Xiaohongshu, striving to be Xiaohongshu

![]() 09/26 2024

09/26 2024

![]() 745

745

[Tidal Business Review/Original]

As a fashion icon, Xiaohongshu is Lisa's "electronic girlfriend" on her growth journey. "When I want to buy clothes, I search on Xiaohongshu; when I don't know what to have for dinner, I search on Xiaohongshu; recently, I've been researching MBTI on Xiaohongshu," she says.

"I can't live without Xiaohongshu now. Whenever I want to do something, I first search on Xiaohongshu," Lisa excitedly shares with her colleagues.

As COO Conan once said, "Xiaohongshu has become an entry point for ordinary people to search the internet."

According to data released at the 2023 WILL Business Conference, 60% of users frequently search on Xiaohongshu daily, with nearly 300 million searches per day on average.

Xiaohongshu, with its strong user engagement, is increasingly becoming the second "home" for many young people in the online world. However, before this, Xiaohongshu also underwent numerous transformations, iterations, and faced challenges.

Founded in 2013, Xiaohongshu is one of the few internet unicorns nurtured in Shanghai.

Initially, Xiaohongshu started as a PDF document titled "Xiaohongshu Shopping Guide for Overseas Travel."

With the growing demand for cross-border shopping, this "Xiaohongshu" quickly gained popularity, surpassing tens of thousands of downloads in just one month.

However, no one knew at the time that this document would become a $30 billion unicorn a decade later.

In December 2013, Xiaohongshu officially launched its overseas shopping sharing community as a mobile app, inviting authors worldwide to share their shopping experiences abroad. Leveraging high-quality content and social needs, Xiaohongshu quickly amassed a loyal following. By August 2014, Xiaohongshu had millions of users, mostly female. Amid the booming domestic e-commerce industry and facing challenges in monetizing traffic, Xiaohongshu decided to transform into a cross-border e-commerce platform.

Relying on its large user base, Xiaohongshu successfully established self-operated bonded warehouses in Zhengzhou in 2015 and Shenzhen in June of the same year.

Xiaohongshu initially envisioned a parallel development of content and e-commerce, but reality proved otherwise. In 2016, Xiaohongshu's cross-border e-commerce market share was only 6.5%, far behind competing platforms.

Moreover, due to a lack of e-commerce experience, Xiaohongshu faced frequent issues with product procurement and authenticity, leading to numerous counterfeit complaints. Consequently, Xiaohongshu refocused on community ecosystem construction.

Losing one battle but winning another, Xiaohongshu capitalized on domestic internet technology advancements to shift from manual content operation to machine distribution, marking a "industrial revolution" that propelled its journey towards high-quality content.

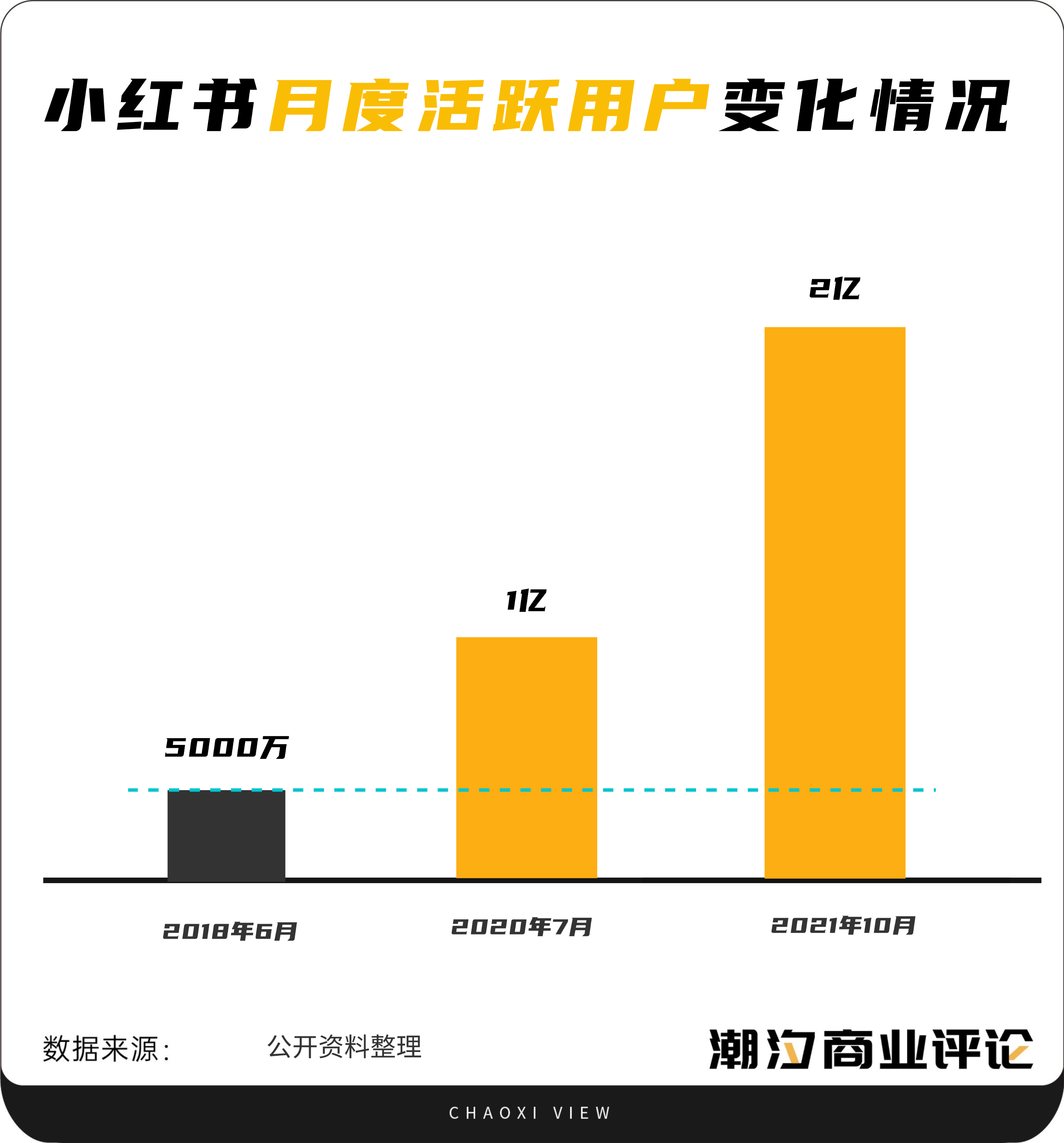

In 2017, Xiaohongshu leveraged celebrity influence to expand its reach, bringing in stars like Lin Yun, Wu Jinyan, Qi Wei, and Zhang Yuqi. By June 2018, Xiaohongshu's monthly active users (MAU) surpassed 50 million; by July 2020, MAU reached 100 million; and 15 months later, surpassed 200 million.

Amidst its rapid growth, Xiaohongshu also garnered capital attention, securing $400 million in funding from Tencent and Alibaba.

The expansion of its user base represents a diversification of audience segments, but Xiaohongshu has consistently prioritized female users. They include confused seniors about to graduate, migrant workers earning less than $6,000 a month in Beijing, and digital nomads traveling the world.

These users share a common trait: a near-obsessive love for life's details. Their activity enriches community content and propels Xiaohongshu into a comprehensive life-sharing haven. By 2023, Xiaohongshu boasted over 350 million users, with females accounting for over 70%.

Unlike other platforms, Xiaohongshu boasts strong long-tail demand, and even ordinary users can gain significant attention through content, outperforming KOCs (Key Opinion Consumers) on other platforms in commercial value.

Over eleven years, Xiaohongshu has evolved from a simple PDF shopping guide to a vibrant content community and then to a comprehensive lifestyle platform. However, amidst this transformation, growth "crises" and directional "confusion" have persisted.

Entering 2024, Xiaohongshu has seen frequent organizational changes and personnel turnover.

Turnover rate has been a hot topic surrounding Xiaohongshu. Earlier media reports claimed that the average tenure of Xiaohongshu employees is only about six months, with those working for more than two years considered "living fossils." Many leave within three to four months.

In the first quarter of this year, He Tong, responsible for Xiaohongshu's community content, resigned due to the platform's failure to meet daily active user growth expectations.

Meanwhile, the organizational structure of Xiaohongshu's e-commerce operations department underwent adjustments at the end of June. According to media reports, the e-commerce operations team is no longer solely managed by Yin Shi but is now overseen by multiple leaders, with Yin Shi overseeing the industry merchant group, Mei Xian overseeing the buyer group, and Xuan Shuang leading the newly established KA (Key Account) group while also serving as the commercialization head of Meishefu.

Dong Zhang coordinates the e-commerce strategy mid-platform with the commercialization department's strategy, efficiency, and strategy teams, fostering a unified commercial and e-commerce mid-platform.

On August 16, Xiaohongshu internally announced simplifications to its management hierarchy, including eliminating the R job grade, streamlining management levels, and appointing leaders at all levels.

Personnel turnover extends beyond current employees. Many Xiaohongshu job openings remain active on BOSS Zhipin.

Behind the frequent personnel adjustments lies Xiaohongshu's prominent "commercialization" challenges.

Xiaohongshu entered the e-commerce space relatively late and, as a content community, prioritizes maintaining its community atmosphere. Thus, in seeking a balance between content and commercialization, some efficiency has been sacrificed.

By the end of 2023, Xiaohongshu reported 312 million monthly active users, revenue of $3.7 billion (approximately RMB 27 billion), and a net profit of $500 million, marking its first profitable year.

However, compared to other platforms, Xiaohongshu operates on a smaller scale. Data shows that Alibaba's revenue in fiscal year 2023 was RMB 868.687 billion, while JD.com, Pinduoduo, and Kuaishou reported RMB 1,084.7 billion, RMB 247.6 billion, and RMB 113.47 billion, respectively, in 2023.

Like Douyin, Xiaohongshu leverages user engagement to expand into e-commerce and other services. A defining feature of Xiaohongshu's commercialization is "seeding": using content to stimulate user interest in products, leading to future purchases.

In reality, while many users are indeed inspired to make purchases through Xiaohongshu posts, they often complete their transactions on established e-commerce platforms like Alibaba's Taobao and Tmall or JD.com, rather than on Xiaohongshu itself.

For Xiaohongshu users, the platform's shopping advice is invaluable, but after reading these recommendations, they often seek cheaper prices elsewhere – even though Xiaohongshu, like Douyin and Kuaishou, requires suppliers to offer prices competitive with other platforms.

Statistics indicate that at least 20% of Taobao and Tmall traffic originates from Xiaohongshu.

Despite having roughly half of Douyin's monthly active users, Xiaohongshu's total revenue is less than one-twentieth of Douyin's.

Balancing Xiaohongshu's core focus on high-quality content sharing with e-commerce platform value appears straightforward but proves challenging in practice.

As Xiaohongshu rapidly grew, its expanding user base and shifting operational strategies led to mixed content quality on the platform.

In 2019, the Xiaohongshu team noticed content with questionable aesthetics attracting attention and traffic. In a 2020 nationwide survey, users reported that excessive advertising from merchants cast doubt on the authenticity of Xiaohongshu's recommendations.

In response, Xiaohongshu issued a community convention in April 2021, clarifying what content is encouraged and discouraged, strengthening oversight of its community environment.

For example, the convention advises against using exaggerated or sensational tactics to attract clicks, encourages everyday people to speak and share, and promotes interactions based on content rather than physical appearance, body shape, or age. It also discourages flaunting excessive spending power.

One of Xiaohongshu's greatest appeals lies in its vibrant community atmosphere and high-quality content. Maintaining the platform's consistent tone and principles amidst commercialization poses a significant challenge for Xiaohongshu.

For today's internet companies, "growth" is an eternal theme, ultimately aimed at maximizing commercial returns.

Xiaohongshu now faces a choice between emphasizing content or commerce. Which way to go? It's a question that requires consideration.

Xiaohongshu's refined content tone underpins its traffic value, yet this refinement also implies a niche audience. As a daily active lifestyle platform with over 100 million users, its commercial value cannot be underestimated. As a "preferred platform for life decision-making searches," Xiaohongshu holds a distinct advantage in commercial monetization among content community peers.

Data shows that as of September 2023, Xiaohongshu boasted a 50% user share in first- and second-tier cities, with post-95s accounting for 50% of users. This indicates a concentration of high-net-worth individuals with strong spending power, enabling merchants to sell high-value products.

Furthermore, 60% of Xiaohongshu users actively search the platform, generating nearly 300 million daily search queries. Six out of ten Xiaohongshu users proactively seek content or products via the search bar. Commercializing search entries, keywords, and trending lists, similar to Baidu and Weibo's past strategies, presents a viable monetization path.

Xiaohongshu's appeal to young users stems from its high-quality UGC content and relatively subtle yet comfortable commercial experience. Consequently, maintaining the platform's atmosphere and consistently delivering quality content is crucial for Xiaohongshu.

Naturally, the commercialization process inevitably impacts the user experience. Balancing the two and making the right choices at the right time is paramount for Xiaohongshu's next phase of growth, as mentioned earlier.

Frankly, in the realm of content seeding, no one has yet replicated Xiaohongshu's success. Fostering a community atmosphere and sharing experiences is key to Xiaohongshu's identity.

Xiaohongshu has already established notable influencers, including Dong Jie, Zhang Xiaohui, and, more recently, renowned host Wu Xin, who launched her second live-streaming session on Xiaohongshu in March 2024, achieving a GMV of over RMB 35 million in a 10-hour broadcast.

Xiaohongshu's strength lies in its reinforced "seeding gene." Users visit Xiaohongshu with a clear purpose: to find expert content. Seeding, inherently close to transactions, allows users to make purchases immediately after reviewing product evaluations, creating a robust commercial closed loop. However, ensuring this loop doesn't isolate users or tarnish the community's atmosphere with a "mercenary" vibe presents a challenging commercialization endeavor.

Tidal Business Review believes Xiaohongshu needn't emulate full-category e-commerce platforms. Instead, it should leverage its strengths and embark on gradual commercialization within the niche content-sharing community space.

Should Xiaohongshu go left or right? When faced with decisions, we often seek definitive answers. However, as an 11-year-old platform still finding its footing, Xiaohongshu may find wisdom in adapting to changes, moving forward or backward as the tides shift, offering another perspective on commercial choices.

Just as Xiaohongshu's initial PDF guide captured hearts a decade ago, why can't Xiaohongshu continue being Xiaohongshu?

"I love Xiaohongshu so much! Opening the app, I find posts that interest me. Now, shopping on the platform is so convenient. Returns and exchanges are even handled by SF Express. Recently, I've been making direct purchases after being inspired by Xiaohongshu," Lisa excitedly shows her newly bought clothes to her friends.

You see, that's how business works.