Temu has soared in popularity over the past two years, forcing Amazon to respond urgently

![]() 10/15 2024

10/15 2024

![]() 453

453

After two years of operation, Temu has surpassed eBay to become the second most visited e-commerce website globally, and it is projected to surpass Amazon in user numbers within the year.

Based on data analysis by Sensor Tower in the United States, as of August 2024, Temu's global user base has reached 91% of Amazon's, and it is expected to surpass the 30-year-old company within the year.

Additionally, according to SimilarWeb data, Temu receives nearly 700 million monthly visits, only a quarter of which come from the United States. In contrast, Amazon receives 2.7 billion visits, almost entirely from American users. Currently, Temu operates in 82 countries and regions worldwide.

Amazon may be facing one of its biggest challenges in recent years - not just in terms of user numbers, but also because some Amazon sellers are beginning to diversify their presence on Temu, where subsidies enable them to offer the same products at lower prices.

The entry of Chinese e-commerce players has forced Amazon, the US e-commerce giant, to reassess the importance of Chinese supply chains and be compelled to compete on lower prices.

I. Amazon "Paves the Road," While Temu "Gets Rich"

Advertising and low prices have been Temu's core weapons in its global market expansion over the past two years.

For two consecutive years, Temu has invested heavily in advertising during the Super Bowl, the North American equivalent of the Chinese New Year Gala. The slogan "Shop like a billionaire" has brainwashed foreign consumers, similar to how Pinduoduo's advertising slogan "Buy more, save more" brainwashed domestic consumers in previous years;

Simultaneously, Temu has continuously purchased advertising on social media platforms. 36Kr reported in October last year that Temu's daily advertising spend on Facebook and Google reached tens of millions of dollars. According to estimates by JPMorgan analysts, Temu's advertising expenditure on Facebook and Instagram reached $600 million in the third quarter of last year.

However, advertising alone has made consumers aware of Temu; what makes them willing to make purchases?

The core reason lies in Temu's low-price strategy in entering a market accustomed to purchasing unknown brands, a market created by Amazon itself.

Unlike domestic consumers, nearly 80% of Amazon buyers search without specifying a brand name. For instance, they are accustomed to searching for "women's running shoes" or "men's tennis shoes" on Amazon, rather than specifying Nike or Adidas. Consequently, many unknown brands have become bestsellers on Amazon - the best-selling lamp on Amazon is not from brands like IKEA but is manufactured by a Chinese company.

Over the past decade, Amazon has replaced brands with reviews and ratings, teaching consumers to purchase products that other consumers prefer. In contrast, Temu believes that checking reviews and ratings is meaningless - after all, the products are all the same, and the cheapest is the best.

Compared to Amazon, Temu's advantage lies in its proximity to the supply chain. Pinduoduo's experience in supply chain management allows Temu to directly collaborate with factory-based sellers, continuously reducing supply costs. In contrast, most merchants on Amazon remain "middlemen" who need to procure from factories, resulting in higher product prices.

Temu has consistently aimed to eliminate middlemen and attract more factories from industrial clusters, directly connecting them with American consumers. Currently, Temu has penetrated over a hundred manufacturing industrial clusters across Guangdong, Zhejiang, Fujian, Hubei, Jiangsu, Shandong, and other regions.

Recently, Temu sold a knockoff of the Alexa voice remote control, claiming compatibility with Amazon's Fire TV Stick. It retailed for as low as $4, while a similar unlicensed version on Amazon costs around $10, and the official Fire TV Stick retails for approximately $25.

However, Temu still faces significant challenges.

Firstly, losses. Wired magazine analyzed its supply chain costs and found that Temu invested heavily to enter the US market, incurring an average loss of $30 per order.

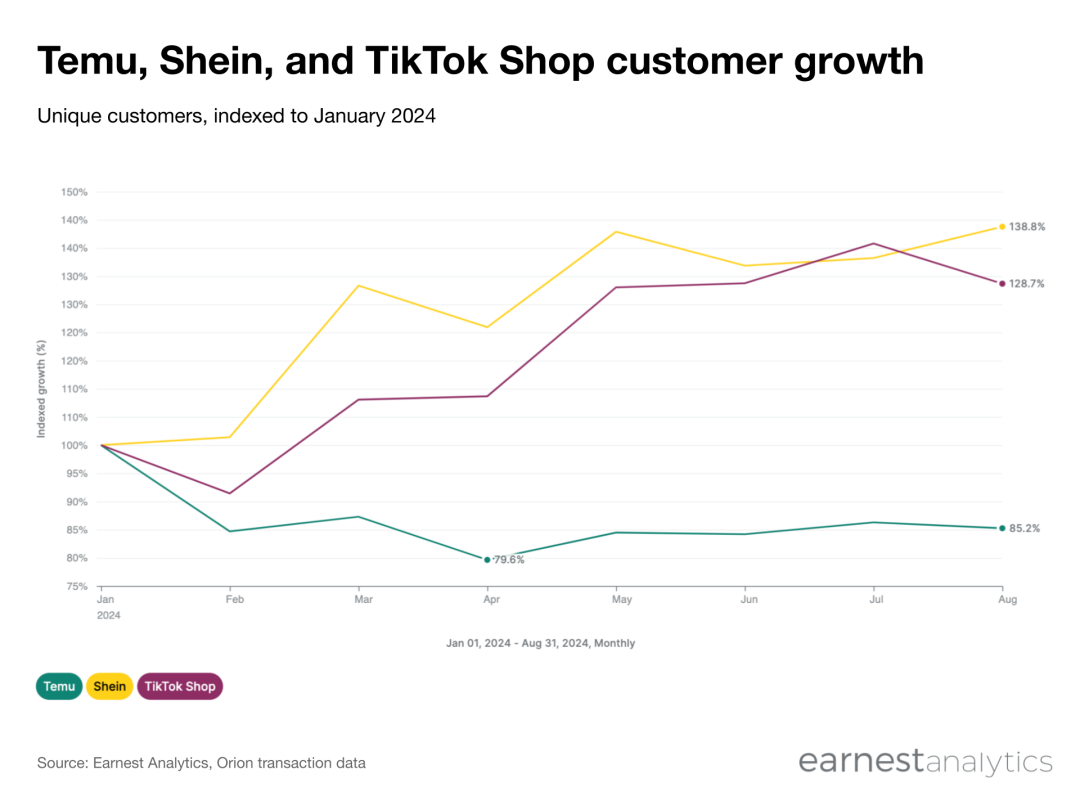

Secondly, low repeat purchase rates. According to Earnest Analytics, the number of shoppers on Temu in August decreased by approximately 25% compared to January. For Temu, it is becoming increasingly difficult to continuously attract new customers and persuade existing ones to make repeat purchases.

Thirdly, the low-price strategy may be impacted by policy changes. In September, the US announced plans to address the abuse of the "de minimis exemption" duty-free import policy by Chinese cross-border e-commerce platforms. Under this policy, packages valued below $800 can enter the US duty-free without customs inspection. If this policy is revoked, Temu's low-price strategy could be severely affected.

II. Temu Competes for Amazon Sellers

Addressing the above challenges hinges on tapping into local US merchants, expanding product categories, and enhancing logistics efficiency, potentially boosting average order value and repeat purchase rates.

In March this year, Temu launched a semi-managed service aimed at attracting merchants with overseas warehouses capable of self-fulfillment.

The benefits of the semi-managed service are threefold: faster delivery speeds, the ability to ship large items such as furniture, and reduced impact from potential changes to the "de minimis exemption" policy.

Currently, Temu's homepage primarily promotes products from local warehouses, ensuring customers receive their orders within four days instead of the usual five to ten. According to The Information, products shipped from US warehouses currently account for approximately 20% of Temu's total gross merchandise volume (GMV) in the US.

For the semi-managed service, Temu's focus is on established Amazon top sellers, though this is no easy feat.

AliExpress, Shein, and others have attempted similar strategies to diversify their seller base. However, to date, they have largely failed to attract a significant number of US sellers or reposition themselves effectively.

According to marketplace reports, Shein sent this message to Amazon sellers in 2023: "Given [Brand Name]'s tremendous success on Amazon, I am reaching out today to explore the possibility of introducing [Brand Name] to the SHEIN marketplace."

However, many sellers were unimpressed. One seller who received the Shein invitation said, "We received the same message, and I marked it as spam."

Nonetheless, with low fees, high growth potential, and guaranteed revenue, Temu has still attracted numerous Amazon sellers.

Some Amazon sellers who have partnered with Temu cite the absence of delivery and advertising fees as a primary reason for trying the platform, enabling them to offer lower prices on Temu. However, Temu requires that pricing for identical products be at least 15% to 35% lower than on Amazon. For example, an Anker power bank recently retailed for $40 on Amazon but was priced at $25 for the same model on Temu.

Despite lower prices, some sellers earn more on Temu.

The Wall Street Journal reported that, based on documents provided by sellers, one merchant made more profit selling printer ink on Temu, even though the price was lower than on Amazon. Sellers speculate that Temu guarantees a certain profit margin per sale, potentially absorbing losses on many products.

To prevent merchant loss, Amazon is also taking measures, though their effectiveness remains to be seen.

According to Amazon merchants, if they list products at lower prices on competing sites, Amazon penalizes them. To avoid detection, some businesses list products under different names on Temu.

III. Amazon is Forced to Compete on Lower Prices

Undeniably, Amazon is under pressure.

Temu is targeting one of Amazon's most crucial businesses.

Third-party sellers are a significant revenue source for Amazon, contributing nearly a quarter of its total revenue through service fees. According to media reports, Amazon generated approximately $140 billion last year by assisting sellers with logistics, account management, and other needs, surpassing its Prime subscription and cloud computing business revenues.

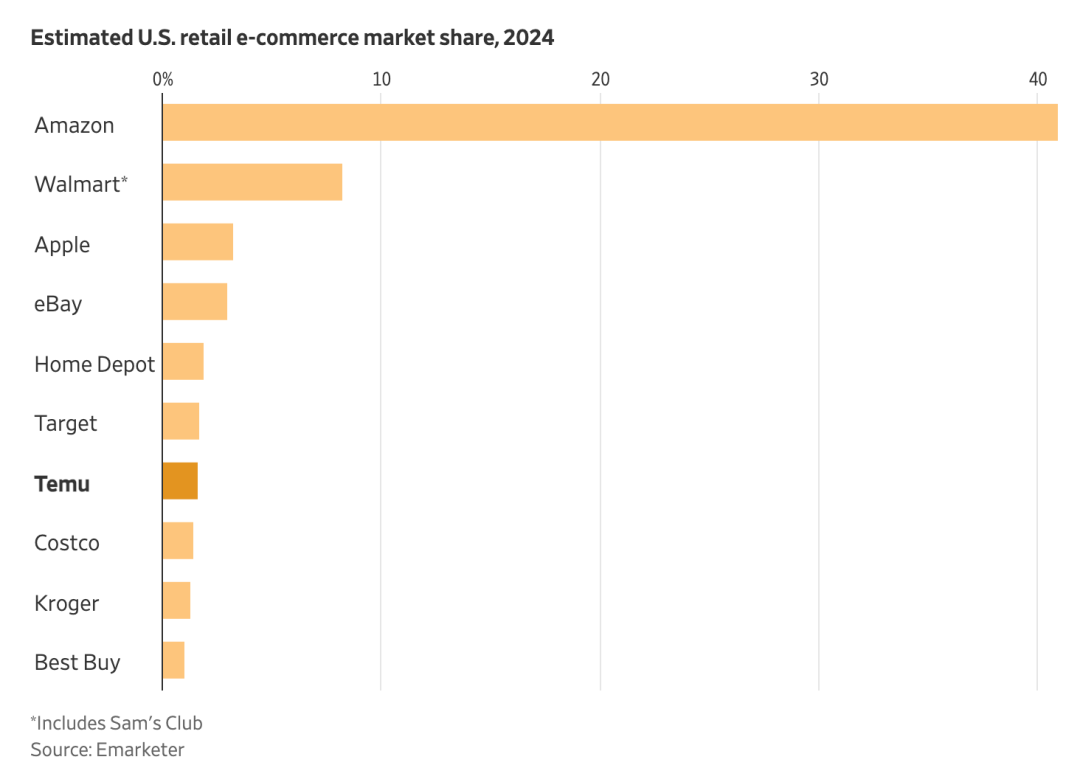

Temu's market share is also on the rise. Research firm Emarketer projects that Temu's share of the US e-commerce market will triple from 0.7% last year to 2.3% next year.

While Temu's market share remains small compared to Amazon's approximately 40% share of the US market, the rise of Chinese e-commerce players like Temu in the US may be one of the biggest challenges Amazon has faced in years, forcing it to lower prices, improve services, and accelerate delivery speeds.

Amazon is reassessing China's role as a sourcing hub for overseas sales and is cultivating sellers there.

Amazon's official WeChat account is also actively recruiting sellers, hosting live seminars almost daily for those considering listing products. Amazon's Vice President for China told Chinese media in May, "In 2024, we will host dozens of events for thousands of sellers."

An even more significant change is that Amazon is learning from the Temu model.

In June this year, Amazon held an internal closed-door meeting in Shenzhen and announced the launch of an entry for a "Low-Price Store" on its main site, focusing on white-label, low-cost fashion and home living products priced below $20 and weighing less than 1 pound. These products will be delivered within 9 to 11 days, targeting consumers who want to save money and are willing to wait longer.

For merchants, all they need to do is ship products to Amazon's warehouses in China, and Amazon will handle all in-store and out-of-store promotions and subsequent logistics. The store offers a money-back guarantee - low requirements for sellers, as long as they have products available.

Clearly, Amazon aims to import cheap goods from China in a "fully managed" model to defend against attacks from Chinese cross-border e-commerce platforms.

However, some sellers performing well on Temu express doubts about Amazon's competitiveness in low-priced products. For example, the founder of a brand that sells on both platforms believes that Amazon relies too heavily on fees. "If you want to be as cheap as Temu and expect Amazon to reduce commissions, how is that possible?" he asks.

Nonetheless, sellers who have joined Temu may not benefit indefinitely. While they may benefit in the short term, in the long run, similar to how domestic internet companies first offer hefty subsidies to attract users before raising prices, Temu may one day follow Amazon's footsteps in increasing fees and striving for profitability, leaving these sellers facing Temu's high service fees.