO Express, and Yunda Express, which had previously co-founded Fengchao, transferred all their shares in Fengchao, giving SF Express primary control over the company.

Moreover, as Alibaba's logistics arm, Cainiao lacked the ability to manage and operate offline entities. In response to the conflict, Cainiao began experimenting with partnerships with offline stores to address the last mile, launching Cainiao Post and Cainiao Parcel services, directly targeting Fengchao's smart lockers.

Clearly, as a platform-based logistics information giant, Cainiao was wary of Fengchao, which it could not control, and sought to seize its market share. However, Fengchao was not about to give in easily. Despite being at the end of the industry chain, Fengchao remained steadfast and eventually turned the tide of competition in its favor.

02 The Battle of Heavy vs. Light Assets, with Fengchao Emerging Victorious

In fact, for a long time, Cainiao and Fengchao had vastly different approaches to last-mile delivery.

As Alibaba's flagship logistics information network, Cainiao is deeply integrated with e-commerce platforms like Taobao and Tmall. In last-mile delivery, Cainiao adopts a light-asset franchise model, resulting in rapid expansion. With over 180,000 Cainiao Posts under its belt, Cainiao handled over 29 billion packages in 2023, demonstrating its formidable logistics capabilities.

In contrast, Fengchao follows a heavy-asset approach.

According to industry insiders, the hardware cost of a Fengchao locker can range from 50,000 to 80,000 yuan, with some exceeding 100,000 yuan. At the same time, property rent for locker locations is a significant cost, accounting for up to 40% to 50% of total expenses. Despite this high-investment model, Fengchao has persisted for years. According to its prospectus, as of May 31, 2024, Fengchao had 330,200 smart lockers with 29.9 million compartments, covering approximately 209,000 communities in 31 provinces across China. It has served 367.8 million consumers and 3.5 million couriers, handling nearly 6.7 billion packages in 2023.

Image/Fengchao Holdings Prospectus

In terms of package handling capacity, Cainiao has the upper hand, but at a cost of greater losses. From fiscal years 2021 to 2023 (ending March 31), its total revenue was 52.733 billion yuan, 66.867 billion yuan, and 77.8 billion yuan, respectively, but it incurred losses totaling 7.102 billion yuan over those three years. It was not until fiscal year 2024 (ending March 31, 2024) that it achieved a profit of 1.402 billion yuan, marking a turnaround from previous losses. However, in the first quarter of fiscal year 2025, it still incurred losses exceeding 600 million yuan.

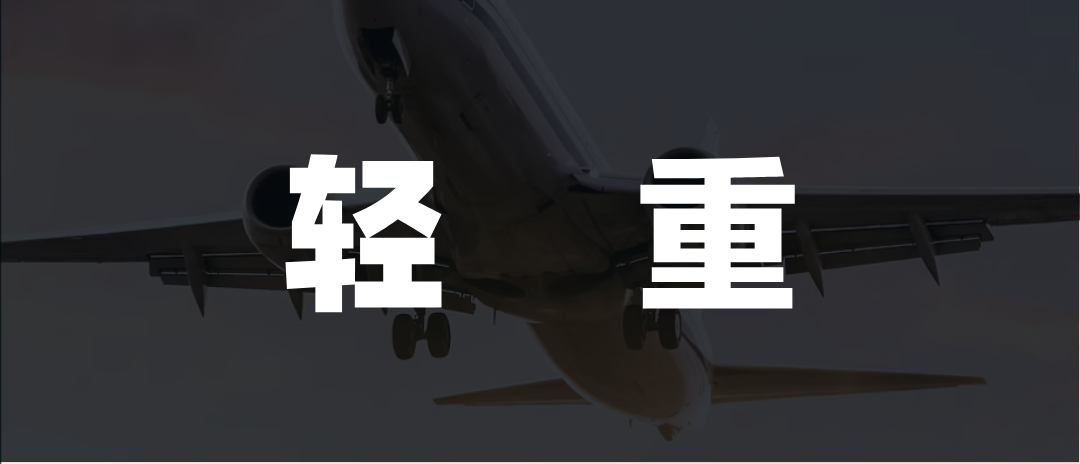

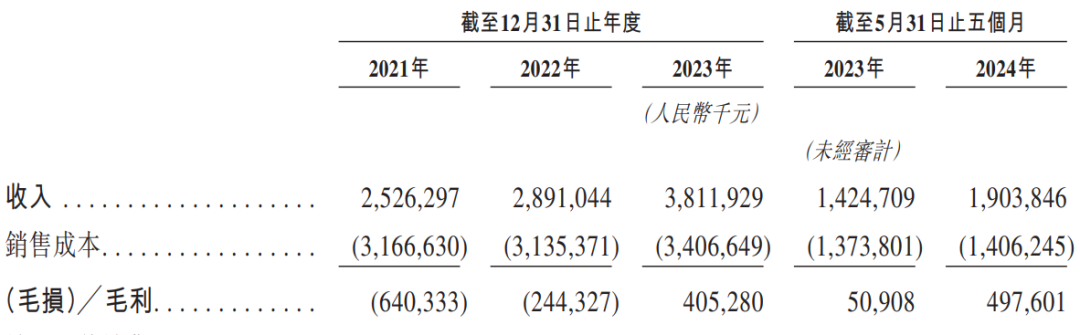

On the other hand, Fengchao's prospectus shows that it recorded revenues of 2.526 billion yuan, 2.891 billion yuan, and 3.812 billion yuan in fiscal years 2021 to 2023, respectively, with net losses of 2.071 billion yuan, 1.166 billion yuan, and 541 million yuan, respectively. From January to May 2024, Fengchao recorded revenue of 1.904 billion yuan and a net profit of 71.6 million yuan.

Image/Fengchao Holdings Prospectus

Clearly, Fengchao has lost less money than Cainiao, and the reason lies in its business model.

In terms of business scenarios, Cainiao relies more on human resources, which inevitably leads to issues with reputation and service efficiency. In contrast, Fengchao's smart lockers provide both hardware and software services, resulting in higher operational efficiency and lower labor and franchise management costs. Although its business scenario is limited to couriers and consumers, it effectively addresses the last 100 meters of delivery, grasping the core pain point and enabling higher profit margins with relatively fewer packages.

However, both models have faced customer scrutiny. In 2022, Pinduoduo's "Duoduo Maicai" announced partnerships with multiple express delivery companies to integrate their sign-in systems. In response, Cainiao immediately notified its franchisees that any violation of related cooperation agreements by connecting to third-party receipt systems would constitute a breach of contract, giving Cainiao the right to terminate cooperation with the posts and cancel their qualification filings.

Similarly, Fengchao's upcoming IPO has been criticized for its unpopular charging system. According to its prospectus, Fengchao offers an 18-hour free storage period, with an additional 0.5 yuan charged for every extra 12 hours, up to a maximum of 3 yuan per package. While the fees may seem low, for working professionals with fast-paced lives, forgetting to retrieve packages is common, and 18 hours is often insufficient. Indeed, Fengchao's data from 2021 to the first five months of this year shows that it collected over 800 million yuan in late fees. Perhaps recognizing dissatisfaction with these fees, Fengchao also introduced a "membership service," offering 5-yuan monthly and 12-yuan quarterly cards that allow unlimited storage for 7 days.

However, even though both Cainiao and Fengchao are incurring losses, Fengchao is able to generate higher profit margins with lower investments, giving it a slight edge over Cainiao. Cainiao is not far behind, having invested in Xiaomi's smart lockers, with Cainiao providing comprehensive support in data processing and storage, cloud computing, program development and design, network information security, and channel construction for various express delivery companies.

Clearly, Cainiao has recognized the changing landscape of business scenarios, where the need for instant package pickup and returns is replacing manual services at inexpensive posts. However, by following in Fengchao's footsteps, Cainiao has already fallen behind.

03 Cainiao's Turn, Doomed to Lag Behind

In the IPO race for logistics companies, Cainiao once took the lead over Fengchao.

On September 26, 2023, Alibaba Group announced plans to spin off Cainiao and list it independently on the Hong Kong Stock Exchange. That night, Cainiao submitted its A1 application to the Hong Kong Stock Exchange, with Citibank, CITIC Securities, and J.P. Morgan serving as joint sponsors and Ampere Partners as financial advisor.

At that time, Cainiao's IPO was not just a capital operation in the logistics delivery sector; it also carried the heavy responsibility of helping Alibaba's e-commerce business break through. Over the past four years, as short video platforms have risen in popularity, the e-commerce market has undergone tumultuous changes. According to various research agencies, Alibaba's e-commerce market share has declined to around 40%. In contrast, Pinduoduo's branded GMV (Gross Merchandise Volume) grew by 48% year-on-year, and its market value briefly surpassed that of Alibaba. Short video platforms represented by Kuaishou and Douyin saw their GMV grow by 32% and 63% year-on-year, respectively.

As Alibaba's core e-commerce business came under pressure, the company felt the need to act. On March 28, 2023, Alibaba Group announced a restructuring plan, launching the "1+6+N" organizational transformation and establishing six business groups, including Alibaba Cloud Intelligence, Tmall and Taobao, Local Life Services, Cainiao, International Digital Commerce, and Alibaba Group Digital Media and Entertainment, as well as several business companies. Each business group and company operates under the leadership of its CEO and is responsible for its own operating results, with the possibility of independent financing and going public.

Against this backdrop, Cainiao became the first business group to officially launch its IPO, naturally receiving high expectations from Alibaba and the capital market. However, just six months later, Cainiao made a 180-degree turn.

On March 26 of this year, Alibaba announced its decision to withdraw Cainiao's IPO application submitted to the Hong Kong Stock Exchange and to make a tender offer to acquire the equity of Cainiao's minority shareholders and vested equity of employees.

Alibaba made the call, and Alibaba reversed it. What were the considerations behind this decision?

Cainiao's about-face is actually rooted in Alibaba's broader strategic shift. Under Daniel Zhang's leadership, Alibaba pursued a diversified strategy with independently operated businesses, following the principle of "the more children, the merrier." This approach allowed the company to rapidly gain market share when the internet red ocean had not yet been fully explored and competition was less intense. However, as the market matured and competition intensified, this fragmented approach made it difficult for Alibaba to form a cohesive force. In fact, many other internet giants, such as ByteDance and Tencent, have also chosen to spin off non-core businesses and focus on their main operations.

With the arrival of Joe Tsai, Jack Ma has repeatedly appeared in the forefront, and Alibaba's trend of returning to its core business has become increasingly apparent. Against this backdrop, Cainiao's valuation perspective for its listing has obviously become much more ambitious, and this is the root cause of the withdrawal of its IPO application.

According to Alibaba's latest financial report for the third quarter of fiscal year 2024, Cainiao Group generated revenue of RMB 28.476 billion in the quarter, a year-on-year increase of 24%. Cainiao's adjusted EBITA was RMB 961 million, achieving a turnaround from a loss compared to the same period last year. Given Cainiao's annual package handling capacity and the vast market behind e-commerce, Alibaba has high expectations for its valuation. Just over a year ago, Hurun's Global Unicorn List showed that Cainiao ranked 10th overall and first among logistics companies, with a valuation of up to RMB 185 billion. However, by 2024, Cainiao's valuation had shrunk to approximately USD 10.3 billion, equivalent to RMB 74.4 billion, a reduction of over half.

Image/Alibaba Financial Report

Faced with such a dilemma, Alibaba naturally finds it difficult to accept, and its strategic focus has shifted from listing to enhancing its market position. In the context of increasingly saturated domestic competition, exploring a second growth curve has become a top priority, and this second curve is the currently popular cross-border logistics.

According to Cainiao's financial report for fiscal year 2023, its total revenue was RMB 77.8 billion, with international logistics and domestic logistics accounting for the first and second largest businesses, respectively, with revenues of RMB 36.85 billion and RMB 35.96 billion. Based on package volume in 2022, Cainiao processed an average of over 5 million cross-border packages per day, making it the world's leading cross-border e-commerce logistics enterprise and boasting the world's largest logistics network in terms of geographical coverage.

Clearly, cross-border operations have become Cainiao's primary pillar business, and Cainiao's focus is on continued expansion in this area.

In September 2023, Cainiao launched the "Global 5-Day Delivery" service, which has since expanded to nearly 20 countries, covering regions such as Europe, the Americas, Japan, Korea, and the Middle East. To achieve broader coverage, Cainiao needs sufficient overseas warehousing and logistics resources, which is where the investment in 4PX comes in.

According to information, 4PX was founded in 2004 in Shenzhen and positions itself as a comprehensive service provider for the global cross-border e-commerce supply chain. Based on its Global Parcel Network (GPN) and Global Fulfillment Network (GFN), 4PX offers three main products: global express delivery, overseas warehousing, and first-mile services.

Currently, 4PX has established over 50 overseas warehouses worldwide, covering an area of 1 million square meters and spanning 20 countries, including the United States, Canada, Australia, Japan, the United Kingdom, Germany, Spain, and the Czech Republic. According to a report published by the Internet of Things Cloud Warehouse Digital Research Institute in 2023, Zongteng Logistics, Sinotrans, and 4PX led the industry with revenues exceeding RMB 10 billion, while companies like SF Express, Yanwen, Cainiao, and Winit had revenues ranging from RMB 2 billion to RMB 10 billion.

It can be said that 4PX's logistics capabilities are exactly what Cainiao desires. As early as 2016, Cainiao had already invested in this overseas logistics company. After this acquisition, Cainiao holds a 50.9459% stake in 4PX, achieving sole control.

Through acquisitions and self-development, as of June 2023, Cainiao had over 1,100 warehouses and more than 380 sorting centers globally, with a global network spanning more than 200 countries and regions. This continued investment in overseas logistics infrastructure is a significant contributor to Cainiao's current losses.

Alibaba's financial report for the first quarter of fiscal year 2025 showed that international business revenue increased by 32% year-on-year, with cross-border operations being the primary driver. Among them, AliExpress Choice performed outstandingly, with improvements in both order volume and monetization rates. For Cainiao, revenue declined by 30% in the second quarter of 2024 to RMB 618 million, down from RMB 877 million in the same period in 2023, primarily due to increased investments in cross-border fulfillment solutions.

Clearly, Cainiao is engaged in a slow but sure path, and its more deliberate approach to going public, in contrast to SF Express's focus on the domestic market and expansion only to Southeast Asia, is now better understood.

After all, the future of logistics delivery is still far away, and some compete on burst speed, while others compete on endurance.