Nanshan Aluminum splits Nanshan Aluminum International and goes to Hong Kong, AIoT provider Terminus Technology submits application

![]() 10/05 2024

10/05 2024

![]() 471

471

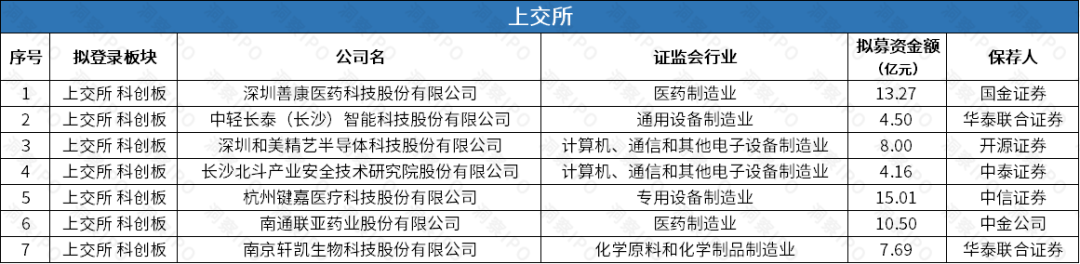

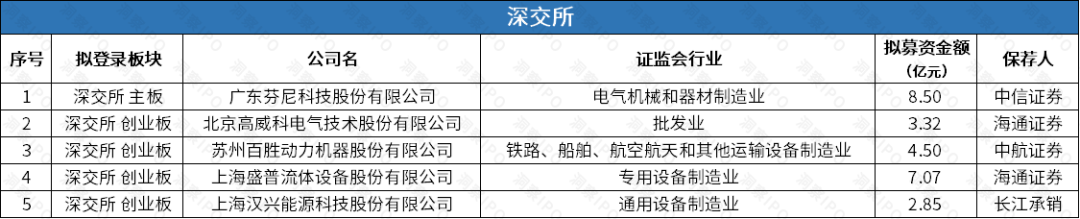

SSE & SZSE

IPO

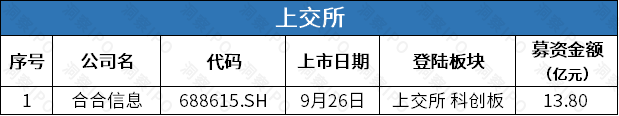

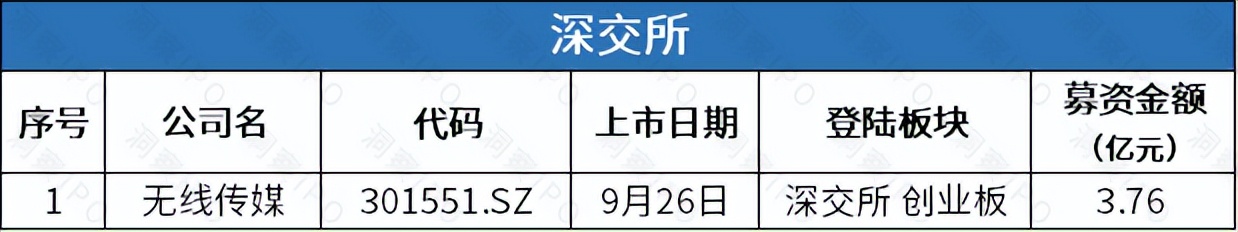

From September 23rd to September 29th, 1 company was listed on the SSE STAR Market; 1 company was listed on the ChiNext.

Data source: Public information; Chart created by Insight IPO

1. Hehe Information: An AI and big data technology company. Its share price closed up 105.91% on the first trading day, and as of September 30, it closed at 245.01 yuan per share, an increase of 344.02% from the issue price of 55.18 yuan per share.

Data source: Public information; Chart created by Insight IPO

1. Wireless Media: A company involved in the construction and operation of the Hebei IPTV integrated broadcast control sub-platform, mainly engaged in IPTV integrated broadcast control services. Its share price closed up 318.83% on the first trading day, and as of September 30, it closed at 181.00 yuan per share, an increase of 1825.53% from the issue price of 9.40 yuan per share.

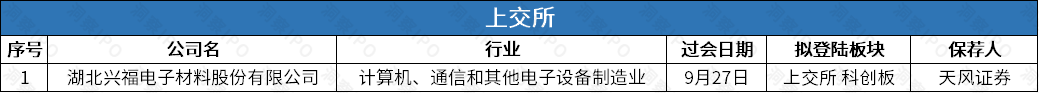

Passing the Listing Committee Review Meeting

From September 23rd to September 29th, 1 company passed the review on the SSE STAR Market; no companies passed the review on the SZSE.

Data source: Public information; Chart created by Insight IPO

1. Xingfu Electronics: Mainly engaged in the R&D, production, and sales of wet electronic chemicals, including general-purpose wet electronic chemicals such as electronic-grade phosphoric acid, electronic-grade sulfuric acid, and electronic-grade hydrogen peroxide, as well as functional wet electronic chemicals such as etching solutions, cleaning agents, developing solutions, stripping solutions, and regenerants.

Submission of IPO Application

From September 23rd to September 29th, no companies submitted IPO applications on the SSE or SZSE.

Termination of IPO Review

From September 23rd to September 29th, 7 companies terminated their IPO reviews on the SSE STAR Market; 1 company terminated its IPO review on the SZSE Main Board, and 4 companies terminated their IPO reviews on the ChiNext.

Data source: Public information; Chart created by Insight IPO

1. Shankang Pharmaceuticals: Primarily engaged in the R&D, production, and sales of innovative drugs, including those for preventing opioid relapse and treating alcohol use disorder.

2. Zhongqing Changtai: A global high-quality supplier in the field of intelligent manufacturing and intelligent warehousing logistics, integrating machinery, electricity, instrumentation, software, and digital technology. Focused on the R&D, design, manufacturing, sales, and service of intelligent manufacturing systems and intelligent warehousing logistics systems.

3. Hemei Precision: Specializes in the field of IC substrate packaging, engaged in the R&D, production, and sales of IC substrate packaging. It is one of the few domestic manufacturers that fully master the technology for large-scale mass production of IC substrate packaging with independent control.

4. Beidou Institute: A research and application-driven high-tech enterprise focused on the generation, measurement, and processing of radio signals. It centers on satellite navigation and space telemetry and control, adheres to independent innovation and domestic control, and has formed three major business directions: navigation simulation and test evaluation, space-time security and enhancement, and space telemetry and ground testing.

5. Jianjia Medical: A high-tech enterprise specializing in the R&D, production, and sales of surgical robots and related products. It has independently developed surgical robots covering various fields such as joints, spines, trauma, and dental implants. Its main product, the ARTHROBOT hip replacement surgical robot, became the first domestically produced hip replacement surgical robot to obtain a Class III medical device registration certificate in April 2022.

6. Lianya Pharmaceutical: Primarily engaged in the R&D, production, and sales of complex pharmaceutical formulations, with products mainly including two categories of high-end generic drugs represented by different types of controlled-release formulations and extremely low-dose drug formulations. It also provides R&D and other services to pharmaceutical companies and R&D institutions based on its leading drug design capabilities and formulation technology.

7. Xuankai Biotech: Focuses on continuous R&D and industrialization in industrial biotechnology and synthetic biology. Its main products include biological additives (mainly composed of single-component substances such as polyglutamic acid, Bacillus subtilis, and chito-oligosaccharides) and biological preparations (formed by combining different components according to a formula).

Data source: Public information; Chart created by Insight IPO

1. Phnix: A company engaged in the integrated R&D, production, sales, and service of heat pump products. Its main products are air source heat pumps and related products, with functions mainly categorized as constant temperature hot water for swimming pools, heating (cooling), domestic hot water, and drying, widely used in three major areas: households, commerce, and industry/agriculture.

2. Gaoweike: A high-tech enterprise specializing in industrial automation, digital integrated services, and the R&D, production, and sales of core automation control system products. It is a distributor for industrial automation product manufacturers such as Mitsubishi, Schneider, SMC, Beiyuan Electric, Sanyo Denki, Siemens, and ABB.

3. Baisheng Power: Primarily engaged in the R&D, production, and sales of outboard motors, aiming to become a world-class supplier of aquatic power products. The company also has some general-purpose machinery business.

4. Shengpu Technology: Focuses on the R&D, production, and sales of precision fluid control equipment and its core components, dedicated to providing customers with safe, intelligent, and efficient fluid control solutions. Its products are mainly used in the manufacturing of new energy (including photovoltaics, power batteries, etc.) and automotive electronics products.

5. Hanxing Energy: A comprehensive service provider specializing in hydrogen energy technology development, consulting and design, complete hydrogen production equipment integration, general contracting, industrial gas investment, and operation in the hydrogen energy industry (upstream hydrogen production, midstream transportation, hydrogen storage, and hydrogen refueling stations).

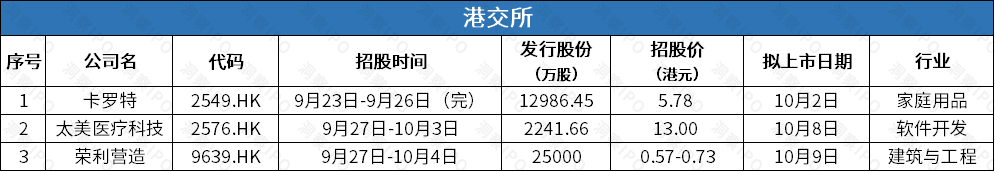

Hong Kong Stock Exchange

IPO

From September 23rd to September 29th, no companies were listed on the HKEx.

IPO Subscription

From September 23rd to September 29th, 3 companies launched IPO subscriptions on the HKEx.

Data source: Public information; Chart created by Insight IPO

1. Kalote: A lifestyle kitchenware brand with the Kalote CAROTE brand.

2. Taimei Medical Technology: A digital solution provider focused on the pharmaceutical and medical device industries in China, designing and providing industry-specific software and digital services to support research and development, as well as marketing and sales of pharmaceuticals and medical devices.

3. Wing Lung Construction: A large-scale Hong Kong contractor engaged in civil and electromechanical engineering as well as renewable energy projects.

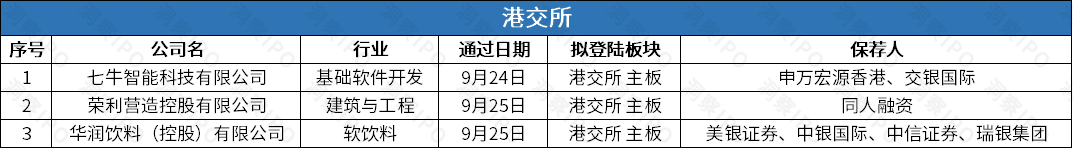

Passing the Listing Hearing

From September 23rd to September 29th, 3 companies passed the listing hearing on the HKEx.

Data source: Public information; Chart created by Insight IPO

1. Qiniu Intelligence: Provides audio and video cloud services, with main products and services including MPaaS products, a series of audio and video solutions, and APaaS solutions, which are scenario-based audio and video solutions based on MPaaS capabilities and utilizing the company's low-code platform.

2. Wing Lung Construction: A large-scale Hong Kong contractor engaged in civil and electromechanical engineering as well as renewable energy projects.

3. China Resources Beverages: A renowned enterprise in the packaged drinking water industry and China's ready-to-drink soft drinks industry. Its "C'est Bon" brand of drinking water products generated retail sales of RMB 39.5 billion in 2023.

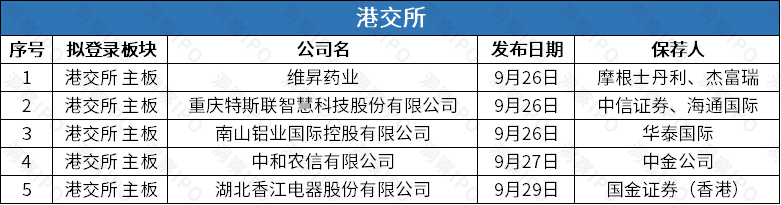

Submission of IPO Application

From September 23rd to September 29th, 5 companies submitted IPO applications to the HKEx.

Data source: Public information; Chart created by Insight IPO

1. Vision Therapeutics: A biopharmaceutical company focused on providing treatment solutions for specific endocrine diseases in China (including Hong Kong, Macau, and Taiwan).

2. Terminus Technology: A public domain operating system-based AIoT product provider, offering full-stack AIoT products (including software, hardware, and services) to enterprises, public administrators, and other public domain space participants.

3. Nanshan Aluminum International: A leading manufacturer of high-quality alumina in Southeast Asia.

4. China Agri-Services: A comprehensive agricultural service provider offering technology-driven comprehensive products and services, including inclusive rural credit services, agricultural production services, rural consumer goods and services, and rural clean energy services.

5. Kingkong Electric: A manufacturer of household and lifestyle products, primarily operating in an ODM/OEM model.

Vision Therapeutics Discloses Prospectus on September 26th

Planned Listing on the Main Board of the HKEx

On September 26th, Vision Therapeutics submitted its prospectus to the HKEx for a main board IPO, with Morgan Stanley and Jefferies serving as joint sponsors.

Vision Therapeutics is a late-stage R&D biopharmaceutical company with products approaching commercialization, focused on providing treatment solutions for specific endocrine diseases in China (including Hong Kong, Macau, and Taiwan). It has one core product and two other investigational drug candidates, all of which have been licensed from Ascendis Pharma, one of its partners and controlling shareholders.

The core product, Lonapegsomatropin, is a once-weekly long-acting growth hormone replacement therapy for the treatment of pediatric growth hormone deficiency (PGHD), a common form of short stature in patients under 18 years old caused by growth hormone deficiency. One of the main drug candidates, Navepegritide, is a long-acting prodrug of C-type natriuretic peptide for the treatment of achondroplasia, a form of short-limbed dwarfism that can lead to severe skeletal complications and comorbidities. The other main drug candidate, Palopegteriparatide, is a once-daily parathyroid hormone replacement therapy for the treatment of hypoparathyroidism, a metabolic disorder caused by decreased secretion or dysfunction of parathyroid hormone.

The prospectus indicates that the funds raised from this offering will be used by Vision Therapeutics to fund the ongoing BLA registration of its imported core products, the ongoing and planned R&D and BLA registration of locally produced core products, planned clinical trials for new indications, and the planned commercial launch of its core product, Lonapegsomatropin; to fund the ongoing Phase 3 pivotal trial in China and planned commercial launch of Palopegteriparatide; to fund the open-label portion of the ongoing Phase 2 trial in China of Navepegritide for the treatment of achondroplasia; and for working capital and other general corporate purposes. The specific amount of funds raised has not been disclosed.

In terms of financial data, Vision Therapeutics generated other income of RMB 5.764 million, RMB 11.356 million, and RMB 5.835 million in 2022, 2023, and January-April 2024, respectively. Its net profits were -RMB 289 million, -RMB 250 million, and -RMB 60.131 million in these respective periods.

The risk factors disclosed in Vision Therapeutics' prospectus mainly include: the rights to develop, produce, and commercialize its drug candidates are subject to the licensing terms and conditions granted by Ascendis Pharma. If the company fails to fulfill its obligations under the exclusive license agreement with Ascendis Pharma, it may lose the rights to develop, produce, and commercialize its drug candidates and may be liable for monetary damages; after the expected commercialization in 2025 and until 2028, the company expects to procure its core products from Ascendis Pharma for commercial supply, which may expose the company to risks such as potential supply chain disruptions, lack of control over product supply quality and timing, and potential adverse impacts on its business and profitability; none of the company's drug candidates have been approved for marketing in China (including Hong Kong, Macau, and Taiwan). If the company fails to advance its drug candidates through clinical development, obtain regulatory approval, and/or ultimately commercialize them, or if there are significant delays in these matters, its business and profitability will be severely impaired, among other risks.

Vision Therapeutics previously submitted prospectuses to the HKEx on August 16, 2023, and March 21, 2024, but they have since expired.

Terminus Technology Discloses Prospectus on September 26th

Planned Listing on the Main Board of the HKEx

On September 26th, Chongqing Terminus Intelligent Technology Co., Ltd. (hereinafter referred to as "Terminus Technology") submitted its prospectus to the HKEx for a main board IPO, with CITIC Securities and Haitong International serving as joint sponsors.

Terminus Technology provides full-stack AIoT products (including software, hardware, and services) to enterprises, public administrators, and other public domain space participants. According to a Frost & Sullivan report, it is one of the top five public domain operating system-based AIoT product providers in China based on relevant revenue in 2023.

According to a Frost & Sullivan report, Terminus Technology's TacOS is one of the earliest public domain AIoT operating systems in Asia to support full-scenario applications in public domain spaces and has become the preferred infrastructure for industrial digitalization. Leveraging TacOS's unique five-layer product and technology architecture, Terminus Technology's public domain AIoT products can connect public domain space participants, smart devices, and infrastructure, providing profound value to various AI application scenarios primarily in the industries, cities, human settlements, and energy sectors.

The prospectus indicates that the funds raised from this offering will be used by Terminus Technology to enhance its R&D capabilities, particularly investing in the R&D of TacOS, green intelligent computing, and domain-specific large models; commercialization and market expansion, including enhancing the capabilities of AIoT product services in various application scenarios such as AI industrial digitalization, AI smart cities, AI smart living, and AI smart energy, expanding domestic sales teams and market penetration, expanding overseas presence, and strengthening the ecosystem; seeking strategic investment and acquisition opportunities to advance AIoT initiatives in the field of digitalization and enhance overall competitiveness; and for working capital and general corporate purposes. The specific amount of funds raised has not been disclosed.

In terms of financial data, from 2021 to 2023, Terminus Technology generated revenues of RMB 1.207 billion, RMB 738 million, and RMB 1.006 billion, respectively, with revenue growth rates of -38.81% and 36.29% in 2022 and 2023, respectively. Its adjusted net profits were -RMB 639 million, -RMB 983 million, and -RMB 600 million in these respective years.

Teslian's operating revenue from January to June 2024 was 357 million yuan, a year-on-year decrease of 30.11%; adjusted net profit was -356 million yuan.

The risk factors disclosed in Teslian's prospectus mainly include: difficulties in keeping up with technological innovation to promote the company's AIoT products; inability to compete with competitors; uncertainty in the growth of demand for AIoT products in the target market size and customer demand for public space; limited operating history and evolving business portfolio; uncertainty about whether the company can achieve and maintain profitability in the future; potential losses or delays in the company's existing contracts; inability to maintain current business relationships with major customers; difficulty in expanding to new application scenarios; difficulty in applying and commercializing the company's R&D results; risks related to the company's AIoT technology and unexpected failures or interruptions in the company's technology system; failure to obtain, maintain, or update licenses, permits, and approvals required for the company's business operations; and seasonal fluctuations, among others.

Nanshan Aluminum International disclosed its prospectus on September 26

Intends to list on the Hong Kong Stock Exchange Main Board

On September 26, Nanshan Aluminum International Holdings Limited (hereinafter referred to as "Nanshan Aluminum International") submitted its prospectus to the Hong Kong Stock Exchange for a main board IPO listing, with Huatai International as its sole sponsor.

Nanshan Aluminum International is a leading high-quality alumina manufacturer in Southeast Asia, committed to continuously strengthening its market position in the region. Since its establishment, the company has focused on developing Indonesia's abundant bauxite and coal resources to power its business.

The completion of the second-phase alumina production project has increased the company's designed annual alumina production capacity to 2 million tons. According to Frost & Sullivan, Nanshan Aluminum International ranks first in Indonesia and Southeast Asia in terms of designed annual production capacity in 2023.

One of the company's controlling shareholders is Nanshan Aluminum (600219.SH). This issuance constitutes a spin-off listing of a domestic listed company as defined in the China Securities Regulatory Commission's spin-off rules.

According to the prospectus, the funds raised from this issuance will be used by Nanshan Aluminum International for the development and construction of an alumina production project in the Special Economic Zone of Bintan Island, Riau Islands Province, Indonesia, to further expand alumina production capacity to a total of 4 million tons through new alumina production projects; and for general working capital. The specific amount of funds raised was not disclosed.

In terms of financial data, from 2021 to 2023, Nanshan Aluminum International achieved operating revenues of US$173 million, US$467 million, and US$678 million, respectively, with year-on-year increases of 170.06% and 45.21% in 2022 and 2023; net profits were US$39.71 million, US$96.09 million, and US$174 million, respectively, with year-on-year increases of 141.98% and 80.58% in 2022 and 2023.

From January to June 2024, Nanshan Aluminum International's operating revenue was US$423 million, an increase of 41.34% year-on-year; net profit was US$159 million, an increase of 138.97% year-on-year.

The risk factors disclosed in Nanshan Aluminum International's prospectus mainly include: the company is influenced by market forces in the aluminum industry; the company's financial performance and operating results in the alumina industry may be significantly adversely affected by export and other trade restrictions; the company has a high concentration of customers. If any major customer reduces purchases or fails to pay, the company's business, financial position, and operating results will be significantly adversely affected; government import or export controls or policy changes may affect the company's business, financial position, and operating results; the company faces competition in the alumina production industry, among others.

China Rural Microfinance disclosed its prospectus on September 27

Intends to list on the Hong Kong Stock Exchange Main Board

On September 27, China Rural Microfinance Co., Ltd. (hereinafter referred to as "China Rural Microfinance") submitted its prospectus to the Hong Kong Stock Exchange for a main board IPO listing, with China International Capital Corporation as its sole sponsor.

China Rural Microfinance is a comprehensive rural support service provider focused on the Chinese rural market. It empowers small farmers and rural small and micro-enterprise owners by providing technology-driven comprehensive products and services, including rural inclusive finance services, agricultural production services, rural consumer goods and services, and rural clean energy services.

As of June 30, 2024, China Rural Microfinance's business covers more than 550 counties in 23 provinces across China, with a presence in over 100,000 villages, reaching nearly 200 million rural residents. As of the same date, China Rural Microfinance relied on over 7,200 service team members and approximately 127,000 village-level partners in approximately 550 rural local service outlets to reach rural users directly. According to Frost & Sullivan's report, China Rural Microfinance is the largest non-traditional financial institution targeting the Chinese rural market, with a market share of approximately 8.6% (based on total loan balances as of December 31, 2023).

According to the prospectus, the funds raised from this issuance will be used by China Rural Microfinance for further investment in its local service network to expand geographical coverage and deepen penetration in rural areas; to expand and improve products and services; to invest in research and development and strengthen technological capabilities; to explore investment and acquisition opportunities for agricultural technology companies or agricultural supply chain companies that can generate synergies with the company; and for working capital and other general corporate purposes. The specific amount of funds raised was not disclosed.

In terms of financial data, from 2021 to 2023, China Rural Microfinance achieved operating revenues of 2.224 billion yuan, 2.429 billion yuan, and 3.181 billion yuan, respectively, with year-on-year increases of 9.23% and 30.96% in 2022 and 2023; adjusted net profits were 506 million yuan, 473 million yuan, and 566 million yuan, respectively, with year-on-year increases of -6.69% and 19.77% in 2022 and 2023.

From January to June 2024, China Rural Microfinance's operating revenue was 1.92 billion yuan, an increase of 29.53% year-on-year; adjusted net profit was 338 million yuan, an increase of 10.75% year-on-year.

The risk factors disclosed in China Rural Microfinance's prospectus mainly include: the company is subject to a wide range of laws and regulations, and future laws and regulations may impose additional requirements and other obligations, which may have a significant adverse impact on the company's business, financial position, and operating results; China's laws and regulations related to the inclusive finance industry are continually evolving, and the company has adjusted and may need to continue to adjust its business operations to ensure full compliance with relevant laws and regulations; the company relies on its own credit assessment models and risk management systems to determine credit approvals and credit line allocations, and if these systems fail to operate effectively, the related failures may have a significant adverse impact on operating results; the company may have limited information about small farmers and rural small and micro-enterprise owners to whom it provides loans, which may result in a decline in the quality of the company's credit assessments, among others.

China Rural Microfinance submitted its prospectus to the Hong Kong Stock Exchange on February 28, 2024, which has since expired.

Xiangjiang Electric disclosed its prospectus on September 29

Intends to list on the Hong Kong Stock Exchange Main Board

On September 29, Hubei Xiangjiang Electric Co., Ltd. (hereinafter referred to as "Xiangjiang Electric") submitted its prospectus to the Hong Kong Stock Exchange for a main board IPO listing, with GF Securities (Hong Kong) as its sole sponsor.

Xiangjiang Electric is a manufacturer of household living appliances. It operates primarily through the ODM/OEM model and has established a customer base comprising globally renowned and historic brands such as Walmart, Telebrands, SEB, Sensio, Hamilton Beach, and Philips. According to Frost & Sullivan's report, it ranks among the top ten enterprises in China's kitchen small appliance industry in terms of export value in 2023.

Xiangjiang Electric focuses on the research, design, production, and sales of electrical and non-electrical household appliances. Electrical household appliances are divided into three categories: electric heating appliances such as electric ovens, air fryers, and electric kettles; electric appliances such as blenders, egg beaters, and can openers; and electronic appliances such as electronic scales, humidifiers, and laser lights. It also offers non-electrical household appliances such as garden hoses and cookware. As of August 30, 2024, over 10 of Xiangjiang Electric's ODM/OEM products ranked among Amazon's "Best Sellers" in their respective categories, with steamers, rice cookers, electric ovens, and electric skillets ranking among the top 10 in their respective Amazon "Best Sellers" lists.

According to the prospectus, the funds raised from this issuance will be used by Xiangjiang Electric to establish a Thai factory to enhance its global presence, upgrade automation and digitization for sustainable growth, establish a new R&D center, introduce new brands to strengthen its OBM business, and provide general working capital. The specific amount of funds raised was not disclosed.

In terms of financial data, from 2021 to 2023, Xiangjiang Electric achieved operating revenues of 1.48 billion yuan, 1.097 billion yuan, and 1.188 billion yuan, respectively, with year-on-year changes of -25.90% and 8.33% in 2022 and 2023; net profits were 71.802 million yuan, 80.261 million yuan, and 121 million yuan, respectively, with year-on-year changes of 11.78% and 51.33% in 2022 and 2023.

From January to June 2024, Xiangjiang Electric's operating revenue was 614 million yuan, an increase of 10.33% year-on-year; net profit was 60.539 million yuan, a decrease of 12.43% year-on-year.

The risk factors disclosed in Xiangjiang Electric's prospectus mainly include: the company's dependence on a small number of major customers, who collectively accounted for more than 60% of total revenue during the track record period; the lack of long-term procurement commitments from most customers, which may expose the company to uncertainty and fluctuations in revenue across periods; the potential adverse impact of Sino-US trade tensions on the company's business, financial position, and operating results; the legal, regulatory, political, economic, commercial, and other risks associated with conducting business in different overseas markets; and the company's non-compliance with certain property ownership certificates for some of its owned properties, which may result in losses if penalties are imposed, among others.