"Singles' Day Pre-Sale: Merchants' Worries Go Beyond Refunds Alone"

![]() 10/15 2024

10/15 2024

![]() 559

559

"Dear Customer, the issue you reported has been resolved by our service team. We wish you continued business success!"

Author: Xue Xingxing

Editor: Wang Bin

Cover: Unsplash

After a relatively lackluster 618 in the first half of the year, e-commerce platforms are placing even more weight on Singles' Day.

One manifestation of this is the extended promotional period. On October 14th at 8 PM, e-commerce platforms like Tmall and JD.com kicked off their Singles' Day promotions, more than 10 days earlier than usual. Some platforms even started their activities as early as October 8th. Additionally, measures temporarily suspended during this year's 618, such as pre-sales, have been reinstated.

Unlike the first half of the year, when platforms focused solely on low prices, during Singles' Day, they are attempting to ease merchants' burdens by offering more favorable policies.

Over the past two months, Taobao and Pinduoduo have aggressively promoted measures to alleviate merchants' burdens, including more lenient policies on "only refund" cases, reducing merchants' costs associated with returns and exchanges, and waiving certain service fees. Prior to the official start of Singles' Day on October 10th, Taobao announced that it had intercepted over 400,000 unreasonable "only refund" requests daily, raising questions about the scale of such requests before this intervention.

Merchants are counting on Singles' Day to boost their annual sales. Several e-commerce merchants interviewed by Shangshan noted that their performance this year has been lackluster, with some even operating at a loss. More than one merchant mentioned that sales during the first half's 618 period remained relatively flat, "with no notable surge, just like any other day."

"We're counting on Singles' Day to turn things around in the second half," said a merchant specializing in clothing products.

01 Disappointed Merchants

"This year wasn't just bad, it was the worst," said Yang Ming, a home goods merchant interviewed by Shangshan.

During this year's 618, his June sales totaled approximately 310,000 yuan, with over 60,000 yuan in returns, leaving actual sales at around 250,000 yuan, "a 43% year-on-year decline."

Major e-commerce platforms no longer disclose their GMV data during promotional periods. According to third-party platform Star Chart Data, total sales during this year's 618 decreased by 7% year-on-year, with comprehensive e-commerce platforms Tmall, JD.com, and Pinduoduo seeing a 6.9% decline.

The lukewarm response during promotional periods in the first half appears to be indicative of the overall trend for the year. A small-to-medium-sized merchant selling gift items on Taobao said that in previous years, her annual sales reached 600,000 to 700,000 yuan, but "based on this year's trend, it'll be tough to even reach 500,000."

Several e-commerce merchants interviewed by Shangshan shared similar sentiments, spanning platforms like Taobao, Pinduoduo, and Douyin. On social media, one can find numerous posts about merchants closing their shops and abandoning e-commerce, including even veterans with over a decade of experience.

Some media reports indicate that there has been a wave of closures among Taobao women's clothing stores, with prominent influencer Zhang Dayi's stores as a notable example. During the 2016 Singles' Day, her store was the first women's clothing store to surpass 100 million yuan in sales. However, in September, she announced that three of her women's clothing stores would indefinitely postpone new product launches, "effectively closing them down."","One promotional event after another in the first half, with similar levels of intensity," said Zuo Tian, a clothing merchant interviewed by Shangshan.

His brand has been operating on Taobao for seven years and has gradually expanded to platforms like Douyin and Xiaohongshu, with annual sales ranging from 20 to 30 million yuan. Despite several promotional periods this year, he still ended up operating at a loss.

Part of the reason is the unusually high return rate this year. According to Zuo Tian, his overall return rate was around 35% to 40% last year, but it has already reached 57% this year. His warehouse is filled with defective merchandise, up by as much as 30% compared to previous years.

Zuo Tian is pinning his hopes on Singles' Day, "We have to save up for Singles' Day and prepare accordingly." He has started introducing new autumn and winter collections, hoping for a less steep decline during this year's Singles' Day.

"Business has been tough this year, and we've priced our products lower than usual," said Yang Ming, the home goods merchant. However, price cuts haven't helped, "They don't boost sales; they just erode your profits."",Low prices have also been the most fiercely contested goal among e-commerce platforms during promotional periods this year, with intense competition among them. During the first half's promotional periods, some platforms even introduced automatic price-matching systems, which automatically adjust prices based on those across the entire network once merchants participate.

However, low prices haven't brought much benefit to merchants. During the first half of this year, to boost sales, Yang Ming targeted a popular pillow from Atour and produced a large batch of similar pillows at a lower price, attempting to sell them through live streaming on Douyin.

After a month, sales totaled around 1 million yuan, but advertising costs alone exceeded 300,000 yuan. One-third of the products were returned, and when combined with operating costs like live streaming hosts, he ended up with a loss of over 100,000 yuan. "As soon as we crunched the numbers, we disbanded the live streaming team," he said.

Yang Ming owns his own factory and has undertaken numerous OEM orders. In the past, he used leather materials costing around 18 to 19 yuan per meter, but now the quality has deteriorated. "They demand cheaper fabrics. The leather materials we use for OEM orders now cost just 9 yuan per meter, and the quality is terrible," he said.

He no longer holds much hope for Singles' Day. "Of course, we'll participate; otherwise, we won't get any traffic," he said. However, he's not planning to stock up on more inventory due to a lack of expectations.

02 The Lingering Issue of 'Only Refund' Policies

In addition to low prices, the theme of the e-commerce industry in the first half of this year was the "only refund" policy.

Originally pioneered by Pinduoduo to enhance consumer shopping experiences in cases of subpar product quality, the policy of refunding without requiring returns has gradually morphed under the intense competition among e-commerce platforms, eliciting widespread opposition from merchants.

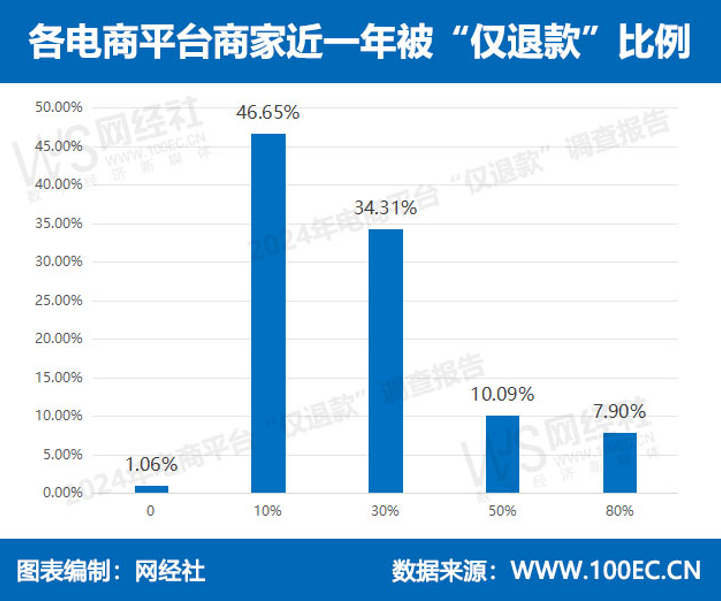

In 2024, the "only refund" policy has become almost standard among e-commerce platforms. According to a survey on "Only Refund" Policies on E-commerce Platforms released by the Network Economy Society in September this year, only 1.06% of merchants reported not encountering any "only refund" cases in the past year, while over 52.3% encountered at least 30% of their orders resulting in "only refunds." The survey found that nearly 90% of merchants strongly oppose such policies.

Survey on "Only Refund" Policies on E-commerce Platforms by the Network Economy Society

Yang Ming has been operating a store on Taobao since 2012 and used to believe that "Taobao is a fair and just platform" where issues would be reviewed by human moderators, without favoring either buyers or sellers. However, starting this year, he noticed a shift in the platform's stance, "Now they're heavily biased towards buyers, supporting them regardless of the reason."","In one absurd after-sales incident, a buyer requested a return due to quality issues but only submitted a simple sketch as proof. "They drew a picture and claimed the quality was poor," he said.

Given the high price of home goods and shipping costs, the buyer demanded that Yang Ming cover the return shipping fees. The system approved the request, prompting Yang Ming to file a complaint. Eventually, the platform ruled that the return was not the seller's fault and agreed to cover the shipping costs instead.

Almost every merchant interviewed by Shangshan had endless tales of "only refund" headaches, particularly those on Pinduoduo. One jewelry merchant who had only been operating on the platform for over a month said that approximately 7.5% of her orders resulted in "only refunds," even after successful appeals. When including unsuccessful appeals, the proportion exceeded 10%.

A female shoe seller who has been operating on Pinduoduo for four years reported an overall return rate of 50%, meaning that for every two orders sold, one would be returned. Around 3% of these returns resulted in "only refunds." "I remember one day when 30 pairs of returned shoes were worn," she said.

She couldn't understand why some orders qualified for "only refunds." Sometimes, the system would automatically pop up the "only refund" option in the chat window while she was communicating with the buyer. Some shoes were even successfully refunded months after being sold. In some cases, buyers would simply find a stock image online to apply for a refund, "I've seen this image appear in my store five or six times, and each time, the refund was approved," she said.

"I sell food products. I suggest you try ordering from a food store, regardless of whether you're satisfied with the product or not, just contact customer service after receiving it and say you got sick after eating it, it tastes funny, or it's leaky. As soon as you mention any of these negative keywords, the system will pop up the 'only refund' option within a minute or two," said a Pinduoduo nut seller.

Yang Ming tested this strategy on Tmall Supermarket. When he encountered too many "only refund" requests, he would apply for one himself on his Tmall Supermarket orders out of frustration. "It's pretty easy to get a refund. If you buy something for 30 or 40 yuan and claim you got sick after eating it or act unreasonable, they'll refund you," he said. He successfully applied for refunds five or six times.

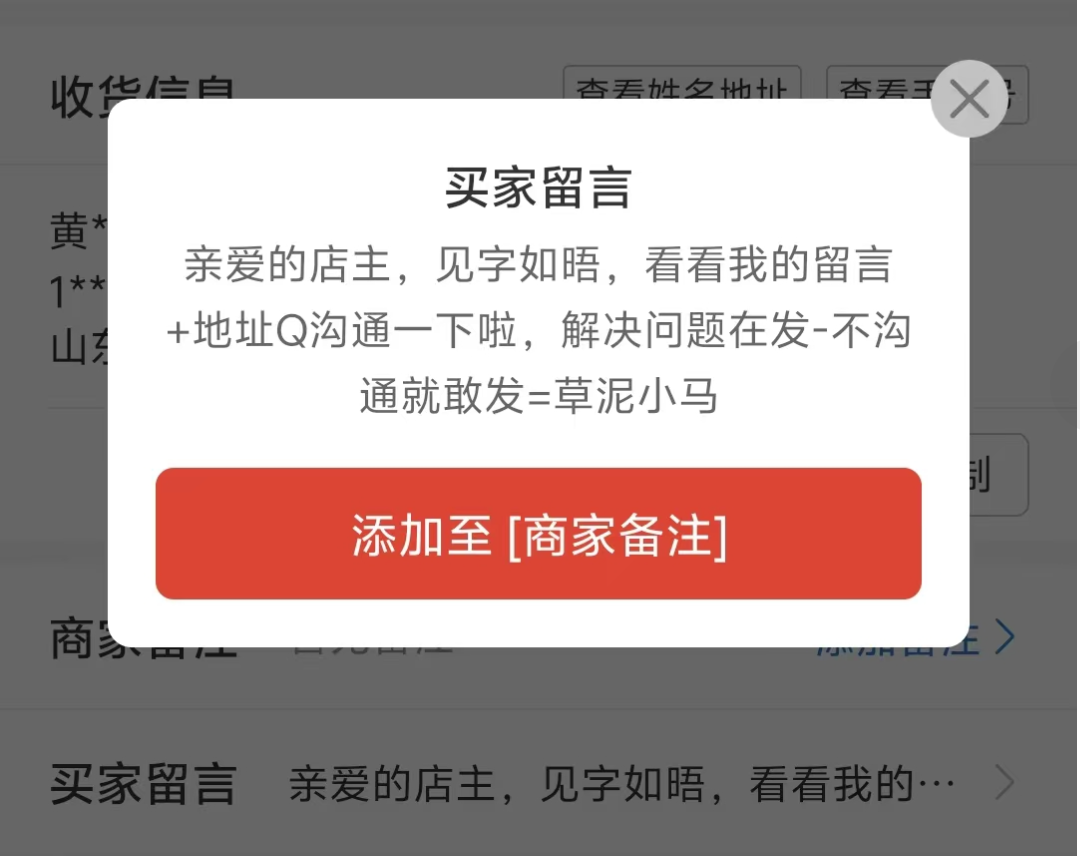

Sometimes, the "only refund" policies of e-commerce platforms attract unscrupulous actors. A new Pinduoduo merchant told Shangshan that shortly after opening his store, he encountered buyers placing bulk orders and then requesting bulk refunds. The buyers left messages asking him to add them on QQ for resolution, only to discover that they were part of a black market operation threatening to continue "harassing" him if he didn't cooperate. Unable to resolve the issue, he complained to the platform, but his complaints were dismissed.

Malicious Orders from Black Market Operations Encountered by a Pinduoduo Merchant

Perhaps due to the strong opposition from merchants, over the past few months, platforms like Pinduoduo and Taobao have introduced varying degrees of merchant support policies, such as easing "only refund" policies and reducing return costs. Before this year, Pinduoduo merchants could only file 10 after-sales complaints per order, but during this year's 618, the limit was removed. Taobao announced in July that it would ease "only refund" policies and reduce or eliminate after-sales interventions for high-quality stores.

It's difficult to say whether these measures have been well-received by merchants. The female shoe seller mentioned earlier noted that while there's no limit on after-sales complaints, each order can only have one complaint filed, "with a roughly 50% success rate." The system also doesn't provide specific reasons for unsuccessful complaints, "It just says it doesn't meet the platform's criteria for approval, but I have no idea what those criteria are," she said. Sometimes, complaints for similar situations are successful one time but unsuccessful the next.

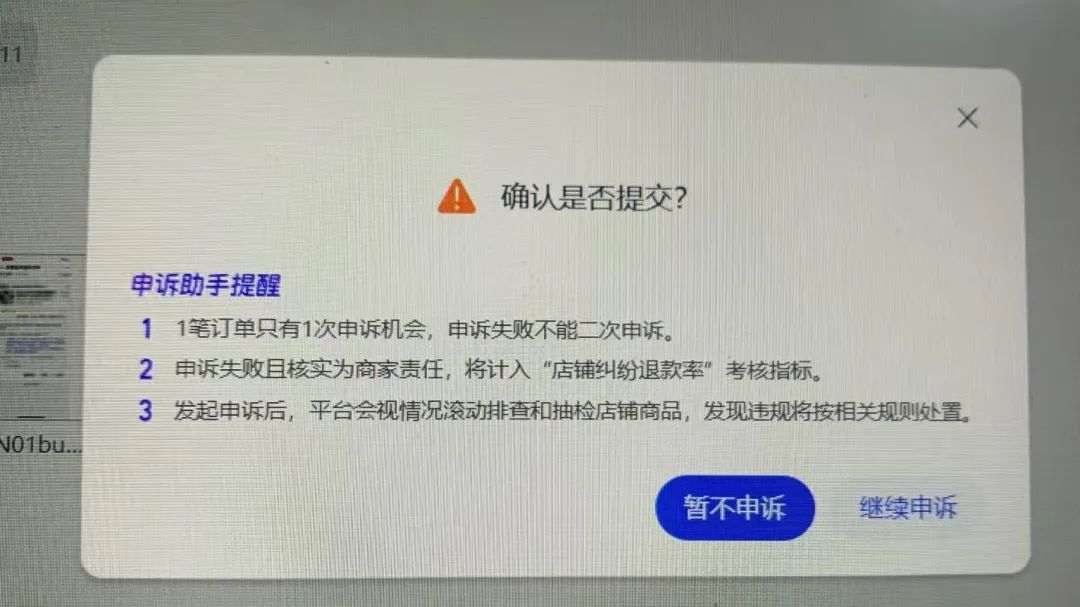

Some Taobao merchants are dissatisfied with the platform's complaint policy. On Taobao's merchant order complaint page, the platform warns that after filing a complaint, it will conduct rolling inspections and spot checks on store products as needed. Some merchants view this as a "threat," saying, "If you dare to file a complaint, they'll inspect your store."

Taobao Complaint Page Shared by Merchants on Social Media

03 The Need for More Concrete Support Policies

"If we analyze these policies objectively, it's clear that Taobao genuinely wants to move towards fairness," said Zuo Tian, the clothing merchant. A platform that consistently favors consumers will only deteriorate the business environment.

The platform's shift has indeed yielded some results. Yang Ming noted that while he still encounters some unreasonable return and refund requests, the number of "only refund" cases has significantly decreased, "much less than in the first half of the year."

However, it's difficult to say that other support policies have been well-received by merchants. Some merchants expressed frustration during interviews, their tones agitated when hearing about the platforms' externally promoted support policies. Some merchants have resorted to litigation to protect their rights, with numerous posts on social media about merchants suing platforms and consumers, mostly related to sales contract disputes. Some merchants are sharing their litigation experiences on social media to assist those without litigation experience in safeguarding their rights.

Zuo Tian, who has been operating an e-commerce clothing brand for years, believes that some platform policies haven't been effectively implemented. For example, Tmall merchants can cancel their annual fees, but "even though we're not huge, we can still afford to pay tens of thousands of yuan in annual fees for e-commerce operations," he said.

He believes that the only concrete preferential policy introduced by Taobao in the past six months is ReturnBao, a new merchant return service launched in September to help reduce return shipping costs by 10% to 30%, according to Taobao.

In the past, many e-commerce merchants had to bear high shipping insurance costs, causing significant distress. "Shipping insurance is twice as expensive as express delivery fees," said Zuo Tian, whose per-item shipping cost is just over two yuan, while shipping insurance costs around five yuan per order.

However, in actual use, Zuo Tian found that ReturnBao's cost reduction wasn't as significant as advertised by the platform, "Currently, it only saves a few cents per order compared to shipping insurance. We were hoping shipping insurance could be reduced from five yuan to three yuan, not just by a couple of cents, which is almost negligible," he said. Yang Ming also told Shangshan that his shipping insurance previously cost around 1.9 yuan per order but decreased to 1.7 yuan with ReturnBao, equivalent to a 10% reduction.

Some small-to-medium-sized merchants choose not to subscribe to any return services, believing that it would encourage more returns. A Taobao merchant told Shangshan that she doesn't subscribe to ReturnBao or shipping insurance because measures that reduce consumers' return costs would only lead to more return orders. Perhaps as a compromise, Taobao no longer mandates merchants to join shipping insurance during this year's Singles' Day.

Some merchants have also criticized Pinduoduo's measures to reduce store deposit requirements. Previously, Pinduoduo announced that it would lower the threshold for basic store deposits from 1,000 yuan to 500 yuan. "It doesn't make much difference to me," said the jewelry merchant. It just reduces the cost of opening a store."

Other measures have been deemed unreasonable fees by merchants, such as the refundable basic service fee for returned orders. In the past, Pinduoduo merchants were charged technical service fees even for returned orders.

Some merchants are dissatisfied with the platform's intensive adjustments over the past year. One merchant gave an example. In the past, he received a telemarketing call promoting the 618 event on Taobao, but the AI customer service representative on the other end read the term "618" as "six hundred and eighteen" when mentioning it. "Isn't that ridiculous?", he asked.

At the Taobao Tmall Double 11 launch conference a few days ago, Duan Chu, Vice President of Alibaba Group and President of Taobao Platform Business Department, stated in a group interview with the media that there are currently three major issues in the industry. Firstly, merchants are facing significant panic and burden due to refunds only, secondly, the high cost of return shipping fees imposes an operational burden on merchants selling low-priced products, and thirdly, the e-commerce industry is caught in a low-price competition spiral.

After more than 20 years of development in China, the e-commerce industry has never been as confrontational and fragmented as it is this year, with platforms, consumers, and merchants distrusting each other. This year, Taobao registered an account named "Taobao Merchant Services" on social media platforms. Over the past few months, this account has only posted one message, but its primary function is to respond to merchants' complaints by saying, "Dear, the issue you reported has been resolved by our service personnel who have contacted you. Wishing you great success in your business!"

That post received over 4,500 comments, with the most liked comment being "Give me back my deposit."

(Yang Ming and Zuo Tian are pseudonyms.)