"High-quality assets on the table, is the Fosun Group set to sell again?"

![]() 09/25 2024

09/25 2024

![]() 647

647

Written by Sansheng

Recently, the struggling "Fosun Group" has been making headlines again.

According to Bloomberg, sources revealed that CapitaLand Investment Ltd. (based in Singapore) is in advanced talks to acquire a stake of approximately 20% to 30% in Club Med (Méditerranée Club), a French luxury resort chain, from Fosun International for several hundred million euros.

Both CapitaLand Investment and Fosun Leisure declined to comment on this news, while Fosun International did not respond to inquiries.

In its latest 2024 interim report, Club Med reported revenue of RMB 8.894 billion for the first half of the year, a year-on-year increase of 10.3%, with adjusted EBITDA reaching RMB 2.003 billion, up 8% year-on-year. During the recent interim earnings call, Guo Guangchang praised Fosun Leisure, with Club Med being its core business.

Compared to Club Med's performance, Fosun International's total revenue for the first half of 2024 was approximately RMB 97.838 billion, a year-on-year increase of 0.8%, with net profit attributable to shareholders of approximately RMB 720 million, a year-on-year decrease of 47.04%. This comparison highlights the quality and importance of Club Med, raising the question of whether Guo Guangchang is truly willing to let go.

In fact, if the sale goes through, it's understandable. The former Shanghai billionaire and Chairman of Fosun International said during the earnings call, "Only by staying alive can we share the future."

Amid difficulties, Guo Guangchang's personal wealth has also been on a rollercoaster ride. According to the Hurun Global Rich List 2024, Guo's wealth stands at RMB 31.5 billion, more than halved from his 2020 net worth of RMB 64 billion. In 2007, when Fosun International went public, Guo was worth RMB 36 billion, ranking 10th on the Chinese mainland rich list and marking his first time as the richest person in Shanghai.

Seventeen years later, he has returned to where he started.

Despite this, Guo remains optimistic. During the earnings call, he also stated that due to various factors, there are fewer and fewer high-quality heavy assets in China, presenting an increasingly favorable opportunity for Fosun to reduce its heavy asset exposure.

In other words, Fosun's journey to reduce heavy asset exposure will continue, and the "selling spree" will not stop. But will he keep selling indefinitely? Where lies Fosun's hope?

01 Behind the Selling Spree: Are Financial Expenses a Burden?

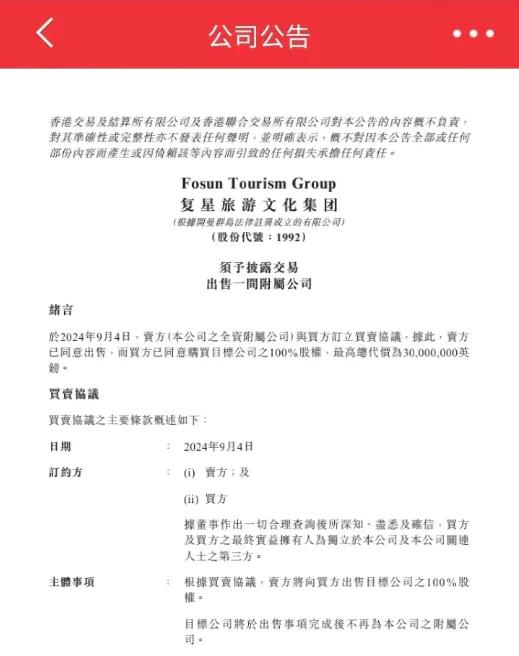

Shortly before the release of its interim report, Fosun Leisure, a subsidiary of Fosun International, sold Thomas Cook, the world's first travel agency with a history of over 180 years, to the Central and Eastern European online travel platform eSky Group.

In March 2015, during the golden age of Chinese capital expansion, Guo Guangchang believed that "there are mines everywhere, we should mine the world, mine every industry, and develop our mining capabilities."

At that time, Fosun Tourism Group acquired a 5% stake in Thomas Cook Group for approximately GBP 91.85 million and later increased its shareholding to 11.38%. After Thomas Cook collapsed due to heavy debts in 2019, Fosun Tourism Group acquired the company along with two affiliated hotel brands, Casa Cook and Cook’s Club, for GBP 11 million.

Fosun Leisure invested over GBP 100 million in total in Thomas Cook. However, according to an announcement issued by Fosun Tourism Group on September 5, the maximum total consideration for this sale was GBP 30 million, a significant discount from the original investment.

Even so, this may be a good thing for Fosun Leisure, as Thomas Cook was a money-losing venture. In 2022 and 2023, it incurred after-tax losses of GBP 15.0497 million and GBP 4.1766 million, respectively, totaling nearly GBP 20 million in losses over two years.

As of July 31, 2024, Thomas Cook's net equity (calculated as total assets minus total liabilities) was approximately GBP -32.8027 million. Furthermore, as of September 5, Thomas Cook owed Fosun Tourism Group a total of approximately GBP 47.4983 million in outstanding shareholder loans.

The divestment of Thomas Cook is a microcosm of Fosun International's broader "selling spree."

In March this year, it was rumored that Fosun Tourism Group was seeking to sell all or part of the assets of the Atlantis Sanya Resort, its "cash cow." In February, it was exploring the sale of a minority stake (up to 30%) in Club Med, with an estimated valuation of USD 800 million for the entire business.

Not only Fosun Tourism Group but the entire "Fosun Group" is accelerating the disposal of its tourism assets.

In July this year, Fosun International announced that its indirectly subsidiary, Yuhai, would sell the Starry Sky TOMAMU Resort in Hokkaido (Hokkaido Zhanguan Village) to YCH16, a company engaged in real estate investment and other businesses, for approximately JPY 40.8 billion (RMB 2.03 billion).

Earlier, the "Fosun Group" had already embarked on a comprehensive "retreat." In the secondary market, according to rough estimates by Jiedian Finance, Fosun has sold a significant amount of shares since 2022, with transaction amounts exceeding RMB 40 billion. These include shares in companies such as Jinhui Wines, Hainan Mining, Zhongshan Public Utilities, Taihe Technology, Sanyuan Foods, Kute Smart, *ST Guangtian, and COFCO Engineering. It has also sold shares in its core assets, Fosun Pharma and Fosun Tourism Group, and even liquidated its holdings in Tsingtao Brewery and Nanjing Iron & Steel.

Tsingtao Brewery holds a special sentimental value for Guo Guangchang. In December 2017, Fosun International acquired 243 million H shares of Tsingtao Brewery for HKD 6.617 billion, becoming the company's second-largest shareholder. However, by May 2022, Fosun International had sold all its shares in Tsingtao Brewery, realizing approximately HKD 15 billion in proceeds, with a profit of approximately HKD 8.4 billion, representing a profit rate of nearly 127%.

In October of that year, Fosun International also sold a 60% stake in Nanjing Iron & Steel, liquidating an asset it had held for nearly 20 years. In May 2023, Fosun International Center, located in Pazhou, Guangzhou, was also sold. During the same period, Fosun also exited Shanghai Pan Asia Shipping Co., Ltd.

In overseas markets, in January this year, Fosun sold a 5.6% stake in Banco Comercial Português for approximately EUR 235 million. In April, it sold an 8.19% stake in a Belgian insurance company for a total price of approximately EUR 626 million to EUR 670 million. In May, Fosun sold all its shares in German bank HAL, realizing EUR 670 million in proceeds.

One significant change resulting from the continuous asset liquidation sales is the rapid increase in financial expenses. Jiedian Finance found that from the first half of 2022 to the first half of 2024, Fosun International's financial expenses were RMB 5.463 billion, RMB 6.533 billion, and RMB 6.823 billion, respectively, while its net profits attributable to shareholders for the same periods were RMB 2.271 billion, RMB 1.359 billion, and RMB 719 million, respectively.

Upon comparison, it is evident that the decrease in Fosun International's net profit over the past three years seems to have been largely absorbed by the increase in financial expenses, which have become a significant burden. Behind Fosun's series of sales lies the necessity to maintain cash flow in order to survive.

02 Has the Cash Flow Pressure Truly Been Resolved?

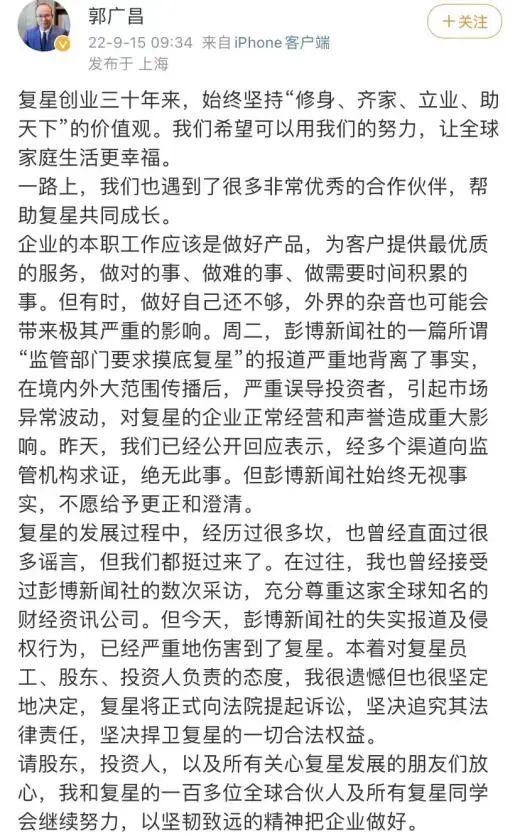

On June 22, 2017, a bombshell news broke that the China Banking Regulatory Commission had instructed banks to investigate the credit and risk profiles of several companies, including Wanda and Fosun. Shares of Wanda Cinema and Fosun-affiliated companies plummeted upon hearing the news.

In response, Wang Jianlin acted swiftly, quickly selling assets. In contrast, Guo Guangchang was less decisive. Nevertheless, after much deliberation, Guo eventually embarked on a similar path as Wang Jianlin. Behind Fosun Group's efforts to raise funds through asset sales lies a core issue: a lack of funds.

It was foreign rating agencies that first publicly acknowledged Fosun's cash flow problems. In June 2022, Moody's downgraded Fosun International's corporate family rating to Ba3 under review for possible downgrade. Moody's believed that "as of the end of March 2022, Fosun International's cash at the holding company level was insufficient to cover short-term debt maturing within the next 12 months."

This report caused significant market turmoil. To stabilize the situation, Fosun International quickly announced an offer to repurchase two overseas bonds for a total amount not exceeding USD 200 million. Subsequently, it announced a full repurchase of these two bonds, one for approximately USD 380 million and the other for approximately EUR 384 million. After the repurchases, Fosun International had no overseas bonds maturing that year.

However, Moody's still downgraded Fosun International's corporate family rating from Ba3 to B1, with a negative outlook. At the time, some media outlets questioned whether Fosun had "RMB 650 billion in debt hanging over its head." This assertion was somewhat biased, as a significant portion of this debt stemmed from insurance operations and did not require group guarantees.

While the capital chain crisis facing the Fosun Group is likely not as severe as rumored, Guo Guangchang's journey to true financial stability remains challenging.

During the 2023 interim earnings call, Guo Guangchang stated, "We have navigated the cycle, and Fosun's cash flow pressure has been well addressed." Nevertheless, the "selling spree" has continued in the subsequent year. Taking Fosun Tourism Group as an example, its financial report for the second quarter of 2024 showed that as of mid-2024, the company had cash and bank balances of RMB 3.54 billion, while its debt maturing within one year amounted to RMB 14 billion.

Upon closer analysis of Guo Guangchang's investment philosophy, Jiedian Finance found that he largely follows Warren Buffett's investment ideas, acquiring high-quality assets at relatively low prices and holding them long-term in a diversified manner. However, unlike Buffett, Guo is more aggressive, especially after 2017, when he continued to expand his business empire globally through aggressive acquisitions.

The benefit of this strategy is that during periods of rapid economic growth, the Fosun Group was able to leverage these acquisitions to grow rapidly. However, when macroeconomic growth slows, this approach can lead to difficulties.

Currently, as of the end of 2023, Fosun International's total assets amounted to RMB 808.388 billion, of which liabilities were RMB 599.813 billion, resulting in an asset-liability ratio of 74.2%, a decrease of 1.6 percentage points from the previous year.

However, this does not reassure Guo Guangchang, as interest-bearing bank loans and other borrowings are more crucial. In 2023, this figure doubled to RMB 211.924 billion from RMB 121.039 billion in 2022. Fosun International's net interest expense for 2023 was RMB 12.07 billion, an increase of RMB 1.6 billion from 2022, primarily due to rising interest rates on borrowings.

Facing both a still-tight capital chain and an urgent need for transformation, how can Guo Guangchang truly navigate through the "perfect storm"?

03 Focusing on Two Core Businesses: How Much High-Quality Assets Remain?

Over the past 30 years, Guo Guangchang has built the Fosun Group into a conglomerate with four core segments: Health, Happiness, Wealth, and Smart Manufacturing.

In China's business world, the Fosun Group stands out as a unique entity without a clear primary business. Instead, it has grown into a giant with assets exceeding RMB 800 billion primarily through investments that bring together seemingly unrelated businesses.

Especially after 2007, Fosun followed in Warren Buffett's footsteps by entering the insurance industry while simultaneously venturing into asset management and real estate funds. It successfully capitalized on the European debt crisis by launching large-scale global mergers and acquisitions, resulting in a 12.47-fold increase in asset size over 16 years.

Guo Guangchang has also stated that Fosun's growth is attributed to "making the right investments at the right time." However, as market conditions change, safely navigating challenging times becomes paramount.

Looking ahead, Guo Guangchang stated at the Seventh World Zhejiang Merchants Shanghai Forum earlier this year that Fosun would focus on two core businesses: biomedicine and tourism, embracing an asset-light operating model. Nevertheless, the current performance of these two core businesses is insufficient to reassure investors.

Fosun Pharma's 2024 interim report revealed revenue of RMB 20.463 billion, a year-on-year decrease of 4.36%, and net profit attributable to shareholders of RMB 1.225 billion, a year-on-year decrease of 31.09%. In 2023, its total revenue was RMB 41.4 billion, down 5.81% year-on-year, with net profit attributable to shareholders of RMB 2.386 billion, down 36.04% year-on-year.

It is evident that both revenue and net profit of Fosun Pharma have been declining year-on-year in 2023 and the first half of 2024, with the decline in net profit significantly outpacing that of revenue. Fortunately, Fosun Pharma achieved some success in its innovative drug business during the first half of the year, with a total of nine indications approved for four innovative drugs/biosimilars developed in-house or licensed in.

However, it remains uncertain when these innovative drugs will translate into growth in performance. In the field of innovative drugs, there is a saying known as the "double-ten rule," which states that it takes approximately ten years and USD 1 billion to develop a single innovative drug. The challenges of research and development and the capital required are significant tests.

The tourism segment, on the other hand, received praise from Guo Guangchang.

In 2023, Fosun Leisure sold resorts in Turkey and the West Indies, along with two hotel brands under Thomas Cook, Casa Cook, and Cook’s Club, realizing a cash inflow of RMB 390 million. He stated that Club Med and the Atlantis Sanya Resort, both under Fosun Leisure, achieved their best-ever performance for the same period in history.

But as high-quality assets such as Club Med are frequently rumored to be up for sale, how to retain the "cash cow" has also put the "Fosun Group" in a dilemma.

Of course, for Fosun's "survival by amputation" and the latest performance, domestic and foreign institutions such as Citibank, Essence Securities, Huaxi Securities, etc. have given "buy" or "increase" ratings. However, in the secondary market, except for a slight rebound at the end of 2022, Fosun International's share price is still in a downward trend with no signs of recovery.

Compared to previous years, the 57-year-old Guo Guangchang has visibly aged, with gray temples and a tired look in his eyes. Can the "Fosun Group" he founded successfully overcome its difficulties? The answer can only be given by time.