"Disappeared" top livestreamers return before Double 11

![]() 10/21 2024

10/21 2024

![]() 556

556

In fact, the return of top livestreamers is a result of compromise among multiple stakeholders, including platforms, livestreamers, and consumers. Consumers need discounts, livestreamers need exposure and traffic, and platforms need sales volume.

Cover image source: Unsplash

It's Double 11 again.

According to the official line, the biggest difference between this year's Double 11 and previous years is that "it is a critical time window for activating the overall consumer market and enhancing the willingness to consume among the general public," said Jia Luo, President of Tmall Business Group, at the Double 11 press conference.

Although Double 11 has been frequently criticized in recent years, it is undeniable that Double 11 remains the most important promotional node for various platforms, merchants, and livestreamers, and it is also a "training ground" for platform reforms.

On the eve of the big promotion, many top livestreamers who had been banned or announced their retirement from the internet also announced their return. Fast-growing livestreamers such as "Xinba," "Daniang," Luo Wangyu, and Erlv have recently released videos announcing their return, and their attitudes in the comeback videos are extremely humble.

After all, platforms, merchants, and livestreamers cannot afford to abandon Double 11, the "golden goose." For platforms and merchants, Double 11 is a golden opportunity to boost sales; for "untrustworthy" livestreamers, Double 11 is an important opportunity to rebuild trust with consumers.

1

Xinba Makes a High-Profile Return

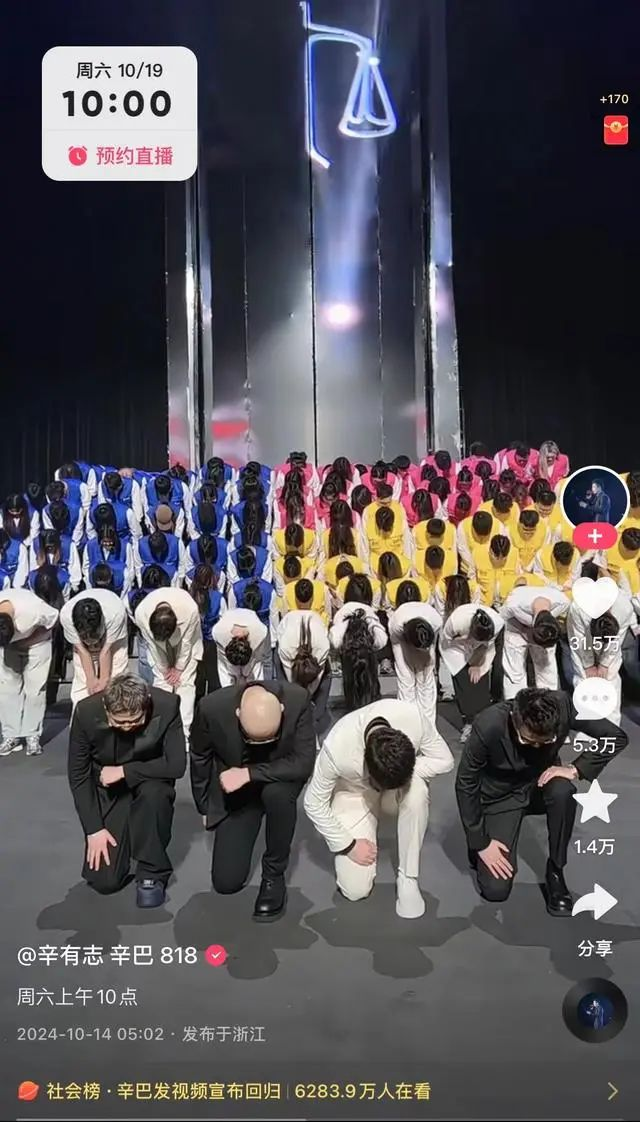

On the 14th, Xinba posted three consecutive videos on Kuaishou to announce his high-profile return and the official launch of Xinba's Double 11 campaign, which will kick off with a "Super Double 11" livestream on October 19th at 10 am.

It is not difficult to see that this comeback is intended to build momentum for the upcoming Double 11.

In one of the videos, Xinba and three Xinba partners knelt down on one knee, paying tribute to users along with the entire team, while also stating in the video that "big livestreamers are in danger, user trust has collapsed, and the media is condemning... This is now the darkest moment for live e-commerce."

Finally, Xinba earnestly pleaded with consumers to "once again trust Xinba and the millions of practitioners in this industry" and shouted the slogan "Protect the bottom line of livestreaming and rebuild industry confidence."

The attitude is extremely sincere. However, it is worth noting that Xinba has been banned and returned multiple times, and this is not the first time Xinba has "knelt" to return, and it can even be said to be a common tactic for Xinba's comebacks.

As early as 2020, when he was banned due to the "bird's nest fraud" incident and returned, Xinba apologized to fans by bowing with his wife and all employees of the company, shouting the slogan "Welcome back all users!" in unison.

Before this ban, Xinba was embroiled in a dispute with "Crazy Brother Xiaoyang" over the pricing of hairy crabs, which led to a war of words.

With elaborate sets, scripts, and camera angles, Xinba is adept at capturing public sentiment for marketing momentum, so much so that after every mishap, Xinba has been able to rely on such marketing to return to the right track of livestreaming. But how much trust do consumers still have in Xinba that can be consumed?

Apart from Xinba, other top livestreamers have also taken the opportunity to make a comeback.

On October 6th, the popular internet celebrity "Luo Wangyu," who had announced his retirement from the internet nearly three months ago, officially announced his return and announced that Double 11 livestream sales would start on October 14th. In the video, Luo Wangyu asked fans, "Would you like him to serve you again?" with a very humble attitude.

Previously, Luo Wangyu announced that he would "refund 150 million in operating funds" and retire from the internet after his CSS olive oil essence product was questioned for false advertising. Luo Wangyu has always cultivated the image of a "conscientious blogger," and this "mishap" has caused considerable damage to his reputation and trustworthiness.

Even Erlv, an internet celebrity who was banned for a year due to staged live broadcasts threatening him with being buried alive, is suspected to have returned to livestreaming in September.

In fact, the return of top livestreamers is a result of compromise among multiple stakeholders, including platforms, livestreamers, and consumers. Consumers need discounts, livestreamers need exposure and traffic, and platforms need sales volume.

However, to rebuild credibility and win back consumer trust, livestreamers who return must strengthen product quality control and improve service levels to go further on the e-commerce path.

2

The Double 11 Campaign is Prolonged

The earliest Double 11 in history.

Just after National Day, major platforms announced their entry into the Double 11 promotion, about ten days earlier than last year.

Pinduoduo and Douyin launched Double 11 on October 8th, while Kuaishou launched its Double 11 pre-sale on October 10th, followed by Taobao, JD.com, and Vipshop, which kicked off the Double 11 promotion on the 14th.

Overall, e-commerce platforms have collectively prolonged the Double 11 "front." On the one hand, due to the sluggish consumer market, it is difficult to recreate the former "one-night miracle"; on the other hand, platforms also need time to allocate and integrate resources.

In terms of specific gameplay, it is basically similar to previous years: discounts and large consumption vouchers.

A responsible person from Taobao Group said that this year's Double 11 is the one with the "largest investment." Based on Tmall's official 15% discount or cross-store full reduction of RMB 50 for every RMB 300 spent, Tmall will additionally invest RMB 30 billion in consumption vouchers and red envelopes.

In addition, some new gameplay has been introduced this year. 88VIP members can redeem RMB 800 worth of consumption vouchers with 118 points, which will be released early at 2 pm on the 14th, and they can also grab exclusive category vouchers for 88VIP members; top 100 livestreams will distribute RMB 1 billion in red envelopes, with a maximum of RMB 1,500 per person per day; Taobao's RMB 10 billion subsidy covers over 10,000 premium products at a minimum 80% discount, with an additional RMB 750 large red envelope.

JD.com has launched a cross-store full reduction activity, with RMB 50 off for every RMB 300 spent, up to a maximum discount of RMB 40,000. Users can receive an additional RMB 60 subsidy per day; Kuaishou E-commerce has provided RMB 20 billion in traffic subsidies, RMB 2 billion in user red envelopes, and RMB 1 billion in product subsidies during Double 11; Douyin's core discount measures include an official 15% direct discount and single item price reductions.

A notable change is that platforms are no longer mentioning "lowest price on the entire network," which means that e-commerce platforms have moved beyond vicious low-price competition and are gradually returning to the essence of "human-goods-market," with a greater focus on "merchant-friendliness" and "consumer experience."

At the Double 11 press conference, Taobao, the leader in e-commerce, stated that this year's Double 11 on Taobao and Tmall is positioned as a "Quality Double 11," emphasizing that instead of blindly pursuing low prices, it will focus on rational low prices and balancing the ecological relationship between consumers and merchants.

Taobao has increased support for merchants during this Double 11 by reducing commissions for major promotions and store livestreams to ease the burden on merchants.

At the Double 11 press conference, the President of Taobao Platform Business Unit introduced that since the beginning of this year, Taobao has addressed the industry's "three major ills" by loosening the only refund policy, upgrading shipping insurance, and reshaping price competitiveness, helping merchants escape from internal competition and attracting more merchants to the platform. The data shows that the progress of merchants and products enrolled in Tmall Double 11 has exceeded expectations.

On the other hand, on the consumer side, Taobao is also taking multiple measures to optimize the consumer experience by simplifying the process and making it easier for consumers to place orders.

On September 27th, Taobao announced that it would introduce WeChat payment capabilities, breaking down long-standing payment barriers; at the same time, in terms of price management, Tmall has simplified the complex "arithmetic" by only displaying the price before the discount and the price after the discount.

It is worth noting that this year, e-commerce platforms have set up special areas for government subsidies for trade-ins on their homepages, offering more preferential activities in combination with government trade-in policies.

Thanks to the efforts of various parties, including policies and platforms, this year's Double 11 has also ushered in a "good start."

According to Tmall and JD.com statistics, sales of home appliances, beauty products, and clothing categories surged after Double 11 kicked off at 8 pm on October 14th, with sales of multiple top brands such as Proya, L'Oreal, and SkinCeuticals exceeding RMB 1 billion. In terms of livestream channels, the purchase amount in Li Jiaqi's livestream room increased by 20% year-on-year, and multiple Taobao livestream rooms achieved sales exceeding RMB 1 billion faster than last year.

3

Is the Big Promotion Still Attractive?

Since 2019, Double 11 has been on a downward trend. Over the past five years, the market has been questioning how much appeal Double 11 still has and whether Double 11 is dead.

Judging from the actions of top livestreamers and e-commerce platforms this year, Double 11 still seems to have plenty of room for imagination.

From a market perspective, with the implementation of a series of incremental policies, consumer enthusiasm in the domestic consumer market continues to rebound; from a platform perspective, e-commerce platforms represented by Taobao seem to be emerging from the reform pain period, finding ways to compete in the second half, and moving towards industry maturity.

Amid the tide of consumption downgrade, the three major platforms led by Taobao, JD.com, and Pinduoduo have set off round after round of "price wars," and Chinese e-commerce platforms have once been trapped in a vicious circle of "low-price competition."

But facts have proved that vicious price wars will only lead to the regression of the entire industry. Under the indicator of extremely low prices, merchant interests are squeezed, and they can only reduce product quality to balance costs, ultimately destroying the ecological balance of the industry and damaging brand image and consumer trust.

As a result, since the beginning of this year, multiple e-commerce platforms have announced their return to the "GMV logic." The e-commerce price war has finally come to a halt.

After the 618 promotion ended, Taobao Group held a closed-door meeting for merchants. At the meeting, it was announced that the weight distribution system with "five-star price competitiveness" as the core logic would be weakened and reverted to distribution based on GMV (Gross Merchandise Volume).

Subsequently, in early July, Douyin Group also adjusted the priority of its business objectives, no longer placing "price competitiveness" first but instead focusing on pursuing GMV growth.

In early August, Pinduoduo also adjusted its business priorities, shifting from pursuing commercialization and "absolute low prices" to making GMV growth its top priority.

Under the "GMV" indicator, total sales are the core competitiveness, which also means that e-commerce platforms will pay more attention to merchants' overall operating capabilities and the value creation of products rather than simply price competition.

This shift indicates that e-commerce platforms will be more "merchant-friendly." After all, merchant experience and user experience are two sides of the same coin. Only by optimizing the merchant ecosystem can a good platform ecosystem be created, which in turn attracts more consumers.

To retain merchants is to retain consumers.

On July 26th, Taobao announced that it would optimize the "only refund" policy, enhancing merchants' autonomy in after-sales service based on the new experience score, and reducing or eliminating after-sales interventions for high-quality stores.

In September, Taobao and Tmall platforms fully launched the Return Assurance service, reducing merchants' return costs by about 20% to 30%; during Double 11, Taobao will fully implement commission-free promotions and store livestreams, and will also unbind shipping insurance for Taobao merchants...

On the other hand, in terms of consumer experience, platforms are also striving to "reduce tricks," reduce "misleading low prices," emphasize "streamlining" gameplay, and offer "old-fashioned" promotional formats such as official discounts and direct price reductions.

It is worth noting that on September 27th, Taobao fully integrated WeChat payment capabilities, enabling interoperability with WeChat; at the same time, JD.com also introduced Alipay and Cainiao, and Taobao and Tmall merchants can now also choose JD.com Logistics for shipping.

Thus, China's largest internet platforms have achieved true interoperability.

This also means that the internet e-commerce industry has entered a more standardized and healthier maturity stage, and platform interoperability is bound to bring new growth space to the e-commerce industry.

In his first letter to all employees after taking office in 2023, Wu Yongming wrote, "Ali must shift more firmly towards a user perspective, satisfying user needs in multiple dimensions, with user needs taking priority over everything. To achieve a better user experience, we must be more open."

The tide washes away the weak. After going through the stage of crazy expansion and vicious low-price competition, only by returning to consumers and truly putting users first can we regain the essence of e-commerce. This applies to both top livestreamers and large platforms.