"Chang Guang Satellite Sprints to IPO: Many Unsolved Mysteries, Shrouded by Equity Holding Cloud, Shareholder Zhao Yongyang's Identity Unknown"

![]() 09/27 2024

09/27 2024

![]() 480

480

Written by Planet

Source: Beiduo Finance

Recently, Chang Guang Satellite Technology Co., Ltd. (hereinafter referred to as "Chang Guang Satellite") released the world's first high-definition global annual image - the "Jilin-1" global image. According to introductions, this image combines high spatial resolution, high temporal resolution, and high coverage, filling an international gap.

It is worth mentioning that Chang Guang Satellite's IPO process has been quite tortuous. According to Beduo Finance, the company's IPO application was accepted by the Shanghai Stock Exchange as early as December 2022, but its review status changed to "inquiry completed" in January of the following year and then stagnated. The review was suspended twice during this period due to "financial materials having expired."

What exactly is holding back Chang Guang Satellite's progress? We need to start from aspects such as its operating performance, financial strength, equity structure, and compliance of equity holding on behalf of others.

I. Continuous Losses Create a "Gold-Eating Beast"

According to the prospectus, Chang Guang Satellite focuses on the research and development and technological innovation of high-performance, low-cost satellites in the commercial aerospace field. It is China's first full-chain commercial remote sensing satellite company integrating satellite research and development, manufacturing, operation and management, and remote sensing information services.

Chang Guang Satellite stated in its prospectus that it independently constructs and operates the world's largest sub-meter-level commercial remote sensing satellite constellation, "Jilin-1," which can provide customers with high-quality satellite remote sensing data and comprehensive spatial information application services based on satellite remote sensing data.

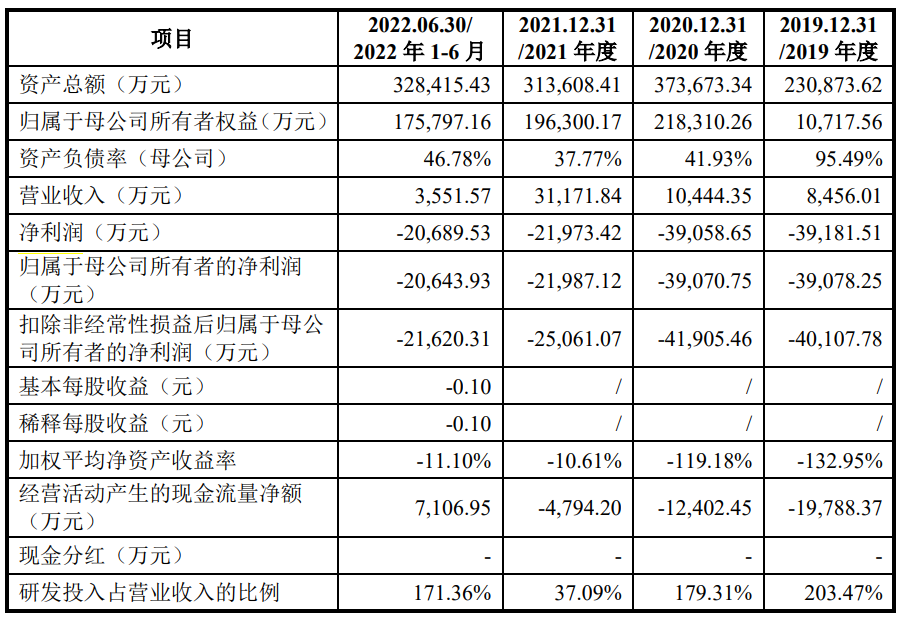

Based on Chang Guang Satellite's prospectus and reply letter, the company's operating revenues from 2019 to 2023 were 84.56 million yuan, 104 million yuan, 312 million yuan, 602 million yuan, and 585 million yuan, respectively, showing an overall upward trend, although the revenue scale in 2023 slightly declined.

From 2019 to the first half of 2022, Chang Guang Satellite's net profits attributable to shareholders were -391 million yuan, -391 million yuan, -220 million yuan, and -206 million yuan, respectively. Although Chang Guang Satellite has not disclosed its latest profits, based on its expectation of achieving profitability by 2025, it is highly likely that the company still incurred losses in 2023.

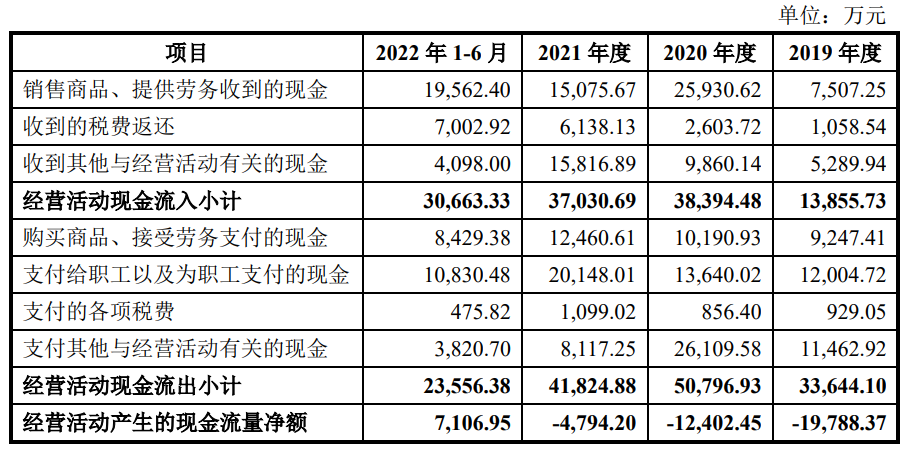

Moreover, the net cash flow generated from operating activities during the same period was -198 million yuan, -124 million yuan, -47.942 million yuan, and 71.0695 million yuan, respectively. The net cash inflow in the first half of 2022 was related to the recovery of receivables from the previous year and the receipt of VAT refunds.

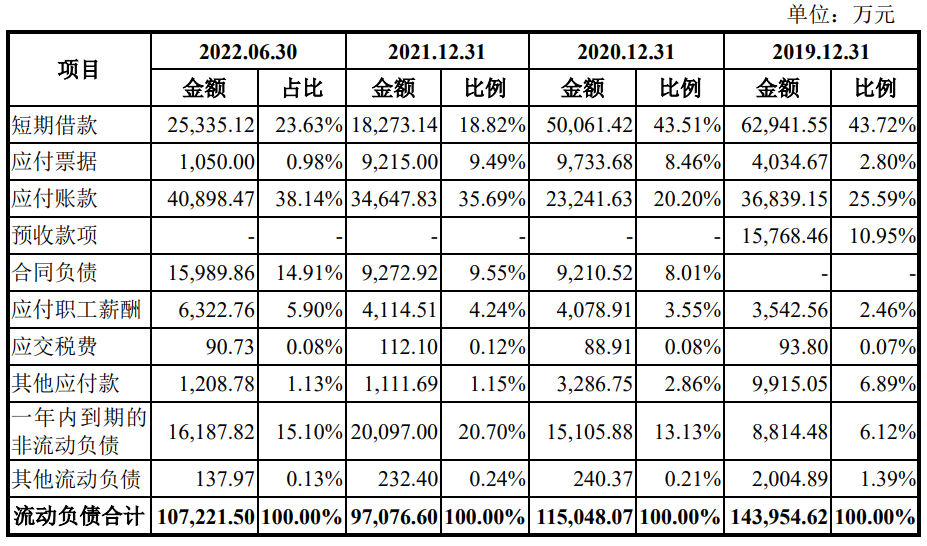

As of the end of the first half of 2022, Chang Guang Satellite's short-term borrowings reached 253 million yuan, in addition to billions of yuan in accounts payable and tens of millions of yuan in notes payable that needed to be repaid. However, its cash and cash equivalents balance was only 292 million yuan, indicating an unfavorable overall financial position.

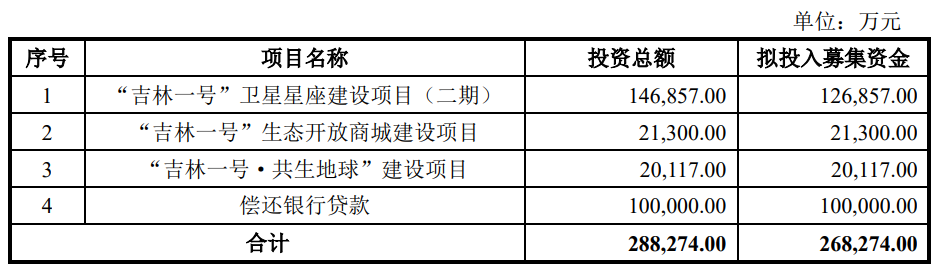

For this reason, Chang Guang Satellite turned its attention to raising funds through an IPO. The company plans to raise 2.683 billion yuan, with 1.683 billion yuan allocated to construction projects related to its main "Jilin-1" business, and up to 1 billion yuan designated for repaying bank loans, accounting for almost half of the total fundraising amount.

The Shanghai Stock Exchange expressed doubts about Chang Guang Satellite's profitability, requiring it to explain its ability to sustain operations from the perspectives of future plans for its main business and industry trends, as well as the reasons and rationality behind using the raised funds to repay bank loans in an amount higher than the company's most recent borrowings.

In its reply letter, Chang Guang Satellite stated that its remote sensing information service business generated revenues of 182 million yuan, 288 million yuan, and 482 million yuan from 2021 to 2023, respectively, showing an overall upward trend. With its rising industry status and increasing customer recognition, the company expects this type of revenue to continue growing rapidly in the future.

Furthermore, Chang Guang Satellite signed loan contracts with multiple banks in the second half of 2022. As of October that year, its short-term and long-term borrowings totaled approximately 1.003 billion yuan, higher than the amount earmarked for repaying bank loans in its fundraising project. The company also has the potential to borrow further in the future, justifying its fundraising plans.

II. The "Rashomon" of Equity Holding on Behalf of Others

According to the prospectus, Chang Guang Satellite's predecessor, Chang Guang Limited, was established in February 2014 by 28 shareholders, including Changchun Institute of Optics, Fine Mechanics and Physics, Chinese SME Development Fund, Wenyu Aerospace, Zhongyuan Aerospace, among others.

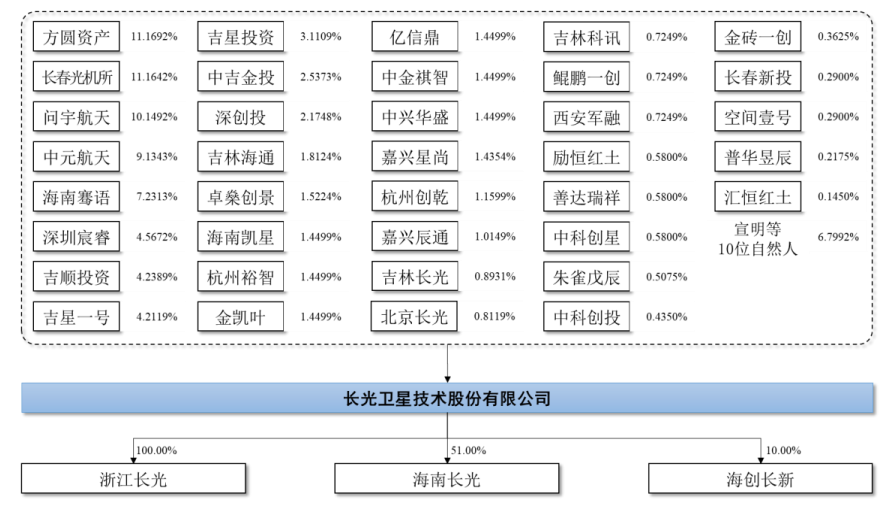

Chang Guang Satellite's equity structure is relatively decentralized, with no controlling shareholder or actual controller. Although its founder Xuan Ming serves as Chairman and General Manager and leads the company's daily operations with his management team, he only holds 4.4723% of the company's shares, insufficient to control the general meeting of shareholders or the board of directors.

As of this IPO, Wenyu Aerospace, Zhongyuan Aerospace, Zhuoshen Chuangjing, Zhongxing Huasheng, Sun Mingchen, and Zhao Yongyang have a consistent action relationship, collectively holding 24.0948% of Chang Guang Satellite's shares. Meanwhile, Fangyuan Assets holds 11.1692%, Changchun Institute of Optics, Fine Mechanics and Physics holds 11.1642%, and Hainan Qianyu, Shenzhen Chenrui, and others are also shareholders of the company.

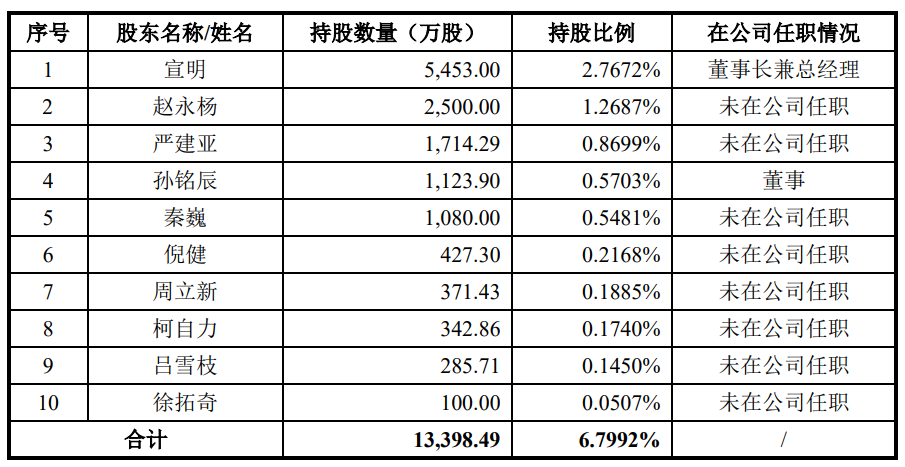

The actual controllers of Wenyu Aerospace and Zhongyuan Aerospace are Sun Mingchen and Sun Lu, siblings. Sun Mingchen is also the actual controller of Zhongxing Huasheng, while Sun Lu is the actual controller of Zhuoshen Chuangjing. Zhao Yongyang has no familial relationship with the Sun siblings but has financial transactions with Sun Zhibin, their father.

Zhao Yongyang is neither a key member of Chang Guang Satellite nor employed by the company, and has no other investment or employment history listed on Tianyancha. Despite this, he has become the second-largest individual shareholder after Chairman Xuan Ming, with an original investment of 87.5 million yuan, holding 25 million shares, or 1.2687% of the company's shares.

This raises questions about the nature of the financial transactions between Zhao Yongyang and Sun Zhibin. If there was direct fund transfer between them, their actual relationship and compliance issues would be of concern to the industry. If they were in a holding-on-behalf-of relationship, why was this not disclosed in Chang Guang Satellite's prospectus?

It is worth noting that Chang Guang Satellite has a history of significant equity holding on behalf of others, which has drawn the attention of the Shanghai Stock Exchange regarding compliance. The Exchange requested Chang Guang Satellite to explain the reasons for previous instances of equity holding on behalf of others, the specific process of clearing such holdings, and whether there were any other issues such as entrusted shareholding, benefit transfers, or other benefit arrangements.

In particular, the equity holding relationship between Chang Guang Satellite and Hainan Qianyu during the company's tenth capital increase was notable in its reply letter. According to the letter, Hainan Qianyu invested 499 million yuan in Chang Guang Satellite in November 2020, with Fu Liming, Song Jieqing, and Xi Zhonghai entrusting Yu Yaqian to hold their partnership shares in Hainan Qianyu and signing an agreement.

In September 2023, Yu Yaqian signed partnership share transfer agreements with Fu Liming, Song Jieqing, and Xi Zhonghai, agreeing to transfer the partnership shares they held on their behalf to the respective entrusted holders. Xi Zhonghai, for personal reasons, intended to no longer hold his partnership shares in Hainan Qianyu and transferred his 1.05 million yuan share to Song Jieqing.

Chang Guang Satellite did not mention the equity holding on behalf of others related to Hainan Qianyu in its prospectus released in December 2022. When introducing Hainan Qianyu, Chang Guang Satellite stated that apart from holding its equity, Hainan Qianyu did not engage in other businesses and was not related to the company's main business.

According to the IPO Enterprise Shareholder Information Disclosure Provisions in the Guidelines for the Application of Regulatory Rules, issuers shall disclose shareholder information truthfully, accurately, and completely. If there are instances of equity holding on behalf of others in their historical development, they must resolve these issues before submitting their applications and disclose the reasons for their formation, evolution, resolution process, and potential disputes in their prospectuses.

From this perspective, Chang Guang Satellite may have issues with inadequate or even non-compliant information disclosure.

III. Notable "Aftereffects" of Multiple Capital Increases

Why has Chang Guang Satellite remained silent about its close relationship with Hainan Qianyu? The answer lies in Yu Yaqian, the entrusted holder for Hainan Qianyu. When Hainan Qianyu invested in Chang Guang Satellite in 2020, Yu Yaqian's investment corresponded to 12.3 million shares. Excluding the 2.3 million shares held on behalf of others, he actually held 10 million shares.

The funds behind these 10 million shares likely originated from corrupt officials. According to Financial Statement Storm reports, in November 2020, with the consent of Gao Mou, Yu Donghai used 35 million yuan to purchase 10 million shares in Chang Guang Satellite on behalf of Gao Mou, which were registered under Hainan Qianyu and held by Yu Yaqian, the son of Yu Donghai.

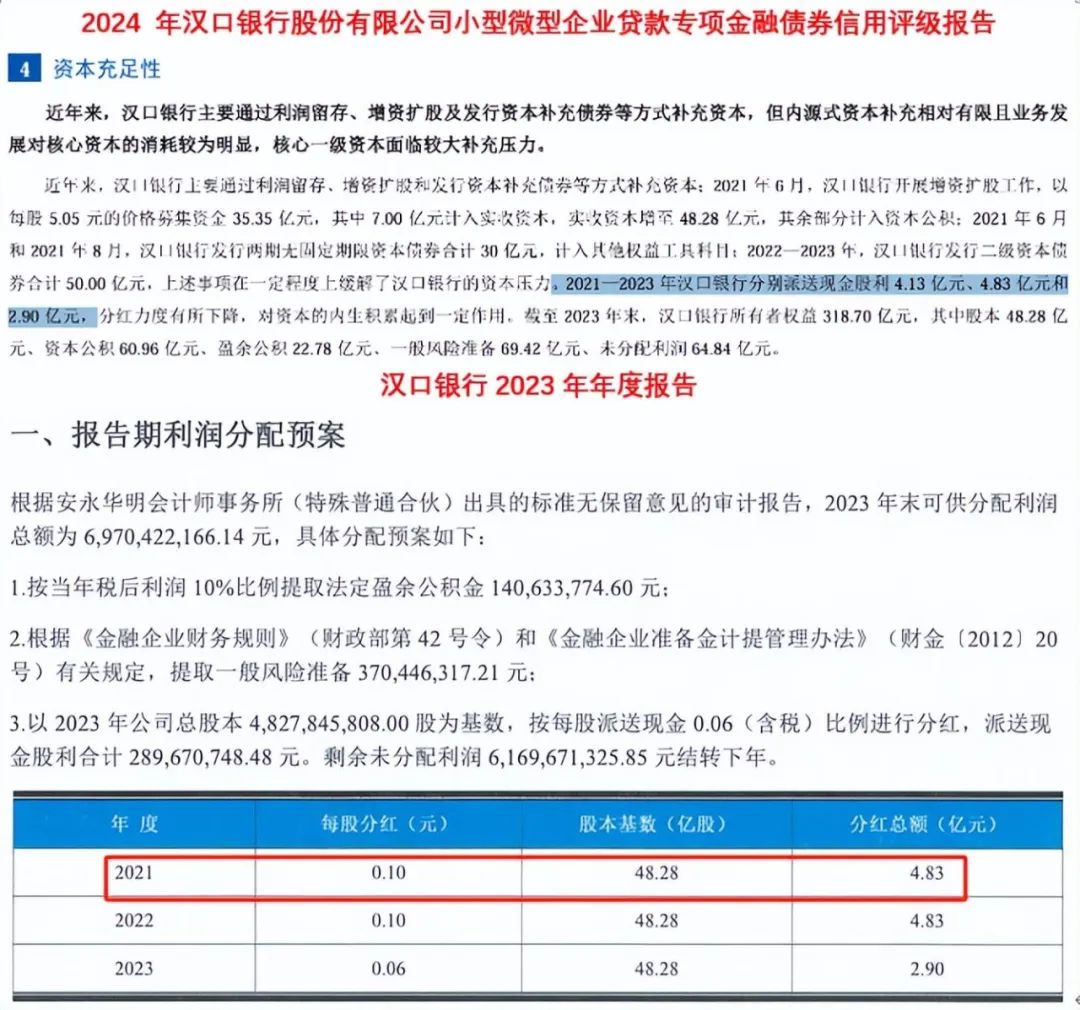

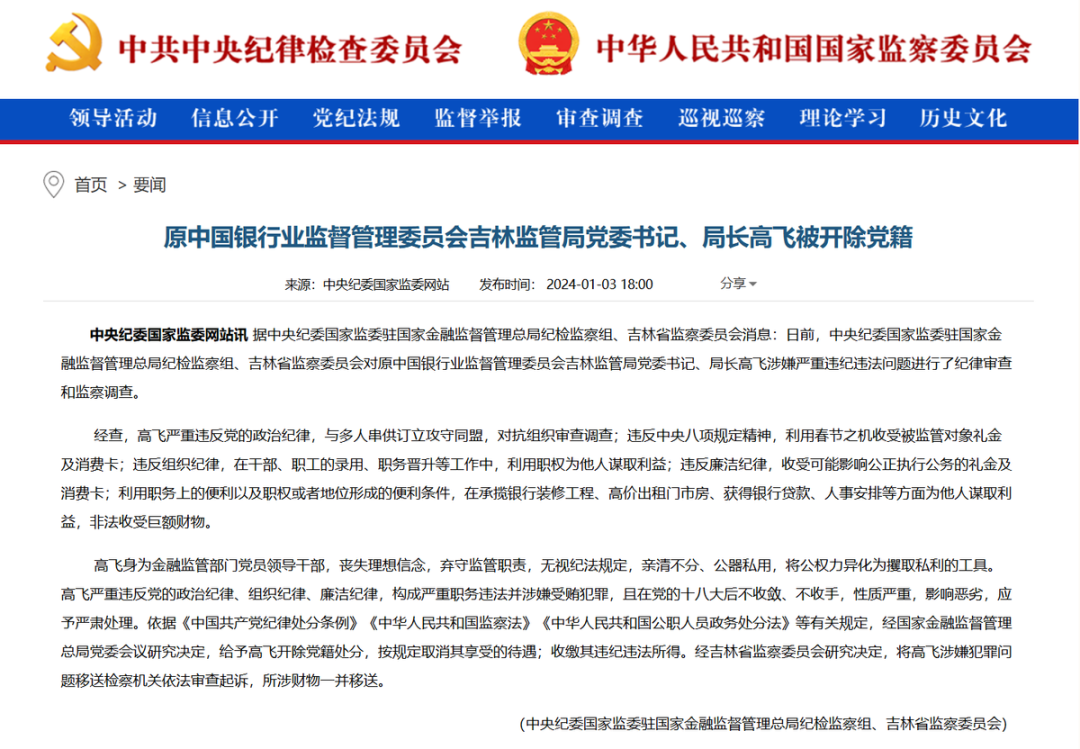

This "Gao Mou" is none other than Gao Fei, the former director of the Jilin Banking Regulatory Bureau. According to announcements disclosed by the Central Commission for Discipline Inspection and the National Supervisory Commission, Gao Fei sought benefits for others and illegally accepted huge amounts of property in areas such as bank renovation projects, high-priced rental of commercial properties, obtaining bank loans, and personnel arrangements, which will be prosecuted for bribery.

Tianyancha App information shows that Hainan Qianyu's 10 million yuan equity and other investment rights and interests have been frozen by the Jilin Provincial Supervisory Committee, with Chang Guang Satellite as the executing enterprise. The freeze period is from August 22, 2023, to February 21, 2024, starting two months after Gao Fei was taken away for investigation.

However, Chang Guang Satellite did not disclose any information related to Yu Yaqian's holding shares on behalf of Gao Fei in its reply letter. Instead, it only revealed that in July 2022, Qi Guangyu acquired a partnership in Hainan Qianyu and held 7.5 million shares on behalf of others, involving situations prohibited or restricted by laws and regulations regarding shareholding. It stated that these entrusted shares have been confiscated.

Whether this is merely a coincidence or a deliberate attempt by Chang Guang Satellite to conceal internal control issues by not verifying funding sources thoroughly remains to be seen and will require further clarification from the company. However, it is certain that this is not the first time corrupt officials have gained equity in Chang Guang Satellite through holding shares on behalf of others.

In August 2015, 22 key company members, including Xuan Ming, invested 77 million yuan in Chang Guang Satellite at a price of 1 yuan per registered capital. Among them, Xuan Ming invested 17 million yuan, and Gao Fubo entrusted Xuan Ming to hold 4.5 million yuan worth of Chang Guang Satellite equity, signing an equity holding agreement with him.

It is worth noting that at that time, Gao Fubo was the Chairman of Jilin Trust Investment Co., Ltd. (hereinafter referred to as "Jilin Trust"), a public official not allowed to invest in private enterprises. Gao Fubo underwent supervisory investigation by the Jilin Provincial Supervisory Committee in 2018 and was eventually sentenced to 20 years in prison for multiple corruption charges, with a fine of 5.6 million yuan confiscated.

In response to the Shanghai Stock Exchange's questions regarding the compliance of Gao Fubo's equity investment funding sources and whether he evaded his status as a public official, Chang Guang Satellite stated that Xuan Ming was once required to cooperate with investigations due to the entrusted holding matter but that relevant authorities did not freeze or seize the shares. Gao Fubo's investment funds originated from his salary accumulation and were legally earned income.

Chang Guang Satellite added that its August 2015 capital increase was targeted at internal key personnel, and others interested in investing could only do so through these key personnel. Since Gao Fubo had already submitted his resignation letter at that time, he entrusted Xuan Ming to hold his shares, not to evade his status as a public official.