Double 11 prelude: The war for low prices lurks beneath the surface, but the logic behind low prices has changed

![]() 10/15 2024

10/15 2024

![]() 503

503

618 starts in May, and Double 11 starts in October, which have long been ingrained in consumers' minds as part of the shopping festival culture.

This year, Taobao, JD.com, and Pinduoduo all kicked off their Double 11 shopping festivals on October 14, earlier than the usual start date around October 24 for previous years. Continuing the momentum from 618, this year's Double 11 period has set a record as the longest in history.

At this juncture, on one hand, the buzz around shopping festivals is not as loud as before. According to a McKinsey survey, consumers are relatively cautious about their expected consumption growth in 2024, with an expected growth rate of 2.2%-2.4%. The diversification of information and sentiments among different consumer groups has made current consumption expectations and category structures more complex.

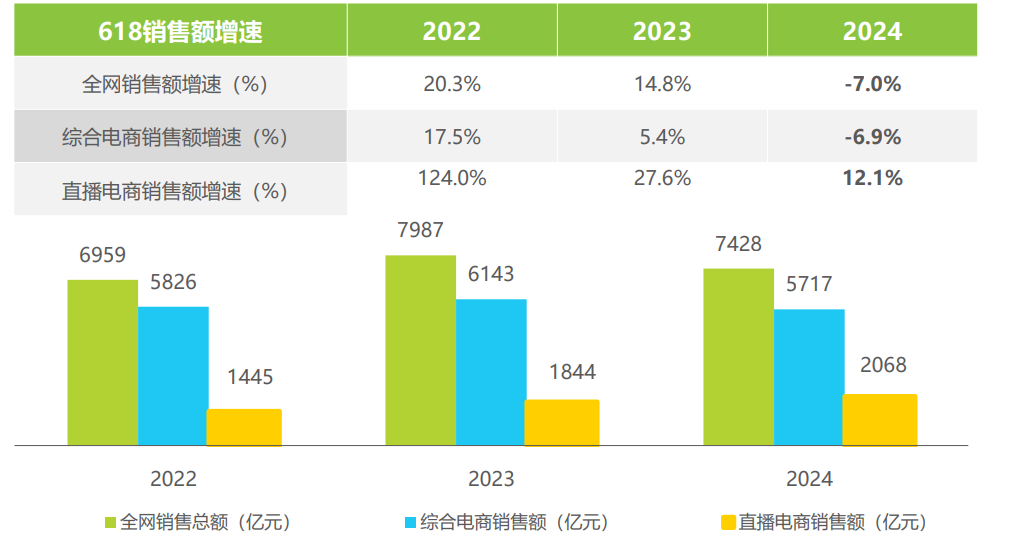

Using 618 data as a reference, iResearch estimates that the growth rate of online sales across all platforms during 618 has gradually declined from 2022 to 2024, with more pressure on traditional comprehensive e-commerce platforms.

(Source: iResearch)

On the other hand, the competitive tension between platforms remains high. In addition to the aforementioned platforms, Douyin, Kuaishou, Xiaohongshu, and others have also chosen to bring forward their start dates to mid-October, leading to some alignment of strategies and services in a close contest. Tmall was the first to announce some of its achievements, with sales exceeding RMB 100 million for several beauty brands within the first 10 minutes of sales opening on the evening of October 14.

Earlier, Pinduoduo upgraded its existing "Buy Expensive, Get Compensated" service to "Buy Expensive, Double Compensation" service ahead of Double 11. In comparison, JD.com has also offered a "Buy Expensive, Double Compensation" service, which was introduced in early 2023.

Double 11 serves as a comprehensive assessment of e-commerce platforms' annual business progress. A brief review of the industry status quo reveals that after collectively emphasizing low prices, platforms have shifted their strategic focus to aligning with their unique characteristics. Shelf e-commerce platforms like Taobao aim to balance GMV and CMR to regain their footing. Meanwhile, Douyin e-commerce has seen slower growth this year, and short video platforms are increasingly facing skepticism about reaching peak traffic.

The battleground between shelf and content e-commerce is increasingly overlapping, with the former craving traffic and the latter moving towards full-category coverage and branding as the need to clear inventory gradually subsides. Against this backdrop, this year's Double 11 may serve as a window into the future plans of these platforms. We will first focus on traditional e-commerce players that initiate and shape shopping festivals.

01. The Price War Moves Deeper

The hallmark of shopping festivals is always cost-effectiveness. Although many platforms have stated that they are no longer "pursuing absolute low prices," they still prioritize this strategy, with various tactical adjustments.

JD.com is a representative of the more aggressive camp. Since 2023, JD.com's promotional direction has shifted to "returning to the mindset of low prices," and as other platforms are scaling back, JD.com is doubling down. From a performance perspective, JD.com Retail's second-quarter revenue grew 1.5% year-over-year, and the group's net profit increased 69% year-over-year, providing some paper evidence to support its commitment to low prices.

However, from a platform positioning perspective, JD.com's advantage lies in standardized products such as 3C and home appliances, which have recognized performance indicators and wide market awareness, making price comparisons more straightforward and consumers more sensitive to price differences. This could explain why JD.com is going all-in as the most important shopping festival of the year approaches.

During the October 14 press conference, CEO Xu Ran noted that vicious competition and the phenomenon of bad money driving out good still exist in the current fiercely competitive market. JD.com's low prices aim to genuinely make users feel that products are "both cheap and good," not just "cheap to buy but expensive to use." During the conference, popular internet memes such as "sweet potato fans" and "ask yourself if your salary has increased before shopping" were mentioned, while JD.com's intensified measures focused on increasing the number of Baibu (hundred subsidies) product categories, especially apparel and beauty products.

JD.com's saturation attack carries the pressure of balancing merchant profitability with the equity between self-operated and POP (Platform Open Plan) businesses. However, a key aspect to consider is that enhancing supply chain capabilities through technology and cost optimization to create structural price competitiveness is likely to become the focus in the new era.

From this perspective, Taobao has been more cautious in this round of price competition. After this year's 618, Taobao announced at a closed-door meeting that it would revert to allocating search weight based on GMV, no longer strongly promoting the "Five-Star Price Power" system.

Taobao, especially Taobao Marketplace, is characterized by its rich product categories and strength in non-standard products like apparel, where effective price comparisons are difficult. There are too many factors influencing consumption decisions, and consumers' sensitivity to prices is uncertain. As a result, it is challenging for consumers to form an overall perception of low prices on comprehensive e-commerce platforms, affecting the effectiveness of hard-fought low prices. In Alibaba's fiscal Q1 2025, China's commercial retail revenue declined 2% year-over-year.

A week before Double 11, Taobao launched a section called "Taobao Selection," which is embedded within the Taobao app as a self-operated store. Similar in presentation and target mindset to Taobao Factory, Taobao Selection is led by the platform to provide exclusive traffic for cost-effective products, and both are operated by Hangzhou Jinrishangmai Supply Chain Management Co., Ltd. The benefits of official operation and platform endorsement are relatively more secure services, including return for damage, instant refunds, etc., catering to cost-effective consumption.

For this Double 11, Taobao has signaled low-price marketing with an additional investment of RMB 30 billion in coupons and red envelopes on top of discounts and instant savings. However, the "overall perception of low prices" mentioned earlier may rely on long-term initiatives like Baibu, 88VIP, and Taobao Selection. The "concentrated detonation" effect of the shopping festival remains to be seen.

According to Taobao's announcement, both the transaction volume and the number of participating merchants in its Baibu program have doubled this year. The 88VIP program, which has been refined in the second half of the year, has also maintained double-digit growth. Meanwhile, the competition for price competitiveness through refined operations has become tacit among e-commerce players. JD.com's Jingxi Self-operated and 9.9 yuan free shipping channels, as well as "Factory Goods Baibu," are expanding their categories, while Pinduoduo's RMB 10 billion in reductions for merchants is aimed at reducing merchants' operational costs.

The price war has not ended but has penetrated more into the daily operational details.

02. Mobilizing the Fatigued Participants

By 2024, the biggest challenge for shopping festivals may be how to excite everyone. After all, in recent years, the keyword "fatigue" has been inseparable from discussions about shopping festivals, with merchants tired of frequent discounts and consumers exhausted by complex rules or "Schrödinger's bargains."

Earlier 618 festivals saw multiple platforms Cancel pre-sale to streamline the process. For this Double 11, Taobao has retained the pre-sale stage, with the platform explaining that pre-sales meet market demand and create value for merchants. "Many merchants believe that pre-sales are essential for their business, as they bring incremental opportunities and are accepted by consumers," they said.

The pre-sale stage of major promotions typically benefits merchants more after weighing the pros and cons. Merchants can collect sales data in advance to better manage inventory and cash flow, while pre-sales themselves are a marketing strategy that increases product exposure. However, for consumers, the delayed shopping experience caused by pre-sale periods lasting from ten to several dozen days often dilutes the joy brought by limited discounts.

The previous Double 11 Merchant Enrollment Conference announced that merchants participating in Taobao's RMB 10 billion subsidy program during the event would receive a 100% refund of Tmall commissions. Concurrently, the platform launched a fully managed product called "Billion Star Aggregation" as a deterministic growth tool open to all merchants. During the previous cycle focused on low prices, merchants may have borne the brunt of the pressure. As the pace slows down, relief measures have correspondingly increased.

Last December, Taobao introduced the "Refund Only" service, which was initially beneficial to consumers and became an industry standard for a time. This service was optimized in July this year, including enhancing merchants' after-sales autonomy by referring to ratings and optimizing merchant appeals. In early September, Taobao announced support for WeChat Pay and gradually opened it up to all sellers. JD.com Logistics also announced before Double 11 that it would integrate with Taobao to provide more logistics options for merchants.

The platform's proactive efforts to reduce the burden on merchants contribute to balancing the triangular relationship between platforms, merchants, and consumers. Daniel Zhang, President of Tmall, said during a media briefing that many large international platforms saw poor offline sales during this year's National Day holiday, but online sales and those on Tmall performed well. Coupled with changing consumption patterns and the introduction of government subsidies, this year's Double 11 carries more expectations from platforms and merchants.

However, consumer perceptions during the upcoming extended promotional period will determine whether these promises and expectations are fulfilled. For Taobao, including pre-sales, the pace of this Double 11 is not significantly different from previous years, and consumers' psychological expectations for the shopping festival are generally consistent with previous years. A significant change is the simplification of red envelope and coupon calculation rules, with the actual price of products displayed directly on the product page for easy price comparisons.

Another noteworthy off-stage factor is that this Double 11 will be the first under Alibaba's younger team. Last December, Alibaba Group underwent a comprehensive management shakeup, appointing six young managers to key business units such as Taobao, Tmall, and M2C, who report directly to Wu Yongming, Chairman and CEO of Taobao China Software.

As the first answer sheet submitted by the younger generation in power, Double 11's performance may directly influence Taobao's strategic rhythm thereafter.

03. Final Thoughts

Today, shopping festivals, especially Double 11, have long been a topic of extensive discussion. All efforts tend to avoid turning them into a zero-sum game between platforms, merchants, and consumers, where traffic is driven solely through gains and losses.

An interesting observation is that alongside the rise of shopping festivals like Double 11, "shopping festival guides" have also emerged as a prominent field of study. Factors contributing to their popularity include the overall rationalization of consumer sentiment, the expanding influence of content platforms, and the increasing complexity of platform rules. Ultimately, this has led to a certain degree of power shift in interpreting Double 11. This phenomenon, not limited to such "special time nodes" as major promotions, corresponds to the content anxiety that has plagued traditional shelf e-commerce in recent years.

E-commerce platforms do not want shopping festivals to evolve into consumer spectacles where people merely seek a sense of participation in festive celebrations. The importance of "guidance" is increasingly apparent. In an era of extreme material abundance, simply providing options is not enough; platforms must also help users make choices.

*The cover image and images in the article are sourced from the internet.