How does Huolala make a profit after enrolling 1.36 million drivers into one app?

![]() 10/10 2024

10/10 2024

![]() 556

556

On October 2, Huolala's parent company, Lala Technology Holdings Limited, updated its prospectus on the Hong Kong Stock Exchange to continue its IPO process. This is the fourth time the company has submitted its listing application, following submissions in March 29, 2023, September 28, 2023, and April 2, 2024. Prior to that, a confidential submission was made to the U.S. Securities and Exchange Commission in June 2021, but it eventually stalled. Competitors Full Truck Alliance and GOGOVAN have listed on the capital market in 2021 and 2022, respectively, while Huolala's path to the stock market, despite its star-studded team, has been somewhat bumpy. So, what's the real deal with Huolala's business?

01 Enrolling 1.36 million drivers into one app

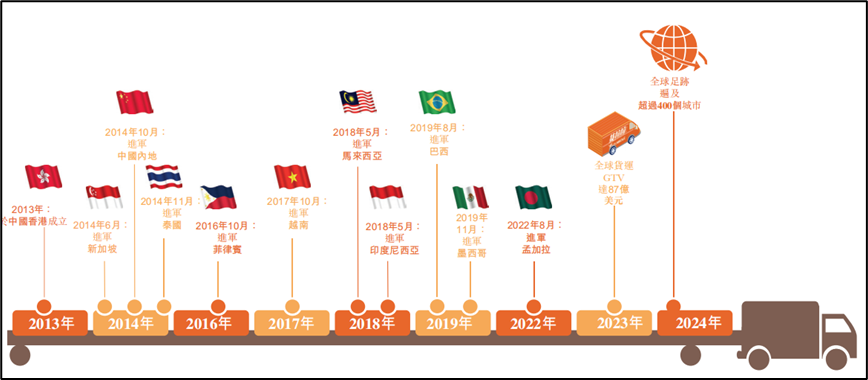

In 2013, with the gradual popularization of smartphones and the application of 4G networks, the internet economy began migrating from PCs to mobile devices, and related industries also began laying out their strategies around mobile platforms. A classic example of this transformation is Tencent's shift from the QQ era to the WeChat era. Innovative players like Meituan and Didi also emerged during this time, while ByteDance, the parent company of Douyin, had only been registered for less than a year. That year, Huolala was founded in Hong Kong, launching its logistics services under the brand name Easy Van. Its mission was to move road freight operations, traditionally conducted offline, online, making it a pioneer in the global digital freight platform space. Starting in 2014, Huolala began operating in mainland China and Southeast Asia. After a decade of development, Huolala's services now cover over 400 cities in 11 global markets. With an average monthly active merchant and driver base of 15.2 million and 1.361 million, respectively, it has become the largest logistics trading platform in terms of global closed-loop freight gross transaction value (GTV) and the largest urban logistics trading platform in terms of closed-loop freight GTV worldwide.

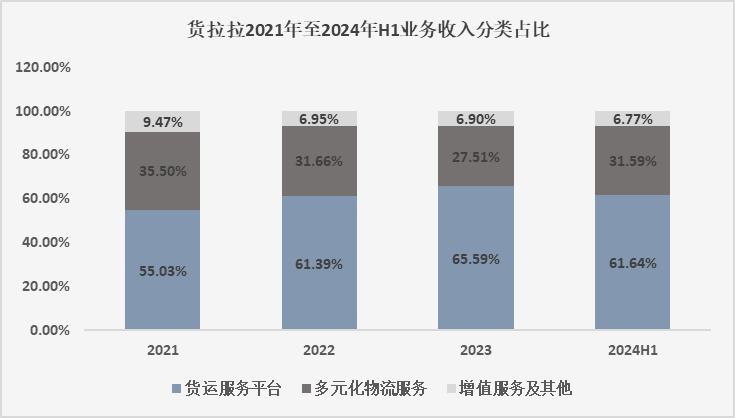

Like most internet platforms, Huolala plays the role of a “connector” in its business chain. By building a transparent platform (to reduce information asymmetry), it connects transport capacity on one end and merchants/users on the other. In its early days, Huolala focused on localization, aggregating excess labor/transport capacity to serve local demand. After establishing this model, it expanded to more cities/regions through replication. As the density of its operations increased, gradually connecting points into a network (with cross-city freight services launched in 2018), this formed the core revenue stream for Huolala: from 2021 to the first half of 2024, freight service platforms accounted for 55.03%, 61.39%, 65.59%, and 61.64% of its operating revenue, respectively. Building upon this foundation, Huolala has also extended its services vertically to meet the needs of both ends, such as “diversified logistics services” primarily serving large enterprise merchants and “value-added services” providing financial services to transport capacity, which contributed approximately 32% and 7% of its revenue, respectively.

02 Increasing commissions and reducing subsidies = profitability

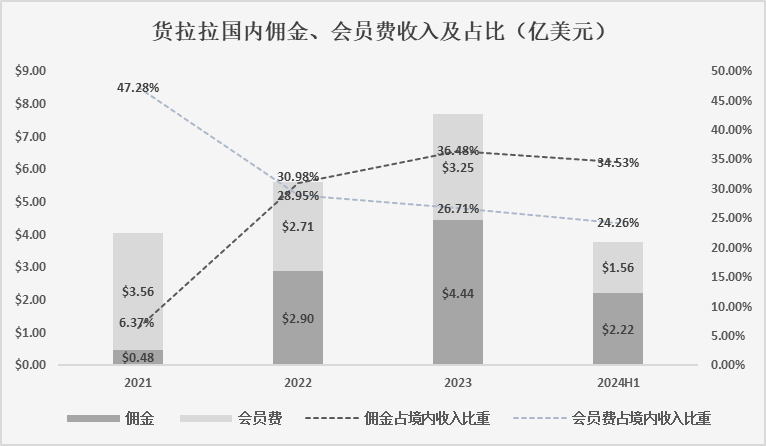

Between 2021 and 2023, Huolala's operating revenue increased continuously from USD 845 million to USD 1.334 billion, with net profits under non-GAAP accounting standards of -USD 651 million, -USD 12 million, and USD 391 million, respectively. In the first half of 2024, Huolala's revenue increased by 18.17% year-on-year to USD 709 million, and its net profit under non-GAAP accounting standards surged by 41.06% year-on-year to USD 151 million. From the data, it is evident that Huolala has turned around from losses to profits. A closer look at its prospectus reveals that the company's rapid growth is driven by a combination of revenue growth and cost reduction, essentially reflecting Huolala's pursuit of profitability after accumulating sufficient scale on both the supply and demand sides as a “connector.” Let's delve into 2022 in detail: (1) Total revenue increased by USD 191 million year-on-year to USD 1.036 billion; (2) “Commissions” from domestic transport capacity surged by USD 242 million (a year-on-year increase of 504.17%), accounting for a leap from 5.7% to 28% of revenue and becoming Huolala's primary source of income; (3) Affected by the pandemic, domestic freight service GTV grew by 8.47% in 2022, with the number of completed orders increasing by 5.69% year-on-year; the number of monthly active drivers grew by 11.69% year-on-year; (4) “Merchant discounts and driver referral fees” in marketing expenses dropped significantly by USD 344 million (an 86.87% year-on-year decrease). In other words, starting in 2022, Huolala substantially reduced subsidies while increasing commissions on transport capacity, thereby turning around its “huge losses” and achieving positive profits in 2023.

03 Membership fees reflect the helplessness of “cattle and horses”

Huolala's revenue primarily comes from domestic sources, accounting for over 90% in recent years, primarily encompassing three categories: “freight platform services,” “diversified logistics services,” and “value-added services.” Among these, “freight platform services” are the core revenue source, accounting for approximately 60% of domestic business income and contributing over 80% of gross profit. Further examination reveals that “freight platform services” primarily consist of “commissions” and “membership fees,” both derived from the transport capacity end.

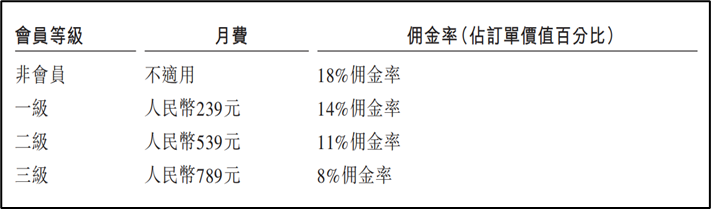

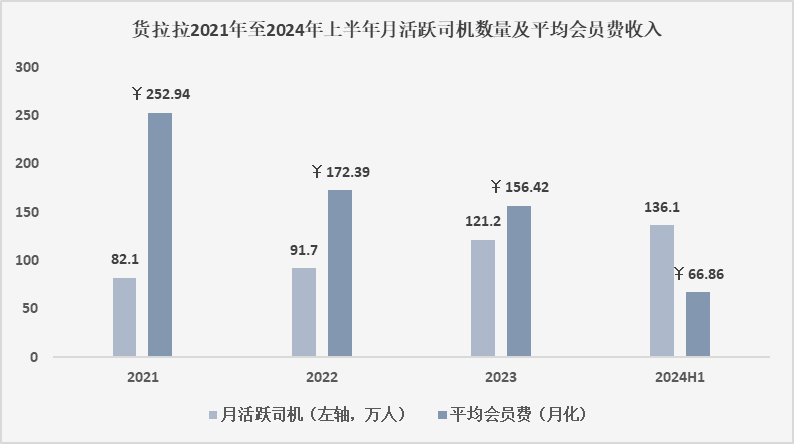

Before “increasing revenue and reducing expenses,” membership fees once accounted for up to 47.28% of domestic revenue and still accounted for nearly a quarter in the first half of the year. From a design perspective, non-mandatory monthly membership fees at different levels (with higher-level members paying lower commission rates) help retain those with “stable output” of transport capacity on the Huolala platform. However, looking at the average, despite an increase in the number of monthly active drivers from 2021 to the first half of 2024, membership fee expenditures have continued to decline:

Since 2022, the average monthly membership fee charged to drivers has been below the lowest tier of USD 239 per month, indicating that newly added transport capacity is not necessarily intended for the long term but rather a pragmatic choice due to the overall economic downturn.

04 Conclusion

From the perspective of the migration from PCs to the internet, Huolala has a first-mover advantage in online road freight transportation. Since its inception, it has raised a total of USD 2.662 billion through 11 funding rounds, with star investors such as Hillhouse Capital, Sequoia Capital, Tencent, and Shunwei Capital among its shareholders, providing ample support for its early-stage “money-burning” efforts. At present, the sustainability of its core business turning profitable remains to be further tested, as the monetization rate and net monetization rate of its freight platform in the first half of 2024 decreased by 0.6 and 0.5 percentage points, respectively, year-on-year. The company's future core strategies include launching “two-wheeler” delivery services in China and expanding into overseas markets. However, as we all know, the urban delivery market is already fiercely competitive, with players like Shunfeng, Flash Express, and Dada already in the fray. Competing with Meituan for transport capacity in the “food delivery” business will be even more challenging. As for extending upstream into vehicle manufacturing, it remains to be seen how successful Huolala will be, given the failures of other players in this space. Whether Huolala's journey on the capital market marks a new step forward or simply a farewell to the mobile internet era, we need to closely observe its developments.