ByteDance's Overseas Expansion: Learning from Little Red Book, Surpassing Little Red Book

![]() 10/17 2024

10/17 2024

![]() 459

459

Two years ago in the summer, a grand event was held in the international business district of Tokyo, Japan. The event was hosted by Uniik, an overseas application under Little Red Book, to celebrate Uniik's download count exceeding 200,000. Fashion influencers from various circles were invited, and the atmosphere was lively.

However, just four months later, Uniik ceased updates.

Similarly, Lemon8 (launched as Sharee), another app Imitating Little Red Book to go global , debuted in Japan in 2020, drawing attention within Douyin, and subsequently launched in Southeast Asia, the United States, and the United Kingdom, rapidly gaining traction.

Lemon8 has experienced two waves of rapid growth. The first wave was in the 12 months leading up to February 2023, with nearly 20 million downloads. The second wave started in 2024 and has resulted in approximately 16 million downloads, with popularity continuing to rise.

However, despite launching multiple community apps like Uniik and Spark overseas, Little Red Book has failed to replicate its domestic success.

So why has Lemon8, which resembles Little Red Book in many aspects, experienced rapid download growth? And why has Little Red Book, which performs well domestically, struggled with its overseas expansion? This article will address these questions.

I. Lemon8's Overseas Success Over Little Red Book

In 2021, after Douyin experienced a surge in traffic, its head Zhang Nan became anxious about slowing growth rates. During a strategic meeting, Zhang asked his team, "How does Douyin's fashion vertical compare to Little Red Book?"

The team unanimously replied, "Better than Little Red Book." Zhang countered, "If we do it better, why is Little Red Book's DAU still growing so rapidly?"

At that time, Little Red Book was also delving into video content, with its DAU growing rapidly, alarming Douyin. It was around this time that ByteDance accelerated the development of its overseas version of "Little Red Book," Sharee, which was later renamed "Lemon8" in September of the same year.

In the same year that ByteDance accelerated its overseas expansion with Lemon8, Little Red Book also embarked on its own overseas journey. In February 2021, Little Red Book launched Uniik, a fashion community app in Japan; in April 2022, Spark was introduced in Southeast Asia; and in November 2022, Catalog, a home-sharing community, was launched for the European and American markets.

However, while Douyin failed to replicate Little Red Book's success domestically, Lemon8 surpassed it overseas.

According to Appfigures estimates, Lemon8 had approximately 16 million global downloads in 2024, with about half coming from the US market. Lemon8's previous surge in downloads was concentrated in Asian countries like Thailand, Japan, and Indonesia. According to DianDian Data, Lemon8's global downloads approached 20 million between February 2022 and February 2023.

On the other hand, some of Little Red Book's overseas apps have stopped updating, while others have few downloads.

By the end of 2022, Uniik in Japan had stagnated in user growth and ceased updates, and the app is no longer available in app stores. Catalog ceased updates after just two months of launch and is also no longer available. Spark faced challenges in retaining creators, leading to product repositioning and its subsequent removal from app stores.

In the second half of last year, Little Red Book embarked on its fifth overseas expansion with the launch of S'more, which is currently available but has minimal downloads.

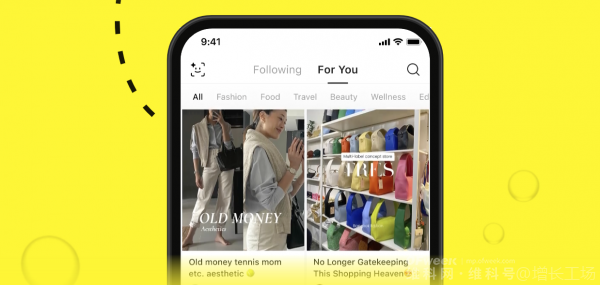

From a domestic perspective, Lemon8's design resembles TikTok, Douyin, and Little Red Book, with two options at the top of the homepage: Following (people you follow) and Follow You (recommended content). The content page is also similar to Little Red Book, featuring a stream of images, texts, and videos.

However, there are also differences. From an international user's perspective, Lemon8 resembles a combination of TikTok, Instagram, and Pinterest. The second tab at the bottom mimics the search options of Instagram and Pinterest, whereas Little Red Book's is a shopping interface.

Why has Little Red Book struggled overseas, while Lemon8, which mimics Little Red Book, has succeeded?

II. Why Lemon8 Comes Out on Top

Expanding overseas has become an important strategy for many companies seeking to escape domestic competition and find new growth opportunities. The success of Lemon8 and TikTok provides valuable lessons for domestic apps looking to expand overseas. We believe Lemon8's overseas performance surpasses that of Little Red Book for the following three reasons:

First, the Lemon8 team has more extensive overseas experience than Little Red Book's overseas team.

The founders of Little Red Book, Mao Wenchao and Qu Fang, primarily have experience in venture capital and investment. Little Red Book evolved from a PDF shopping guide to a community app focused on sharing overseas shopping information, and now covers various categories such as beauty, personal care, sports, and travel, primarily serving Chinese users.

In contrast, ByteDance has richer overseas experience.

In 2017, ByteDance acquired Musical.ly, which later became TikTok and embarked on its overseas journey. Chen Ying, the main person in charge of Lemon8, was previously an employee of Musical.ly, TikTok's predecessor. Chen Ying reports to Zhu Jun (ByteDance's Senior Vice President of Products and Strategy and Head of Strategic Investments), and the two had a superior-subordinate relationship at Musical.ly.

This combination gives Lemon8 a deeper understanding of global users, while Little Red Book's overseas department has undergone frequent changes, with rumors even circulating in 2022 that the entire international department would be cut.

Second, aggressive paid advertising across platforms is a significant factor in Lemon8's surge in downloads.

If you search for Instagram on the App Store, Lemon8 is likely to be the top result. The same applies to Pinterest. These are all Lemon8 advertisements.

In terms of advertising volume, Lemon8's primary focus is shifting from East Asia to Europe and the Americas. In 2022, Japan and Thailand were Lemon8's two major advertising markets. From July 2023 to January of this year, Lemon8 placed over 45,000 ads globally, primarily on Instagram and Facebook.

The shift in advertising markets corresponds to changes in Lemon8's download numbers. Early in 2023, shortly after entering the US market, Lemon8 experienced a surge in downloads. The US market has since surpassed East Asia as the primary source of new users this year.

Third, TikTok has provided Lemon8 with significant free traffic and algorithmic expertise, creating a synergistic effect.

Browsing TikTok reveals that it recommends using the #Lemon8 hashtag and features numerous Lemon8 ads, inviting TikTok influencers to join Lemon8 to drive traffic. Currently, the #Lemon8 hashtag on TikTok has accumulated over 4 billion views.

Furthermore, Lemon8 employs the same recommendation engine as TikTok.

When Lemon8 launched in the US, the marketing firm it hired stated that Lemon8 used the same recommendation engine as TikTok, incentivizing creators to post content on Lemon8 and become creators themselves.

Zhang Yiming once said, "ByteDance's core competitiveness lies in our products, which are supported by our technological system." This technological system is centered on the recommendation engine that Zhang Yiming initially developed.

Although Little Red Book also developed a recommendation engine, it relied heavily on manual editing for recommendations for a long time. It wasn't until 2015, when Qie Xiaohu, a technical expert, joined Little Red Book, that manual editing was replaced by algorithmic distribution.

III. Challenges for 'Little Red Books' Expanding Overseas

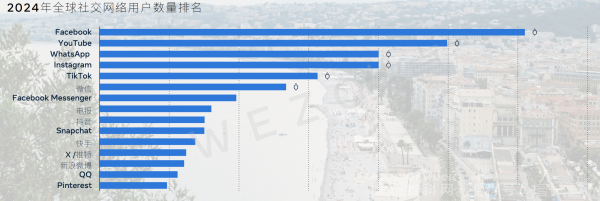

Whether it's Lemon8 or Little Red Book's overseas products, they both face stiff competition from globally popular platforms like Instagram and Pinterest, which has seen rapid user growth in recent years.

Instagram reached 130 million users in 2013, 400 million in September 2015, and 800 million in September 2017, with 2 billion users by 2024. Pinterest had 175 million monthly active users in April 2017, growing to 250 million in September 2018 and 463 million by April 2023.

Their user demographics are similar to those of Little Red Book, dominated by young female users. Instagram's US user base is 55.5% female, while Pinterest's is nearly 70% female.

When Lemon8 launched in the US in February last year, a user posted on Reddit asking if Lemon8 could eventually replace Instagram. At the time, TikTok was already the fifth most popular app globally with 1.5 billion users (including Douyin). Users responded that it would be challenging for Lemon8 to reach Instagram's scale and that there was still a long way to go.

Indeed, after Lemon8's launch last year, its downloads surged briefly due to advertising but then declined. Many believed that Lemon8 was not well-suited to the US market, with low user retention and a perception that it was merely spending money on advertising without substantial gains. Only when downloads surged again did Lemon8 regain attention.

The US market is the toughest nut to crack globally. Global internet giants are concentrated in the US, and most of these giants are domestic companies that grew up in the US, giving them technological and localization advantages. Therefore, ByteDance is bound to face many uncertainties in the US market.

In other markets, it is equally important to continuously accumulate local experience and make localized adjustments to apps.

For example, Yalla, an overseas app developed by Yalla Group, a company listed in the US, discovered that Middle Easterners tend to have larger thumbs than Chinese people, making small buttons inconvenient to operate. As a result, Yalla designed buttons 1.5 times larger than those in China specifically for Arabs in the Middle East and North Africa.

Such detailed localization experiences can only be perfected through sufficient long-term investment and accumulation.