Is this the last batch of billion-dollar IPOs in China's internet industry?

![]() 10/17 2024

10/17 2024

![]() 468

468

"A community is not a collection of content, but a collection of people," said Qu Fang, the founder, describing the underlying logic of Xiaohongshu's product.

Nowadays, with more and more investors and institutions backing Xiaohongshu, the issue of going public has naturally been raised again. On October 13, the Financial Times reported that Xiaohongshu released its latest performance for 2024, with quarterly revenue reaching $1 billion and net profit reaching $200 million, up 67% and 400% year-on-year, respectively. Rumors of a Hong Kong listing have also surfaced again.

Xiaohongshu, one of the last batch of unicorns established during the mobile internet wave in 2013, is finally going public?

The "Nth" rumor of going public, a super IPO eagerly anticipated by global venture capitalists

Founded in June 2013 in Shanghai, Xiaohongshu has grown from a platform for sharing shopping tips to a comprehensive content community encompassing various topics.

At that time, China was witnessing an unprecedented wave of mobile internet startups. ByteDance, Didi, Pinduoduo, and Depop, which were born around the same time, quickly saw an explosion in user base and revenue. Among them, Pinduoduo succeeded in listing on Nasdaq in just three years, with its market value once exceeding that of Alibaba.

In contrast, Xiaohongshu underwent a long period of exploration before achieving its breakthrough. From 2013 to 2020, Xiaohongshu was widely regarded as a "slow company" in terms of both user growth and commercialization. Founder Qu Fang admitted, "Xiaohongshu's attitude towards commerce is to let it grow slowly rather than hastily reap traffic."

It was not until early 2021, when the increase in work-from-home scenarios brought opportunities to Xiaohongshu, that its daily active user count surged to 40 million, making it one of the fastest-growing internet products at the time. ByteDance even attempted to acquire Xiaohongshu for $20 billion at one point but was ultimately rejected.

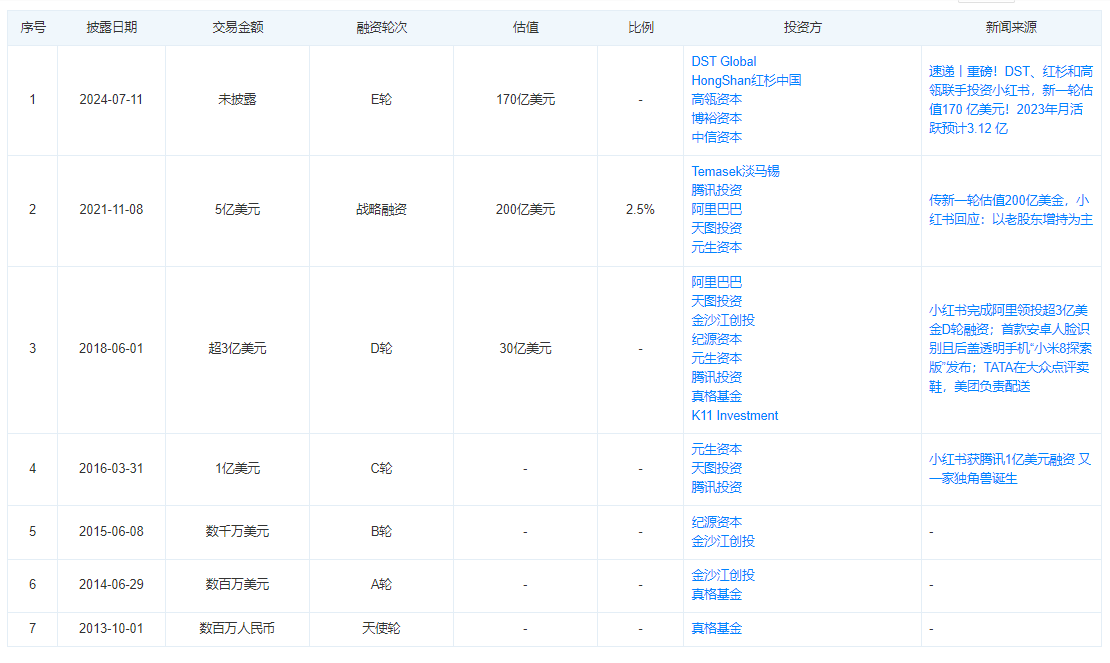

Judging from Xiaohongshu's funding history, it is clear that the platform is not short of money, attracting both old and new capital players.

According to Tianyancha, Xiaohongshu has raised funds seven times since its inception. ZhenFund, Alibaba, and Tencent have all invested multiple times, and in July this year, a new batch of star investment institutions, including DST Global and Sequoia China, joined in, boosting the company's valuation from a low of $10 billion last year to $17 billion.

The main reasons for investors' optimism and the rebound in valuation are twofold: Firstly, the company has demonstrated a clear intention to go public. As early as April 2018, Qu Fang, the founder of Xiaohongshu, disclosed the company's plans to go public. In 2021 and 2023, rumors emerged that Xiaohongshu was planning to list in the US and Hong Kong, respectively.

Although the specific timing and location of the listing have not been confirmed, venture capitalists have seen potential exit opportunities.

Secondly, with a clear strategy in place, Xiaohongshu has gradually found its own pace of commercialization. In 2023, the company's total revenue reached $3.7 billion, with a net profit of $500 million, turning around from a loss of $200 million in 2022 despite $2 billion in revenue that year.

Therefore, for both Xiaohongshu and its investors, the significant jump in Q1 2024 performance, amidst a trend towards value investing in valuation logic, represents a definite positive. While Xiaohongshu's official channels remain tight-lipped about IPO details, it is clear that the platform, which has been "waiting for the wind to blow," is merely a matter of time away from going public.

Grassroots to E-commerce

Looking back at Xiaohongshu's commercialization journey, the platform has transformed from a vertical community to an e-commerce hub.

Starting in 2014, Xiaohongshu began experimenting with e-commerce monetization by developing its cross-border e-commerce arm, "Welfare Society." However, this initial foray into the e-commerce space failed to yield a breakthrough for Xiaohongshu. According to iMedia Research, Xiaohongshu's market share in cross-border e-commerce fell from 6.5% in 2016 to 4.3% in 2018.

Subsequently, from 2016 to 2018, Xiaohongshu began inviting third-party merchants and attempting to build its own brands. By the end of 2016, the platform had expanded its SKU count to 150,000, covering categories such as beauty, fashion, and food.

According to Euromonitor, citing insiders, Xiaohongshu reported sales of RMB 6.5 billion in 2017 and targeted RMB 12 billion in 2018. However, sales in the first half of 2018 remained flat or even lower compared to the same period in 2017.

Meanwhile, to promote "online-offline integration," Xiaohongshu ventured into physical retail in 2018, opening its first offline experience store, RED home, in Shanghai's Jing'an Grand IMAX. Unfortunately, this venture was short-lived, and RED home ultimately closed its doors in early 2020.

In other words, by 2019, Xiaohongshu had tried various e-commerce monetization models, including cross-border e-commerce, merchant onboarding, private labels, and offline stores, but none of these seemed to generate profits for the platform. According to Caijing Magazine, Xiaohongshu failed to meet its GMV targets in both 2018 and 2019.

It was not until 2020 that Xiaohongshu embarked on live streaming e-commerce, finding its sweet spot in buyer-centric e-commerce.

In the second half of 2020, Xiaohongshu signed former entertainment agent Yang Tianzhen and beauty influencer Fu Peng, both of whom achieved single-session GMV of RMB 20 million.

In 2023, actors Dong Jie and Zhang Xiaohui gained immense popularity through Xiaohongshu's "slow live streaming." According to Xiaohongshu's official "Live Potato" data, Dong Jie gained over 1.1 million followers and accumulated over RMB 100 million in GMV after her first three live streams. Zhang Xiaohui's debut live stream generated RMB 50 million in GMV, attracting over 1 million viewers and selling out 57 items.

Under the "buyer-centric e-commerce" model, the core advantage of buyers lies not in price but in aesthetics, style, personalized experiences, and emotional value aligned with their own brand identity, making them a perfect fit for Xiaohongshu's grassroots culture.

From this perspective, after a decade of development and much deliberation among various business paths, Xiaohongshu has finally found its niche.

Balancing Content and Commerce: A Dilemma for Xiaohongshu

However, with the resolution of commercialization challenges came the inevitable erosion of community ecology by marketing content.

In 2021, Xiaohongshu faced backlash for misleading users through marketing, hype, and over-glamorizing tourist attractions, sparking a debate on "exposing fake internet celebrity spots." In 2023, Xiaohongshu again came under scrutiny for issues such as "fake grassroots marketing," becoming a focal point of public opinion.

In fact, the dilemma faced by Xiaohongshu echoes a common challenge among all content-based e-commerce platforms today: how to maintain a balance between commercialization and content ecology. Similar issues have arisen on platforms like Bilibili and Zhihu in the past.

Historically speaking, in the current environment, "excessive pursuit of profits may compromise the future, but a lack of profits will threaten survival today." Therefore, prioritizing profitability is crucial for content platforms to remain competitive.

Nevertheless, in the pursuit of profitability, how can Xiaohongshu learn to strike a balance, reasonably advance commercialization while enhancing the integration of content and commerce, safeguard user experience, and achieve sustainable platform development? These are questions that Xiaohongshu must ponder.

In July this year, Xiaohongshu's COO Conan defined the platform's e-commerce arm as "lifestyle e-commerce" for the first time, downplaying the original "buyer-centric" model and returning to its core mission of "bringing users value and lifestyle experiences beyond price."

This move can be seen as Xiaohongshu's return to its original vision amidst its commercialization journey, echoing CEO Mao Wenchao's statement at the end of 2023, summarizing Xiaohongshu's corporate value: "For everything related to life, Xiaohongshu has the most comprehensive answers in the world."

From this perspective, this statement encapsulates both Xiaohongshu's past and poses a test for its future. Finding an innovative model that satisfies both commercial demands and maintains community atmosphere will be crucial to Xiaohongshu's long-term success.

Source: Hong Kong Stock Research Institute