How will Ding Jian cultivate "Xianyu" into a big fish after elevating its business level for a year?

![]() 10/08 2024

10/08 2024

![]() 635

635

In November 2023, both Xianyu and 1688 were upgraded to Tier 1 businesses within Taobao Group, with their respective heads reporting directly to the CEO of Taobao Group. While their strategic positions were elevated, they also bore more expectations.

Each of them occupies a niche position in Taobao's e-commerce lineage. 1688, as an established B2B platform, is crucial to the upstream supply chain of e-commerce. Meanwhile, Xianyu, as a C2C idle trading platform, has the responsibility to capture consumer mindshare. Amidst the unrelenting pressure on the main Taobao site, these two entities, once seen as side businesses, are now required to become the backbone, with the immediate priority of "taking things further."

Since last year, 1688 has embarked on an aggressive cross-border expansion aimed at gaining a voice in the global supply chain while actively tapping into Taobao's traffic sources, both of which are extensions of its original business portfolio. In contrast, due to its unique positioning, Xianyu needs to supplement its logic to expand its business boundaries.

It's challenging to define the consumer demographics of idle e-commerce as a whole. Any product can potentially be labeled as idle, broadening the range of products that fall under this category and diversifying consumer motivations.

However, two significant (overlapping) consumer forces can be identified on the current Xianyu platform. One is driven by the low prices of used goods, with a high sensitivity to cost-effectiveness. The other stems from interests, culture, or emotional value, exemplified by the anime communities with dedicated columns on the Xianyu app.

Long-term growth in e-commerce is always tied to the efficiency of supply-demand matching. Therefore, whether it's cost-effective consumption or emotional consumption, both contribute to amplifying the imagination of platform scale. Yet, Xianyu, already boasting the industry's largest user base, doesn't lack imagination; doubts mainly center on how it will bridge the gap from imagination to reality.

01. Storing Water for Standby

There are two distinct paths for idle e-commerce: the asset-light C2C model, where the platform minimally participates in transactions, and the asset-heavy C2B2C model.

The former, represented by Xianyu, emphasizes community attributes and, in recent years, has placed greater importance on creating a pleasant browsing experience to satisfy users' diverse demands for second-hand goods. The latter, represented by Zhuanzhuan and Wanwu Xinsheng, focuses on high-value niches, addressing information asymmetry and pricing opacity in transactions to facilitate smoother exchanges between buyers and sellers with clear needs.

The asset-light C2C model is more suitable for mid-to-long-tail non-standard products. The platform provides information aggregation scenarios, transaction tools, and security guarantees, fostering a consumer community. To enhance supply-demand matching efficiency, the platform often encourages active interactions among community participants, fully exploiting users' dual roles as buyers and sellers. Some have compared the current Xianyu to the early Taobao, striving for a shelf-like full-category presence within the C2C context.

With its user scale as an advantage, it's understandable that Xianyu's first step in advancement is to pursue even greater scale.

Ding Jian, General Manager of Xianyu (nickname: Jishan), has set a target for Xianyu to surpass 200 million monthly active users (MAUs) in 2024. According to QuestMobile data from April this year, Xianyu leads idle e-commerce with 162 million MAUs, up 19.1% year-on-year, followed by Zhuanzhuan and Zhaoliangji.

For reference, among leading e-commerce platforms during the same period, Taobao had 928 million MAUs, Pinduoduo 677 million, and JD.com 507 million. Positioned as a single-transaction-format platform, Xianyu currently ranks first in idle e-commerce MAUs. However, given its current expectations, merely serving as a replacement system under Taobao is insufficient.

The tension in the C2C transaction model lies with consumers themselves. Since Ding Jian's appointment, Xianyu's community positioning has received greater emphasis. Meanwhile, data shows that nearly 50% of China's 178 million MAUs in idle e-commerce are young people under 30, indicating potential for scale expansion among this demographic.

Two noteworthy changes along this expansion path are worth exploring. Firstly, expanding the tradable scope from physical goods to virtual ones. For instance, Xianyu has launched resumes, allowing users to showcase their idle time, hobbies, experience, skills, and more, encouraging them to offer services such as education and training, design customization, pet companionship, etc., as sellers. Xianyu highlights that the primary target audience for this initiative are Gen Z users with a strong online presence and forward-thinking mindset.

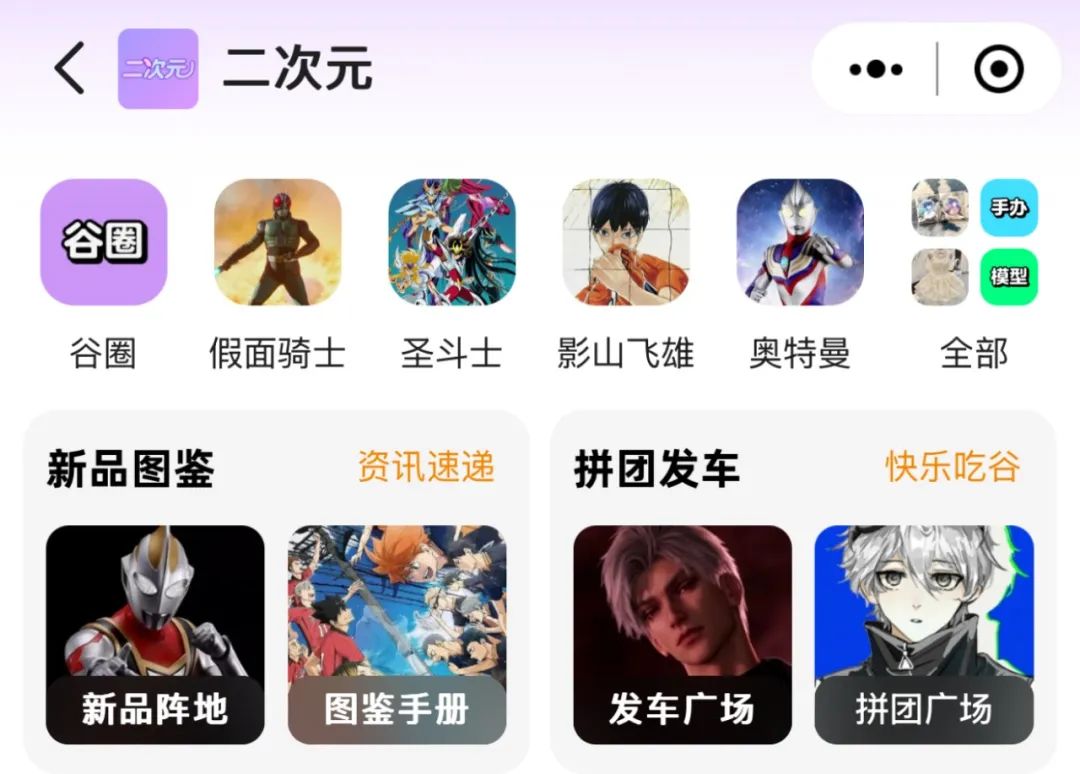

Secondly, Xianyu aims to create a hub for niche interests among young people. Subcultures like anime circles, doll circles, account trading, and game boosting have gained momentum on Xianyu, making it a transaction base for the anime community to some extent. According to QuestMobile, Xianyu boasts the highest proportion of anime and gaming users among mainstream e-commerce platforms, at 50%, with a scale of 81.5 million.

Xianyu has also designed a "group buy" tool specifically for anime transactions, facilitating transactions within the anime circle (a term for merchandise related to manga, anime, games, idols, etc.).

This approach of capitalizing on young consumer trends and facilitating second-hand transactions through social interaction has parallels worldwide. UK-based Depop, a second-hand e-commerce platform, has integrated social media features into its shopping platform, allowing users to follow others, like, comment, and share products, enhancing interactivity and community feel. Focusing on fashion and youth culture, Depop attracts independent designers and fashion KOLs to showcase and sell their products, making it popular among young Britons.

Returning to Xianyu, these two changes still aim to enrich the supply-demand dynamics in the second-hand market but with a clearer focus on new supply-demand relationships fueled by generational cultures. Taking the game account trading market as an example, Xianyu hosts professional account valuation and resale merchants, who essentially sell market valuation information for virtual assets within specific gaming communities. A female "account appraiser" shared that plotting the fluctuations in Xianyu account prices over time closely mirrors the market feedback trends of those games.

Xianyu has expanded its "water reservoir." During the 10th-anniversary media communication session in July, Jishan clarified that Xianyu's positioning is shifting from a "second-hand trading platform" to a "young people's interest trading community." However, the user base established during the Taobao era makes it challenging for Xianyu to stand alone, and this more inclusive consumer community now faces the challenge of an overly elongated commercialization frontline.

02. Traffic Ahead, Eyeing Monetization

Since its inception, Xianyu has maintained a free model to continually improve community activity and scale, gradually building a substantial user base. Meanwhile, its commercialization process has been relatively slow, with long-term monetization expectations.

Commission is often the first thought when considering monetization paths for the C2C model.

In 2023, Xianyu announced that it would charge software service fees for sellers conducting "frequent and high-value transactions" on the platform. Sellers with 10 or more completed orders and cumulative transactions exceeding 10,000 yuan in a month would be charged 1% of the excess amount. This change targeted frequent B-end sellers. In July 2024, Xianyu further expanded its fee structure, announcing a basic software service fee of 0.6% for all sellers, capped at 60 yuan per transaction.

However, as a full-category second-hand trading community, the commission rate should not increase significantly to maintain a diverse supply, lest it discourage individual sellers. For reference, eBay recently announced the elimination of cross-category sales fees for private sellers in the UK to maintain competitiveness in the online resale market, widely seen as a response to competition from platforms like Depop and Vinted, aimed at attracting more individual sellers.

A more aggressive direction for Xianyu is exploring idle B2C business. On September 12, Xianyu launched the "Xianyu Outlet" channel on its homepage, targeting idle B2C business with slightly flawed deals, brand-new items, and branded clearance sales. Merchandise in this channel primarily comes from e-commerce returns, brand channels, and some brand distributors, covering categories such as digital appliances, travel tickets, outdoor sports, food and beverages, etc.

In C2C second-hand platforms, professional and individual sellers can easily become ecological adversaries. Past approaches involved merchants avoiding conflicts by posing as C-end sellers or platforms mediating for peaceful coexistence. Xianyu Pro, launched in 2020, aimed to provide account upgrade services for professional individual sellers to meet more complex operational needs. However, features like higher SKU limits, product grouping, pinning, and data analysis supported by Pro accounts have already enabled some small B-end merchants to operate smoothly.

Now, by entering the fray itself and introducing reliable small B-end sellers, Xianyu enriches its cost-effective merchandise offerings, undoubtedly appealing to cost-conscious consumers. As mentioned earlier, though, the underlying logic of the C2C trading community restricts B2C business to supplementing C-end supply unless Xianyu intends to overhaul its community DNA.

Yet, the "professionalization" of sellers can potentially tap into another monetization path—amplifying advertising and value-added service revenues that lean more towards community operations within the "transaction and community" concepts.

Xianyu has similar revenue streams, such as charging sellers for inspection and consignment services. On September 1, Xianyu introduced the "Personal Seller Traffic Guarantee Program" and a new "Personal Idle Items" entry to ensure traffic for individual sellers. The traffic filtering rules prioritize sellers with good credit and active responses, allowing consumers to filter products based on criteria like credit, price, distance, and discounts.

The New Position believes that, without altering the underlying C2C logic, guiding individual sellers to adapt to professional operating procedures may stimulate more demand for advertising and value-added services. However, this necessitates careful platform oversight to ensure fair traffic distribution, balancing the interests of buyers and sellers amid fluid identities.

03. Closing Thoughts

Affordability has been the focal point of e-commerce in recent years, with low prices the dominant keyword for an extended period. As overall consumer trends shift towards rationality, with growing emphasis on price, practicality, and long-term value, idle e-commerce finds itself in a favorable environment.

At this stage, Xianyu, as a fluid space within Taobao's highly structured system, boasts visible strategic value. Born from Taobao's "Second-Hand" business in 2012 and officially renamed in 2014, Xianyu synergizes with Taobao's new and used goods businesses, offering layered shopping experiences within a single e-commerce ecosystem. Sellers who cannot meet the thresholds for new goods e-commerce or lack centralized trading tools flock to Xianyu, helping Taobao retain overflow demand and facilitate traffic circulation.

This is why, for more perceptive consumers, knowing the right keywords can unlock a world of products on Xianyu unavailable on Taobao.

Yet, Xianyu struggles to shoulder the burden of being a pillar. Due to a notable time lag between current traffic growth and monetization expectations, it cannot quickly become Taobao's right-hand support like concurrently promoted 1688. Nonetheless, the allure of youth preferences consistently whets the market's appetite. Xianyu's occupation of this mindset remains forward-looking and offers development potential. For Alibaba, expanding the "water reservoir" is feasible, but activating its waters carries greater significance and challenges.

*Images in the headline and article are sourced from the internet.