High return rate deals a fatal blow, e-commerce ecosystem in peril

![]() 10/17 2024

10/17 2024

![]() 443

443

The escalating return rate is inextricably linked to merchants, platforms, and consumers alike.

Original @ New Entropy

Half fire, half glacier. While the Double 11 frenzy approaches, many online stores and influencers have collapsed before it, including Zhang Dayi, Zhou Yangqing, and countless merchants on the brink of survival.

During major sales events, the ever-increasing return rate often becomes the final straw that breaks the camel's back for merchants. According to incomplete statistics from LinkShop, no fewer than 40 women's wear online stores have announced closures or ceased updating since 2024, including several well-established and highly rated shops with over a decade of operation.

In recent years, the e-commerce return rate has soared rapidly. From 2021 to 2023, the return rate for branded stores increased from 24% to 35% in the first half of 2024, while the return rate on e-commerce platforms peaked at 60%. According to data from the domestic online consumer dispute mediation platform "DianSubao," among the top 58 digital retail platforms, Pinduoduo, Taobao, Douyin, JD.com, and Xianyu topped the list in terms of complaints.

Facing the rigorous challenges of this Double 11 sale, e-commerce giants must consider how to address the stubbornly high return rates while focusing on GMV, to avoid repeating past mistakes during 618 and Double 11.

Live streaming return rates skyrocket

The rapid escalation of return rates during major sales events has been a fatal blow to merchants. During this year's "618," the topic of "women's wear return rates" trended on social media, with insiders revealing return rates as high as 80% for women's wear live streams.

A Zhejiang-based merchant operating on Douyin revealed on Xiaohongshu that out of the 9,000 orders shipped before National Day, over 1,000 were returned, with hundreds more on their way. This translates to a return rate of 20%. This merchant is now transitioning to cross-border e-commerce, citing more opportunities and generally lower return rates.

Users who shop on Douyin argue that the products showcased in live streams can be deceiving, leading to a significant disparity between what's seen and what's received, prompting returns. Some analysts attribute this to the platform's relatively lax regulatory framework as a newer entrant.

Regarding the recent 618 sale, netizens reported that a friend's women's wear online store generated nearly RMB 10 million in sales. However, after deducting refunds (RMB 3.5 million), return refunds (RMB 3.8 million), and various costs, the store is projected to incur losses of RMB 500,000 to RMB 600,000. The return rate soared from an initially estimated below 50% to a staggering 80%.

The daunting return rates that merchants fear are often closely tied to factors such as product quality, return thresholds, and shipping costs on e-commerce platforms.

According to data released by the domestic online consumer dispute mediation platform "DianSubao" on the 15th, among the top 58 digital retail platforms, Pinduoduo, Taobao, Douyin, JD.com, Xianyu, Xiaohongshu, Tmall, Kuaishou, Zhuanzhuan, and Youzan topped the list in terms of complaints.

Pinduoduo's low-price priority strategy has led to quality issues and extremely low return thresholds, contributing to its top position in return rates.

A women's wear merchant shared that to attract traffic, they shifted from Taobao to Pinduoduo, which indeed offered higher traffic and order volumes. However, the subsequent deluge of returns overwhelmed them, with a return rate as high as 90%. The cost of return shipping alone was significant.

This merchant believes that selling the same clothing as on Taobao, coupled with Pinduoduo's lower return thresholds, contributed to the higher return rate to some extent.

Taobao, ranking second, has also been severely impacted by high return rates. After relaxing its "return only" policy, merchants have faced notable cost increases related to returns and exchanges, leading to widespread grievances.

According to Taobao data on October 10, two months after the introduction of a new strategy to "intercept unreasonable returns only," Taobao intercepted over 400,000 such returns daily on average.

To systematically reduce merchants' return and exchange costs, Taobao had to introduce "ReturnBao" to help mitigate these expenses.

Ranking third as a leader in live streaming e-commerce, Douyin has made remarkable achievements in recent years but also faces notable issues.

Many consumers argue that to drive traffic, live streams often exaggerate product features and apply excessive filters, misleading viewers. When they receive their orders and realize the discrepancy, significant returns ensue.

Wave of influencer store closures

In 2024, prominent influencers Zhang Dayi and Zhou Yangqing's decisions to close their online stores sparked heated discussions.

Regarding the reasons for closure, Zhang Dayi cited the shared struggles faced by merchants, including high return rates, thin margins, and escalating marketing costs.

Apart from variations in return rates across platforms, notable differences also exist among product categories. According to public data, women's wear has the highest return rate, reaching 60% to 80%, or even exceeding 90%. Beauty products follow closely behind, while household items and snacks are relatively less prone to returns.

Household items are practical products like towels, detergents, and garbage bags. Most buyers have a clear purpose in mind when purchasing these items and are less inclined to return them, even if their quality is mediocre. Food products, especially snacks, are generally non-returnable once opened and consumed, even if the taste doesn't meet expectations.

Contrastingly, during the glorious era of 2016, three influencer women's wear stores – "My Favorite Wardrobe," "ANNA IT IS AMAZING," and "Qianfurenjia Xueli Custom" – achieved single-day sales exceeding RMB 100 million during Double 11.

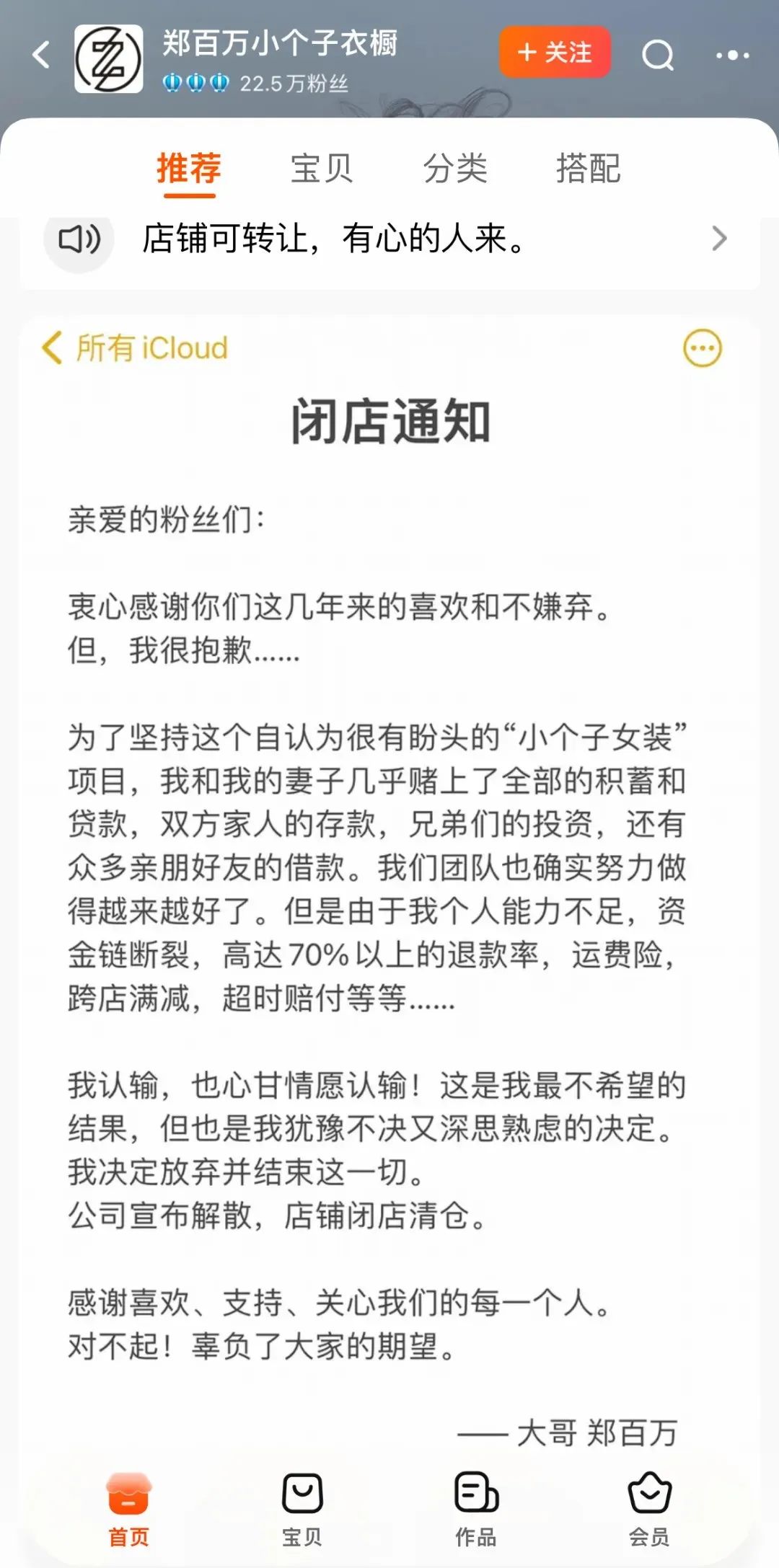

"Zheng Baiwan Xiao Gezi Yichu," a top-performing store specializing in petite women's wear on Taobao, recently announced its closure due to cash flow issues, a refund rate as high as 70%, and various compensation penalties, forcing the owner to dissolve the company.

The current wave of store closures reflects the industry's multifaceted challenges, with high return rates posing a fatal blow to merchants.

After incurring significant expenses on traffic, promotion, production, and shipping, merchants are met with massive returns. Not only do they fail to successfully sell their products, but they also incur additional costs in inventory, packaging, logistics, shipping insurance, and product depreciation, severely impacting their profits. To control costs, merchants may extend pre-sales periods or compromise on product quality, further degrading the shopping experience for consumers.

Merchants across various forums and social platforms have expressed their frustration over rising return rates and the relentless pressure to compete on low prices, seeing no end or hope in sight.

How to survive in this harsh environment?

Some practitioners suggest two options: lower quality (a primary cause of consumer complaints about "mismatched products"), or increase prices ("until profitability is achieved, regardless of the return rate, as logistics costs are largely fixed, and only product costs can be reduced"). However, the latter option is treacherous, as higher prices often deter buyers.

Other merchants have adapted by redesigning their business models. For instance, if 1,000 clothes are sold, they might initially produce only 200, ship them out, and then redistribute returned items to subsequent customers. Naturally, the costs incurred during returns are factored into the garment prices.

Clearly, this is not a sustainable business strategy in adverse conditions.

Platform ecosystem under attack

The escalating return rate is intricately linked to merchants, platforms, and consumers alike.

Fang Jianhua, founder of the women's wear brand Inman, spoke out during this year's 618, blaming mandatory shipping insurance for the surge in return rates and calling for its abolition.

Ultimately, the primary factor lies in the quality of products offered by merchants. To compete on low prices and traffic, merchants often compromise on quality. Additionally, excessive retouching in product images or filters in live streams mislead consumers, leading to dissatisfaction and returns.

Secondly, the popular "return only" policy in recent years has fostered a culture of opportunistic returns, emboldening consumers to return products more freely. With no thresholds or costs, returns become effortless when consumers feel dissatisfied or simply want to take advantage of the system.

As Alibaba grappled with Pinduoduo's rapid rise, it was forced to adapt. Taobao promptly revised its "dispute resolution rules," leaning towards buyers and even introducing the "return only" policy. Since then, return rates for many Taobao sellers have skyrocketed.

Platforms' neglect or tacit acceptance of high return rates further exacerbates the issue. While merchants' profits and consumers' shopping experiences suffer, the platform's healthy ecosystem ultimately takes a hit.

Ironically, the express delivery industry has benefited, with the surge in returns and exchanges fueling growth. Delivery volumes have doubled as items are shipped back and forth.

According to the latest Fengchao IPO prospectus, it generated nearly RMB 700 million in revenue in the first five months of this year. From 2019 to 2023, the annual compound growth rate of e-commerce reverse logistics in China's express delivery industry was 22.7%, translating to over 20 million items being returned or exchanged daily. In terms of scale, reverse logistics grew from 3.6 billion items in 2019 to 8.2 billion in 2023 and is projected to reach 20.9 billion by 2028.

Some practitioners reveal that some delivery station owners have even created fake accounts to exploit merchants offering shipping insurance. Insurance companies are also winners, as higher return rates drive merchants to purchase more shipping insurance.

As numerous merchants close and platforms suffer backlash, the entire e-commerce ecosystem is impacted, necessitating change from e-commerce platforms.

Alibaba was the first to take action, introducing the "ReturnBao" service in early September, reducing merchants' return and exchange costs by 10% to 30%. By late September, "ReturnBao" prices were slashed further, with some merchants enjoying discounts of up to 58%, valid until Tmall's Double 11 concludes.

Only when merchants ensure product quality, consumers shop ethically, and platforms uphold fair trading rules can the shopping environment and e-commerce ecosystem achieve a virtuous cycle.