Flash Express IPOs but fails to find a "cure"

![]() 10/21 2024

10/21 2024

![]() 615

615

After a decade of development in the instant delivery sector, Flash Express finally went public on Nasdaq on October 4, marking a new chapter in its journey towards capital markets. However, the capital markets have already detected Flash Express's decline, and their response speaks volumes.

Since its IPO, Flash Express's share price has been on a rollercoaster ride, with shares plummeting to $15.1 on October 21, two weeks after its listing, falling below its IPO price of $16.5 per share. Although there has been some recovery in recent days, the share price had previously hit an all-time low of $11.465, representing a drop of over 30% from the IPO price. Additionally, the company's market value has shrunk from $1.28 billion at IPO to $1.072 billion, a decline of 16.25%.

In the fiercely competitive instant logistics sector, Flash Express, as a prominent player, has enjoyed several moments of glory. In 2021 and 2022, it achieved significant market share. However, these successes were accompanied by profitability challenges, exposing weaknesses in operational efficiency and cost control. Furthermore, the intensifying price wars in the industry have driven down order values, further squeezing Flash Express's profit margins.

Given these circumstances, it's difficult to argue that Flash Express has found a "cure" through its IPO.

01

Revenue growth slows, with profitability achieved in 2023

Founded in 2013, Flash Express began as a small errand service platform. Leveraging precise market positioning and an efficient delivery network, it quickly emerged as a frontrunner among competitors. The founding team astutely captured the growing demand for personalized, rapid delivery services among urban residents and built an efficient service system around this core competency.

Initially serving major cities like Beijing, Flash Express expanded nationwide through continuous algorithm and technology optimization. Its services encompassed instant delivery of documents, flowers, cakes, and other items, catering to diverse consumer needs. With a growing user base, Flash Express solidified its position as a leader in the instant logistics industry.

As of 2024, Flash Express covers hundreds of cities nationwide, boasting a vast user base and stable delivery team. According to iResearch data cited in its prospectus, Flash Express accounted for approximately 33.9% of China's independent one-to-one express delivery service market in terms of 2023 revenue. As the company grew, so did its financial performance.

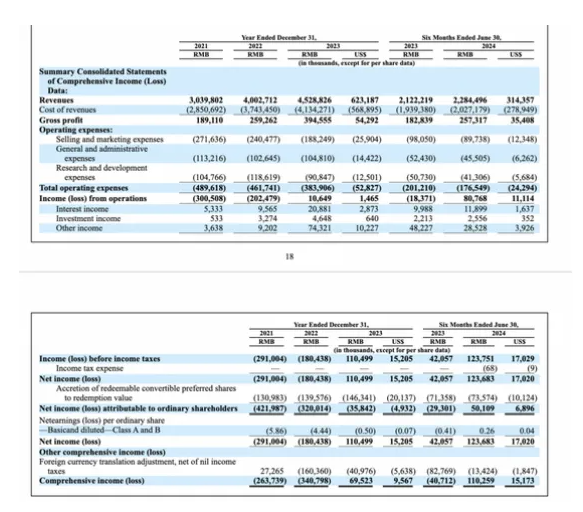

According to the prospectus, Flash Express's revenue reached RMB 3.04 billion, RMB 4.0 billion, RMB 4.5 billion, and RMB 2.284 billion in 2021, 2022, 2023, and the first half of 2024, respectively, demonstrating growth. However, revenue growth rates slowed, with a 31.6% increase from 2021 to 2022 and a narrower 12.5% increase in 2023.

Beyond revenue growth, profitability improvements lagged. Flash Express achieved its first net profit of RMB 110 million in 2023 and RMB 124 million in the first half of 2024. Prior to this, it incurred net losses of RMB 291 million and RMB 180 million in 2021 and 2022, respectively, totaling RMB 471 million in cumulative losses over two years.

While Flash Express shed its long-standing losses in 2023, profitability stability remains uncertain in the fiercely competitive instant delivery market.

Rider costs have consistently been Flash Express's largest expense, posing a significant barrier to profitability. According to the prospectus, rider compensation and incentives accounted for 90.5%, 90.3%, 87.8%, and 85.4% of revenue in 2021, 2022, 2023, and the first half of 2024, respectively. Although this percentage declined, it remains high, reflecting significant pressure on human resource costs.

The high cost of human resources has made profitability challenging for Flash Express. Therefore, effectively controlling rider costs while maintaining service quality will be crucial for sustained profitability.

02

Frequent price wars lead to declining order values

Price wars have become a common strategy for platforms vying for market share in the instant logistics market. As competition intensifies, logistics companies have introduced preferential policies to attract users and merchants by reducing delivery fees. These price wars extend beyond traditional express services to fresh food delivery, food delivery, and other niche markets.

According to iMedia Research's "2022 China Errand Economy Market Insight Report," the errand economy is expected to expand, with a market size of RMB 66.4 billion by 2025 and a compound annual growth rate of 75.4% from 2018 to 2025. This has attracted not only traditional logistics giants but also new players, intensifying competition.

In March 2023, freight platform Lalamove launched a two-wheeled same-city errand service, followed by Didi Chuxing's Didi Express service. Map platforms like Gaode Maps also entered the fray with services like "Gaode Instant Delivery" in Beijing, Wuhan, Hangzhou, and Changsha. In early 2024, bike-sharing brand Hello Bike announced its foray into instant delivery with a delivery errand service.

Amid intense competition, Flash Express has been drawn into these price wars. To maintain market share, it offers coupons and discounts, attracting users but leading to declining order values.

From 2021 to the first half of 2024, Flash Express's 2.7 million riders fulfilled 159 million, 213 million, 208 million, and 138 million orders, respectively. While order volume reflects robust market demand, average revenue per order declined from RMB 19.12 to RMB 16.55, indicating a downward trend in order values.

Unfortunately, Flash Express's strategy of sacrificing prices for market share has not paid off. According to Toubao Research, Flash Express has slipped from a market leader to the second tier, lagging behind competitors like Meituan Delivery and Ele.me in terms of market coverage, rider count, and delivery volume. This indicates significant market share erosion.

Rapid business expansion has also compromised service quality. Online complaint platforms reveal over 5,684 complaints about Flash Express, including issues like unauthorized deductions, severe rider delays, and order mismanagement. Rider complaints about unfair compensation, deposit issues, and unscrupulous practices further underscore management shortcomings.

Moreover, as a labor-intensive business, Flash Express relies heavily on human resources, which cannot be significantly reduced through digitalization alone. Without new funding or a robust competitive barrier, Flash Express faces an uphill battle.

03

No new funding in three years; Wang Sicong invested twice

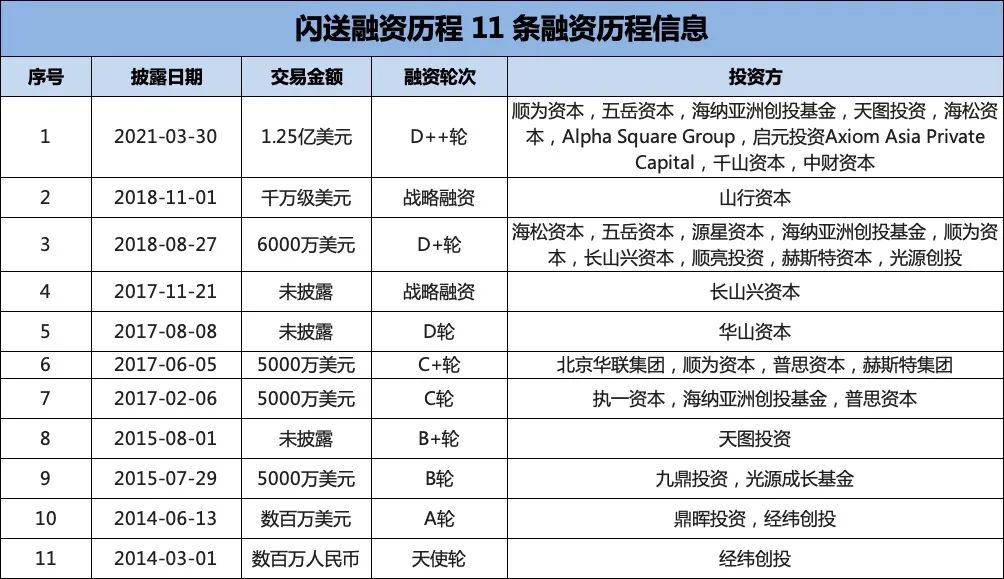

Since its inception, Flash Express has completed at least 11 funding rounds, attracting significant capital market interest. In May 2014, just months after its launch, Flash Express secured A-round funding from CDH Investments, valued at tens of millions of dollars. This period saw the entry of numerous players like Fengniao Express, SF Express, YTO Express B-net, Lightning Express, Linqu, and Dada Nexus, making the sector a hotbed for VC/PE investment.

As the market heated up, Flash Express entered a rapid funding phase. In July 2015, it closed a US$50 million B-round led by Jiuding Capital and followed by CDH Investments, valuing the company at US$200 million. In August, Tiantu Capital participated in the B+-round.

In 2017, Flash Express completed C- and C+-rounds within six months, raising a total of US$100 million from investors like SIG Asia Investments, Zhide Capital, Shunwei Capital, and Hualian Group Hearst Capital. Wang Sicong's Pusi Capital also invested in both rounds.

However, after the US$125 million D++-round in 2021, co-led by Shunwei Capital, Wuyue Capital, and SIG Asia Investments, Flash Express's funding momentum stalled. Despite IPO rumors in 2020, its IPO journey only commenced four years later.

Backed by prestigious investors, Flash Express seemingly lost its way. From 2021 to 2023, its net cash flow from operating activities was negative at RMB -195 million, RMB -87 million, and RMB 46 million, turning positive only in 2023. As of the first half of 2024, Flash Express had RMB 712 million in cash and cash equivalents, providing ample liquidity. However, amidst price wars and persistent losses, this cash flow is insufficient to sustain further expansion, making the IPO a crucial step for revitalization. While the IPO aimed to secure new funding and boost market confidence, the current share price plunge suggests that it is not a panacea. For Flash Express, the real test has just begun.

Conclusion:

Amid a complex market environment and fierce competition, Flash Express's future remains uncertain. Balancing service quality, cost control, and sustained profitability presents a core challenge. The IPO may offer new growth opportunities, but sustained, robust development requires strategic adjustments and service innovations.

*Disclaimer: This article is intended to provide information and does not constitute advice.