"Electronic takeaways" normalized, consumer electronics aspire to certain growth

![]() 09/27 2024

09/27 2024

![]() 625

625

Author | Lushi Ming

Editor | Dafeng

As a new increment in the e-commerce market, the pie of instant retail is getting bigger and bigger.

Not long ago, Huawei and Apple held their product launches on the same day, and Huawei Mate XT and Apple iPhone 16 series were highly sought after, quickly selling out on various platforms.

Interestingly, unlike previous shopping frenzies, more and more consumers are no longer limited to JD.com, Taobao, and official websites this year. Instant retail platforms like Meituan Flash Sale and short video platforms like Douyin and Kuaishou have also become common choices for "snatching up" products.

According to Xincai Finance, on the day of the two major brand launches on September 10, Meituan Flash Sale made progress in its cooperation with Huawei and Apple authorized stores in the field of instant retail, with nearly 7,000 Apple authorized stores and over 4,300 Huawei authorized experience stores and Huawei Smart Life stores joining Meituan Flash Sale.

Ele.me also announced that it will collaborate with nearly 4,000 Apple authorized stores this year to support the pre-sale and concurrent launch of iPhone 16.

What you see is what you get, and you can get your new device in half an hour. This "fast, convenient, and abundant" consumer experience, combined with the heavy investments of various platforms in recent years, has made instant retail a regular consumption channel for consumers and a new engine for brand merchants to acquire incremental customers. This phenomenon is particularly prominent in vertical fields such as mobile phones, computers, digital products, and home appliances.

It is foreseeable that as consumers' demand for instant access to everything increases, and competition among platforms intensifies, the instant retail market will experience a new round of expansion, potentially changing the future landscape of domestic e-commerce.

Competing for the multi-billion dollar pie, focusing on "electronic takeaways"

Instant retail is no longer a new concept. Starting from the establishment of front-end warehouses by Missfresh in 2015, instant retail has gone through three stages: free growth, explosive growth, and refined operation.

In the past decade, due to the huge market potential, many platforms have entered the field. For example, JD.com officially launched JD.com Daojia in 2015; Hema Supermarket was established in 2016; Meituan launched its flash sale business in 2018; and Douyin Supermarket was officially launched in early 2023...

With the increased investments from various platforms, the market size of instant retail continues to grow.

According to the "Big Data Analysis Report on Regional Development of China's E-commerce" jointly released by the E-commerce Research Institute of the Ministry of Commerce Academy and Zhidemai Consumer Industry Research Institute, the market size of instant retail reached 504.286 billion yuan in 2022, and is expected to triple by 2025, exceeding 3 trillion yuan by 2030.

Amidst this massive scale, Xincai Finance notes that, besides food delivery and fresh produce, which are the two main protagonists of instant retail, consumer electronics are emerging as a core category due to their high growth trend among all other categories.

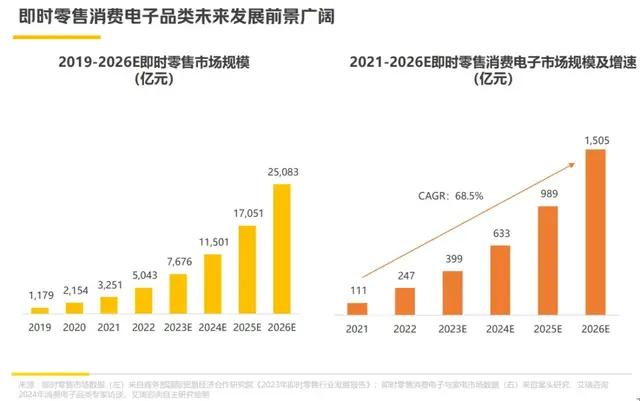

According to the "White Paper on the Instant Retail Consumer Electronics Industry" released by iResearch, the consumer electronics category has experienced rapid growth in the instant retail market over the past three years. It is estimated that the compound annual growth rate will reach 68.5% from 2021 to 2026, and the size of the instant retail consumer electronics industry will exceed 100 billion yuan by 2026.

Source: "White Paper on the Instant Retail Consumer Electronics Industry"

Behind this rapid growth lies a simple logic.

From the consumer's perspective, when prices are similar across channels, speed becomes the most crucial factor.

Taking the rush to buy an iPhone as an example, choosing an instant retail platform allows the product to be shipped from the nearest Apple authorized store, and a rider can deliver it within half an hour. No more waiting in long lines or for a day or two on traditional e-commerce platforms; buying an iPhone is as simple as buying an apple.

Moreover, the "emergency scenario" is also crucial. For instance, during festivals like Chinese New Year, Qixi Festival, and Mid-Autumn Festival, ordering gifts like iPhones, AirPods, Apple Watches, or iPads through food delivery platforms not only ensures fast delivery but also adds a sense of ceremony to gift-giving.

This instant gratification of consumer demand determines the prominence of electronic categories in instant retail.

Additionally, for platforms, electronic products are highly standardized, with significant industry scale and economies of scale. They have a large user base that can reach young people, who are trendsetters in lifestyle. The industry has a certain level of professionalism, and the supporting system is mature. Therefore, platforms can easily create new value through user scale and timeliness.

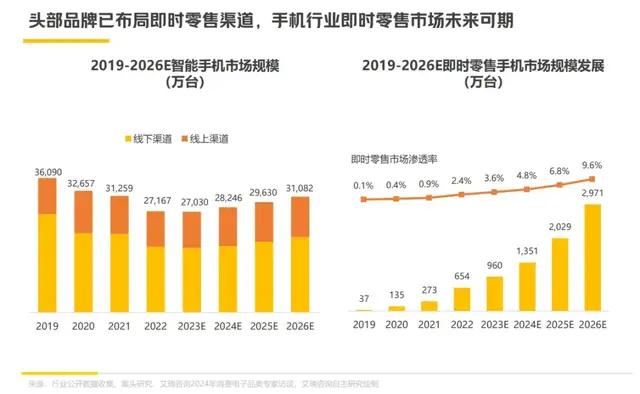

The "mutually beneficial" relationship between platforms and consumers has also "dragged" consumer electronics merchants into the fold. Major domestic mobile phone manufacturers such as "Huawei, Xiaomi, OPPO, and Vivo" (collectively known as "HOVM"), as well as large 3C and home appliance chain brands like Suning Tesco, have joined Meituan Flash Sale and Ele.me. At present, instant retail platforms have become a regular channel for mainstream 3C and digital manufacturers.

Source: "White Paper on the Instant Retail Consumer Electronics Industry"

Given this "win-win-win" situation, it's no surprise that the instant retail consumer electronics category is experiencing explosive growth.

Platforms enhance services, users take it for granted

Theory is just the foundation; all growth ultimately comes from practice.

Although it's a "win-win-win" situation, without a systematic setup, it will remain theoretical and unattainable. From an industry perspective, as a "bridge" connecting merchants and consumers, instant retail platforms undoubtedly bear the responsibility of meeting the needs of both sides.

While consumers may take it for granted to buy mobile phones and home appliances on food delivery platforms, there's more to it than meets the eye.

Take mobile phones as an example. An iPhone 16 starts at several thousand yuan, and consumers are bound to have concerns during delivery. Can it be delivered safely? What if it's lost or damaged? How to proceed with returns or exchanges? These questions require satisfactory answers from the platform.

Of course, besides safety and service attitude, the core competitiveness of instant retail lies in the timeliness of fulfillment services. "Speed" is the focus of the user experience.

Meituan and Ele.me have absolute logistical advantages, relying on their vast delivery teams, increasingly dense warehouse networks deep in communities, and growing partnerships with merchants for wider coverage.

In recent years, Meituan Flash Sale has continuously cooperated with domestic and foreign mobile phone brands to expand the number of mobile phone brands and stores, covering more regions and meeting users' shopping needs for "more, faster, better, and cheaper" products.

In terms of the number of Apple authorized stores joining Meituan Flash Sale this year, it has increased from 4,700 in 2023 to 7,000, covering from first-tier cities to township markets and expanding from shopping malls to operator stores like China Mobile, significantly enhancing supply coverage and sourcing channels to ensure sufficient supply of new products.

Unlike the delivery capabilities of Meituan Flash Sale and Ele.me, JD Daojia emphasizes B2C+O2O digitalization and supply chain integration in instant retail. On the other hand, Douyin Hourly Delivery's main advantage still lies in traffic, requiring merchants to operate their own delivery or rely on third-party delivery services.

Only high-quality services can continuously improve user retention and order rates. With the continuous optimization of platform services, instant retail has become a highly predictable lifestyle.

It's evident that more and more consumers have formed the habit of buying electronic products through food delivery, and instant retail purchasing scenarios are gradually shifting from rigid needs to non-rigid needs, from emergency to normalization.

According to the "White Paper on the Instant Retail Consumer Electronics Industry," among the primary motivations for consumers to choose instant retail, 54% cited "not having to go out" and 40% cited "bad weather." Staying at home, gift-giving for gatherings, 24-hour operation, business trips, and leisure relaxation are also common motivations.

As users take it for granted, instant retail has transformed merchants' participation from "optional" to "necessary."

Unleashing industry growth, merchants "flock in"

Ensuring a better consumer experience also paves the way for merchants to acquire more incremental customers.

As the instant retail platform service system continues to iterate, there have been notable changes in mobile phone manufacturers' new device sales through instant retail channels over the past few years.

From consumers being able to buy mobile phones through food delivery for the first time in 2020 to Meituan Flash Sale becoming Apple's global first-sale pre-order channel, to the "fastest 30-minute delivery of the latest iPhone" service covering third- and fourth-tier cities and township consumers...

This year, Meituan Flash Sale launched a special offer of 16 months of VIP membership with the purchase of new mobile phones (such as the iPhone 16 series and Huawei Pura 70 series), highlighting the platform's support and sales assistance for mobile phone and digital brands and retailers.

In fact, not only Meituan Flash Sale but also platforms like JD.com, Ele.me, Douyin, and Kuaishou are leveraging various promotional activities to bring more exposure and traffic to brands, driving first-time purchases and boosting merchants' sales growth in instant retail channels.

The manager of an Apple authorized store in Xishuangbanna, Yunnan, told Xincai Finance that over 60% of their sales now come from instant retail platforms like Meituan Flash Sale and JD Express Delivery since joining the channel in 2021. Sales on Meituan Flash Sale have doubled year-on-year, and sales through instant retail channels have increased by about 30% during this Apple product season compared to last year.

Beyond one-time traffic, this rapid growth is also fueled by the strong "connectivity" of user consumption behavior.

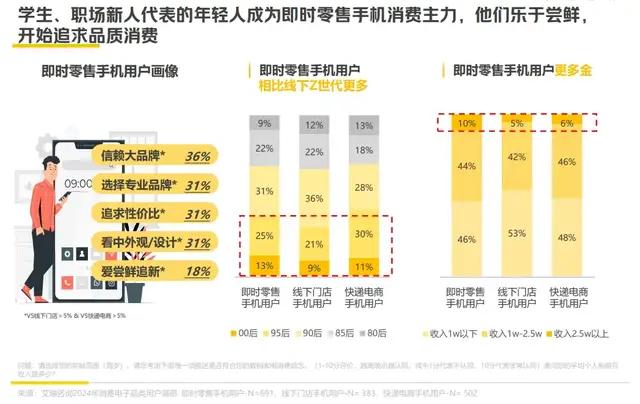

Dominated by Gen Z, users gradually develop a habit of "connected consumption" from accessories to mobile phones to computers, digital products, and home appliances. The instant retail shopping experience with accessories and mobile phones can build trust in users for full-category purchases, shifting from low-frequency to high-frequency consumption.

Such young consumers and their behaviors undoubtedly provide long-term momentum for sustainable brand growth.

Source: "White Paper on the Instant Retail Consumer Electronics Industry"

Overall, for electronic consumer brands, instant retail not only expands their business radius and boosts sales but also stimulates new demand and attracts new users, providing more growth momentum for the brand. It's a win-win situation with no downsides, which explains why leading 3C and home appliance brands are accelerating their embrace of instant retail.

Consumer electronics have become an important category for instant retail platforms to compete for, and instant retail channels have become a booster for the omnichannel development of the consumer electronics market. As the most crucial player, it remains to be seen which instant retail platform will emerge victorious over time as consumer needs continue to evolve.

But it is certain that performance in improving services and adapting to the market will be a crucial factor in determining the outcome of this competition.