The good days of Chinese stocks listed overseas are coming soon!

![]() 09/25 2024

09/25 2024

![]() 547

547

After nearly four years of decline, Chinese stocks listed overseas have recently experienced a sudden surge. JD.com, Ke.com, XPeng Motors, and Futu Holdings all surged by over 10% within three days, while Alibaba and Tencent Music saw gains of over 6%...

The direct trigger for this rebound was the Federal Reserve's announcement on September 18th to cut interest rates by 50 basis points. With the official shift in US monetary policy, will Chinese stocks listed overseas finally reverse their fortunes?

[Waiting for the Bottom Pickers]

Since February 2021, Chinese stocks listed overseas that have gone public in the US have collectively fallen by over 70%, comparable to the collapse of the global dot-com bubble in 2000, with a cumulative market value erosion of 9.5 trillion yuan. Among them, 152 companies have seen declines of over 90%, and 196 companies (46% and 60% of the total number of Chinese stocks listed overseas in the US, respectively) have fallen by over 80%.

At their peak, Chinese stocks listed overseas boasted three trillion-yuan and 28 hundred-billion-yuan market cap companies. Today, only two companies remain with a market value exceeding a trillion yuan, and just 12 with values exceeding a hundred billion yuan.

Despite the dire situation, there are still many investors who have braved the storm, including top-tier public and private equity funds as well as a large number of retail investors.

As of the end of the second quarter of 2024, eight of the top 20 holdings of Hillhouse Capital were Chinese stocks listed overseas, including Pinduoduo, Full Truck Alliance, New Oriental, Futu Holdings, ZTO Express, Alibaba, etc., with a total holding value of $1.83 billion, accounting for nearly 50% of the firm's total US stock holdings. Furthermore, with the exception of ZTO Express and Qifu Technology, the other six Chinese stocks in the portfolio saw varying degrees of position increases during the second quarter.

Gao Yi Asset Management has been even more aggressive in its overseas allocation of Chinese stocks listed overseas. As of the end of the second quarter, it held shares in 19 US-listed companies, of which 15 were Chinese stocks listed overseas, including Pinduoduo, Huazhu Hotels Group, NetEase, iQIYI, Tencent Music, etc., with a total holding value of $760 million, an increase of $200 million from the end of the first quarter.

On the public fund side, E Fund Asian Select, led by Zhang Kun, had three Chinese stocks listed overseas (Hong Kong-listed) among its top ten holdings, including Giant Network Group, Ctrip.com International, and Meituan, with the first two being newly added to the portfolio in the second quarter.

In addition to institutional investors, a large number of retail investors have also taken advantage of ETFs to bottom-pick Chinese stocks listed overseas against the trend. A typical example is a certain Chinese Internet ETF, whose shareholdings have increased nearly tenfold from 3.4 billion shares in February 2021 to 34.8 billion shares today, with the market value of these holdings ballooning from 8 billion yuan to approximately 35 billion yuan.

Bottom-picking investors have long been lurk , eagerly anticipating a reversal in the fortunes of Chinese stocks listed overseas.

[Three Major Setbacks]

The depth and duration of the decline in Chinese stocks listed overseas have set historical records. The main reasons for this dire situation include three major negative factors: industry policy, fundamental performance, and high valuations.

Firstly, regulatory policy interventions have accelerated the sudden change in the outlook for the internet industry.

As early as November 2020, the State Administration for Market Regulation drafted the "Anti-Monopoly Guidelines for the Platform Economy Sector (Exposure Draft)," marking the beginning of China's antitrust regulation and the prevention of disorderly capital expansion.

The following year, in April, a major e-commerce giant was fined over 18 billion yuan, signaling the end of the era of unchecked growth for Chinese internet companies. Since then, regulation has become normalized, placing a tight leash on the rapid development of the internet industry.

Against this backdrop, profound changes have taken place in the "quantity and price" dimensions of China's internet industry.

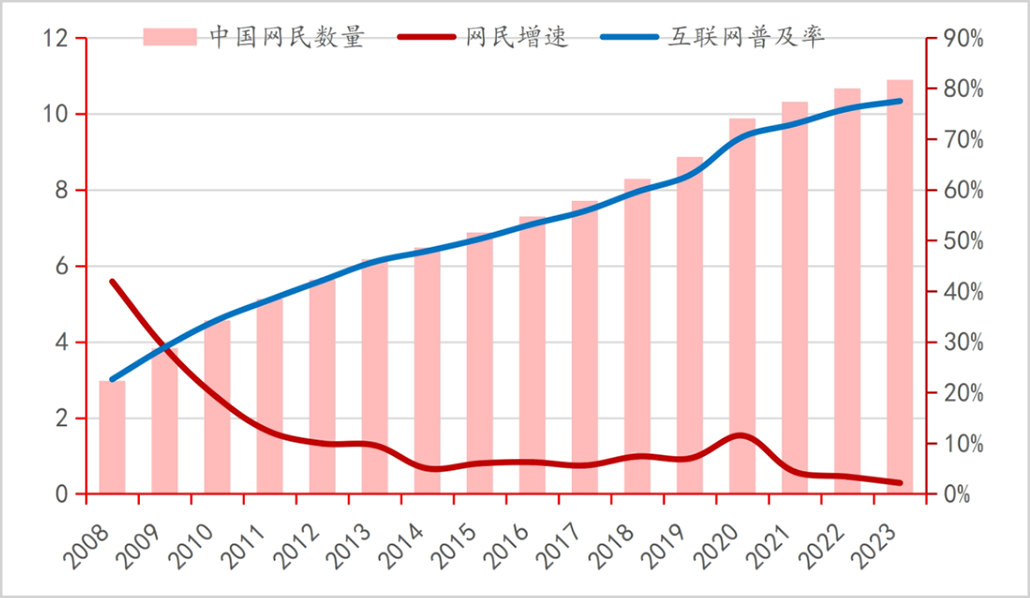

On the one hand, the number of internet users in China and internet penetration rates have accelerated towards their peaks. In 2020, the number of internet users surged to 989 million in December, a significant increase of 85.4 million from March, with an internet penetration rate of over 70%. Since then, growth has slowed considerably, with 1.092 billion internet users and a penetration rate of 77.5% at the end of 2023, approaching saturation.

▲Number of Internet Users and Internet Penetration Rate in China, Source: China Merchants Bank Research Institute

On the other hand, internet companies have engaged in a fierce price war, particularly in the e-commerce sector.

From 2020 to 2022, the first phase of the e-commerce price war unfolded, with Alibaba and JD.com launching Taobao Tejia and Jingxi to compete directly with another major e-commerce giant for the lower-tier market and consolidate their existing market share.

From 2023 to the first half of 2024, e-commerce platforms engaged in a comprehensive price war. On the one hand, consumer spending patterns have diversified, with consumers favoring low-cost, high-quality products. On the other hand, the continued rise of short video platforms led by Douyin, Kuaishou, and Xiaohongshu has taken a significant chunk of the e-commerce pie, intensifying competition.

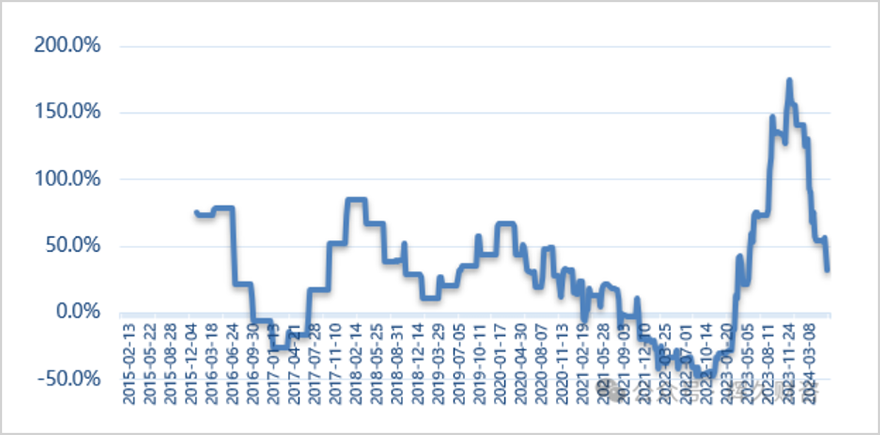

As a result, the overall profit growth of Chinese stocks listed overseas has reverted from high to medium-low speeds, with some even experiencing significant negative growth in 2022. Furthermore, the net profit margins of most Chinese stocks listed overseas have remained volatile and declining over the past four years, leading to varying degrees of decline in return on equity.

▲Year-on-Year Growth Rate of Net Profit for Chinese Stocks Listed Overseas, Source: Institutions

While actual performance is one aspect, expectations are a more crucial factor in determining pricing. However, with policy interventions accelerating changes in the "quantity and price" dimensions of the internet industry, market expectations have reversed, shifting from extreme optimism to extreme pessimism, driving a sustained and significant decline in Chinese stocks listed overseas.

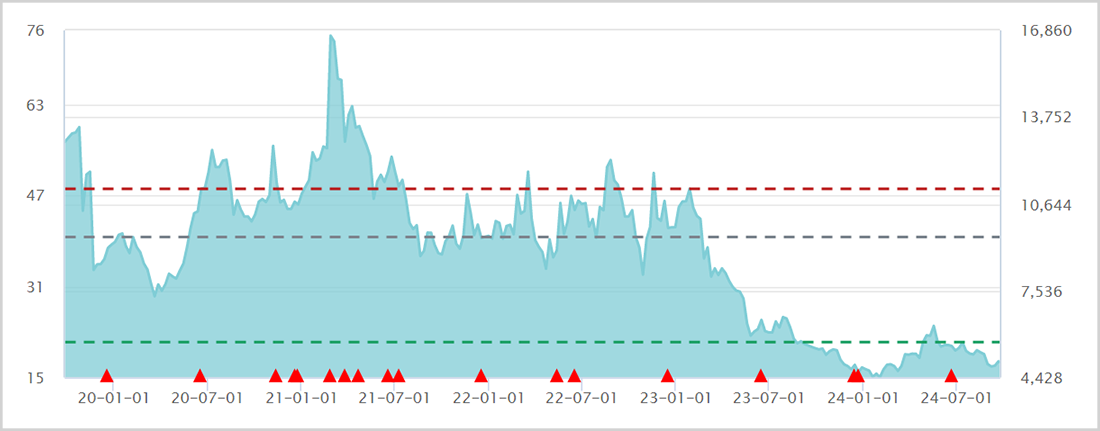

Moreover, the collapse of Chinese stocks listed overseas is closely related to their excessively high valuations prior to the decline. In February 2021, the overall P/E ratio of Chinese stocks listed overseas was over 75 times, with many leading internet companies exceeding 100 times, resulting in significant valuation bubbles due to institutional herd behavior over the previous year.

Under multiple negative factors, the high valuations of Chinese stocks listed overseas eventually underwent a significant correction through share price declines. However, after a prolonged period of share price declines and valuation digestion, the darkest hour for Chinese stocks listed overseas may have passed.

It is worth noting that since 2021, the lowest price for Chinese stocks listed overseas occurred in October 2022, and even during the panic in early February 2024, prices did not fall below that previous low.

[No Reason for Pessimism]

In the view of Market Value Observation, Chinese stocks listed overseas are poised for a solid valuation recovery in the future.

Firstly, the past four years have seen declines of over 70%, fully pricing in significant negative factors such as policy and performance, and potentially overestimating the extent of these factors. According to Wind, as of September 23rd, the valuation of Chinese stocks listed overseas stood at 17.75 times, significantly below the median and opportunity value of the past five years.

▲China Internet 50 Index PE Trend Chart, Source: Wind

Secondly, regulatory policies across various industries, including e-commerce, education, and gaming, have eased significantly. Moreover, the performance of leading internet companies, which account for a significant weight, has not decelerated as much as anticipated.

According to Data Value Investment statistics, in the second quarter of 2024, the top 10 Chinese stocks listed overseas (Tencent, Alibaba, JD.com, Pinduoduo, Meituan, Baidu, Kuaishou, NetEase, Ke.com, and Bilibili) generated revenue of 994.95 billion yuan, a year-on-year increase of 10.3%, and non-GAAP net income attributable to shareholders of 203.496 billion yuan, a year-on-year increase of 33.7%. Additionally, gross margin was 38.7%, and operating margin was 16%, both of which have rebounded compared to previous quarters.

Thirdly, the Federal Reserve has officially announced a 50 basis point interest rate cut in September and expects another cut of over 50 basis points within 2024. This will inevitably lead to a reallocation of capital flows towards emerging markets, providing an upward pull for Chinese stocks listed overseas, which are at a global valuation low.

However, it is highly likely that the performance of Chinese stocks listed overseas will diverge in the future, and greater emphasis should be placed on leading companies that have bucked the trend during the downturn. These companies often represent robust fundamentals with alpha sufficient to offset the significant beta impacts, and they are likely to benefit significantly from any market recovery.

For example, among the top 18 Chinese stocks listed overseas by market value, only Ctrip.com International recorded a positive return against the trend, with a gain of over 28%.

On the one hand, its current fundamental performance is solid. From 2022 to 2023 and the first half of 2024, its net profit has maintained triple-digit growth, with profitability also strengthening.

On the other hand, market expectations for future growth are not bleak. In the domestic market, Ctrip.com International remains the leading online travel agency, with a near-monopoly on premium hotel contract prices. It relies on its early accumulation of tourism resources and a large base of high-net-worth customers to fend off competition from other OTA platforms.

In overseas markets, Ctrip.com International has replicated its Chinese experience in the Asia-Pacific region, leveraging cost-effectiveness to capture market share in emerging markets with low concentration levels. Furthermore, with policies such as visa exemptions in place, inbound tourism to China has flourished, giving Ctrip.com International an advantage in serving overseas users.

Another example is Legend Biotech, which bucked the trend to surge by over 75% during the period. In terms of current fundamentals, revenue has grown by double-digit or even triple-digit percentages over the past six years, although net profit has remained in the red for over six years. On the expectation front, the company has won significant market value gains through its groundbreaking CAR-T cell therapy (a cancer treatment that modifies a patient's T cells to recognize and attack cancer cells) in the capital markets.

In summary, after experiencing an epic collapse, Chinese stocks listed overseas are highly likely to experience a valuation recovery during the Federal Reserve's interest rate cut cycle. Greater emphasis should be placed on leading companies that have bucked the trend in the past. The storm has passed, and there is no reason to remain pessimistic about Chinese stocks listed overseas.

Disclaimer

The content related to listed companies in this article is based on the author's personal analysis and judgment based on information publicly disclosed by the companies in accordance with legal obligations (including but not limited to interim announcements, periodic reports, and official interaction platforms). The information or opinions contained herein do not constitute any investment or other business advice. Market Value Observation shall not be held responsible for any actions taken as a result of adopting this article.

-END-