Double 11 enters its 16th year, e-commerce platforms begin a “laid-back” marathon

![]() 10/21 2024

10/21 2024

![]() 431

431

The starting gun for Double 11 2024 has been fired.

The event officially kicked off on October 14, with Alibaba, JD.com, and Pinduoduo all launching their Double 11 promotions on the same day. The rising star Douyin E-commerce had already kicked off its Double 11 sales promotion earlier on October 11. Xiaohongshu, participating in Double 11 for the first time, also announced that its “once-a-year shopping spree” would begin on October 12. Compared to last year, the start dates for Double 11 this year have been moved up by about ten days on average. It is predicted that after Double 11 ends, e-commerce platforms will continue their promotions until the end of November, meaning that this year’s entire Double 11 promotion period will last for one and a half months, setting a new record as the longest Double 11 in history.

Continuing the usual practice, e-commerce platforms are again focusing on promotional strategies such as “billions in subsidies, limited-time discounts on big brands, and various discounts and giveaways.” Each platform has continued to increase the magnitude of its discounts, with Tmall investing an additional 30 billion yuan in shopping vouchers and red envelopes for Double 11; JD.com officially announced that it would launch a “Billions in Subsidies Day” at the end of October; and even the usually low-key Pinduoduo introduced its first “Billions in Shopping Vouchers” campaign and upgraded its “Super Double Subsidy” policy.

As Double 11 enters its 16th year, the pre-sale period starts earlier and earlier, but the enthusiasm seems to be waning, with a noticeable slowdown in sales growth. According to data from the third-party platform Star Chart, during Double 11 2023 (from 8:00 PM on November 10 to 12:00 AM on November 11), the total sales of integrated e-commerce platforms amounted to 277.7 billion yuan, with Tmall accounting for the highest proportion at 60.02%.

Taking Tmall as an example, sales growth during Double 11 has slowed down year after year. Starting in 2022, Tmall stopped announcing its total transaction volume, stating that the transaction volume for that year’s Double 11 was on par with 2021. Tmall last announced its numbers in 2021, when its total transaction volume for Double 11 reached 540.3 billion yuan (from November 1 to November 11), achieving year-on-year growth of 8.5%, but this was a marked slowdown compared to the 26% growth in the previous year. In 2023, the total sales of integrated e-commerce platforms only reached half of Tmall’s total transaction volume from 2021.

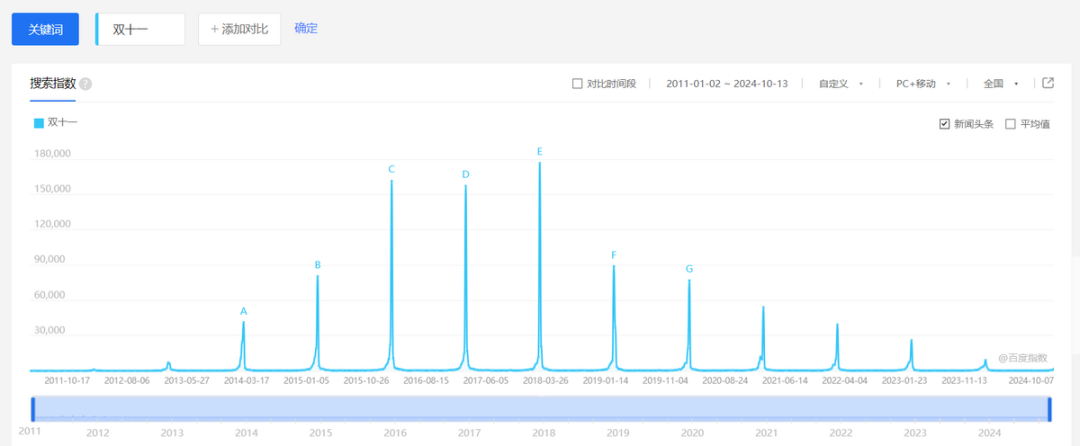

According to Baidu Index, the popularity of Double 11 peaked from 2016 to 2018 but has been declining since 2019, with search interest in Double 11 even regressing to levels similar to those in around 2013 in the past two years.

It is evident that consumers have lost much of their novelty for the Double 11 shopping festival, merchants are tired of shouting promotions, and platforms are actively shifting strategies, making “Double 11 promotions” more relaxed.

1

Platforms collectively abandon “lowest price on the entire network”

For Double 11 this year, the apparent “lowest price on the entire network” is no longer the core of competition among platforms, which have taken the lead in “anti-involution” and no longer mandate low prices.

A clear signal is that Pinduoduo, which has always relied on “low prices” as a weapon, has narrowed the price comparison scope for merchants during this year’s Double 11, Cancelled it “ The lowest price across the entire network ” The requirements , Instead “ Same style, same price ”, Targeted invitation brand merchants no longer need to compare prices across the entire network , Just need to complete the price comparison within the scope of the benchmark store 。

In the past few years, the domestic e-commerce industry has experienced intense internal competition, with platforms vigorously competing for the “lowest price on the entire network,” pushing the e-commerce environment to the brink and fostering vicious competition.

For example, platforms have made price a crucial factor in traffic allocation, neglecting the importance of product quality and shopping experience, leading to a brainless race to the bottom in prices and the expulsion of good money by bad. Another example is the “refund only” policy, which has overwhelmed countless small and medium-sized merchants, increasing their operational pressures and production costs, ultimately forcing them to sacrifice quality and leading to a surge in trade disputes with consumers.

Since this year, the Political Bureau meeting of the CPC Central Committee has mentioned the need to cultivate and expand emerging and future industries, strengthen industry self-discipline, and prevent “involutional” vicious competition.

Daniel Zhang, Vice President of Alibaba Group and President of Taobao Platform Business Department, publicly stated, “Blindly pursuing low prices will set back China’s business environment, consumption, and manufacturing.” Xu Ran, CEO of JD.com, also mentioned at this year’s JD.com Double 11 press conference that in the current fiercely competitive market, there are still phenomena of “vicious involution” and the expulsion of good money by bad within the industry.

While market order is being reshaped, platforms have not abandoned competition over “low prices” as an effective strategy to stimulate consumption. Compared to the complex discount schemes of previous years, platforms have generally simplified their approaches this year, offering real money and tangible benefits.

Tmall has launched the slogan “Buy Expensive, Get a Refund,” and for the first time, incorporated government subsidies into its Double 11 discount strategy. The discount red envelopes distributed overlap with large consumption vouchers and subsidies from local governments, totaling nearly 30 billion yuan in consumer discounts. In addition to direct discounts and buy-one-get-one-free offers, 88VIP large-denomination vouchers are also available. In the live streaming sector, the platform generously sprinkles 2 billion yuan in live streaming red envelopes, with each person eligible to receive up to 1,500 yuan per day.

JD.com has introduced a cross-store discount activity, offering a 50 yuan discount for every 300 yuan spent, with a maximum discount of 40,000 yuan. Users can receive an additional 60 yuan subsidy daily. Additionally, there are platform-wide subsidies of 20 yuan off for purchases over 200 yuan, which can be stacked with other promotional benefits.

Pinduoduo has launched its first “Billions in Shopping Vouchers” campaign and upgraded its “Super Double Subsidy” policy, changing its previous “Buy Expensive, Get a Refund” service to “Buy Expensive, Get Double Refund,” which will take effect on October 16.

Undoubtedly, after abandoning the blind pursuit of low prices, e-commerce platforms are returning to the essence of e-commerce, focusing on long-term value, gradually weakening low-price strategies, and placing greater emphasis on the consumer experience.

2

Platforms regain merchants’ confidence

Kicking off the battle for merchants

Another notable change this Double 11 is the battle for merchants among platforms, with Taobao, JD.com, and Douyin E-commerce introducing cold-start preferential policies and reducing commissions for merchants.

A merchant on the Tmall platform said that when registering for Double 11 promotions this year, they found that the platform no longer mandated merchants to activate shipping insurance and canceled the rule of prepayment. There was no mandatory low-price constraint on prices, and traffic instead increased significantly.

In the second half of this year, in response to the long-standing problems of “refund only” and “shipping insurance” that have plagued merchants, the three major traditional e-commerce platforms have introduced corresponding services to alleviate the burden on merchants and unbind the “refund only” policy, efficiently helping merchants achieve “efficiency improvement and cost reduction.”

To address merchant losses caused by “refund only,” Tmall has launched a Return Treasure service, reducing merchants’ return costs by up to 20% on average, with some merchants even achieving a direct 30% cost reduction. During Double 11, Tmall also offers merchants a 0-fee, instant refund service, allowing merchants to receive payment immediately after shipment, effectively alleviating financial pressure. It is understood that merchants who register for Tmall’s “Billions in Subsidies” program will also enjoy the benefit of participating in the promotion at zero cost, as Tmall will refund 100% of the merchant’s commission.

Pinduoduo, the initiator of the “refund only” policy, has also begun to Tilt more resources towards merchants 。Not only has it lowered the threshold for withdrawing merchant funds from 100 yuan to 1 yuan, but it has also eliminated remote area order logistics transfer fees for merchants and further reduced the technical fee rate for pay-later orders from 0.4% to 0.6%. At the same time, for abnormal and malicious complaint orders, the platform has opened an appeal channel for merchants. After a successful appeal, the platform will compensate the relevant orders and does not limit the number of merchant applications.

For Double 11 this year, JD.com has also increased its support for third-party sellers, further upgrading its “Spring Dawn Plan” to empower merchants in three dimensions: traffic support, AI technology efficiency, and ultra-light asset operation. Additionally, JD.com has invested up to 1 billion yuan in resources to support the live streaming sector, providing free JD digital human experience services to platform merchants and opening return and exchange guarantees.

Platforms are also complementing each other’s weaknesses. Taobao and JD.com continue to align their supply of white-label merchants with Pinduoduo, with Taobao Factories launching its “Black Label Store” this year, and JD.com introducing the “Factory Goods Billions in Subsidies” channel, extending an olive branch to white-label merchants.

Clearly, Double 11 this year will be a crucial turning point for merchants to find a breakthrough. In the entire industry closed loop, as the production and supply side, the improvement of merchants’ operational efficiency can also effectively enhance the user experience to a certain extent. Essentially, the e-commerce industry is returning to a competition logic centered on “users.”

3

Under interoperability

A new competitive landscape is emerging

At present, China’s consumer market is undergoing structural changes, and the established players in the e-commerce sector face a reshuffle amidst stock competition.

In 2023, Alibaba and JD.com’s market shares in e-commerce were 41% and 14%, respectively, down 3 and 2 percentage points from 2022. JD.com’s second place in e-commerce was surpassed by Pinduoduo last year, which reached an 18% market share.

Meanwhile, new players continue to enter the field, with long and short video platforms such as Douyin, Kuaishou, and Bilibili successively holding Double 11 merchant conferences. Social media platform Xiaohongshu also joined Double 11 for the first time, continuing to reshape China’s e-commerce competitive landscape.

While platforms fiercely compete during Double 11, it is undeniable that consumer interest is waning. In a stock market, it has become increasingly difficult for platforms to gain more traffic and business through individual efforts. Only through interoperability and traffic sharing among platforms can an effective way out be found.

On the eve of Double 11, the e-commerce industry embarked on a significant demolition of walls. First, Taobao announced the opening of WeChat Pay, followed by a payment-level cooperation between Taobao and JD Logistics.

Payment and logistics, as core nodes of e-commerce transactions, were once the focus of competition among e-commerce platforms to achieve a closed loop. Now, in the second half of the e-commerce industry, where the traffic dividend period has dissipated, and with the industry’s general trend of interoperability, breaking down these two walls has become imperative.

The latest version of Taobao has officially launched WeChat Pay functionality, allowing users to directly use WeChat Pay when shopping on the Taobao platform. Meanwhile, users can also directly open the Taobao H5 page within WeChat to complete the order and payment without having to jump to the Taobao app.

The complete integration of payment systems means that users are no longer limited to a single payment method when shopping on e-commerce platforms, and competitive barriers among platforms are gradually being dismantled. The further simplification of the payment process undoubtedly enhances consumer satisfaction with the shopping experience. For Taobao, integrating WeChat Pay means attracting a wider range of consumers, especially those in lower-tier cities and rural areas. Similarly, for JD.com, integrating Alipay can improve the user experience while covering a larger user base.

On October 16, JD Logistics officially announced its full entry into Taobao and Tmall. JD Logistics stated, “JD Logistics has fully entered Taobao and Tmall! Merchants can directly choose JD Logistics in the merchant shipping backend. Consumers can track JD Logistics shipments within the Taobao and Tmall apps.”

It is reported that after Taobao and Tmall integrated JD Logistics, JD.com will also integrate Cainiao Express and Cainiao Stations and is expected to integrate Alipay payment functionality before Double 11.