Ride-hailing commission mystery

![]() 10/09 2024

10/09 2024

![]() 602

602

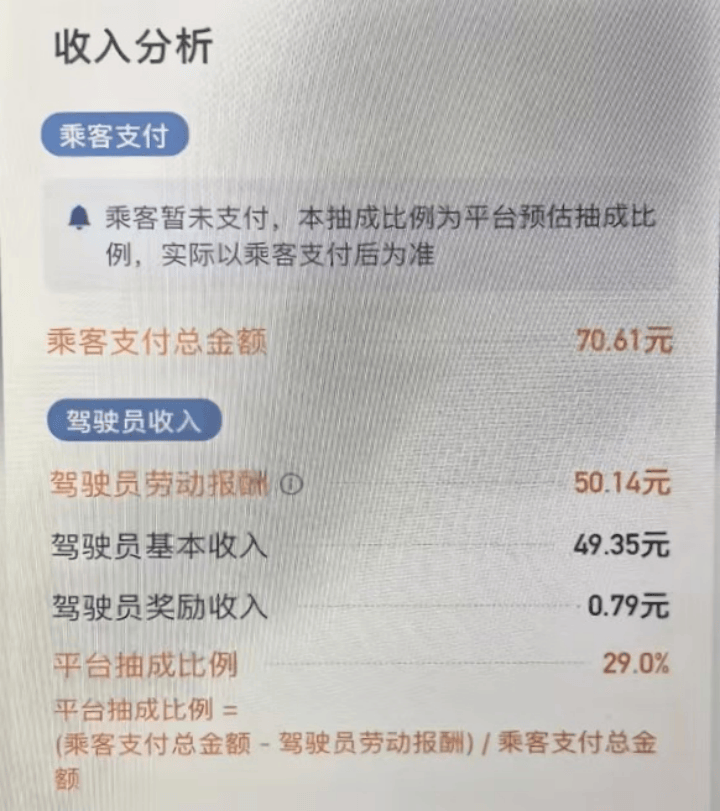

"For this 7.4-kilometer special offer order, Didi Global actually took a commission as high as 29%, and it was during the morning rush hour. If the platform can't even guarantee the drivers' income, how about the passengers' protection?" Recently, a netizen publicly questioned Didi Chuxing's commission rate on social media platforms.

"Indeed, such a commission rate is astonishing, especially during the morning and evening rush hours, when drivers already face greater traffic pressure and fatigue challenges. Coupled with a significant reduction in income, it's hard for them to feel at ease," a long-time Didi user shared with "City Scene".

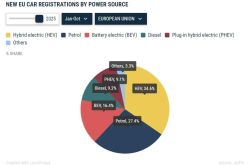

Just before National Day, the Ministry of Transport held multiple meetings with various ride-hailing platform companies to encourage them to reduce their commission rates. Although regulatory authorities like the Ministry of Transport have set an upper limit for the commission rates of ride-hailing platforms (generally 30%), many platforms' actual commission rates are far above this standard in practice.

"Through meetings, reminder letters, and administrative guidance, we urge platform enterprises to strictly fulfill their primary responsibilities, continuously regulate their business practices, and optimize their operating rules," said Wang Xiuchun, head of the Transport Service Department of the Ministry of Transport at a press conference. "We have continuously organized and implemented the 'Sunshine Action' to reduce excessive commissions and promote a better distribution of benefits between drivers and platforms."

01 High Commission Rates Persist

In 2022, the Ministry of Transport launched the 'Sunshine Action' for commission rates of new transport services platforms, requiring major ride-hailing platforms to disclose their pricing rules, set and announce upper limits for commission rates, and ensure that drivers can view the commission rate for each order in real-time. At that time, most ride-hailing platforms disclosed commission rates ranging from 18% to 30%, which subsequently established an implicit red line of 30%. However, currently, platforms are finding ways to reach this ceiling.

Wang Cheng, a Didi Light Luxury driver, recalled, "At first, the commissions were very low, or even zero. But over time, Didi's commission rate per order gradually increased and is now basically between 22% and 29%."

In a highly competitive market environment, platforms often reduce fares to attract passengers, ultimately shifting these costs to drivers. Ride-hailing drivers must not only bear the operational costs of vehicle maintenance, fuel, or electricity but also face high platform commissions, significantly reducing their actual income.

Wang Cheng shared a specific order case that was particularly distressing: "That order was actually assigned to me as a Light Luxury driver after no other cars were available. The platform offered a discount and downgraded the order. After deducting the platform's 29% commission from the total fare paid by the passenger, the remaining amount could only be given to me as a reward because the platform's maximum commission rate is 29%."

Even more concerning, a driver on an aggregation platform told "City Scene" that the phenomenon of "large platforms like Gaode taking a commission, followed by smaller platforms" is widespread. This means that orders resold to other platforms may face secondary commissions due to the use of certain aggregation platforms or third-party services. This double or even multiple commission mechanism undoubtedly further compresses drivers' profit margins.

Ride-hailing aggregation platforms rely on internet technology to collaborate with ride-hailing platform companies, match supply and demand information for passengers, and jointly provide online taxi-booking services, such as Gaode Map Taxi and Baidu Taxi. By integrating vehicle resources from multiple ride-hailing service providers, these platforms provide users with a unified travel service platform.

Aggregation platforms solve the customer acquisition problem for ride-hailing platforms through their traffic advantages and provide greater survival space for small ride-hailing platforms. At the same time, aggregation platforms have gradually expanded their business to include errands and chauffeur services based on ride-hailing. As service scenarios increase, aggregation platforms gain more traffic advantages. However, behind this rapid development, the issue of layered commissions has gradually emerged. On the surface, the commission rate of a single platform is below 30%, but after orders are resold and commissions are taken at each layer, the total exceeds the 30% red line.

02 Semi-transparent Bills

The details of ride-hailing bills seem to be a "secret that cannot be spoken of."

"We have no idea about the unit price, and customer service won't tell you when you call," Wang Cheng from Didi expressed his frustration to "City Scene." He added, "A bill only shows how much the passenger paid, how much I received, how much the platform took as a commission, the base fare, the distance traveled, and the duration. We don't even know if the passenger used a coupon."

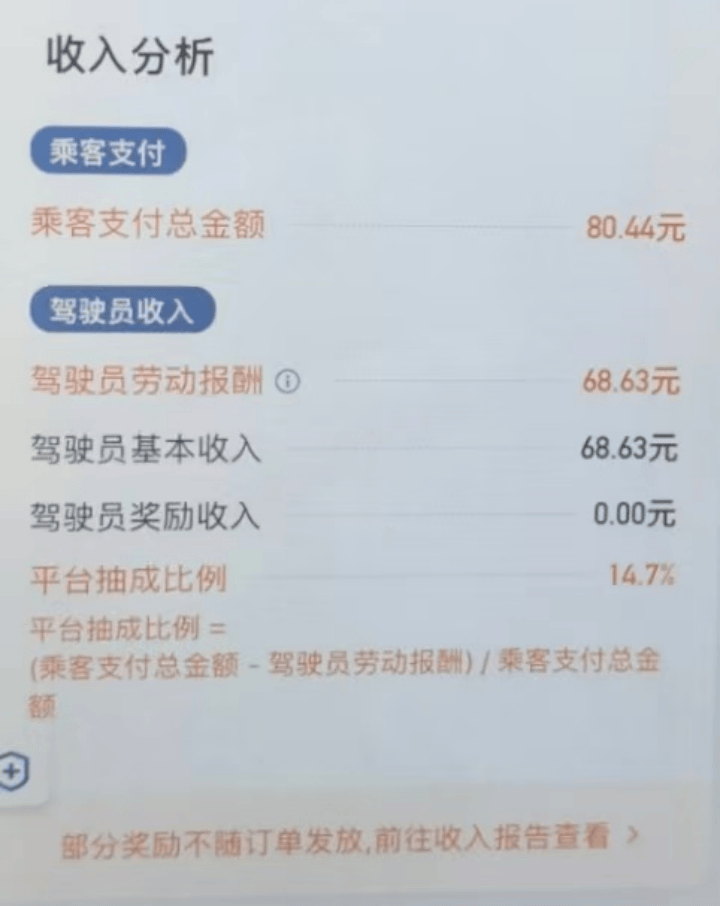

Wang Cheng also specifically mentioned the handling of additional fees, "Highway tolls and road tolls incurred during the trip are also subject to commissions, I've calculated it." He explained, "Once, I received a pickup order with a 20-yuan highway toll. Ideally, the platform should take a commission based on the base fare of 60.44 yuan. But look at the price; the platform took a commission based on 80.44 yuan, which clearly includes the additional fee."

Regarding whether additional fees are subject to commissions, Sun Shu, CEO of Didi Mobility, previously responded during a "Driver Feedback Collection" event on the Didi Driver app that highway tolls are fully paid to drivers and are not subject to commissions. However, when calculating the commission rate, highway tolls are included in the display of the commission calculation, which is just a matter of presentation and not actual commissions.

Nonetheless, it appears that Didi has not made substantial improvements in this regard, and drivers can still only "calculate" whether additional fees are subject to commissions based on the displayed commission results.

Unlike Wang Cheng, Zhang Cong is a driver who accepts orders on aggregation platforms. He bluntly stated, "I don't even know how much commission is taken now. I used to be able to get a rough idea, but now it just shows the final amount received, nothing else."

Zhang Cong's confusion reflects the greater challenge of transparency in commissions on aggregation platforms. As a collection of multiple ride-hailing service providers, aggregation platforms often have more complex and elusive commission mechanisms.

Furthermore, platforms often do not disclose information such as the actual payment by users and the commission rate, leaving drivers to passively accept the final settlement amount provided by the platform. This lack of transparency not only makes it difficult for drivers to make reasonable income projections and plans but also exacerbates unfair competition and irregularities within the industry.

In addition to not disclosing relevant information on bills, some drivers have even encountered the phenomenon of "yin-yang bills." According to Worker's Daily, for an order with a passenger payment of 84.34 yuan and no commission, the driver only received 61.12 yuan, with the remaining 23.22 yuan unaccounted for. The driver suspected that the platform resold the order to another platform, which then took a commission.

This phenomenon is not an isolated case.

Gu Dasong, Executive Director of the Transportation Law and Development Research Center at Southeast University, also noticed this issue last December. A set of order screenshots released by Gu Dasong showed that for one trip, the passenger actually paid 98.11 yuan, but the driver received only 71.46 yuan from the passenger, with an actual income of 52.17 yuan. The remaining 26.65 yuan was unaccounted for, exceeding half of the driver's actual income. After analysis, Gu Dasong found that the order had been resold multiple times, and the missing 26.65 yuan was the result of layered commissions taken by various platforms during the resale process.

Aggregation platforms do not fully disclose detailed information to drivers and passengers, including platform service fees, commission rates, and potential additional fees. This lack of transparency may lead to the resale of orders, where each platform takes a commission during the resale process, resulting in a significantly lower amount received by drivers compared to the passenger's payment.

The lack of transparency in bills also allows platforms and operators some room for manipulation in fee calculations. They may obtain more profits by adjusting commission rates or adding additional fees, often without the knowledge of drivers and passengers.

In addition to directly impacting drivers, the lack of transparency in bills also indirectly affects passengers. The resale of orders cannot ensure vehicle conditions and driver service quality to a certain extent, and the varying service standards of different providers greatly affect the passenger travel experience. Moreover, with multiple platforms involved, accident liability determination becomes complicated, and the uncertainty of driver qualifications increases safety risks.

03 Can Win-Win Outcomes Be Achieved?

According to Ride-hailing Observer, a car enthusiast in Shenyang revealed that before National Day, some aggregation platforms issued price adjustment notices, implementing new pricing rules from October 8. The starting fare was reduced by an average of 1.5 yuan per kilometer, and the segmented mileage fee was also slightly decreased. This new round of price adjustments reduced fares to just over 1 yuan, and ride-hailing drivers' working hours will be extended again.

This year, cities like Jingdezhen in Jiangxi Province, Suzhou in Jiangsu Province, and Shangqiu in Henan Province have successively issued risk warnings for the ride-hailing industry, reminding practitioners to be cautious about entering the field.

According to public data, the average daily orders per ride-hailing vehicle in many cities declined in the second quarter of this year. Taking Hangzhou as an example, the city's ride-hailing regulatory system reported that in the second quarter of 2024, the city's total daily ride-hailing orders were 1.2917 million, up 15.84% year-on-year and 14.21% quarter-on-quarter. However, the average daily orders per vehicle were 15.73, down 4.52% year-on-year and 4.91% quarter-on-quarter.

These figures directly reflect the current oversaturated state of the ride-hailing platform market.

A driver who joined the ride-hailing industry last month said, "I start driving at 7:30 am and finish around 11:00 pm. I only earn around 280 yuan a day, which barely covers my costs. If I hadn't already signed a car rental contract, I wouldn't want to do this anymore."

The saturation of the ride-hailing industry is evident not only at the driver level but also at the platform level. On the aggregation platform Gaode Map, there are 35 selectable models for economy and express cars alone. With the continuous emergence of new platforms, it has become common for ride-hailing drivers to compete for cross-platform orders during non-peak hours. For the ride-hailing industry, which is already approaching its market capacity limit, simply offering discounts to consumers can no longer sustain the sustained development of a platform. Instead, this approach may lead to vicious competition and predatory pricing.

In such circumstances, the core strategies to foster a more efficient and sustainable business model for the ride-hailing industry are clear: excessive platform commissions must be reduced, and billing transparency must be ensured. These two measures are not only the cornerstone for promoting the long-term healthy development of the industry but also crucial for safeguarding the legitimate rights and interests of practitioners and stimulating market vitality.

However, it is worth acknowledging that some regulatory authorities have recognized the issue of excessive ride-hailing platform commissions and have repeatedly issued policies requiring platforms to reduce their commission rates.

(All names mentioned in the article are pseudonyms)