"XinXin Semiconductor Advances in A-share IPO, CITIC Securities and Top Five State-owned Banks Rush to Join Before IPO","",""," 10/21 2024

10/21 2024

617

617

Auditor | Song Wen

After three months, the Shanghai Stock Exchange finally accepted the second IPO application of a company on the STAR Market this year.

On September 30, Wuhan XinXin Integrated Circuit Co., Ltd. (hereinafter referred to as XinXin Semiconductor) received approval for its listing application on the STAR Market of the Shanghai Stock Exchange. Guotai Junan Securities and Huayuan Securities served as joint sponsors, while CITIC Securities acted as the joint lead underwriter.

Public information shows that XinXin Semiconductor is primarily engaged in wafer foundry services and was once operated under the management of Semiconductor Manufacturing International Corporation (SMIC) in its early stages. It is the second 12-inch wafer manufacturing line established and mass-produced in mainland China and currently operates two 12-inch wafer fabs.

On the eve of the IPO, 30 external shareholders simultaneously entered the scene by investing in XinXin Semiconductor, including state and local industrial funds, banking institutions, and securities firms such as Bank of China, China Internet Investment Fund, China Construction Bank, and CITIC Securities.

With the strong support of various capital investors, will XinXin Semiconductor's journey to listing be smooth sailing?

1. Unspoken Past with SMIC, Are They "Drifting Apart"?

XinXin Semiconductor is a wafer foundry enterprise.

Generally speaking, the semiconductor industry comprises three core segments: chip design, wafer foundry, and packaging and testing. Among them, wafer foundry belongs to the production and manufacturing segment. Wafer foundry enterprises do not directly participate in chip design but specialize in providing wafer foundry services to chip design companies, converting designs into actual products using mature manufacturing processes.

(Image from Shutterstock, based on VRG agreement)

Currently, XinXin Semiconductor primarily provides 12-inch specialty process wafer foundry services to customers, focusing on specialty memory, mixed-signal, and 3D integration business areas. As of the end of March 2024, the company operated two 12-inch wafer fabs.

This industry is technology-intensive, characterized by rapid technological iteration, significant capital investment, and long R&D cycles. XinXin Semiconductor, born with a "golden spoon," naturally does not lack capital and technology.

In April 2006, Hubei Ketou, a state-owned enterprise in Wuhan's East Lake High-tech Development Zone, established the predecessor of XinXin Semiconductor—Wuhan XinXin Integrated Circuit Manufacturing Co., Ltd. (hereinafter referred to as XinXin Limited)—with a registered capital of 1.6 billion yuan. This means that XinXin Semiconductor was a state-owned enterprise from its inception.

The Hubei and Wuhan governments had high expectations for XinXin Semiconductor. According to reports in Hubei Daily and Changjiang Daily, Hubei and Wuhan invested 10.7 billion yuan in the first phase of XinXin Limited, accounting for nearly one-tenth of the total state-owned economic investment in the province that year.

According to multiple media reports, XinXin Limited was initially operated under the management of SMIC during its early stages. Around 2010, when a significant customer of XinXin Limited, Spansion, filed for bankruptcy protection, rumors circulated that Micron Technology and Taiwan Semiconductor Manufacturing Company (TSMC) planned to invest in XinXin Limited, but ultimately, SMIC secured the partnership.

In May 2011, SMIC announced the signing of a joint venture contract with Hubei Science and Technology Investment Group to jointly operate XinXin Limited's 12-inch chip production line project.

However, the cooperation between the two parties did not last long. In March 2013, XinXin Limited officially announced a new corporate brand and logo—XMC, marking its status as a fully independent company.

(Image from the official WeChat account of Wuhan XinXin Integrated Circuit Co., Ltd.)

Just before XinXin Limited became fully independent, several employees with a background in SMIC joined the company.

The prospectus reveals that YANG SIMON SHI-NING (Yang Shining, US nationality) served as Chief Operating Officer at SMIC from 2010 to 2011. In January 2013, he joined XinXin Limited as CEO and has been Chairman of the Board since December 2022.

Additionally, according to incomplete statistics from Bullet Finance, the company's Director and President, Sun Peng, Vice Presidents Zhou Jun and Wang Ning, and Manufacturing Center Director Wang Sen all previously worked at SMIC. Among them, Sun Peng, Zhou Jun, and Wang Sen worked at SMIC for over six years and joined XinXin Semiconductor between September 2012 and March 2013, becoming core technical personnel at the company.

Regarding XinXin Semiconductor's past with SMIC, the prospectus remains silent, with SMIC appearing primarily as a "peer" in the document.

Has XinXin Semiconductor "drifted apart" from SMIC? Is there still cooperation between the two parties? Bullet Finance attempted to seek clarification from XinXin Semiconductor but had not received a response as of press time.

2. Growing Scale and Continuous Related-party Transactions

Independently operated XinXin Semiconductor continues to expand.

Public information indicates that in its early stages, XinXin Semiconductor primarily manufactured NAND Flash memory for Spansion Semiconductor. Through its foundry business, XinXin Semiconductor accumulated experience and technology in chip manufacturing.

According to the prospectus, the company is now the largest NOR Flash (a type of non-volatile memory chip) manufacturer in mainland China. As of the end of March 2024, the company had shipped over 1.3 million 12-inch NOR Flash wafers cumulatively.

XinXin Semiconductor's performance has also been steadily climbing. The prospectus shows that from 2021 to the first quarter of 2024 (hereinafter referred to as the reporting period), the company achieved revenues of 3.138 billion yuan, 3.507 billion yuan, 3.815 billion yuan, and 913 million yuan, respectively.

However, net profits attributable to shareholders of the parent company have fluctuated. During the reporting period, net profits attributable to shareholders of the parent company were 639 million yuan, 717 million yuan, 394 million yuan, and 14.8664 million yuan, respectively. In 2023, net profits almost halved.

(Image from XinXin Semiconductor's prospectus)

Nonetheless, achieving such performance would not have been possible without the support of major customers.

Despite their importance to the company, XinXin Semiconductor chooses to obscure the details of its major customers. Beyond Hengshuo Co., Ltd., XinXin Semiconductor does not disclose the specific information or names of its other major customers in the prospectus, instead referring to them as "Customer 1," "Customer 2," and so on.

Apart from these major customers, related parties also play a significant role in XinXin Semiconductor.

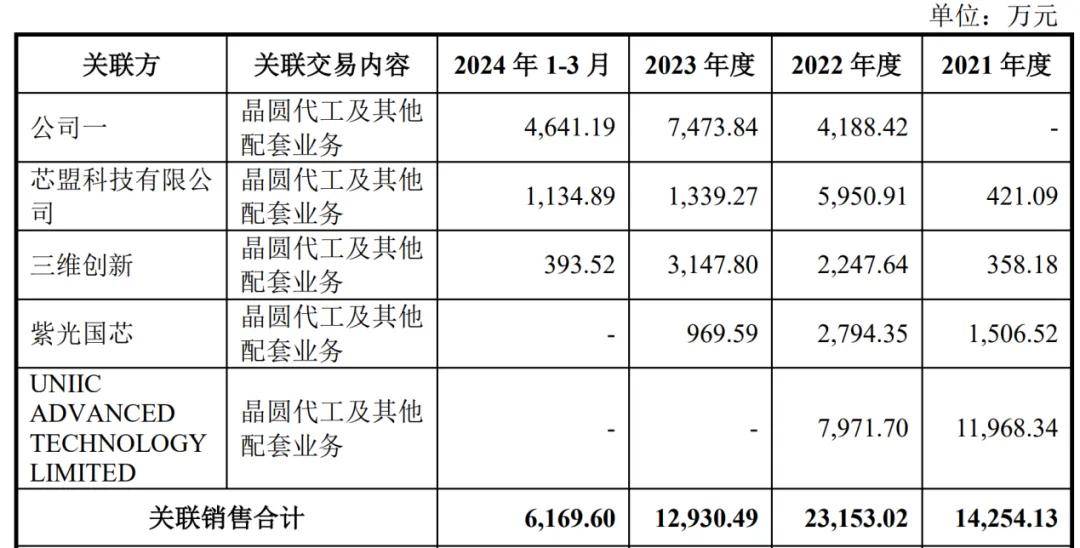

For instance, during the reporting period, the company provided wafer foundry and other supporting services to related parties such as Company One, Xinmeng Technology, Sanwei Innovation, Unisplendour Microelectronics, and UNIIC ADVANCED TECHNOLOGY LIMITED, with cumulative sales amounting to 143 million yuan, 232 million yuan, 129 million yuan, and 61.696 million yuan, respectively. From 2021 to 2023, XinXin Semiconductor's annual sales to related parties exceeded 100 million yuan each year.

(Image from XinXin Semiconductor's prospectus)

Furthermore, Bullet Finance noticed that XinXin Semiconductor's relationship with a related party known as "Company Three" is more complicated than it seems.

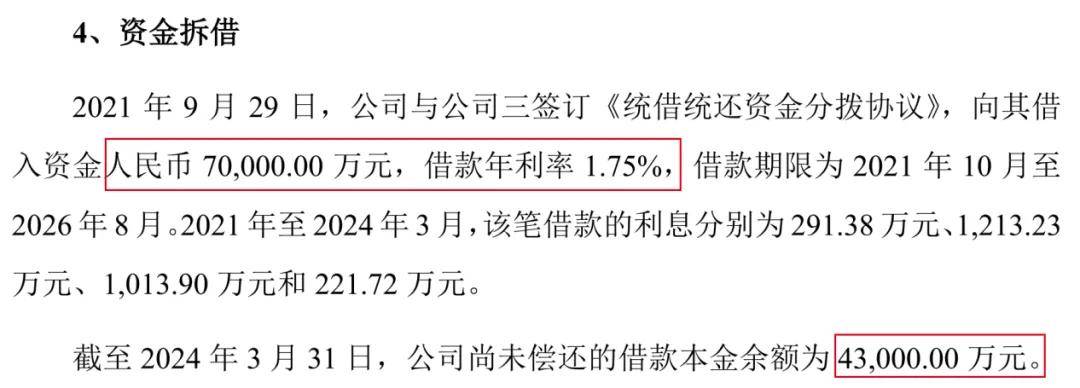

In September 2021, XinXin Semiconductor borrowed 700 million yuan from "Company Three" at an annual interest rate of 1.75%. From 2021 to March 2024, XinXin Semiconductor paid interest to "Company Three" of 2.9138 million yuan, 12.1323 million yuan, 10.139 million yuan, and 2.2172 million yuan, respectively.

As of March 31, 2024, the outstanding loan principal balance owed to "Company Three" was 430 million yuan.

(Image from XinXin Semiconductor's prospectus)

Curiously, while borrowing funds from "Company Three," XinXin Semiconductor also purchased equipment from the same entity.

According to the prospectus, in 2023, the company spent 2.143 billion yuan purchasing equipment from "Company Three." XinXin Semiconductor stated that some of the equipment purchased from "Company Three" had already been mortgaged at the time of sale.

(Image from XinXin Semiconductor's prospectus)

Moreover, XinXin Semiconductor purchases goods and services from "Company Three." From 2021 to March 2024, the transaction amounts were 26.595 million yuan, 13.0658 million yuan, 5.734 million yuan, and 21,100 yuan, respectively.

(Image from XinXin Semiconductor's prospectus)

Bullet Finance attempted to seek clarification from XinXin Semiconductor regarding the specific information of its top five customers and the identities of "Company One" and "Company Three," among other pseudonyms. We also inquired about why the company obscured the details of these customers and related parties, and why it borrowed funds from "Company Three" while simultaneously spending huge sums on equipment purchases. However, as of press time, no response had been received.

3. Concentrated Entry of 30 Shareholders with Substantial Funds

On the eve of this IPO, XinXin Semiconductor first rewarded its shareholders with a "big package."

In 2023, XinXin Semiconductor generously distributed 500 million yuan in cash dividends, even though its net profit attributable to shareholders of the parent company for the period was less than 400 million yuan. Interestingly, in 2021 and 2022, when net profits exceeded 600 million yuan, XinXin Semiconductor did not distribute dividends.

Generally, A-share IPO companies that simultaneously distribute dividends and raise funds are often criticized for potentially transferring funds to major shareholders through dividends and then raising funds to replenish operating capital, giving the impression of "going public to raise money."

However, XinXin Semiconductor does not actually lack funds.

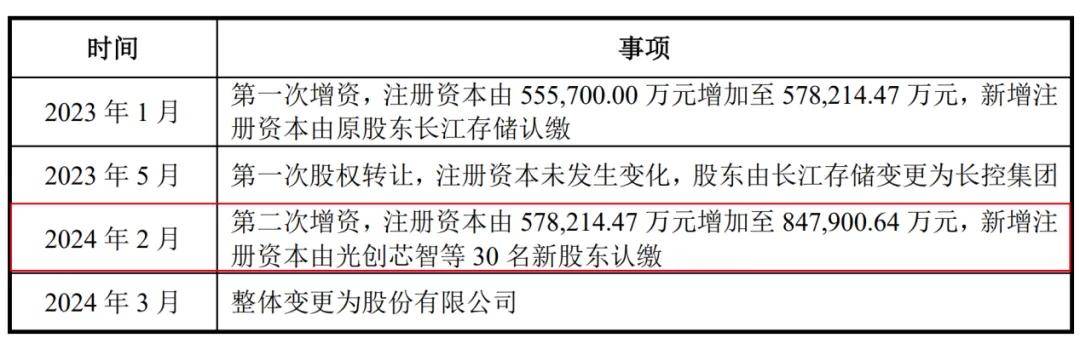

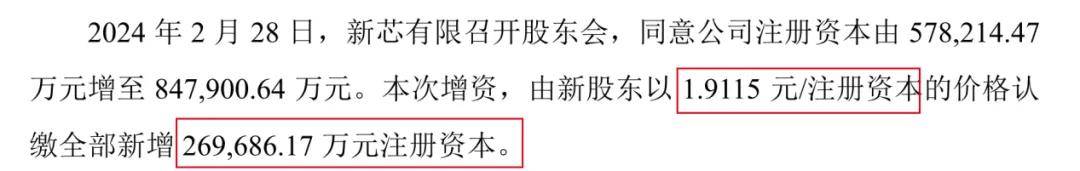

On the eve of the listing, 30 external shareholders concentrated their capital investments in XinXin Semiconductor. According to the prospectus, in February 2024, XinXin Limited held a shareholders' meeting and approved an increase in capital. Subsequently, 30 investors seized this opportunity to enter the company.

(Image from XinXin Semiconductor's prospectus)

Most of these 30 new shareholders are significant players. They include the top five state-owned banks—Industrial and Commercial Bank of China, Agricultural Bank of China, China Construction Bank, Bank of China, and Bank of Communications—as well as securities and fund investment institutions such as CITIC Securities, Changtou Fund, China Internet Investment Fund, and Rongmeiti Fund.

These investors brought substantial capital to XinXin Semiconductor. For this capital increase, the 30 new shareholders subscribed to all the additional 2.697 billion yuan in registered capital at a price of 1.9115 yuan per registered capital. Based on this calculation, XinXin Semiconductor raised over 5 billion yuan in funds.

(Image from XinXin Semiconductor's prospectus)

As of March 31, 2024, XinXin Semiconductor's monetary funds amounted to 6.277 billion yuan, an increase of approximately 137% from 2.654 billion yuan at the end of 2023.

During the same period, XinXin Semiconductor's short-term borrowings amounted to only 10 million yuan, and its non-current liabilities due within one year totaled 526 million yuan. Although short-term borrowing pressures are not significant, the company still has 3.088 billion yuan in long-term borrowings pending repayment.

(Image from XinXin Semiconductor's prospectus)

While there is no immediate debt repayment burden, it does not mean that XinXin Semiconductor is without pressure, which primarily stems from industry competition.

XinXin Semiconductor faces global market competition in a highly transparent and monopolistic industry where a few companies dominate the market and key technologies.

Achieving profitability or growth is not the end goal; XinXin Semiconductor still has a long way to go to secure a larger share of the market "pie."

XinXin Semiconductor is striving to expand its competitive edge. For this IPO, the company plans to raise 4.8 billion yuan, which will be used for the third phase of its 12-inch integrated circuit manufacturing production line project and special technology iteration and R&D supporting projects.

(Image from XinXin Semiconductor's prospectus)

To support this listing, many shareholders have chosen to "personally" escort the process. According to the prospectus, joint sponsors Guotai Junan Securities and Huayuan Securities, as well as joint lead underwriter CITIC Securities, have close ties with the new investors who joined XinXin Semiconductor in February 2024.

Among them, Guotai Junan Securities is a sibling company of Guoxin Venture Capital, a new shareholder of XinXin Semiconductor, with both companies under the control of Shanghai International Group Co., Ltd.;

The executive partner of Wuhan Xinsheng, a new shareholder, is indirectly controlled by Wuhan Financial Holding Group, which indirectly holds a 50% stake in Huayuan Securities;

CITIC Capital, a new shareholder of XinXin Semiconductor, is a wholly-owned subsidiary of CITIC Securities.

Escorted by its shareholders, XinXin Semiconductor stands at the doorstep of the Shanghai Stock Exchange. Currently, amidst the vibrant A-share market, Bullet Finance will continue to closely monitor whether XinXin Semiconductor can successfully knock on the door of the Shanghai Stock Exchange and advance its IPO plans.