"Planting seeds" community goes overseas, ByteDance gives Xiaohongshu a lesson

![]() 10/12 2024

10/12 2024

![]() 501

501

ByteDance's lavish spending tactics are in stark contrast to Xiaohongshu's organic growth strategy. Xiaohongshu's overseas attempts failed, while ByteDance, through Lemon8 and other products, demonstrated its ambition and strength in its global layout.

Original @ New Entropy

How big is the potential of the "planting seeds" community?

In 2021, Zhang Nan, then CEO of Douyin Group, challenged his team: "If Douyin is doing well, why is Xiaohongshu still growing so rapidly?" This affirmed the rise of Xiaohongshu in the cracks of a market surrounded by giants and its successful entry into the "planting seeds" community platform with 100 million DAU.

Subsequently, Douyin set its sights on the "planting seeds" community product type and implemented it in the form of Douyin's image and text function or as a standalone app. Xiaohongshu, on the other hand, launched a "sitting and observing three" development strategy in 2023, aiming for a comprehensive surge in DAU to 300 million. This represents different strategies pursued by the two companies in response to the dream of growth within the "planting seeds" community, based on their respective stages of development in the domestic market.

In the overseas market, the growth potential of the "planting seeds" community presents a different picture. After multiple failed attempts to expand overseas, Xiaohongshu now focuses primarily on serving the overseas Chinese market. Meanwhile, ByteDance, facing bans in overseas markets, pins its hopes on Lemon8, the "planting seeds" community, becoming the next TikTok.

The differing expectations for the "planting seeds" community have led to vastly different growth trends in overseas markets. With its aggressive approach, ByteDance's dream of replicating Xiaohongshu's success is gradually becoming a reality in overseas markets.

Over the past month, Lemon8, ByteDance's version of Xiaohongshu, has seen another major surge in the US market. To achieve a new milestone of ranking 10th in US App Store downloads in a short period, ByteDance has once again increased its advertising spend on the Apple App Store.

According to Appfigures, Lemon8's parent company, ByteDance, has been running a "massive" search advertising campaign on the Apple App Store for several weeks in September, using nearly 5,300 keywords in just the first week of September 8 alone, primarily covering brand keywords related to TikTok, CapCut, Instagram, and more.

Lemon8 is not a new app, having been launched globally in 2020, but its marketing efforts in the US only began last year. Over the past year, it has experienced both explosive growth and dips in data. However, amid the pressure of TikTok bans, Lemon8 is emerging as ByteDance's flagship product in its layout of the European and American markets.

As an image and text-based "planting seeds" community product, Lemon8's recent outstanding performance has undoubtedly left Xiaohongshu, which has suffered setbacks in overseas markets, feeling inadequate. However, from a practical implementation perspective, ByteDance's lavish spending tactics are not something that Xiaohongshu can emulate at present. Faced with the lesson that ByteDance has taught it in overseas markets, Xiaohongshu can only watch and worry.

01

Cracking the Code of Overseas "Planting Seeds"

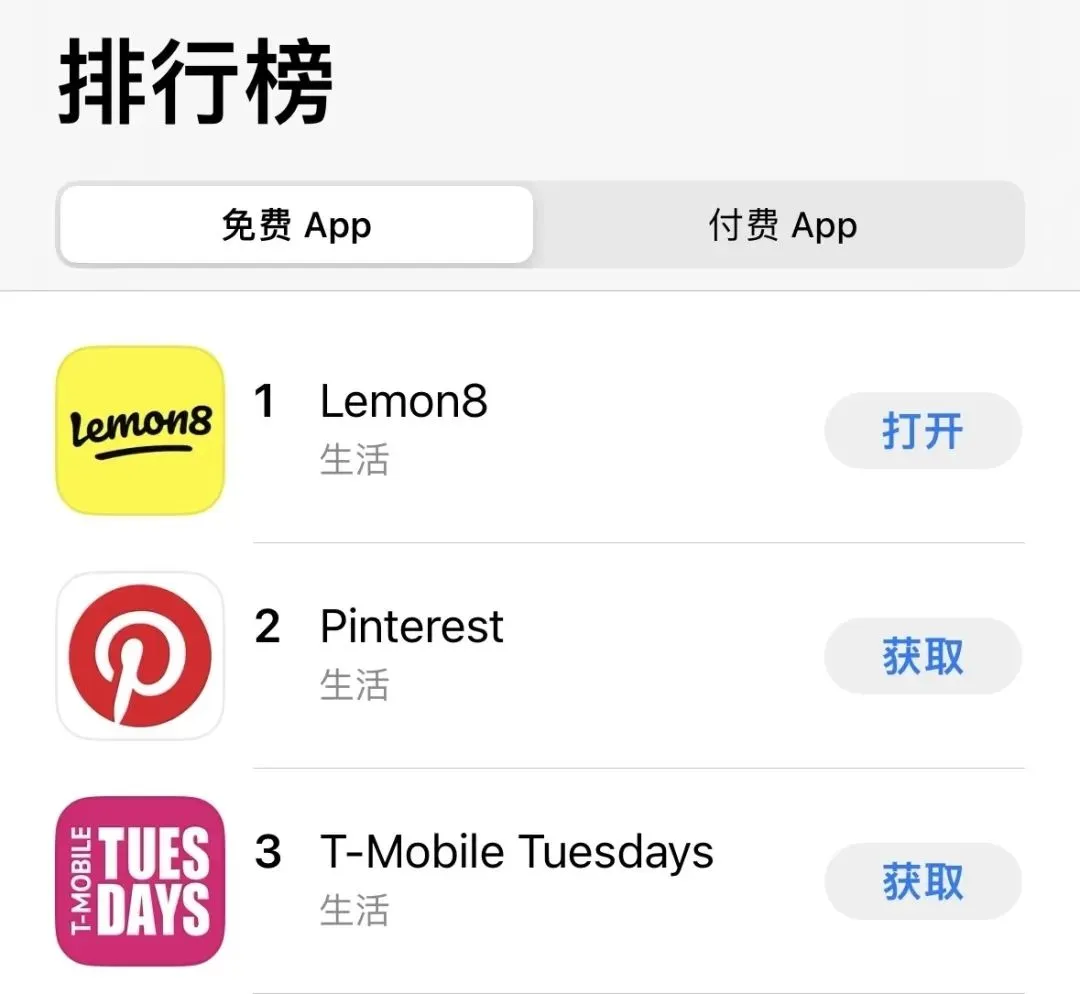

ByteDance, which has struggled repeatedly in the domestic "planting seeds" community sector, has gradually found the key to success in overseas markets. Recently, Lemon8 successfully ranked among the top 10 most downloaded apps in the US App Store. Data shows that downloads exceeded 70,000 on Saturday alone, 44% higher than the average daily download rate over the past few weeks. According to Appfigures estimates, Lemon8 has been downloaded approximately 16 million times globally this year, with roughly half of those downloads coming from US consumers. Notably, Lemon8 was not initially launched for the US market. It debuted in Japan in 2020 as ByteDance's attempt at an overseas "planting seeds" community similar to Xiaohongshu. Until 2022, Lemon8's primary focus remained on East Asia.

▲ Photo/Screenshot of US App Store download rankings

At the time, some media outlets believed that unlike the US market, which has native "planting seeds" internet forces like Pinterest and Instagram, ByteDance had the potential to replicate TikTok's growth capabilities in relatively untapped markets like Indonesia. According to TikTok Report data, as of 2021, Indonesia was one of TikTok's top three markets, achieving high penetration in less than a year from virtually zero market share. However, Lemon8's primary operating market is now rapidly shifting from East Asia to Europe and the Americas. Based on advertising data from App Growing Global and Guangdada, Japan and Thailand were Lemon8's two primary advertising markets in 2022, with Japan accounting for over 80% of total advertising materials.

However, from July 2023 to January of this year, Lemon8 placed over 45,000 ads globally, primarily on Instagram and Facebook. From December 2023 to January, it placed over 12,000 ads on these two platforms, accounting for 70% of total ads across all channels during the same period. The shift in buy-side markets also corresponds to changes in Lemon8's downloads. The US market has replaced East Asia as the primary source of new users this year, while downloads in other markets like the Philippines and Singapore are currently declining.

Therefore, some foreign media analysts believe that while Lemon8's rapid growth is impressive, it remains to be seen whether the new users acquired through paid advertising can be converted into active community members over time.

02

Overwhelming Expansion Overseas Crushes Xiaohongshu

In contrast to ByteDance's aggressive push for Lemon8 in overseas markets, Xiaohongshu's overseas expansion has focused on organic growth.

Xiaohongshu's current overseas efforts primarily involve two approaches: launching localized apps targeting native market users and promoting the internationalization of the Xiaohongshu app for the Chinese diaspora in international markets.

On both fronts, Xiaohongshu has not forcibly pushed for traffic, instead relying more on community content to achieve organic growth.

Unsurprisingly, Xiaohongshu's organic growth strategies have not been successful.

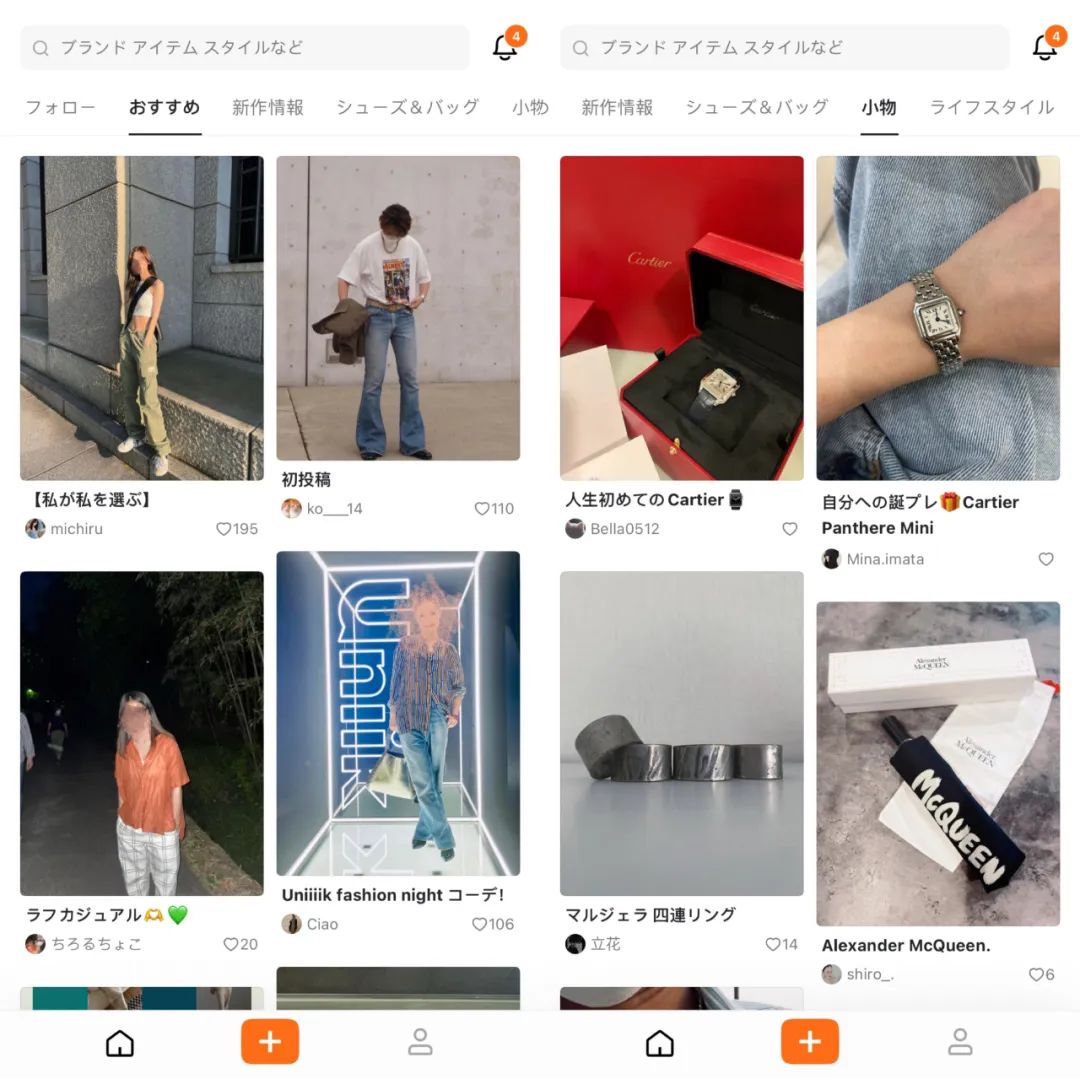

In terms of localized apps, media reports show that Xiaohongshu launched three products for the Japanese market over three years: fashion community Uniik in February 2021, camping enthusiasts' community Takib in October 2022, and beauty community habU in March 2023.

▲ Photo/Screenshot of Uniik

In the Southeast Asian market, Xiaohongshu launched Spark, which is highly similar to its domestic version, in April 2022. In November 2022, it targeted the European and American markets with Catalog, a home sharing community. However, overall, these regional niche communities have not been successful, with Uniik and Catalog both ceasing operations.

Regarding the internationalization of the Xiaohongshu app, localized versions were launched in Japan, South Korea, the US, Germany, Singapore, France, Thailand, and other regions on the App Store in 2014. However, these regional Xiaohongshu apps have since stopped updating and have been replaced by the main Xiaohongshu app.

Internet observers believe that the differences between ByteDance and Xiaohongshu's overseas expansion stem primarily from two aspects:

Firstly, the product genes of the two teams differ, including cultural differences in corporate culture. However, it remains uncertain whether the international market will change after Xiaohongshu began emphasizing DAU and growth in 2023.

Secondly, there are differences in familiarity with product growth and resource coordination in international markets.

For example, Lemon8 leverages TikTok's creator ecosystem directly. According to foreign media reports, during early creator acquisition, Lemon8 invited TikTok creators to join based on TikTok's influence, paying influencers to post on the app as long as they followed guidelines such as posting 10 times a month with titles of at least 150 characters and carousel images containing 3 to 10 photos.

TikTok also provides traffic support. In September, ByteDance has been promoting Lemon8 ads in TikTok's "For You" section, piquing user curiosity. Additionally, TikTok creators can showcase the app on their profiles.

The creator ecosystem forms the content foundation, while traffic resource marketing serves as the exposure strategy. Content and traffic drive Lemon8's rapid growth in the US market.

In terms of resource coordination, according to the latest research from Watchful.ai, TikTok appears to be integrating with Lemon8. In this new collaboration, TikTok has developed a feature allowing users to sync their Lemon8 posts to TikTok and add sounds and music using TikTok's editing tools, achieving product function synergy between the two.

In contrast, Xiaohongshu lacks a strong backing in overseas markets.

03

More TikTok Backups Being Elevated to Full Status

ByteDance's integration of product function synergies often aims to boost a new product with a hit product.

For example, in 2021, TikTok's Global Head of Music, Ole Obermann, stated that Resso's artist support program not only drove music consumption but also promoted music engagement. Resso's top songs became new material for TikTok to adapt into popular music, while trends could increase music streaming on Resso.

This efficient synergy with TikTok in music material functionality also comes from ByteDance. Launched in 2020, Resso, a music streaming app, has covered major markets like India, Brazil, and Indonesia, emerging as a dark horse challenger to the global music streaming giant Spotify.

At the end of last year, it was reported that the company was in talks with several major music companies to enter over a dozen other markets. Some speculate that if Resso proceeds with this plan, it may be renamed "TikTok Music".

Like Lemon8, this app is also part of ByteDance's broader efforts to expand its global app matrix.

Beyond product synergy, Resso's design also incorporates social elements similar to TikTok, such as like, comment, share options, and a follow button. Since its launch, Resso has amassed a loyal user base. According to analytics firm Sensor Tower, over 250 million people have downloaded the app as of May 2023.

Compared to Lemon8, which has yet to surpass 100 million downloads, the music app Resso is undoubtedly closer to TikTok. However, their different product forms make it difficult for music apps to support TikTok's ecosystem imagination. In terms of ecosystem imagination, the image and text-based "planting seeds" community Lemon8 offers significantly more potential.

With a rapid shift from East Asian to European and American markets, foreign media believe that ByteDance is implementing a TikTok backup plan. In April last year, it was reported that TikTok CEO Shou Zi Chew's responsibilities would be expanded to oversee ByteDance's content-sharing platform Lemon8. Meanwhile, Lemon8's head, Chen Ying, who is currently based in Shanghai and reports to ByteDance executive Zhu Jun, is set to relocate to Singapore and report to Chew.

Following the personnel adjustment to oversee overseas operations, Lemon8's position in the US market has further risen over the past year as a top priority project. ByteDance's General Counsel and TikTok representative, Erich Andersen, has declared, "We will do everything we can to ensure that the Lemon8 app complies with US laws." While Lemon8 holds great promise for TikTok, its identity and background issues are more challenging than quickly becoming a hit app. After teaching Xiaohongshu a lesson in overseas expansion, ByteDance still needs to find a mentor to guide its globalization efforts and help it become a truly global company.