Crazy Chinese stocks: How long can the “chicken blood” (motivation) last?

![]() 09/30 2024

09/30 2024

![]() 442

442

Currently, the most pressing question on the market's mind is likely how long and how high Chinese stocks will rebound. While it's challenging to answer definitively when gauging policy dynamics, this article attempts to provide a perspective, albeit a subjective one.

With the rebound potential for Chinese stocks opening up, the starting point is the Fed's interest rate cuts (not focusing on the liquidity and exchange rate improvements directly from the cuts but rather the domestic policy space they create).

Therefore, the extent of this space largely depends on how much room the Fed has to cut rates. Once the Fed's path is clear, the market must seriously consider whether the economy will experience a soft landing, as this is ultimately the fundamental factor determining whether the equity market rebounds and then turns downward or continues upwards.

Dolphin Investment Research will first analyze the US economic fundamentals and policy orientation before delving into the interest rate cut space for Chinese stocks.

Detailed Content Below

I. Inflation Risk Minimal, Consumption Weakening Further

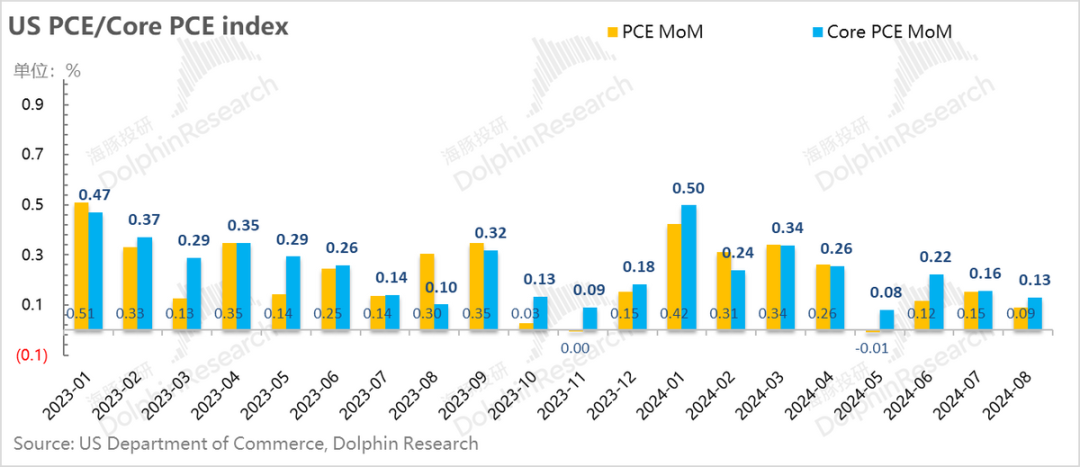

During the press conference following the 50 basis point rate cut in September, Jerome Powell's message was clear: inflation is essentially a closed chapter. This view is supported by the core PCE data for August, the Fed's preferred inflation gauge, which increased just 0.13% month-on-month, well within the normal range of monthly fluctuations (0.1%-0.2%) during the 2% inflation era. When factoring in energy and food, the overall PCE growth dropped to 0.09%.

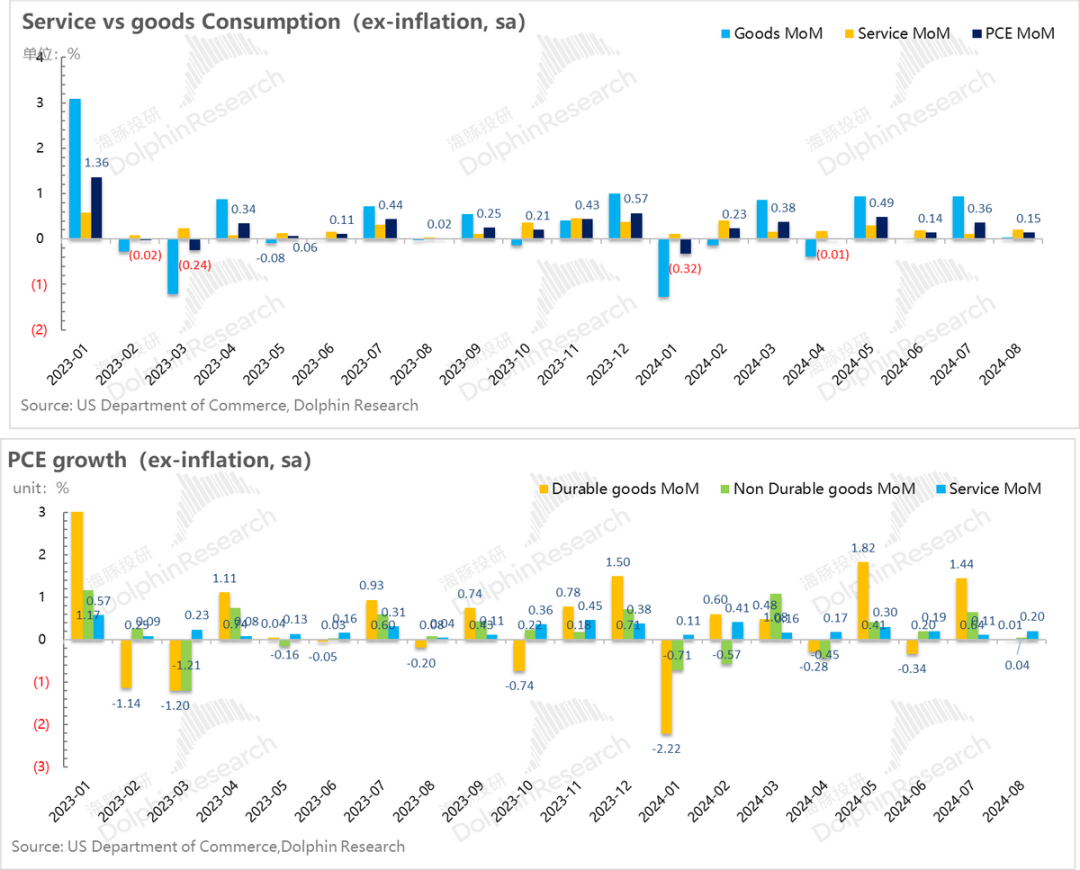

While inflation continued to weaken, consumption also showed marked weakness in August: real personal consumption expenditures grew just 0.15% month-on-month, with durable goods consumption virtually stagnant, though partially influenced by the previous month's surge.

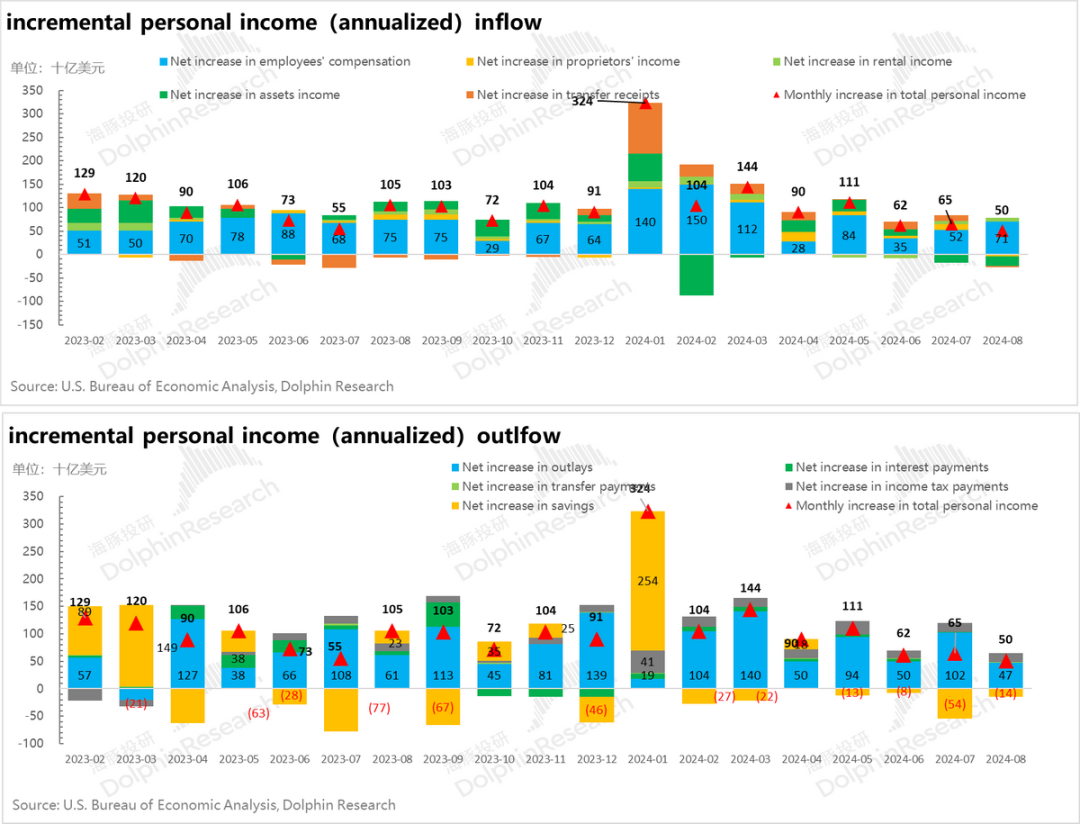

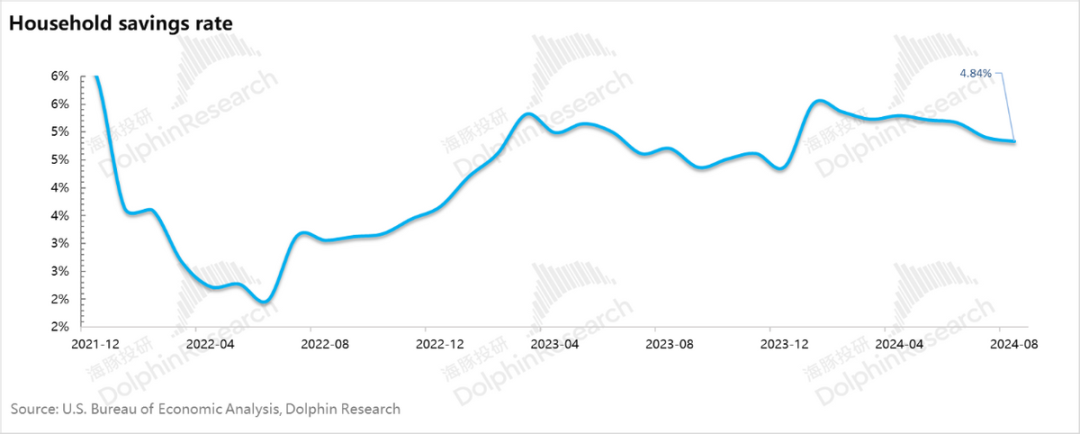

So, what's behind the slowdown in overall consumption growth? Is it due to increased savings rates or slower income growth? According to August's household income and expenditure data, Americans' earning power is still rising (indicating stable employment and wages), but asset-based income (e.g., dividends) has declined, impacting overall income growth, though the overall income side remains relatively robust.

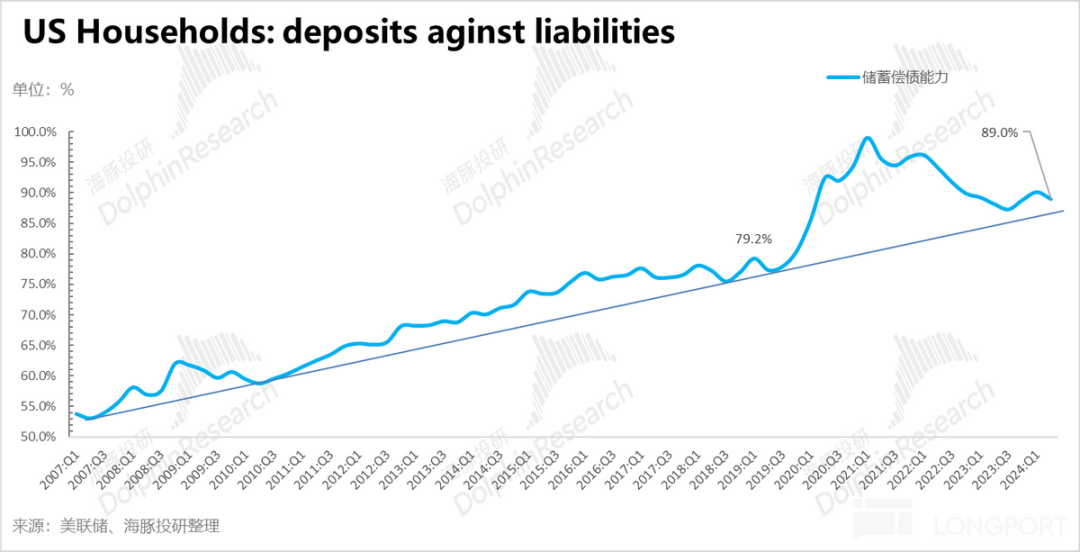

The slowdown in August's consumption growth is primarily attributed to less pressure on savings compared to July. During this period, Americans felt secure with strong balance sheets and job security, leading to consumption outpacing income growth, particularly in July. However, in August, while consumption still surpassed income, the pace of savings decline slowed. By the end of Q2, the coverage ratio of household savings to liabilities had gradually approached pre-pandemic levels, limiting further compression of savings rates.

Future consumption growth will likely depend on income growth. Currently, total and disposable personal income are growing at a monthly rate of 0.2%-0.3%, corresponding to an annualized nominal growth rate of 2.5%-3.7%.

Based on inflation and consumption data, inflation is trending towards the Fed's 2% long-term target, while consumption is also declining. With limited room for further consumption growth through savings compression, the focus shifts to preserving income growth and employment rates.

II. Beyond Ineffective Rate Hikes: Ineffective Rate Cuts Too?

Against this economic backdrop, Dolphin Investment Research is increasingly focused on the possibility of accelerated Fed rate cuts. Recent developments have heightened this concern.

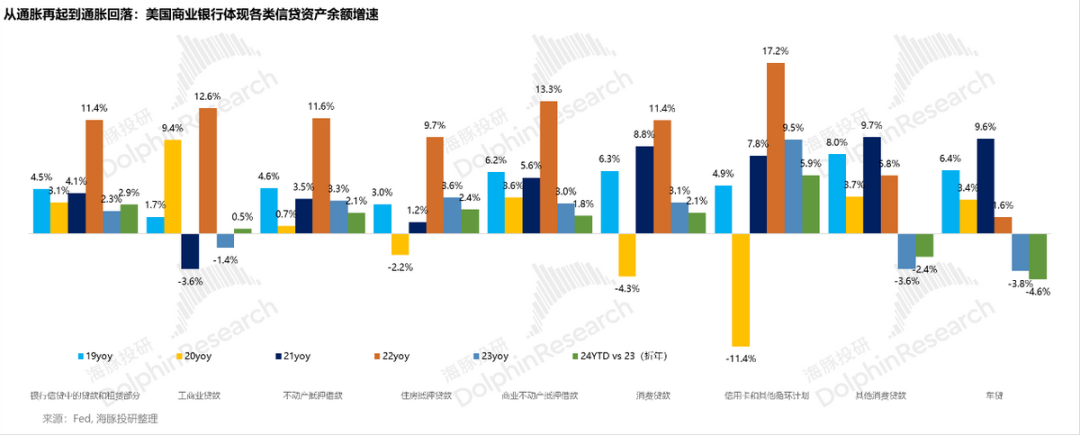

During the Fed's rate hike cycle, it was argued that inflation rose due to supply chain disruptions, the Russia-Ukraine war, and the pandemic, and would fall as these factors subsided. Combined with low interest rate sensitivity in US government debt, the effectiveness of Fed rate hikes was limited. For example, in 2023, the nominal growth rate of outstanding loans in the US commercial banking system was just 2%, yet GDP grew by 3% in real terms.

Conversely, now that the Fed is cutting rates, there's skepticism about the effectiveness of these cuts in stimulating credit and the economy. Dolphin Investment Research has observed three interesting phenomena:

a. Nick Timiraos, a Wall Street Journal reporter known for his Fed insights, wrote on September 27 that rate cuts may not guarantee a soft landing. He argued that the success of rate cuts in supporting the economy depends on the economy's weakness and their ability to stimulate credit demand. With rate cut expectations already formed and current rates still above pre-hike levels and average outstanding loan rates, consumers may not immediately increase leverage even after rate cuts begin.

(PS: Dolphin Investment Research Analysis: Due to high interest rates, the initial phase of rate cuts primarily relieves interest payment pressures for sectors with significant debt accumulation during the hiking cycle, such as the Fed itself and borrowers with floating-rate loans. However, overall rates remain high, limiting effective credit demand stimulation.)

b. The President of the New York Fed announced on September 26 the establishment of a Reference Rate Oversight Committee, set to commence operations in October, to monitor the use of benchmark rates in financial markets and underlying market changes supporting reference rates.

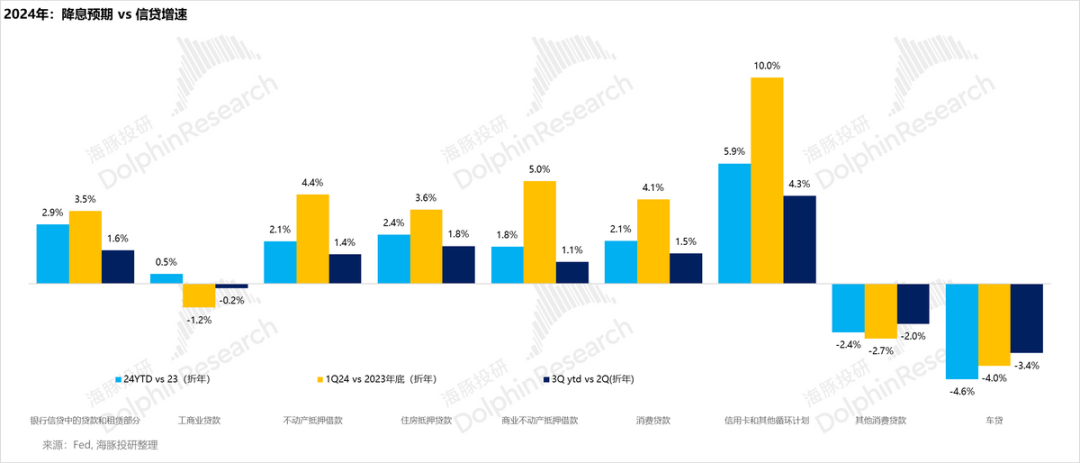

c. There have been two rate cut expectations this year: one in late 2022, just before the end of Q2, and another more recently. During the first expectation, credit growth accelerated sharply in Q1, with an annualized growth rate of 3.5%. However, during the second expectation, credit growth remained muted, with an annualized growth rate of just 1.6% from the end of Q2 to the present. This suggests limited stimulus from rate cut expectations.

Despite similar rate cut expectations, with the recent one even seeing a smaller decline in 10-year Treasury yields, credit growth failed to pick up. This suggests limited stimulus from rate cuts and their expectations. The Fed's decision to establish a Reference Rate Oversight Committee may reflect an effort to observe whether market interest rates are tracking benchmark rates closely.

Putting these pieces together, Dolphin Investment Research wonders:

1) As economic indicators (labor market supply-demand dynamics, household balance sheets, inflation trends, nonfarm payrolls, etc.) gradually return to historical averages from the 2% inflation era, the risk of inflation rebound appears increasingly minimal.

2) At this juncture, the Fed, through media outlets and a new regulatory body, is exploring why its benchmark rates are not effectively permeating real markets. If 50 basis point rate cuts have limited stimulus on credit demand, does this imply that, akin to aggressive rate hikes, the Fed may need to cut rates more aggressively in this unique cycle to achieve the same impact as smaller cuts in past easing cycles?

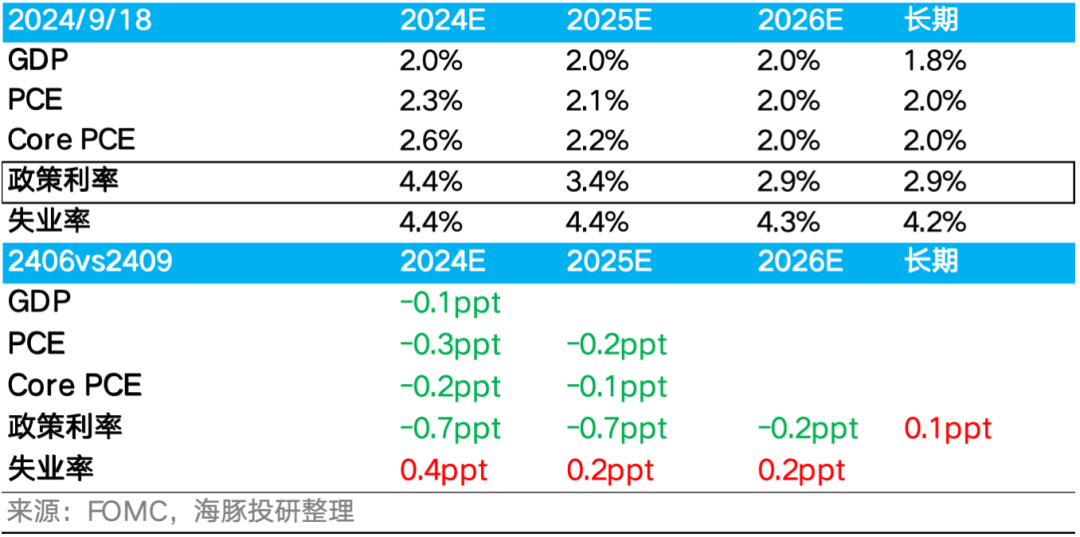

The Fed's current guidance calls for 50 basis point rate cuts in 2024, 100 basis points this year, and another 100 basis points next year, with the long-term nominal interest rate approaching 3%. However, the Fed's other long-term guidance—a 2% long-term inflation rate and 1.8% long-term economic growth—implies a lower nominal interest rate than 3%.

Dolphin Investment Research believes this policy rate guidance path does not necessarily reflect the Fed's true rate cut magnitude and pace but is more about inflation expectations management: by guiding for a tighter easing path, the Fed can anchor inflation expectations while rapidly and substantially lowering interest rates in reality, reducing interest rate pressures on the real economy (and US government debt service costs), and bringing new loan borrowing costs closer to pre-pandemic levels.

Given this scenario, Dolphin Investment Research cautions that the Fed may actually cut rates faster than its guidance from this year to next.

III. If the Fed Accelerates Rate Cuts, Will Chinese Stocks Shine Continuously?

Faster rate cuts under this mindset can aid a soft economic landing by managing expectations and allowing for quicker rate reductions to alleviate interest payment pressures on economically stressed sectors, such as US Treasury debt and floating-rate bonds. In this scenario, stock selection in the US can expand beyond tech into cyclical sectors like discretionary, energy, and transportation. Regarding Chinese stocks, the question arises: will they benefit from aggressive Fed rate cuts?

Dolphin Investment Research highlighted the potential for Chinese stocks to rebound shortly after the Fed's Jackson Hole conference confirmed the easing cycle in its mid-August Strategy Weekly Report, noting that Fed rate cuts could modestly open up room for RMB rate cuts, alleviating high real borrowing costs and weakening economic expectations. With fiscal spending expected to pick up in the second half, Chinese stocks could see a short-term rebound amidst a stabilizing economy and gradually dissipating earnings season headwinds.

Dolphin Investment Research began re-establishing previously reduced positions based on this outlook.

Fed rate cuts present two opportunities for Chinese stocks:

1) Improved liquidity after rate cuts could modestly repair overseas Chinese assets, though this elasticity increasingly depends on domestic demand improvements and is becoming less sensitive.

2) A second, more significant opportunity arises from the domestic policy space opening up after rate cuts, potentially supporting the economy through measures like interest rate and reserve requirement ratio reductions.

Both these logics played out by last week. However, what surpassed Dolphin Investment Research's expectations was the implicit shift in policy focus at the Politburo meeting, particularly the recognition of deflation as a self-reinforcing negative cycle rather than merely a symptom of economic restructuring. This shift signals a commitment to bolstering domestic demand rather than solely focusing on supply-side improvements.

The missing piece in domestic policy is the announcement and implementation of fiscal measures. While the market fears overzealous market reactions may dampen actual policy effectiveness, Dolphin Investment Research believes the true test will come from consumption data over the National Day holiday and any substantive fiscal policy announcements at the October meeting.

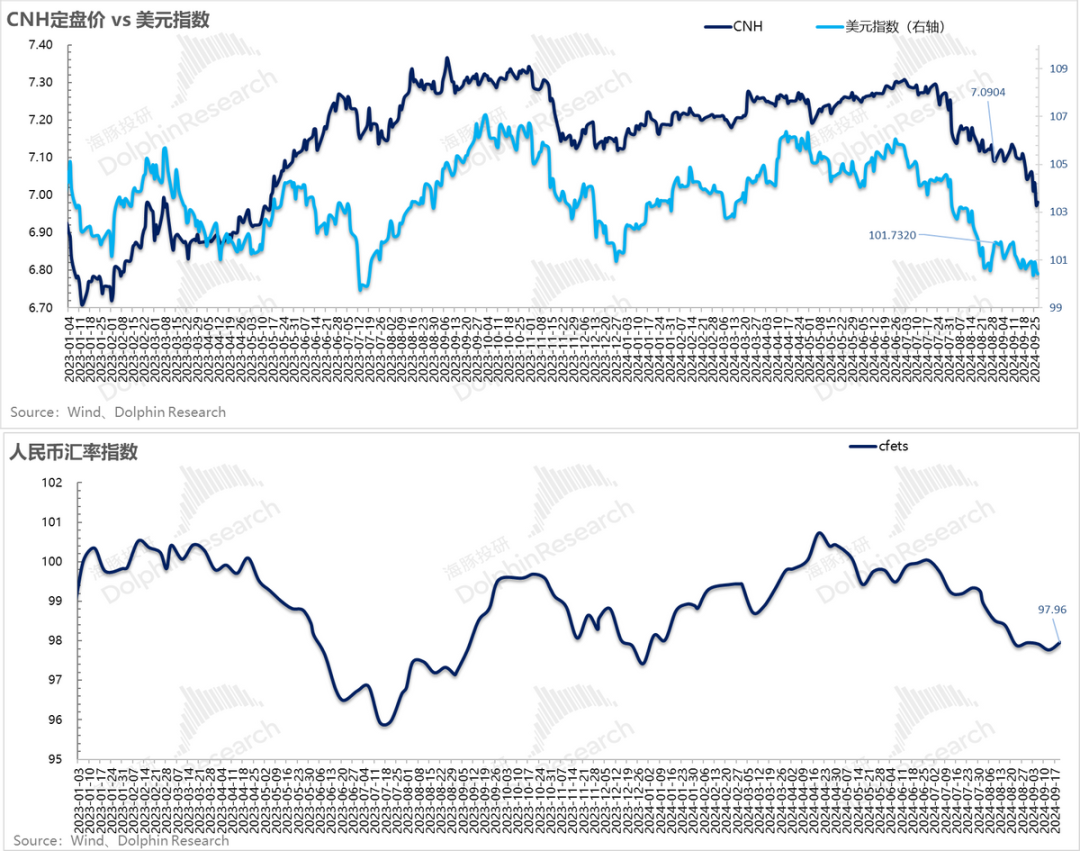

However, if a) the Fed actually cuts rates faster than currently expected, and b) the RMB manages to appreciate against the USD while depreciating against a basket of currencies, this could objectively create further policy space domestically, allowing for more aggressive policy steps if desired.

In China, some high-quality assets, even if they fall again after a surge due to the sluggish consumption data during the National Day holiday, still have room for growth given their low valuation and the brewing fiscal policies.

IV. Portfolio Rebalancing and Returns

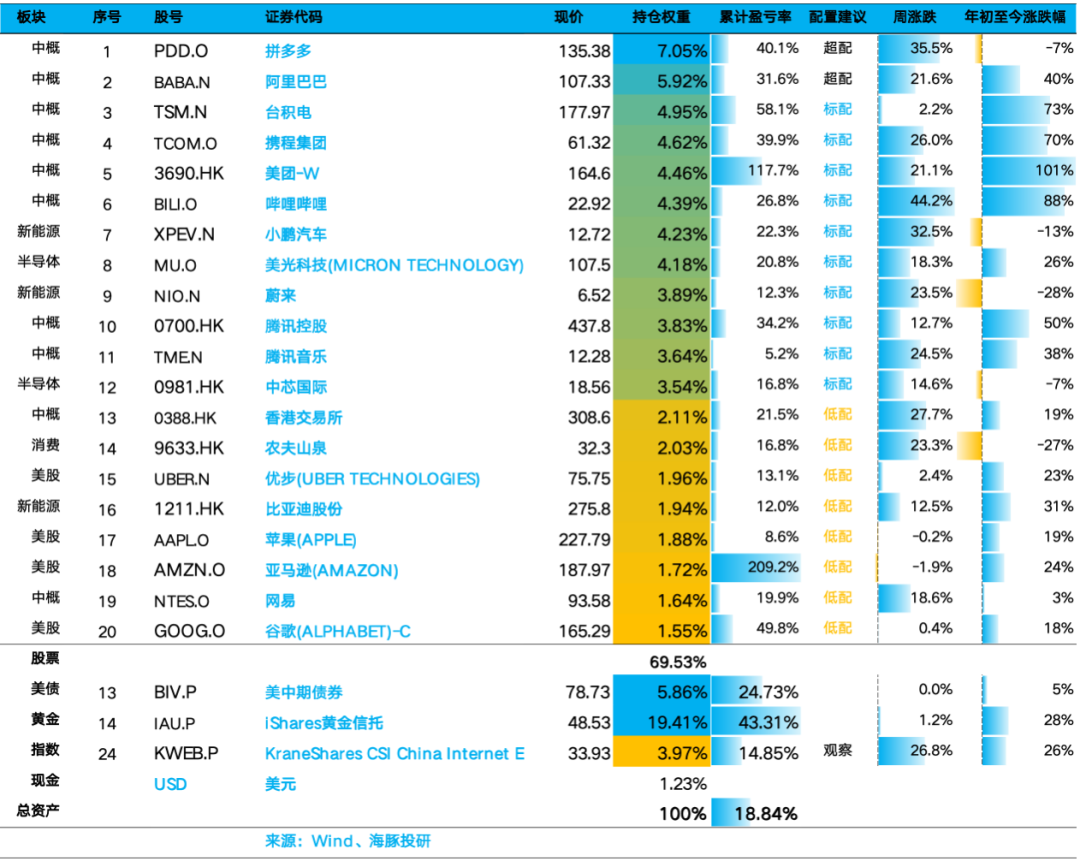

Based on the logic outlined in Dolphin's previous strategy report, "Fed Cuts Rates by 50 Basis Points: The Ultimate Influencer of U.S. Stocks?", after the Fed's rate cut, domestic policy space opened up. Dolphin initially increased its holdings in relatively high-quality Chinese stocks and further adjusted into secondary high-quality Chinese stocks with improved fundamentals after the policy announcements at the three major financial sector conferences exceeded expectations.

Specific stocks and the rationale for the adjustments are as follows:

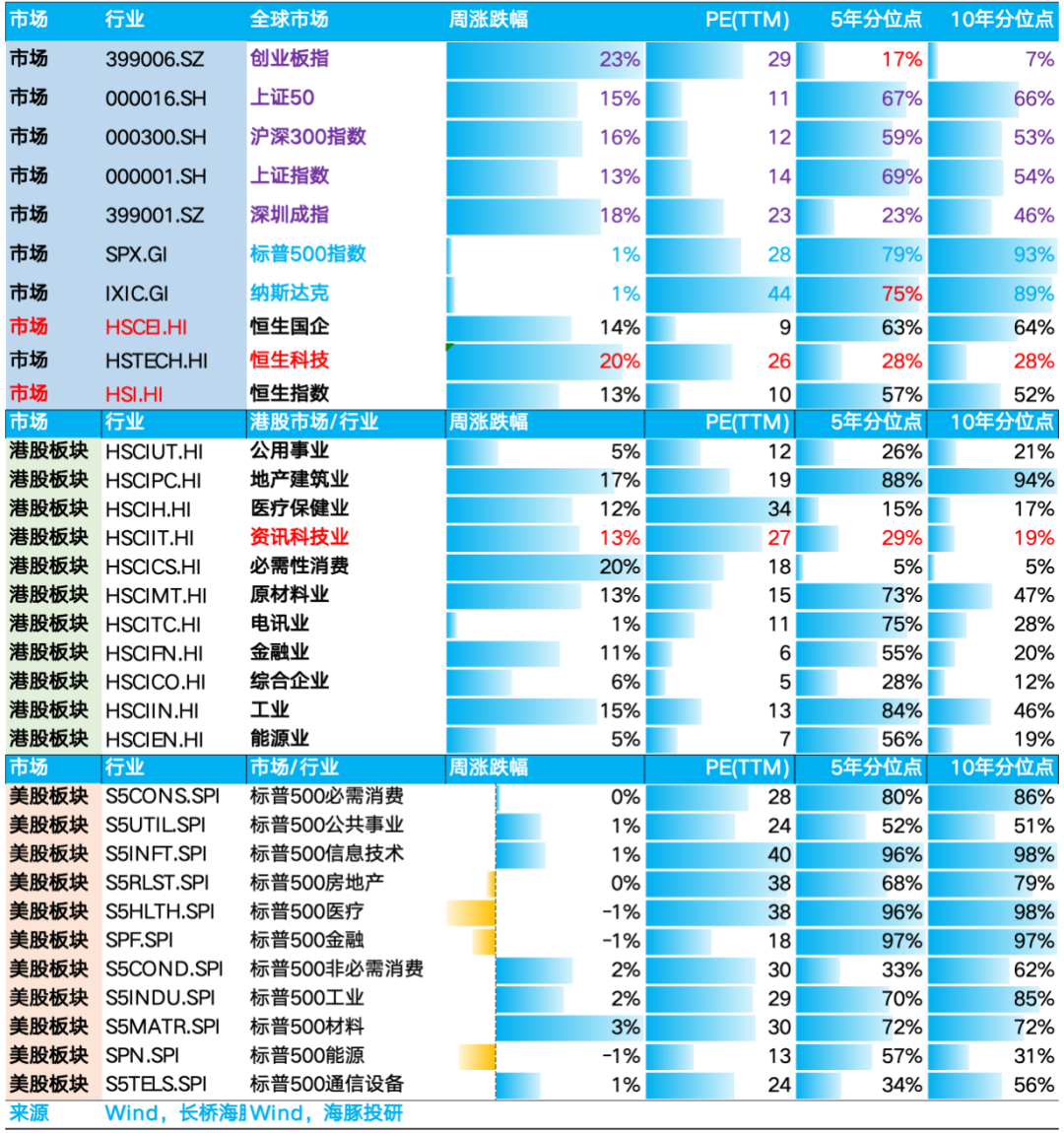

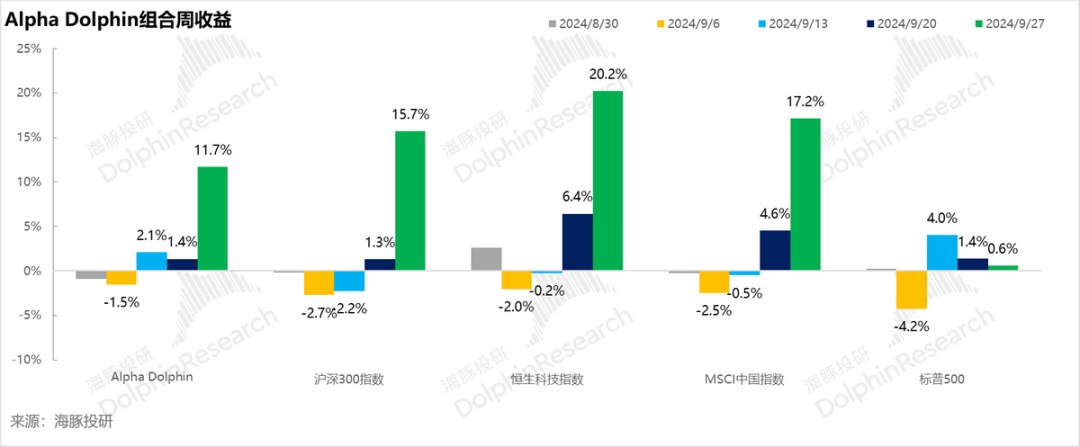

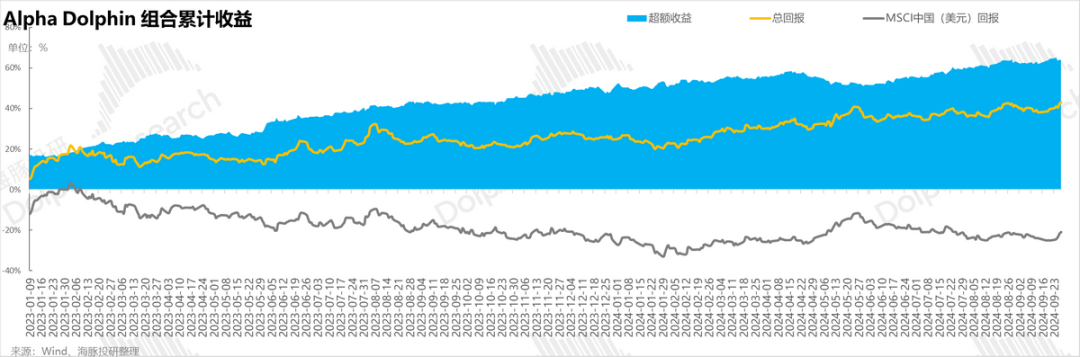

After the rebalancing, Dolphin's virtual portfolio Alpha Dolphin increased by 12% last week, underperforming the CSI 300 Index by 16%, Hang Seng TECH Index by 20%, and MSCI China by 17%, but outperforming the S&P 500 Index by 0.6%. The main reason for underperforming Chinese stocks was the holdings of U.S. stocks and gold in the portfolio.

Since the start of the portfolio test until last weekend, the absolute return of the portfolio was 60%, with an excess return of 66% compared to MSCI China. From a net asset value perspective, Dolphin's initial virtual assets were $100 million, which have now fallen to $162 million.

V. Portfolio Asset Allocation

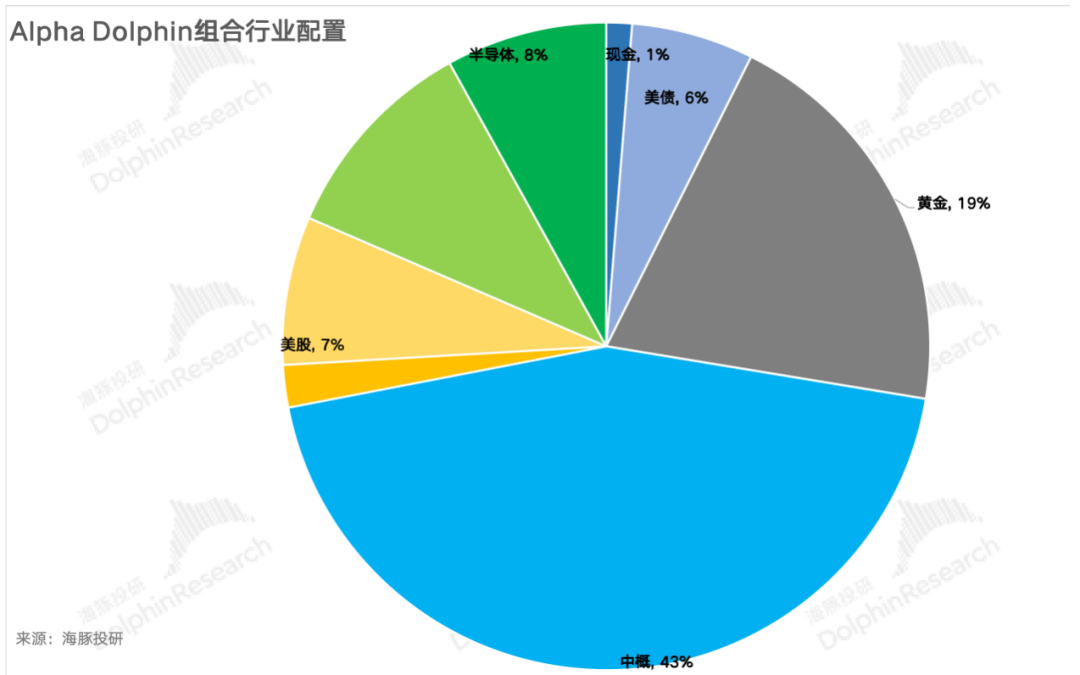

The Alpha Dolphin virtual portfolio holds a total of 13 stocks and equity ETFs, with 5 standard holdings and 8 underweight equity assets. The remainder is distributed among gold, U.S. Treasuries, and U.S. dollar cash. Currently, there is still a significant amount of cash and cash equivalents, and Dolphin is considering increasing its holdings in the near future. As of last weekend, the asset allocation and equity asset holdings weights of Alpha Dolphin were as follows:

- END -

// Reprint Authorization

This article is an original creation by Dolphin Investment Research. Please obtain authorization for reprinting.