The UK emphasizes IPO review, adding uncertainties to the IPO journey of the unicorn SHEIN

![]() 10/21 2024

10/21 2024

![]() 546

546

The overseas listing of Chinese stocks is heating up, which corresponds to the booming overseas business of an increasing number of enterprises. This mutually reinforcing trend reflects the importance of going global.

From early-stage 3C products sold on Amazon or independent websites, to the "Four Little Dragons of Cross-border E-commerce" that emerged with the support of China's supply chain, to independent brands capturing niche markets in the "post-going-global era" such as home furnishings and appliances, Chinese brands are embarking on a new wealth-creation movement by going global.

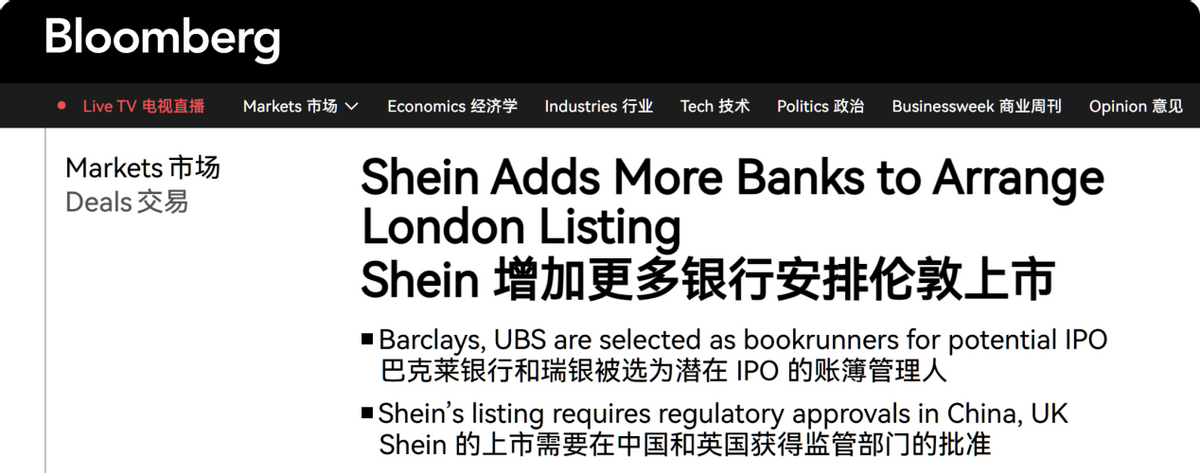

Taking SHEIN, one of the "Four Little Dragons of Cross-border E-commerce," as an example, Bloomberg reported that Singapore-headquartered SHEIN was valued at $66 billion in its last round of funding and confidentially filed documents in June for a potential listing in London. Recently, it was reported that Barclays and UBS had been selected as the bookrunners for SHEIN's IPO, further strengthening its listing capabilities.

(Image source: Bloomberg website)

However, the Blueshirt Group, a US investor relations and media relations consulting firm, recently told the media that based on current trends, the listing of Chinese stocks may reach another peak next year. But before that peak, there will be uncertainties in the market.

SHEIN is also facing such a situation. At last week's London International Investment Summit, Bloomberg interviewed UK Prime Minister Keir Starmer about SHEIN's IPO, and he said, "I won't talk about individual companies. What I will say is that, let me be clear, standards and high standards are really important to us. Of course, we will look at any issues, particularly issues around workers' rights."

(UK Prime Minister's statement on the need for a labor rights investigation for SHEIN's listing. Image source: Bloomberg website)

In other words, while the London Stock Exchange needs some large IPOs, it will not relax its review of companies planning IPOs. At present, the listing of large companies like SHEIN still has uncertainties.

SHEIN tries to catch up with the active trend of Chinese stock listings

According to Wind Financial Terminal data, influenced by the strong performance of the secondary market and the Fed's previous interest rate cut expectations, the listing situation of US stocks improved significantly in the first half of the year. Among them, the boost to Chinese stocks was also significantly enhanced.

On the one hand, Zhu Chen, a listing business partner in South China of Deloitte China's Capital Markets Services Department, told Securities Times reporters that due to the improved macroeconomic environment, the number of Chinese mainland enterprises filing for US listings surged in the first half of 2024, with more Chinese-funded enterprises going public in the US.

In addition, there are many supportive policies at the policy level. For example, the 16 Measures for Serving the High-level Development of Science and Technology Enterprises in the Capital Market issued by the China Securities Regulatory Commission (CSRC) proposes supporting technology-based enterprises in going public overseas in accordance with laws and regulations. The new "Nine Policies" issued in April this year also clarifies the need to broaden financing channels for enterprises' overseas listings and improve the quality and efficiency of overseas listing filing management.

On the other hand, some influential large enterprises in specific fields have emerged among the current overseas listed enterprises.

For example, Amer Sports, the parent company of sports brands such as Arc'teryx and Salomon, with Anta as its largest shareholder, has a global presence and raised $1.571 billion in its IPO on the New York Stock Exchange earlier this year. Meanwhile, ZEEKR, which went public in May this year, is backed by Geely and raised $440 million. It is also the fastest IPO for a new energy vehicle company in history, having been established for just three years.

These factors explain why SHEIN's listing may attract widespread market attention. In Bloomberg's report, SHEIN's $66 billion valuation in its last round of funding, although lower than previous valuations, may still be one of the most influential listings in the global capital market.

In another report, SHEIN's UK subsidiary, Shein Distribution UK Ltd., submitted an information document to Companies House this month. The document shows that SHEIN generated approximately $2 billion in revenue in the UK in 2023, an increase of approximately 38% over the same period in 2022. This also makes the UK SHEIN's third-largest market after the US and Germany.

(Image source: Bloomberg website)

Perhaps this is also a major reason why SHEIN chose the London market as its new target after being blocked from an IPO in the US by US legislators.

Is the final hurdle of listing easy to overcome?

There are multiple factors indicating that SHEIN's listing process is accelerating at an unprecedented pace.

For example, The Wall Street Journal, the Financial Times, and other media outlets previously reported that SHEIN's mysterious founder Xu Yangtian recently traveled to the US and London to meet with investors. His main activity was to introduce business development to investors, which may have been aimed at stabilizing investor sentiment and strengthening support ahead of the IPO.

Since Xu Yangtian has never publicly attended any major events related to SHEIN or given speeches or interviews, it is widely believed that his emergence was to drive forward SHEIN's listing process at a critical juncture.

Furthermore, the selection of Barclays and UBS as bookrunners for SHEIN's IPO underscores the company's accelerated efforts to fulfill listing-related formalities.

However, as Bloomberg reported and the industry has noted, SHEIN finds itself in two uncertain trends beyond its control.

On the one hand, Bloomberg stated that "the e-commerce company is awaiting regulatory approval from both China and the UK for its IPO."

On the UK side, while SHEIN's estimated IPO valuation of £50 billion is attractive to the London Stock Exchange and SHEIN has a significant presence in the UK market, the labor rights issue mentioned by Starmer reflects overseas concerns about SHEIN's business model. As a manufacturing company, SHEIN's "small-order, quick-response" apparel manufacturing model relies on a large number of factories and workers, raising questions about whether it fully safeguards supply chain interests.

On the Chinese side, SHEIN's upstream supply chain is deeply rooted in China and requires compliance with laws and regulations for listing filing. However, SHEIN's name is not yet listed in the overseas listing review documents recently released by the CSRC, meaning that there are still processes to complete before its listing. The current introduction of international banks is also aimed at further strengthening listing capabilities in all aspects.

On the other hand, the listing of a start-up after multiple rounds of funding is never a unilateral action by the enterprise. It requires careful consideration of multiple factors, including the macro environment and shareholder opinions.

Scott Rubner, Managing Director and Strategist at Goldman Sachs Global Markets, mentioned during the earlier surge in Chinese assets that the US election could be a critical juncture. Media reports suggest that SHEIN's estimated earliest IPO timeline is early next year, while the Financial Times reported in June that SHEIN may have reserved Hong Kong as an alternative IPO location. This underscores the uncertainty in the coming six months to a year.

(Image source: Financial Times website)

Essentially, SHEIN, already valued at tens of billions of dollars, has a greater need to cash in on the capital market. However, the current macroeconomic environment is unstable. The more unstable the environment, the more likely it is that uncertainties will arise in the listing process. For SHEIN, the UK review will test its ability to "walk the tightrope," a necessary path for a large company to traverse.