ZTE: Revenue and profit decline in Q3, with domestic market pressure on pillar businesses

![]() 10/24 2024

10/24 2024

![]() 544

544

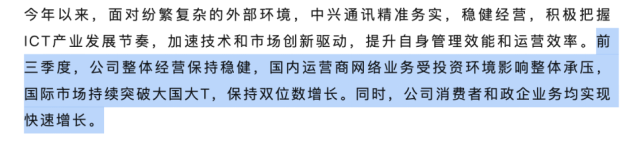

On October 21, leading information and communication technology equipment provider ZTE Corporation (000063.SZ) released its third-quarter results for 2024, showing slight growth in both revenue and net profit attributable to shareholders.

Stockstar notes that despite the apparent growth, there are still hidden concerns behind ZTE's performance. The growth rate of the company's net profit attributable to shareholders has slowed significantly in recent years, dropping to a single-digit figure. While the slight increase in net profit is partially due to reduced period expenses, a more crucial factor is the increase in software tax rebates, which contributed over 20% of the company's profit.

Simultaneously, the company's pillar business – carrier networks – has been under pressure in the domestic market due to investment environment factors. Looking at a single quarter, ZTE experienced a decline in both revenue and profit in Q3.

In the secondary market, ZTE's A-shares and H-shares both experienced significant declines on the first trading day after the announcement of its third-quarter results. On October 22, ZTE's A-shares fell nearly 6% intraday, closing down 5.14% at 30.08 yuan per share, with a current market value of 143.9 billion yuan. Meanwhile, the H-shares closed down 8.03% at 19.36 Hong Kong dollars per share, with a market value of 92.6 billion Hong Kong dollars.

01. Software tax rebates contribute 21% of net profit

Public information shows that ZTE provides ICT (Information and Communication Technology) technology and product solutions to telecom operators and government and enterprise customers, as well as terminal products to individual consumers.

According to the company's third-quarter report for 2024, ZTE achieved revenue of 90.045 billion yuan, an increase of 0.73% year-on-year, and net profit attributable to shareholders of 7.906 billion yuan, a slight increase of 0.83% year-on-year. However, compared to the 14.97% growth in the same period last year, the growth rate of net profit attributable to shareholders has slowed significantly.

Quarterly analysis shows that ZTE experienced a decline in both revenue and profit in Q3. The company's Q3 revenue was 27.557 billion yuan, a year-on-year decrease of 3.94%, while net profit attributable to shareholders was 2.174 billion yuan, a year-on-year decrease of 8.23%. JPMorgan Chase noted that ZTE's third-quarter revenue and earnings were 16% and 9% lower than market consensus, respectively.

Amid declining net profit, the company's operating cash flow came under pressure, with a net cash flow from operating activities of 1.049 billion yuan in Q3, a year-on-year decrease of 63.02%.

Stockstar notes that the reduction in period expenses helped to some extent to increase the company's net profit in the first three quarters of this year.

During the reporting period, the company's period expenses were 28.087 billion yuan, a decrease of 795 million yuan compared to 28.882 billion yuan in the same period last year, and the period expense ratio fell from 32.31% to 31.19%.

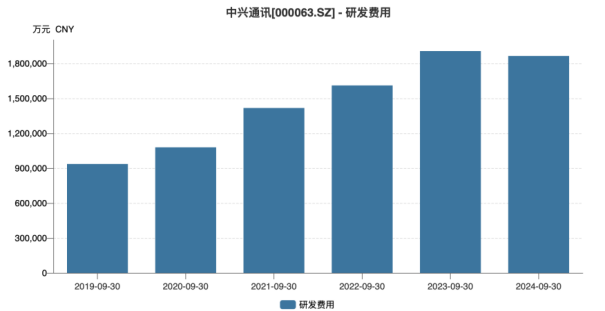

In terms of individual expenses, the company's administrative expenses decreased significantly, falling 15.13% year-on-year to 3.232 billion yuan. ZTE, which has always prioritized research and development, also reduced its R&D expenses. In the first three quarters of this year, ZTE's R&D expenses were 18.641 billion yuan, a year-on-year decrease of 2.2%, marking the first decline in third-quarter R&D expenses since 2019.

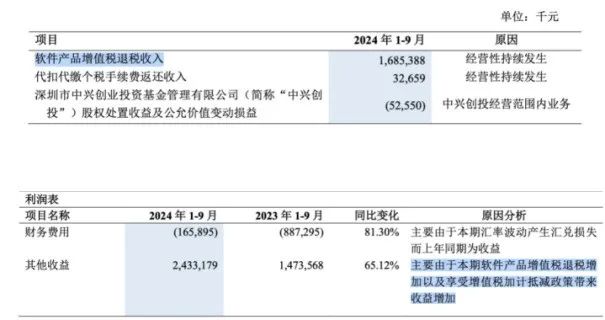

In addition to the reduction in period expenses, software tax rebates contributed over 20% of ZTE's profit.

In the first three quarters of this year, due to increased VAT rebates on software products and the benefits of the VAT additional deduction policy, the company's other income increased by 65.12% year-on-year to 2.433 billion yuan, accounting for 31% of the company's current net profit, up from 19% in the same period last year.

Among them, the company's income from VAT rebates on software products was 1.686 billion yuan, an increase of 42% year-on-year, accounting for 21% of the company's net profit attributable to shareholders, up from 15% in the same period last year.

Although the company's net profit attributable to shareholders increased, its core net profit declined. In the first three quarters of this year, the company's core net profit was 6.898 billion yuan, a year-on-year decrease of 2.86%.

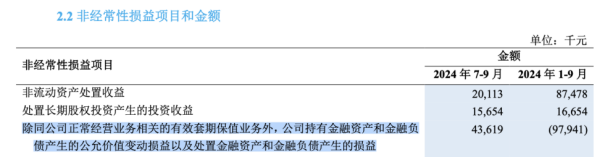

In the company's non-recurring gains and losses breakdown, in addition to effective hedging activities related to the company's normal business operations, there was a significant increase in fair value changes arising from the holding of financial assets and liabilities, as well as gains and losses arising from the disposal of financial assets and liabilities, which increased by 67% year-on-year, pushing up the total amount of non-recurring gains and losses. In the first three quarters of this year, the company's total non-recurring gains and losses were 1.008 billion yuan, an increase of 36% year-on-year.

02. Domestic carrier network business under pressure

By customer segment, ZTE's main businesses include carrier networks, consumer business, and government and enterprise business. Among them, carrier networks are the company's pillar business, accounting for nearly 60% of the company's revenue, with main products being carrier networking equipment, including wired and wireless products.

Although the company did not disclose revenue figures for its three main businesses in its third-quarter report, Stockstar notes that the company mentioned on its official public account that both its consumer and government and enterprise businesses grew in the first three quarters, while the domestic carrier network business was under pressure due to the investment environment.

Combined with the half-year report results, the carrier network business was the only one among the company's three main businesses to experience a decline in revenue, falling 8.61% year-on-year to 37.296 billion yuan. This is mainly due to the overall slight decrease in capital expenditure plans by China's three major telecom operators this year, with wireless investment starting to decrease. Wireless product revenue is the foundation of the company's performance, so changes in domestic carrier investment have affected this part of the business.

Stockstar notes that in the third-quarter report, the company's gross margin did not improve significantly, falling 3.24 percentage points year-on-year to 40.43%. In fact, in the half-year report, due to the decline in gross margin of the government and enterprise business, ZTE's overall gross sales margin declined year-on-year to 40.47%. (This article was originally published on Stockstar, written by Li Ruohan)

- End -