Shrinkage of over 60 billion, Yunda struggles to maintain third place

![]() 10/12 2024

10/12 2024

![]() 579

579

The growth rate of China's express delivery industry is accelerating continuously.

According to statistics from the State Post Bureau, China's express delivery volume reached 108.8 billion parcels in the first eight months of 2024, up 22.5% year-on-year, a further increase from 19.4% in 2023. Reaching the 100 billion parcel milestone came 71 days earlier than last year.

However, the industry's recovery has not changed the situation of intense competition, and domestic express delivery companies continue to rely on price cuts to increase volume. Among them, Yunda Express, as one of the leading express delivery companies, has seen its market share decline continuously in recent years. Its former position as the second-largest player has been usurped by YTO Express and is now at risk of being overtaken by STO Express.

Coupled with slowing performance and inadequate terminal operation management, the challenges facing Yunda's future growth remain significant.

[“Third Place” May No Longer Be Secure]

Yunda's slipping ranking is a microcosm of the industry reshuffle in recent years.

Looking back, the COVID-19 pandemic over the past three years posed severe challenges to the operation and management of express delivery companies, but it also presented opportunities for companies to seize market share and expand their business scale. This was evident in the fierce price competition among the giants during this period.

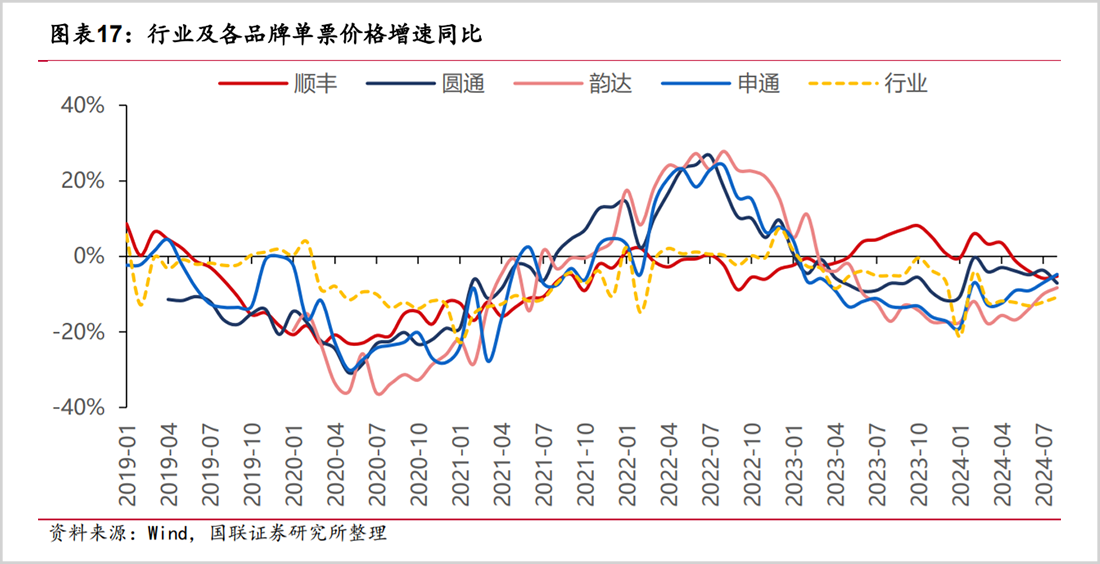

As early as 2017, the average price per parcel in the express delivery industry was around 12.5 yuan. After the intense price competition around 2020, this figure dropped to 10.55 yuan that year, with major players experiencing price drops of over 20% per parcel. Since then, with the introduction of regulatory policies, the competition temporarily subsided, and growth rates rebounded in 2022.

However, the "truce" lasted only a year before the price competition reignited. By August 2024, the average price per parcel in the industry had fallen to 7.93 yuan, a year-on-year decrease of 10.8%.

Amidst this fierce competition among giants, the industry rankings have also quietly shifted.

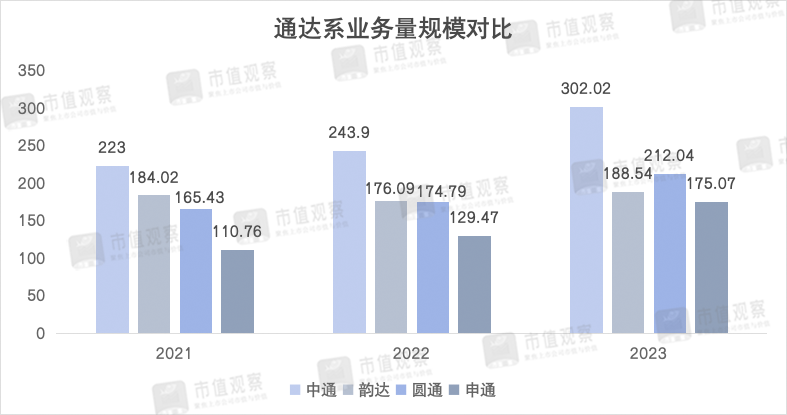

As the former second-largest player in the industry, Yunda had a business volume of 18.402 billion parcels in 2021, second only to ZTO Express's 22.3 billion parcels, with a market share of 16.99%, higher than YTO Express's 15.28% and STO Express's 10.23%.

In 2022, Yunda's business volume declined by 4.31% year-on-year to 17.609 billion parcels, while other giants maintained their expansion. ZTO Express, YTO Express, and STO Express had business volumes of 24.39 billion, 17.479 billion, and 12.947 billion parcels, respectively, representing year-on-year growth rates of 9.37%, 5.66%, and 16.89%.

Yunda's decline in business volume continued into the first half of 2023, with 8.402 billion parcels handled, a year-on-year decrease of 1.63%. It is worth noting that the overall domestic express delivery volume during the same period was 59.52 billion parcels, representing a year-on-year growth rate of 16.2%.

It was not until the second half of 2023 that Yunda's business volume stabilized and rebounded, with a full-year volume of 18.854 billion parcels, up 7.07% year-on-year. However, this growth rate was not as high as the over 20% achieved by other major players in the Tongda system.

It was also in 2023 that Yunda was officially surpassed by YTO Express, with its market share falling to 14.28%, dropping to third place.

More importantly, Yunda's third-place position is now under threat. STO Express, once the leading express delivery company, has accelerated its catch-up in recent years after falling behind.

In 2021, STO Express handled only 11.076 billion parcels, more than double the distance from Yunda's 22.3 billion parcels. By 2023, its business volume had reached 17.507 billion parcels, narrowing the gap with Yunda to 1.447 billion parcels.

In August 2024, STO Express achieved a monthly express delivery volume of 1.936 billion parcels, up 27.26% year-on-year, while Yunda achieved 1.973 billion parcels, up 21.57% year-on-year, with a narrow gap of only 37 million parcels between them.

Meanwhile, STO Express's market share increased from 10.23% in 2021 to 13.5% in August, just 0.2 percentage points behind Yunda's 13.7%.

STO Express maintained a relatively fast growth rate in express delivery volume even during the off-season in August. At the current pace, it will not be difficult for STO Express to surpass Yunda and rank among the top three after the industry gradually enters the peak season in October.

[Lack of Momentum]

Yunda's being overtaken is related to ineffective terminal network operation and management.

Especially in 2022, some of Yunda's terminals in regions such as Shanxi and Beijing were closed down, leading to delays in package delivery, unattended deliveries, and customer service complaints, exposing shortcomings in terminal operations.

Financial reports show that the number of Yunda's terminal outlets decreased in the first half of 2022. While there were 32,274 outlets nationwide in 2021, this figure dropped to 29,844 in the first half of 2022, a decrease of 2,430 outlets. In April of that year, Yunda's business volume was surpassed by YTO Express for the first time.

Yunda responded quickly to this issue and began vigorously deploying terminals in the second half of 2022, increasing the number of outlets to 33,301 by the end of the year. However, this failed to stem the decline in its annual business volume.

Yunda's business volume growth in 2023 was still driven by the traditional strategy of "trading price for volume."

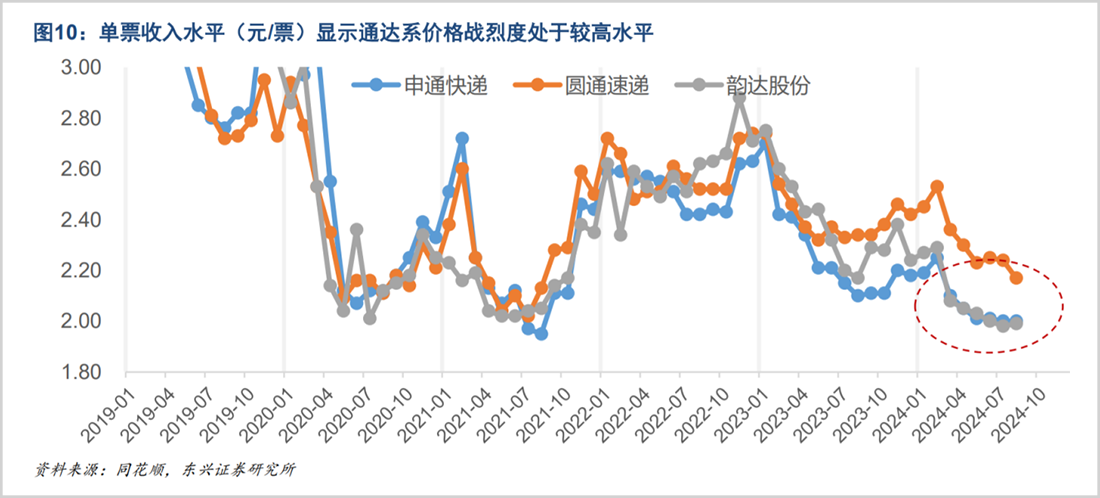

As the chart below shows, the current level of price competition in the industry is comparable to that in 2021. In recent years, Yunda's average price per parcel has declined rapidly, reaching 1.99 yuan in August 2024, the lowest among the major express delivery giants. Other giants like SF Express, STO Express, and YTO Express charged 15.67 yuan, 2 yuan, and 2.17 yuan per parcel, respectively.

In 2022, Yunda's average price per parcel was still the highest among the Tongda system players, at 2.6 yuan, higher than YTO Express's 2.59 yuan, STO Express's 2.53 yuan, and ZTO Express's 1.34 yuan. By August 2024, the average price per parcel had decreased by 23.46% from 2022 levels.

It is worth noting that both STO Express and Yunda are now operating at the bottom of the price range, with average prices per parcel around 2 yuan. Given the State Post Bureau's clear stance against "anti-competition" and vicious competition, future price competition may ease somewhat.

On the performance front, Yunda's "trading price for volume" strategy has been akin to a shot in the arm, but the boost to performance from scale growth has weakened. Despite restoring positive growth in scale in 2023, Yunda's operating revenue declined by 5.17% year-on-year to 44.98 billion yuan, making it the only company among the "Three Tong and One Da" (ZTO Express, YTO Express, Yunda Express, and STO Express) to experience a decline in growth rate.

Moreover, despite a 30% growth rate in business volume in the first half of 2024, Yunda's performance was far from impressive. The company achieved operating revenue of 23.25 billion yuan, up 7.8% year-on-year, and net profit attributable to shareholders of 1.04 billion yuan, up 19.8% year-on-year. The double-digit growth in net profit was also related to gains of 328 million yuan from the disposal of long-term equity investments and financial products. Excluding non-recurring gains and losses, net profit was 830 million yuan, up just 5.4% year-on-year.

The high growth in business volume coupled with relatively low profit growth rates also indicates a lack of momentum in the company's performance growth, which is also reflected in its share price. As of the close on October 11, Yunda's share price of 8.46 yuan had fallen by over 70% from its previous high of 29.62 yuan, and its market value had shrunk by over 60 billion yuan.

Yunda's current situation is closely related to changes in industry competition dynamics.

[It's Time for a Change in Operating Models]

As a typical industry with economies of scale, express delivery companies previously relied on price competition to gain market share and establish a scale advantage during periods of rapid growth. However, with the current average price per parcel already at a relatively low level, there is limited room for further decreases in the future, and the scope for "trading price for volume" is also expected to be limited.

At the same time, with the rise of online channels such as live streaming e-commerce and social commerce, a large number of low-cost individual returns and exchanges are growing rapidly. This has reduced the pull effect of scale on performance, not just for Yunda but also for YTO Express.

In the first half of the year, YTO Express completed 12.203 billion parcels, up 24.81% year-on-year, but its growth rate in net profit after deducting non-recurring gains and losses was only a low single-digit figure of 6.84%. While STO Express achieved double-digit growth in net profit due to a rebound in profit per parcel, it remained the lowest among the major express delivery giants at 0.044 yuan. The extent to which it can continue to rebound in the future remains uncertain.

Therefore, competition in the industry cannot be limited to price alone. Focusing on cost management, operations, and service is the core of the next stage.

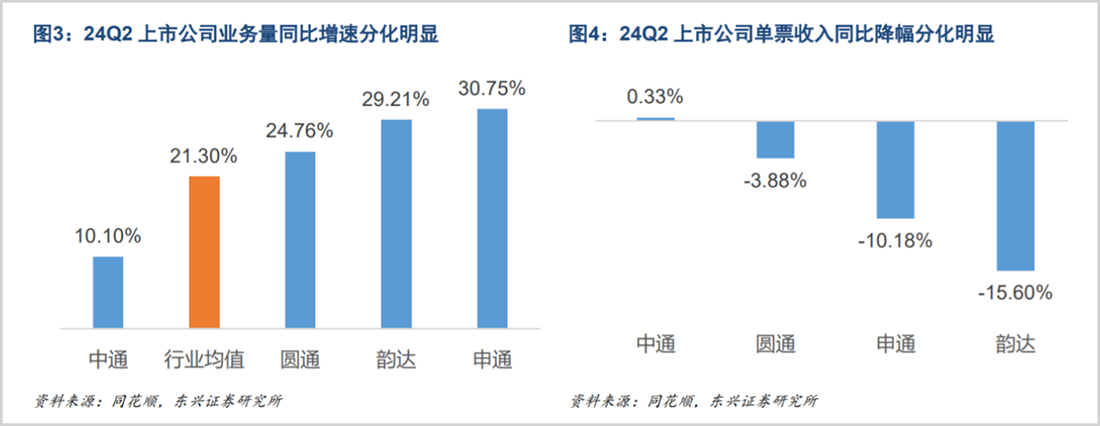

Currently, there are differences in business strategies among the major players. Continuing to compete for scale and market share or prioritizing profit is an important strategic decision facing enterprises. It can be said that ZTO Express has taken the lead in moving beyond price competition and entered an operations and service-driven model.

In terms of business volume, ZTO Express significantly slowed down in the second quarter of 2024, with a year-on-year growth rate of only 10.1% to 8.452 billion parcels, lower than the industry average of 21.3%.

The slowdown in ZTO Express's business volume naturally led to a decline in its market share, from 22.87% in 2023 to 19.6% in the second quarter, the first time it has fallen below 20% since 2020.

ZTO Express has proactively reduced the intensity of price competition by avoiding participation in low-cost individual parcel competition and shifting its focus to serving higher-value customers, which has better maintained its profit per parcel and profit levels. In the second quarter of this year, while the revenue growth rate per parcel declined to some extent for other major players in the Tongda system, ZTO Express's revenue per parcel increased by 0.33% year-on-year to 1.24 yuan.

In terms of profit per parcel, ZTO Express achieved a net profit of 0.33 yuan per parcel in the second quarter of 2024, up 0.2% year-on-year, significantly higher than other major players in the Tongda system. YTO Express's net profit per parcel was 0.17 yuan, down 7.8% year-on-year, while Yunda's fell 5.8% to 0.11 yuan and STO Express's was 0.04 yuan, up 60% year-on-year.

At the operational level, the Tongda system has been increasing investments in direct operation and automation in recent years, such as in transportation routes, transfer centers, sorting equipment, transportation resources, and digital infrastructure, to achieve cost reduction and efficiency gains. Among them, ZTO Express has made the largest investments and achieved the most significant cost reduction and efficiency gains.

Taking 2023 as an example, according to Guolian Securities research, ZTO Express's asset expenditure (fixed assets + construction in progress + land use rights) per parcel was 1.64 yuan, higher than YTO Express's 1.36 yuan, Yunda's 1.42 yuan, and STO Express's 0.88 yuan.

It can be said that ZTO Express's transformation in its business model has begun to bear fruit. In the first half of 2024, its adjusted net profit was 5.03 billion yuan, up 13% year-on-year.

In contrast, STO Express and Yunda are still clearly operating within the first stage of competition. YTO Express, on the other hand, is transitioning to the second stage while aiming to balance price and market share. Since 2022, its price per parcel has not declined significantly, with a price of 2.34 yuan in the first half of the year, down 9.65% during the period, less than Yunda's 20% decline and STO Express's 17.4% decline. Its market share has remained stable at around 15.8%.

For Yunda, the loss of market share due to poor terminal operations reflects deficiencies in the supervision and management system for terminal outlets under the franchise model.

Yunda operates with a direct operation model for its transfer and trunk networks and a franchise model for its terminal outlets. With a multi-level franchise system, the headquarters assigns outlets to franchisees by region, who then subcontract the regions. In this scenario, Yunda lacks strong management over franchisees and relies more on penalties than solutions to address problems.

Without a solid market position to support it, Yunda is currently stuck in a cycle of intense competition for scale. In an era where operations drive profit, if Yunda cannot quickly find a balance between scale and profit and achieve a model transformation, its future growth prospects remain uncertain.

Disclaimer

The content related to listed companies in this article is based on personal analysis and judgment by the author based on information disclosed by the listed companies in accordance with their legal obligations (including but not limited to temporary announcements, periodic reports, and official interaction platforms). The information or opinions contained herein do not constitute any investment or other business advice. Market Value Observation assumes no responsibility for any actions taken as a result of adopting this article.

-END-