AI video track, the weather is changing

![]() 10/22 2024

10/22 2024

![]() 507

507

"Destroy you, what does it have to do with you?" This is a sentence used in Liu Cixin's science fiction novel "The Three-Body Problem" to describe the war between humans and the Trisolarans.

Today, a similar "dimensionality reduction attack" is also occurring in the video industry: Since June, from face swapping to voice mimicry, from fantasy to simulation, AI video models from Adobe, Kuaishou Keling, Zhipu Qingying, and other domestic and foreign companies have ushered in an intensive release period, upending the traditional video industry in terms of cost.

Compared to the past, these products have exceeded expectations in terms of effect optimization, functional innovation, and application implementation. In this round of competition among large models, which companies are at the forefront of the "AI video battle"?

The "second half" of the large model competition: Where has AI video gone?

In February of this year, the highly anticipated Open AI introduced the video large model Sora, sparking widespread interest in the AI video generation track. However, to date, Sora is still only open to a small number of users for testing and has not been officially launched.

According to Open AI's statement, the main reason why Sora is still in the research phase is that "communication between the company and policymakers is ongoing." According to foreign media reports, Open AI is in contact with relevant parties from YouTube, Hollywood, etc., to obtain more support. Open AI's Chief Technology Officer, Mira Murat, said, "Before the official launch, we must first reduce the production cost of Sora, as the current cost is 'too expensive.'"

Since the beginning of this year, at least 10 large and innovative companies at home and abroad have released new products or model upgrades related to AI video, and most of them have been open to all users.

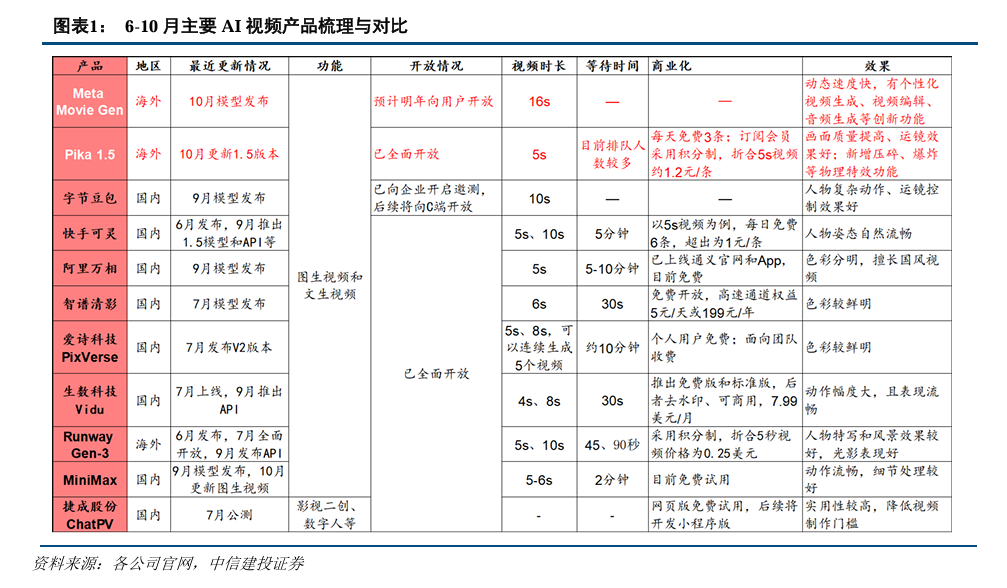

Image source: CITIC Securities research report

According to the data provided in the research report above, the AI video industry has undergone the following three main changes from June to October 2024:

Technologically, the video generation time has been significantly extended, the video production speed has been markedly improved, and the resolution and frame rate have been upgraded in terms of visual effects, further narrowing the gap with Sora.

In terms of applications, except for ByteDance's Doubao, all other products have been opened to C-end users, and some products have already begun to be applied in actual creation. The API prices have been significantly reduced compared to the experimental stage. Domestic companies have taken the lead in opening up to users and commercial implementation compared to Sora, demonstrating the specific scenarios and commercial feasibility of AI video large model applications to the market.

In terms of funding, at least five startups have raised over 100 million yuan in funding, totaling approximately 1.2 billion yuan. Runway has been reported to be in talks for a 450 million US dollar funding round. Companies such as Aishi Technology, Shengshu Technology, Sand AI, and Haiper AI have all received institutional funding. Pika and HeyGen received 80 million and 60 million US dollars in funding in June, respectively, with post-investment valuations of approximately 500 million US dollars each.

From this perspective, it is precisely the "window period" left by Open AI due to cost considerations that has given other companies in this track the opportunity to seize the initiative and run ahead.

What makes AI video popular?

Marx once said, "Capitalists will sell the rope with which they hang themselves." Similarly, in the capital market, money always flows where it should. The reason why so many companies and hot money are flooding into the AI video industry is that the rapid development of AI technology is reshaping the video production industry, thus creating enormous market potential.

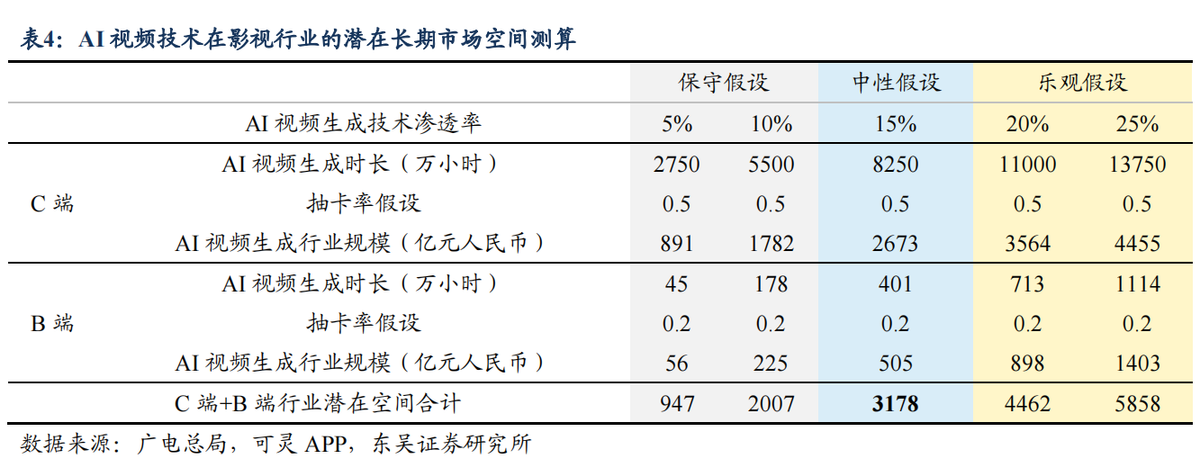

According to estimates by Dongwu Securities, under neutral assumptions, the potential market space for AI video generation in China is 317.8 billion yuan, with the C-end and B-end markets accounting for 267.3 billion yuan and 50.5 billion yuan, respectively.

The core support for building this multi-billion-yuan market lies in the existing demand for cost reduction and efficiency enhancement in video production enterprises, which will continue to drive the penetration rate of AI in video production and bring revenue growth to related enterprises.

In terms of cost reduction, taking movies as an example, according to Dongwu Securities' estimates, before 2018, the production cost of a movie made in the traditional way ranged from approximately 23 million to 170 million yuan per movie. With the addition of AI, not only can the production cycle be shortened, but some personnel can also be replaced in the production and promotion stages of the movie, ultimately reducing the production cost of each movie to 25,000 yuan, a cost reduction of over 95%.

In terms of efficiency enhancement, judging from the currently released products, the technology for AI-generated videos is still evolving rapidly: From the introduction of video generation technology at the beginning of 2023 to the release of Sora in February of this year, it took only one year; in June of this year, Kuaishou Keling was released and has undergone nine iterations in just three months, with improvements in the model's understanding ability, controllability of generation results, and yield rate.

In July of this year, AI micro-shorts titled "Sanxingdui: Revelations of the Future" and "Wonderland of Mountains and Seas: Slicing Through Waves" were released on Douyin and Kuaishou, respectively, pioneering the application of AI in the short video field.

In September, the three major traditional video platforms, iQIYI, Youku, and Tencent Video, also began to ramp up their efforts and increase support for AI creation. Taking Youku as an example, it recently announced a new short film revenue-sharing rule, raising the unit price of exclusive short films from 6 yuan to 16 yuan for S-grade films and from 4 yuan to 8 yuan for A-grade films. In addition to the new user acquisition coefficient, the revenue-sharing income of short films with good data performance can increase by up to 120%. Youku has promised to give 70% of the revenue to the producer.

From this perspective, AI video is undergoing iterations similar to those of large AI models, evolving spontaneously towards lower costs, wider application ranges, and higher technical capabilities. When AI video tools evolve from "toys" to "productivity tools," they may reach a "singularity" in user scale, driving the data flywheel and promoting further industrial development.

A new round of the "traffic battle" is coming. Who will become the next Open AI?

In the era of text AI, America's Open AI took the lead among global AI companies with its technological advantages in underlying computing power and algorithms, becoming the "first one to eat the crab." Today, in the era of video AI, China's major internet companies have significantly accelerated their pace and are unwilling to be followers again.

Previously, ByteDance positioned Jianying as a P0-level project, led by former CEO Zhang Nan, seeking breakthroughs in AI-assisted creation. Zhang Nan said, "AI image generation technology will bring tremendous changes and possibilities to the content creation tool industry."; Kuaishou positioned "Keling" as a strategic project, led by technical expert Wan Pengfei. Less than a month after the project's launch, it received support from Cheng Yixiao in terms of funding, GPUs, talent, and more; in addition, companies such as Meitu and Wondershare Technology have also intensified their efforts in AI video functions, launching multi-modal AI large models such as Meitu Qixiang and Wondershare Canvas.

The reason they attach such importance to AI video projects is not only to generate revenue but also, more importantly, to compete for traffic. After all, with the support of AI, the threshold for creation will become lower, enabling more users to transform from content consumers to content producers, thereby providing a richer supply of content and winning the "traffic battle" in the new AI era.

Moreover, compared to Open AI, domestic video and editing vendors naturally have more accumulated video data. According to QuestMobile data, in June 2024, short video MAU reached 1 billion, with an average monthly usage time per user of 61 hours, significantly ahead of other channels and highly concentrated in top apps like Douyin and Kuaishou.

This accumulation enables Chinese vendors to have inherent advantages in terms of training data, application scenarios, and user scale when developing AI video models. Among them, data is the key to training high-quality models, scenarios determine the market adaptability and commercial potential of products, and users can provide feedback to help products iterate faster.

It is precisely with the leadership in these three essential elements that Douyin and Kuaishou have now surpassed OpenAI and pioneered the era of inclusive AI video in China, the world's largest video consumption market. Meitu and Wondershare are also accelerating their pursuit of Adobe in the field of AI video editing.

From this perspective, in the era of AI video, to become an industry leader, one must not only have a deep accumulation of video content but also possess robust AI model training capabilities and be able to withstand the test of user application scenarios. In this "video industry revolution" triggered by AI, China's video giants may take on the role of leaders.

Source: Hong Kong Stocks Research Community