Too late to open an account, post-00s buy funds on Alipay

![]() 10/12 2024

10/12 2024

![]() 473

473

Combing creative financial management and painless savings

Written by Li Jinlin

Edited by Li Ji

Typeset by Annalee

On October 10, the topic of "Post-00s earning 30,000 yuan in 3 days after rushing into the market" trended on social media, sparking heated debate. Prior to this, after six consecutive trading days of significant gains, the A-share market gained momentum and became a popular topic for the past half-month. On the first trading day after the National Day holiday, the significant opening gains of the three major A-share indices further fueled the nation's investment sentiment. In particular, the "post-00s" investors, as fresh blood in the market, attracted much attention.

Just like the line from the movie "The Wolf of Wall Street": "I'm talking about ordinary people, wage earners, the common folk. Everybody wants to make a lot of money. Am I wrong? There's no such thing as a saint."

However, seasoned investors are not unusual in this context. The real focus is on the "post-00s" and "post-05s" who are rushing into the market. Witnessing the continuous rise in the market, they have absorbed the idea that "missing out is worse than being trapped," but due to factors such as being too late to open an account or lacking experience in stock trading, they have begun to seek more convenient ways to enter the market.

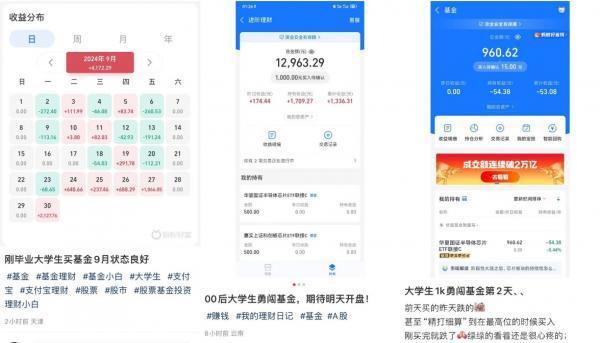

Among them, purchasing funds has become the preferred choice for the "post-00s" generation to step into the world of financial management. The simple operation mode and intelligent plan recommendations have allowed cautious young people to develop a new philosophy of saving money.

The "post-00s" have already infiltrated the ranks of investment and financial management

During the National Day holiday, Feng Yi, a senior university student, heard that the topic most discussed by his classmates and online bloggers was the "crazy surge in A-shares," with almost everyone wanting to get a piece of the action. "My roommate usually follows his parents in stock trading, and he said he made a nice meal out of his pocket money this time," said Feng Yi. His usual approach to financial management is to put his living expenses and part-time savings into Yu'ebao, a typical example of a prudent investor who believes in "low risk and low return are better than high risk and high return."

However, this time, Feng Yi was persuaded by his classmates and decided to try investing in funds with half of his monthly pocket money. "Opening a stock account is too complicated, and the threshold is a bit high for me. Relatively speaking, funds are simpler, and I can just buy them directly on Alipay," he said. Feng Yi told Xincedu that he invested a total of 1,000 yuan to learn financial management skills, and that regardless of gains or losses, it was within his affordable range.

Some classmates with experience in stock trading told Feng Yi that this was actually a course that tested one's mindset. Starting with a little extra money and trying it out, even if there are losses, they are not fundamental and can be seen as a mindset training. "They said that if you make money the first time, it's easy to get caught up in it later, so investing itself has two sides. For me, getting some experience is enough," he said.

It is common for college students to learn financial management

In recent years, more and more "post-00s" like Feng Yi have become aware of investment and financial management, and the minority group of young people who "spend money at the beginning of the month and eat dirt at the end" is actually small. Xincedu found from social platforms such as Xiaohongshu, Weibo, and Douban that whether it is stock trading, buying funds, or buying gold, it is no longer the domain of middle-aged people. However, the posture of the "post-00s" entering the market has indeed changed.

According to Alipay data, 20 million "post-00s" users of Yu'ebao choose to save money regularly, and 6.4 million set up a system where they save money with every purchase. At the same time, the "post-00s" also rely on the "7-day trading method" to make the most of their funds.

In simple terms, they have developed a short-term trading strategy with relatively low redemption fees, aiming to maintain weekly profits at around 2%, with stable and long-term operations.

More "post-00s" are rushing into the market

In fact, the "post-00s" and "post-05s" have already quietly infiltrated the ranks of investment and financial management. Although they have not yet become the main force, their awareness and approach to investment and financial management are gradually emerging as a new trend. Data shows that the "post-00s" group prefers to watch "get-rich-quick" videos on Alipay Life, such as "earn a million yuan a year with just two tricks" and "new model of flower vending stalls," which have received high praise. In addition to these videos, young people are also interested in professional content such as financial hot spot analysis and business behavior observation. Meanwhile, as "digital natives," this generation of young people has discovered more creative ways to use various apps, forming a brand-new concept of financial management.

Young people who want to retire early start with painless savings

In addition to "bravely" investing in funds, young people's approach to financial management is also reflected in their long-term savings plans. The purpose of saving money is to gain more freedom, and to achieve this goal, young people have come up with all sorts of clever strategies.

Amu, a "J-person" (a term referring to a specific subculture or lifestyle), has formed a wealth mindset since her college days, believing that "one should control money, not be controlled by it." She makes clear plans for every income and expenditure, even outlining the expenditure structure of subsistence consumption, development consumption, and enjoyment consumption to use limited funds more reasonably for a richer life experience.

Amu showed Xincedu that she has set up three small purses for living expenses, savings, and special budgets. Each week, she allocates her living expenses to the living expenses purse to cover daily expenses, and then uses the savings purse at the end of each week for discretionary spending, self-rewards, or to save for the next week's budget. The special budget purse is used to cope with emergencies.

"As long as you use it reasonably, you can easily control your budget and avoid unnecessary expenses. Over time, you will even look forward to the new weekly budget, like leveling up in a game," said Amu. She believes that this way of controlling life is not only interesting but also full of anticipation.

Small purses cooperate with multiple popular IPs

Data shows that 40% of Alipay Small Purse users are "post-00s," and nearly 3 million people visited Warren Buffett's live stream during the May Day holiday to comment on "receiving wealth." The younger generation pursues stable investment over time and is willing to prepare early for future freedom, demonstrating a stronger willingness to invest and manage their finances.

However, based on risk management considerations, young people are also pursuing both creative financial management and painless savings.

Taking Yu'ebao users as an example, 20 million "post-00s" choose to save money regularly, and 6.4 million have set up a system where they save money with every purchase. By the end of May, the average Yu'ebao position of the "post-00s" was nearly 3,000 yuan, a year-on-year increase of nearly 50%, and their monthly savings frequency reached 10 times, a 10% increase from last year. Nearly half of the "post-00s" users of Small Purse have enabled automatic savings plans, smartly building up their financial reserves.

In terms of Alipay's user base, young people aged 18-35 account for half of Alipay's platinum and diamond members. The rise of financial management awareness among this group has not only facilitated the smooth development of Alipay's various segmented products but also made the path to financial management more convenient for young people, fostering a mutually beneficial relationship with a shared direction.

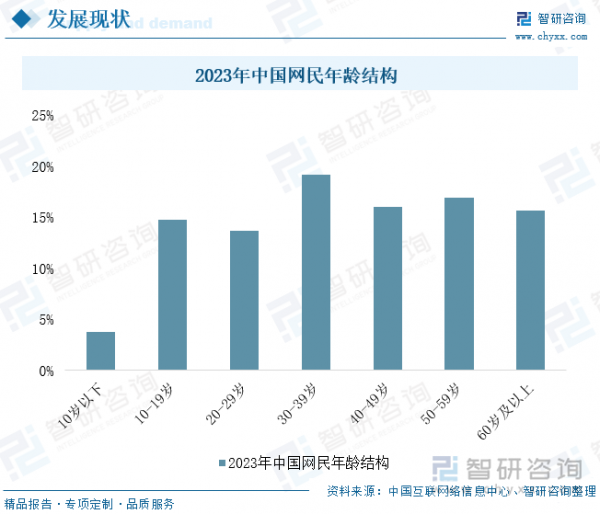

A better match for young people's financial management needs

There is a consensus among internet giants today: "He who captures the post-00s captures the world." According to QuestMobile data, as of September 2023, the total number of active users on the internet reached 1.224 billion, with the average monthly usage time of post-00s users reaching 173.9 hours, far exceeding the overall average of 157.9 hours. The increasingly active post-00s generation has given rise to more personalized needs and interests, driving internet giants to complete a new round of strategic layout.

From the perspective of young people's financial management needs alone, the saying "Ignore the temple of love, kneel before the temple of wealth" is not just a joke but a true reflection of many young people. Earlier, the "FIRE movement" proposed in the book "Your Money or Your Life" led the "Z generation" to embark on a lifestyle movement aimed at financial independence and early retirement.

In China, young people tend to call the "FIRE movement" "living off interest" and have extended its scope. They replace "lying flat" with minimalism and use the interest from stable financial products such as Yu'ebao and bond funds to cover some living expenses, both controlling expenses and saving deposits, hence the term "partial retirement" was derived.

Age structure of internet users. Source: Zhiyan Consulting

This lifestyle encapsulates the needs of young people and represents a new frontier that all players must compete for.

For this generation of "digital natives," attracting them to try various flashy apps is not difficult, but retaining them is not easy, especially when it comes to financial management apps involving money, where they are even more cautious. Platforms that understand young people's financial management needs and create financial management methods more suitable for them have gained opportunities to cross cycles.

Through a series of gameplay such as stealing energy, feeding chickens, planting fruits, and saving money, the growth trajectory of Alipay and its post-00s users is clear. After multiple trials and errors, Alipay began to focus on niche groups, opening up various products and tools to merchants to achieve full and precise matching, revitalizing the entire traffic pool.

For example, young people and ordinary investors often lack financial management experience and fall into a gap in traditional financial services. In response, Ant Fortune launched AI financial assistant "Ma Xiaocai," which accompanies users in real-time within the Alipay app to answer various financial questions. Compared to general large model products, "Ma Xiaocai" has a higher level of financial literacy and can present more substantial insights in an easy-to-understand format. For example, when asked about the investment prospects of the artificial intelligence sector, "Ma Xiaocai" would synthesize the analyses of dozens of fund companies, securities firms, and other institutions, presenting their "neutral" views clearly through graphics and text, and reminding users that "short-term performance growth may not meet expectations." For young users who want to start investing with a small amount of money, such answers are more helpful than "correct nonsense."

In the mobile internet era, content related to "making money" has become a spiritual totem for young people. Alipay, which is closer to money and understands the needs of young people, may have seized new opportunities under the "FIRE movement".