Can Douyin's shelf market pick up the baton after live streaming e-commerce reaches its saturation point?

![]() 10/23 2024

10/23 2024

![]() 591

591

As mentioned in our previous article, the competition among top live streamers during the Singles' Day shopping festival illuminated the evolution of Douyin's traffic distribution rules. However, for Douyin E-commerce, the need for transformation may be more pressing than identifying the next superstar.

As previously discussed, since September 26th, when Yang Xiao, a popular Douyin streamer, was penalized for false advertising, less than half a month later, top streamers like Tingquan Jianbao, Mr. K, and Da Bing all announced that they would halt their broadcasts, giving a sense of collective retreat from the spotlight.

The title of top streamer seems like a hot potato, but with Douyin's highly centralized traffic distribution system, no one can truly secure the throne. According to a report by LatePost, Douyin conducted multiple tests in the first half of 2022 and found that once the platform's e-commerce content exceeded 8% of its total content, it significantly impacted the user retention and engagement time on the main platform.

The groundwork for the second path was laid early on. At the Second Douyin E-commerce Ecosystem Conference in May 2022, Douyin announced that it would upgrade interest-based e-commerce to omnichannel interest-based e-commerce, further expanding into shelf e-commerce. In 2022, Douyin E-commerce's GMV reached $208 billion (approximately RMB 1.41 trillion), a 76% increase from 2021, indicating that it was still on a high-growth trajectory.

At that time, Douyin E-commerce's president reported that shelf scenarios accounted for approximately 20% of the platform's overall GMV and predicted that this proportion would reach 50% in the future.

However, after a period of rapid expansion, Douyin E-commerce's sales growth began to slow down this year, increasing the sense of urgency.

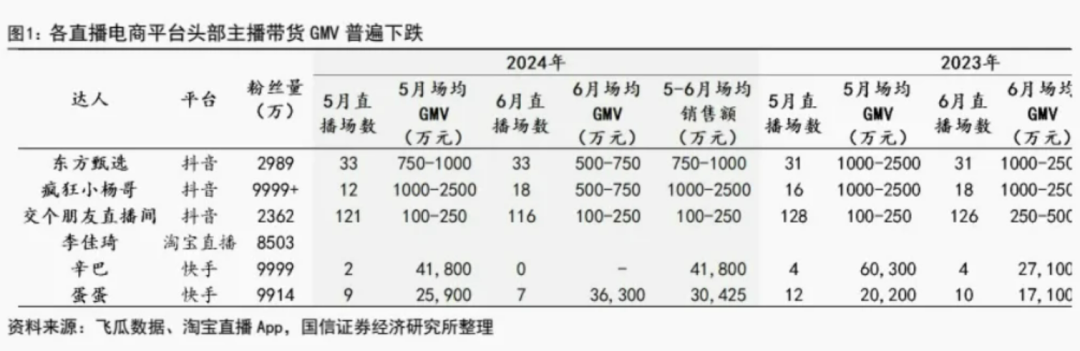

In a report published on September 30th, Guosen Securities noted that since March of this year, the GMV growth rate of live streaming e-commerce, led by Douyin and Kuaishou, has declined significantly. In May and June, the GMV of top influencers' live broadcasts on Douyin, Kuaishou, and Taobao halved. Specifically, Douyin's content-based GMV growth rate fell to single digits in the first half of 2024, while the shelf scenario lacked independent profitability, resulting in an overall GMV growth rate drop from over 60% to around 20%.

E-commerce cannot rely solely on content for growth, and the development of shelf scenarios has been increasingly mentioned. On October 17th, Douyin E-commerce's "Merchant Growth in Live Streams" event released data showing that Douyin E-commerce's GMV increased by 46% year-on-year last year, while the GMV of shelf scenarios increased by 86% year-on-year.

Correspondingly, according to LatePost, ByteDance's advertising revenue in China grew at a slower pace in the first three quarters of this year, with the year-on-year growth rate in a single quarter falling from around 40% to less than 17%, and the company failed to meet its targets in the past two quarters.

A well-established shelf scenario seems to have become a necessary condition for Douyin E-commerce to land safely.

01. The Urgency of E-commerce Transformation

Douyin's shelf e-commerce development has significantly accelerated this year.

In the simplest terms, shelf e-commerce corresponds to "people finding products," while live streaming e-commerce corresponds to "products finding people." From a consumer journey perspective, the starting point of shelf e-commerce is search, with a relatively clear intention to purchase, while live streaming e-commerce begins with browsing, where consumers are attracted to products while consuming content, leading to less well-defined purchasing intentions.

Merchants operating under these two models follow different traffic logic. Shelf e-commerce relies on advertising to drive traffic and requires purchasing traffic from the platform to gain visibility. In contrast, live streaming e-commerce's traffic is inseparable from content output, relying on interest-based distribution to push products to users. These fundamental differences give rise to different behaviors, such as the stimulation of impulse purchases in live streaming e-commerce, often leading to higher return rates.

Since the core of shelf scenarios is to meet consumers' "immediate purchasing needs," enabling them to quickly complete the entire process from awareness to purchase in a specific scenario, the development of shelf scenarios pays particular attention to path and product display adjustments, such as refining search functions and product cards.

We can observe shifts in strategic focus from the evolution of the business methodologies promoted by the platform.

From 2021 to 2024, Douyin E-commerce's primary methodologies have been "FACT," "FACT+," "FACT+S," and "CORE," each highlighting where merchant traffic comes from and its distribution logic.

The original FACT model was a typical live streaming e-commerce operating model, based on a progressive traffic explosion path that includes merchant self-broadcasting, influencer outreach, joint marketing, and top influencer collaborations. Starting with the addition of a "+" sign, the operating field gradually expanded from content-based scenarios like live streams and short videos to shelf scenarios dominated by the mall and search. The subsequent addition of "S" directly underscores the increasing importance of search (Search) and the shopping center (Shopping Center) in e-commerce operations.

The CORE methodology this year emphasizes cost-effectiveness (Cost vs. Quality), omnichannel content (Omni-Content), marketing amplification (Reach), and experience enhancement (Experience), essentially requiring merchants to actively improve their competitiveness. Merchants must not only provide quality content but also amplify their influence through omnichannel operations, offer products with both quality and value, and ensure that supporting services do not fall short.

Compared to the past focus on content creation, live streaming sales, and user engagement through interest-based distribution mechanisms, Douyin is now calling for merchants with stronger product management capabilities, price competitiveness, supply chain efficiency, and better adaptability to shelf market competition.

Earlier this year, Douyin E-commerce launched the "Douyin Mall" app, forming an independent e-commerce shopping platform separate from the main app, further emphasizing its move towards traditional e-commerce and shelves. Judging from its interface, Douyin Mall is indistinguishable from typical shelf e-commerce platforms like Taobao and JD.com.

Douyin's sense of urgency is understandable. Apart from its own decelerating GMV growth, as mentioned in our previous article, iResearch predicts that China's live streaming e-commerce market will grow at a compound annual growth rate (CAGR) of 18.0% from 2024 to 2026, indicating a flattening growth curve. The rapid development of live streaming e-commerce in recent years has partly benefited from accelerated inventory turnover for merchants during destocking cycles. As this cycle draws to a close and the main platform's advertising revenue growth begins to slow, the pressure to pivot becomes evident.

Moreover, merchants seeking a way out amidst high competition may face even greater urgency than Douyin.

02. Merchants Need More Self-Sustainability

"Makeup must be sold through live streams," which became an industry consensus during the rapid development of live streaming e-commerce. An insider from the cosmetics industry shared that new brands incubated around 2021 quickly gained popularity by securing spots on top streamers' channels, resulting in explosive sales even during cold starts. "The order volume far exceeded our expectations, even surpassing the factory's production capacity. We had to urgently contact the streamer who was still promoting our products to remove the links."

This is the rationale behind the rapid growth of live streaming e-commerce. The platform can bring sales increments far above the average for merchants, who are willing to pay higher marketing and promotion fees in return. Consumers benefit from the "channel discounts" or real-time emotional value provided by streamers. This mutually beneficial value creation process has given live streaming e-commerce remarkable monetization capabilities that envy its peers.

However, as the operating models of live streaming e-commerce become increasingly refined, the relationship among multiple stakeholders in this value chain has begun to loosen after several rounds of negotiation.

Considering a phenomenon, according to Guosen Securities' compilation, it becomes evident that compared to the same period in 2023, the GMV generated by top streamers on various live streaming e-commerce platforms has decreased to varying degrees when comparing the number of live streams. In layman's terms, streamers seem less effective at driving sales than before.

(Source: Guosen Securities)

The causes of this change are complex. A consensus is that the market is currently buyer-driven, and consumers are becoming increasingly rational, comparing prices, quality, and services comprehensively. Impulse or emotional purchases are becoming more sporadic.

Simultaneously, the cost of platform traffic has been rising. For instance, as Douyin E-commerce gained popularity, a massive influx of "gold diggers" entered the platform. However, considering the user experience on content platforms, advertising slots cannot be indefinitely increased. Furthermore, the short video track is approaching its user growth ceiling, making limited traffic resources increasingly competitive. Additionally, the high return rate characteristic of live streaming e-commerce indirectly raises marketing costs, leading merchants to feel that "throwing money at it doesn't yield the same results as before."

Changes are also evident from the consumer's perspective. In the live streaming e-commerce ecosystem, merchants must consider influencer commissions and invest more in technology and creativity to optimize advertising performance. Under this structure, it is difficult to keep product prices competitive. Paradoxically, in the current industry competition, low prices hold absolute priority.

Moreover, recent controversies surrounding streamers have continuously highlighted the trust risks in live streaming e-commerce.

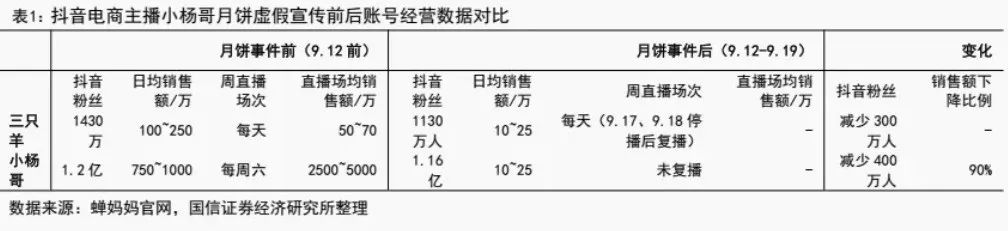

The "Hong Kong Mei Cheng Mooncake" incident related to Yang Xiao's broadcast halt is a typical case of streamer trust crisis. The mooncake brand claimed to be a "Hong Kong brand specializing in high-end mooncakes" but had no physical stores in Hong Kong. Guosen Securities compared the account's operating data before and after Yang Xiao's false advertising of the mooncakes, revealing a significant drop in follower count and daily sales.

(Source: Guosen Securities)

The industry's wild growth phase is over, and relevant policies and regulations are becoming more comprehensive. The Regulation on the Implementation of the Law of the People's Republic of China on the Protection of Consumers' Rights and Interests, published in April this year, specifically addresses new areas like live streaming sales, clarifying the primary responsibility of live streamers, prohibiting practices such as "fake orders to boost ratings," "forced bundling," and "big data price discrimination."

Against this backdrop, the recent halt of broadcasts by "up-and-coming top streamers" can be seen as a strategic retreat signal. As the future of live streaming sales becomes increasingly uncertain, merchants need e-commerce platforms with self-sustainability capabilities, which falls on the shoulders of shelf scenario development.

03. Final Thoughts

Douyin is not alone in actively deploying shelf e-commerce strategies. Shelf and content are not mutually exclusive.

Kuaishou, also founded on content, emphasized the growth of its pan-shelf scenarios in its Singles' Day e-commerce report released on October 19th, with pan-shelf GMV increasing by 128% year-on-year on the 19th.

Emerging players like WeChat's Mini Program e-commerce have also made moves, adding a "Store" channel to search results pages, creating a fixed e-commerce entry point within search scenarios and presenting store and product information in a list format, both common shelf planning practices.

However, it should be noted that shelves are not necessarily the optimal solution for e-commerce operating models. While typical shelf e-commerce players like Alibaba, JD.com, and Pinduoduo each face their own pressures, the shelf model at least offers stability. In the shelf e-commerce model, consumers come to the platform with relatively clear purchasing intentions, seeking to fulfill specific needs. Products are organized and displayed systematically, offering a wealth of options and easy access.

Showcases, advertising slots, and storefronts, coupled with a comprehensive supply chain and logistics system, facilitate better connections between merchants and consumers, fostering long-term relationships and repeat purchases. Compared to content-driven, "pulsed" sales performance in live streaming e-commerce, shelves offer greater stability in long-term operations.

As the tide of competition rises, failing to build solid competitive barriers during periods of rapid growth may leave stability as the only viable option.

*Images and illustrations in the article are sourced from the internet.