Mixed news in ZTE's mid-year report: Decline in revenue from pillar businesses

![]() 10/08 2024

10/08 2024

![]() 480

480

At the recently held 32nd China International Information and Communication Exhibition 2024, ZTE (000063.SZ) showcased its innovative achievements in the field of 'Connection + Computing Power' under the theme of 'Integration of Digital and Physical Worlds, Intelligent Connection for Symbiotic Growth'.

Securities Star notes that high R&D investment is one of ZTE's defining characteristics. According to the data disclosed in the 2024 half-year report, despite investing billions of yuan in R&D expenses, ZTE's ranking in the number of effective global patent families related to 5G technology, a crucial indicator of a company's competitiveness in the global 5G technology field, dropped from fourth place globally in the same period last year to fifth.

In the first half of this year, while ZTE successfully achieved both revenue and profit growth, its three major business segments faced varying degrees of challenges. The company's pillar business, carrier network business, saw a decline in revenue. Although the revenue of its consumer business and government and enterprise business increased, the consumer business had limited market influence, with its mobile phone brand failing to make a significant impact in the market; meanwhile, the gross margin of the government and enterprise business decreased significantly, dragging down the company's overall gross margin performance.

01. Net profit growth rate slows to single digits

Public information indicates that ZTE provides ICT (Information and Communication Technology) technology and product solutions to telecom operators and government and enterprise customers, as well as terminal products to individual consumers.

According to the 2024 half-year report, ZTE achieved operating revenue of 62.487 billion yuan in the first half of this year, an increase of 2.94% year-on-year; net profit attributable to shareholders of the parent company was 5.732 billion yuan, an increase of 4.76% year-on-year. Although the company achieved both revenue and profit growth in the first half of the year, its net profit growth rate has entered the single-digit era, compared to 19.85% in the same period last year.

Securities Star notes that the slowdown in ZTE's net profit growth rate was affected by a decline in its gross margin. In the first half of this year, the company's gross margin was 40.47%, a decrease of 2.75 percentage points year-on-year. This decline was primarily influenced by changes in revenue structure and the decrease in gross margin of the government and enterprise business.

Asset impairment losses also impacted the company's net profit to a certain extent. In the first half of this year, ZTE's asset impairment losses amounted to 601 million yuan, an increase of 116.7% year-on-year, primarily due to increased inventory write-downs during this period.

It is worth noting that after provisions, ZTE's inventory book value reached 40.96 billion yuan, accounting for 27% of current assets, with the book value of work-in-progress and inventory goods amounting to 5.679 billion yuan. If the market price of products falls significantly in the future, the company's inventory will face the risk of impairment, which will have a significant adverse impact on the company's operating performance.

Furthermore, Securities Star notes that the company's accounts receivable increased significantly, with a growth rate much higher than that of revenue. In 2023 and the first half of this year, the company's accounts receivable amounted to 20.822 billion yuan and 20.925 billion yuan, respectively, representing year-on-year increases of 17.3% and 25.57%, higher than the revenue growth rates of 1.05% and 2.94%.

02. Challenges in all three major business segments

Categorized by customer type, ZTE's business is primarily divided into three segments: carrier network, consumer business, and government and enterprise business. Among them, the carrier network segment is the company's pillar business, with its main products being carrier networking equipment, including wired and wireless products.

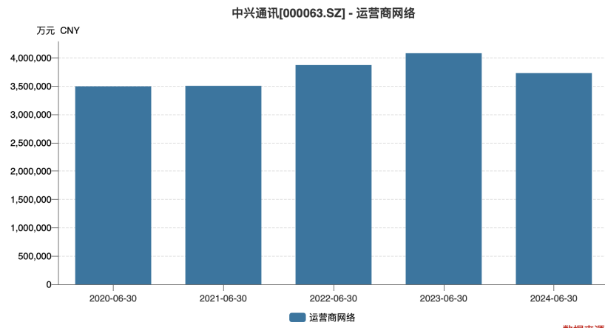

Securities Star notes that in the first half of this year, ZTE's pillar business declined, with carrier network revenue reaching 37.296 billion yuan, a year-on-year decrease of 8.61%, accounting for 59.69% of total revenue. This is the first decline in the company's mid-year report in the past five years.

In fact, investors had previously expressed concerns about the carrier network business. At that time, ZTE held an optimistic attitude, stating that the overall capital expenditure plans of China's three major telecom operators in 2024 would decrease slightly, with wireless investment starting to decline and computing network investment continuing to increase. Against this backdrop, domestic wireless product revenue serves as the foundation for the company's performance, and while growth faces challenges, the company is confident in maintaining steady growth. However, based on the performance of this business segment in the first half of the year, the company was proven wrong.

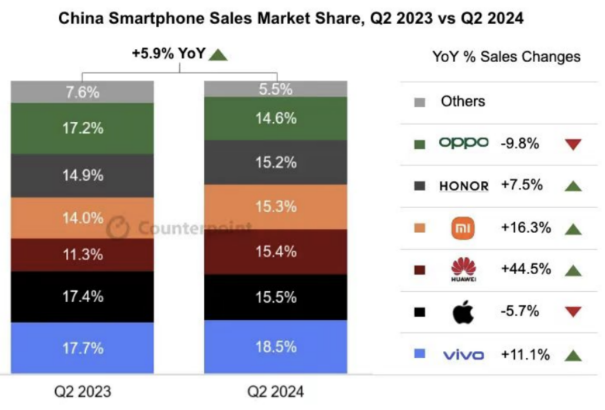

The consumer business, which includes home terminals and mobile phone products, achieved growth in the first half of the year, with revenue increasing by 14.28% year-on-year to 16.019 billion yuan. It is worth noting that despite this growth, ZTE's mobile phone brand has not made a significant impact in the market.

It is reported that ZTE has three mobile phone brands: ZTE, Nubia, and Red Magic, catering to business, fashion-conscious, and gaming enthusiasts, respectively. In terms of mobile phone products, the company has invested considerable effort, introducing numerous new products targeting both individual and industry users, such as the nubia Pad 3D II, the world's first 5G+AI 3D tablet, and the Red Magic 9 Pro series, a gaming flagship phone with exceptional performance and battery life.

In terms of sales volume, according to Counterpoint data, in the second quarter of 2024, the top six brands in China's market share were vivo, Apple, Huawei, Xiaomi, Honor, and OPPO, with ZTE's brands classified under 'Others'.

ZTE's government and enterprise business primarily provides products such as communication networks, the Internet of Things, big data, and cloud computing, with some overlap with its carrier business. This segment mainly provides various information technology solutions to governments and enterprises. In the first half of this year, the segment generated revenue of 9.172 billion yuan, a year-on-year increase of 56.09%, representing a significant growth rate.

However, this segment is also the only one among ZTE's three major businesses to experience a decline in gross margin. In the first half of this year, the gross margin of the government and enterprise business was 21.77%, a year-on-year decrease of 5.74 percentage points. This decline, in turn, dragged down the company's overall gross margin.

03. Urgent need to improve R&D efficiency

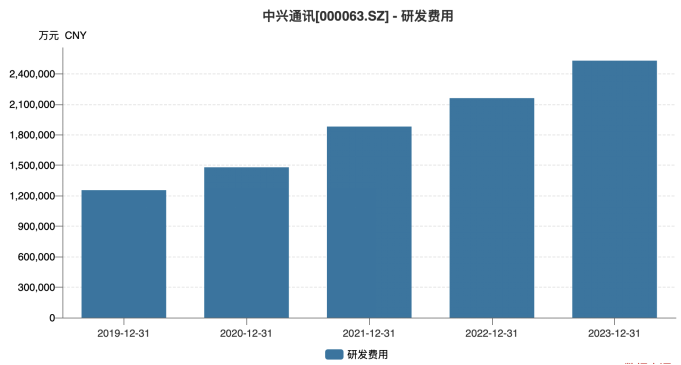

Securities Star notes that high R&D investment is one of ZTE's defining characteristics. Since 2019, the company's R&D expenses have continued to rise, from 12.548 billion yuan in 2019 to 25.289 billion yuan, with the R&D expense ratio increasing from 13.83% to 20.53%.

Despite the continuous increase in R&D expenses, the number of R&D personnel at ZTE has decreased. At the end of 2023, the company had 35,400 R&D personnel, a decrease of 907 from the previous year. Interestingly, despite the reduction in R&D personnel, the amount spent on salaries, benefits, and bonuses has increased. In 2023, salaries, benefits, and bonuses amounted to 17.817 billion yuan in R&D expenses, an increase of 18% year-on-year.

In the first half of this year, ZTE maintained a high level of R&D investment, with R&D expenses reaching 12.726 billion yuan, and the R&D expense ratio remaining at around 20%. However, the company's ranking in the number of essential 5G standard patents decreased.

As of June 30, 2024, ZTE had approximately 91,500 global patent applications and a cumulative total of approximately 46,000 globally authorized patents. Compared to the same period last year, both the company's global patent applications and cumulative globally authorized patents have increased. However, the number of essential 5G standard patent families, a crucial indicator of a company's innovation capability and market competitiveness in the 5G technology field, dropped from fourth place globally in the same period last year to fifth place.

In terms of R&D direction, the company's investment and achievements focus on two major areas: connectivity and computing power. ZTE has repeatedly emphasized the importance of its computing power business, with deployments in both computing power infrastructure and large models. However, ZTE's progress in the computing power field seems unsatisfactory. The 2023 annual report mentioned that there was a mismatch between the timing of the company's smart computing server launch and the pace of smart computing construction.

Furthermore, against the backdrop of declining revenue from the company's pillar business and slowing net profit growth in the first half of this year, ZTE needs to consider how to more effectively convert R&D investment into market revenue and profit growth, thereby enhancing the company's overall competitiveness. (First published on Securities Star, Author: Li Ruohan)

- End -