Rumors and Truths About 'ByteDance's Version of Xiaohongshu'

![]() 10/18 2024

10/18 2024

![]() 640

640

This article is based on publicly available information and is intended for information exchange only and does not constitute any investment advice.

In recent days, when opening technology media and WeChat official accounts, I was bombarded with keywords such as 'Lemon8,' 'dominating the charts,' and 'American Xiaohongshu.'

Out of professional habit, we checked the US iOS charts and found no sign of 'dominating the charts.' Instead, Lemon8 is currently the number one app in the 'Lifestyle' category (see the image below).

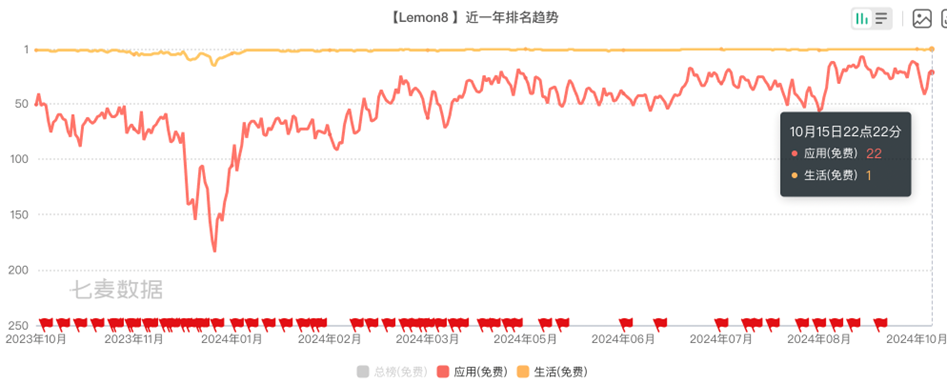

Image: Lemon8's chart trend over the past year

How large is the 'Lifestyle' category? The number one app in this category is the 22nd in the overall free app chart.

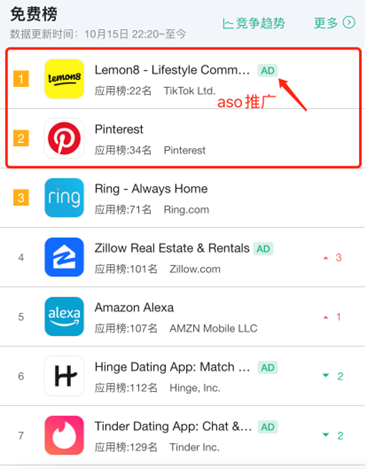

Lemon8's top position in the Lifestyle category is also aided by ASO (App Store Optimization) advertising (see the image below).

Image: Lifestyle category ranking as of 10 PM, October 15th, Beijing Time

Without actually checking the charts, uninformed individuals might genuinely believe that ByteDance has once again stunned the American public.

What is behind Lemon8's user growth, and what is ByteDance's positioning for this business? Let's analyze a few related 'rumors' and 'truths' we've encountered.

01

Rumors and Truths

Rumor 1: Lemon8 is poised to 'shake up' the American internet?

As seen in the image above, the current number one app on the US iOS charts is META's Threads, with 346,000 daily downloads, while Lemon8 has 55,000 downloads.

The truth is that Lemon8 has increased its marketing efforts in the US, leading to a rapid surge in downloads.

Simultaneously, ByteDance has been promoting Lemon8 as an overseas marketing platform through various media channels in China. It is speculated that Lemon8's future positioning may be as an overseas product marketing platform.

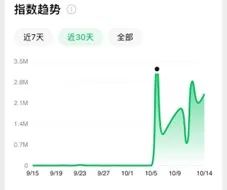

The sudden surge in WeChat Index over a day or two is attributed to a flurry of articles published by various self-media outlets highlighting Lemon8's growing popularity in the US.

The content of these articles tends to be similar, even attracting automotive self-media outlets to join in the discussion.

Rumor 2: Lemon8 is ByteDance's answer to Xiaohongshu in the US?

In my opinion, viewing Lemon8 as ByteDance's response to Xiaohongshu in the US underestimates ByteDance's strategy. The biggest misconception here is whether Xiaohongshu can sustain ByteDance's growth trajectory.

While Xiaohongshu enjoys a strong reputation and a vast user base in China, it is yet to go public and only became profitable in 2023.

Devoting human and financial resources to compete with a product that has not yet 'come of age' would be a questionable strategy for ByteDance's strategic team.

So, why is ByteDance launching Lemon8 in the US and investing heavily in its promotion? I believe there are two possible reasons: advertising revenue and content coverage.

Why do I believe Lemon8's future target is the advertising market? Based on my observations, Lemon8 is perceived by American users to serve a similar function and value as Pinterest.

Pinterest ranks second in the Lifestyle category on the iOS charts, just behind Lemon8, and without ASO advertising, it still achieves 47,000 daily downloads. Moreover, Pinterest is already listed, and according to its latest financial report, it generated revenue of $854 million in Q2 2024, a year-over-year increase of 21%. It reported a net profit of $8.88 million and an adjusted EBITDA profit of $180 million.

In the past two quarters, Pinterest's advertising platform and algorithm have undergone continuous adjustments, driving rapid growth in advertising revenue. This provides a blueprint for Lemon8's future.

02

Value and Significance

Rather than Xiaohongshu, Pinterest serves as a more mature model for Lemon8.

ByteDance has a mature advertising platform and algorithms that can be leveraged by Lemon8, significantly reducing development costs and addressing the challenges Pinterest faced with high development costs, advertising algorithms, and advertising platform optimization.

If these assumptions hold true, Lemon8's quarterly revenue of $800 million could merely be its starting point.

While ByteDance's TikTok has achieved success in the US short video market, it still lags in the image-text content and social media sectors. These areas are dominated by mature players like Pinterest, Reddit, Tumblr, and the globally dominant Instagram.

The advertising revenue in these sectors should not be underestimated.

Breaking into this sector is more challenging for ByteDance than short videos. Lemon8 must find a niche among established players.

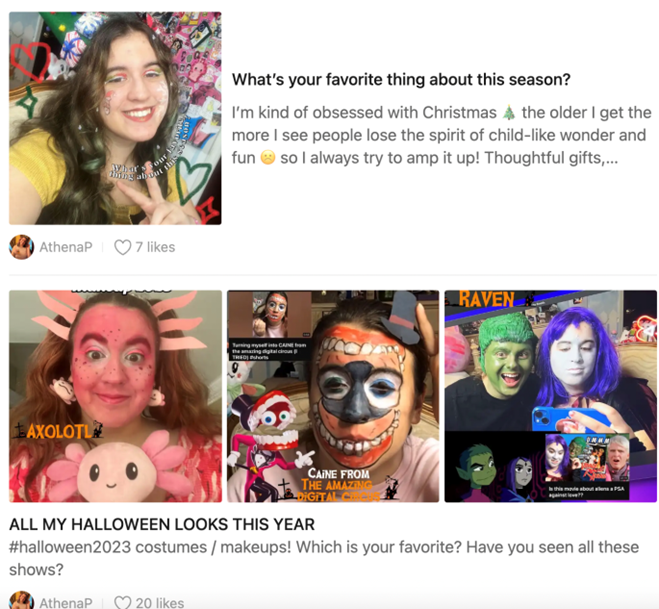

As such, Lemon8 has positioned itself as a 'Lifestyle Community.' What does such a platform look like?

I randomly sampled some user profiles and found that users primarily share details of their lives, such as headphones, bedroom decorations, gifts, and even borderline inappropriate images, with likes, interactions, and comments in abundance.

Browsing through app store reviews, one can sense that some users struggle to differentiate between Lemon8, Pinterest, and Instagram.

However, in terms of user base and experience, Lemon8 cannot yet compete with the latter two well-established players.

Unsurprisingly, users jokingly refer to Lemon8 as the love child of Instagram and Pinterest.

Currently, Instagram poses a significant challenge for Lemon8, as users tend to turn to Lemon8 only when Instagram is inconvenient or restrictive.

Lemon8 must break free from Instagram's user habits to achieve significant user growth.

In conclusion, these are our initial impressions of the so-called 'ByteDance's Version of Xiaohongshu.' We will continue to observe the overseas innovations of Chinese internet companies, including Lemon8, and promptly adjust our views as necessary.