This "leverage war" will determine the competitive landscape of China's e-commerce industry in the coming years

![]() 10/25 2024

10/25 2024

![]() 446

446

This article is based on publicly available information and is intended for informational exchange only and does not constitute any investment advice

Autumn 2024 has brought a chill to China's e-commerce industry, but this chill is not indicative of the rise and fall of the industry cycle; rather, it stems from the successive decline of top livestreamers.

Represented by Little Yangge and Northeast Yujie, the trend extends back to Viya , Li Jiaqi, and ripples out to Xinba, Dong Yuhui, and even celebrity endorsement scandals. The breadth and intensity of these incidents are eerie and almost supernatural.

As a result, a narrative has emerged and gained widespread support: the once-prosperous "KOL economy" is on the decline, platforms no longer need these top livestreamers, and sales channels will shift from centralized to decentralized structures. While outsiders watch the spectacle, insiders see the real story. We must remain vigilant: are we clear-headed enough to understand the essence of these phenomena?

As the saying goes, "Heaven's laws are constant; they do not exist for the virtuous Yao and do not perish with the wicked Jie." In reality, what we see is the collapse of influencers due to human weakness and greed, but what we don't see is the far-reaching and cutthroat "leverage war" behind it all.

01 The Primacy of Time Value in Livestream E-commerce

This "leverage war" is still raging, and the outcome remains uncertain. In this article, we will explore its mechanisms and significance from a fundamental perspective.

...When discussing the elements of production value, we tend to focus on supply and demand while neglecting the most crucial element: time. To put it more simply: almost all trade activities are based on the value of time. Both economic theorists and practitioners recognize this clearly. In Marxist theory, the concept of socially necessary labor time is introduced in Volume 1 of Capital, arguing that every commodity's production involves socially necessary labor time, which constitutes its intrinsic value. In Western economic principles, time is also a crucial dimension for valuing goods and services. Beyond measuring basic labor value, complex formulas are used to standardize the value of money and wealth across different time frames.

Hence, concepts like present value, future value, discounting, and discount rates emerge in fundamental value calculation formulas. In practice, whether in ancient barter systems or modern, complex, currency-centric business models, the value of time remains central. For example, trading a stone axe for three liang of rice is based on the approximation of labor hours required to produce each item. In modern internet economies, the three primary monetization channels—e-commerce, advertising, and gaming—are no exception. E-commerce reduces the cost of goods distribution, advertising builds channels at low cost, and gaming accelerates the path to achievement through monetization. In all these cases, time serves as a key production factor. Reexamining livestream e-commerce through this lens reveals that it seemingly defies modern economic principles by facilitating human-to-goods matches within minutes, extending consumer engagement to hours in livestreams. Consequently, some argue that livestream e-commerce is merely mobile TV shopping.

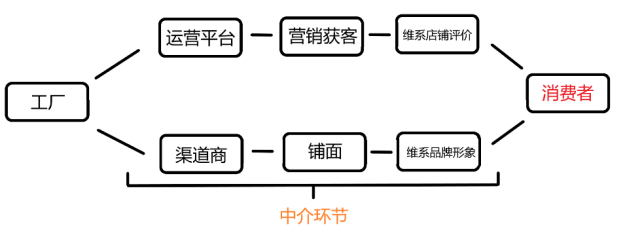

However, as we explored in "The 7-Year War Between Short Videos and E-commerce," livestream e-commerce's impact on trade and consumption far exceeds that of TV shopping. While livestream e-commerce may increase content consumption time, it shortens the supply chain by eliminating intermediaries. Traditional store-centric e-commerce involves online operations, marketing, and maintaining store traffic and ratings, whereas livestream e-commerce simplifies the process by requiring only marketing costs, reducing branding and store maintenance efforts.

Figure: Illustration of intermediary links in the consumer supply chain. Source: Jinduan Research Institute. Livestream e-commerce addresses traditional merchants' pain points, particularly those unfamiliar with marketing. Factories often lack branding and maintenance expertise, but algorithms and KOLs can now directly connect them with consumers. Thus, livestream e-commerce isn't a betrayal of modern economics despite potentially reducing human-to-goods matching efficiency; it shortens trade chains, and its true value lies in whether the efficiency gains from shortened chains can effectively offset the reduced matching efficiency. This requires leverage.

02 KOLs as the Critical Lever for Current E-commerce Platform Development

The law of conservation of energy applies universally; trade chains don't disappear but shift. Livestream e-commerce is no exception. Traditional e-commerce's customer acquisition, operations, and store evaluation functions are essentially integrated into KOLs, who embody trade credit systems and attract fans through content, a form of customer acquisition. Can the efficiency gains from shortened trade chains in KOL-driven livestream e-commerce effectively offset reduced human-to-goods matching efficiency?

First, let's examine the core of these efficiency gains and the challenges KOLs solve for platforms and merchants. For platforms, consider this: in 2017, China had 533 million online shoppers; today, that figure stands at 915 million, nearly matching the 968 million people aged 14-65. This means the major e-commerce platforms like Taobao, JD.com, Pinduoduo, and short video platforms like Douyin and Kuaishou have little room for new users. Instead, they compete on daily and monthly active user ratios (DAU/MAU), indicating user engagement.

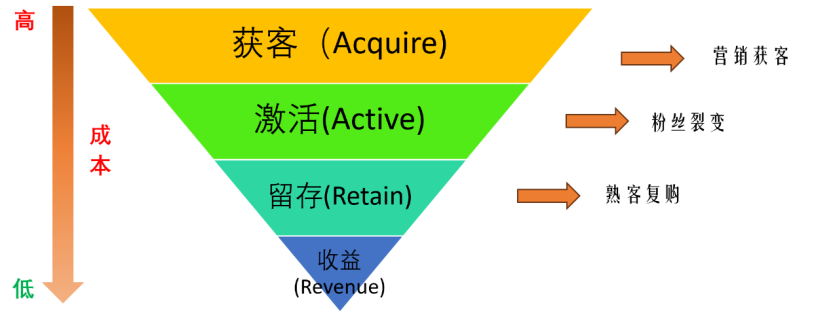

Content is the most effective lever for boosting engagement. From 2016 to 2019, Taobao's overall DAU/MAU ratio increased by about 10.3 percentage points, coinciding with the boom of Taobao Live, demonstrating that even KOL-driven shopping can significantly increase user frequency and duration. In internet marketing, viral customer acquisition costs less than traditional marketing and facilitates transactions, underpinning brand building.

Figure: Funnel diagram of internet consumption links. Source: Jinduan Research Institute. KOLs' credit systems are stronger than traditional store credit systems. Social learning theories in marketing and behavioral science emphasize the influence of social circles on decision-making, fostering group effects. In philosophy, human-to-human communication involves intersubjectivity, where both parties are independent decision-makers influencing each other. Human-to-object communication lacks this interaction because objects aren't independent decision-makers. Many entrepreneurs now recognize the leverage of individual IP promotion over corporate promotion.

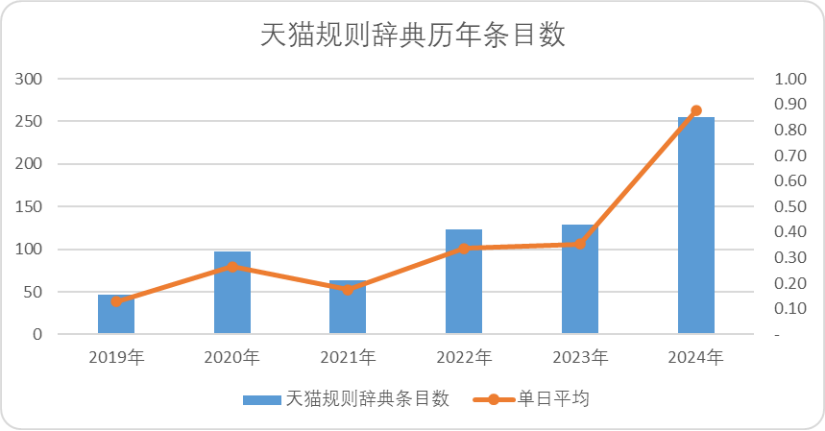

For merchants, direct feedback between KOLs and consumers is harder to achieve across platforms. New stakeholders complicate business. Major e-commerce platforms have undergone significant shifts, with platforms balancing investor, consumer, and merchant interests through rules and mechanisms, raising operational costs. According to incomplete statistics from Tmall's rule dictionary, 255 new rules were introduced this year, averaging 0.88 per day, making it challenging for merchants to keep up.

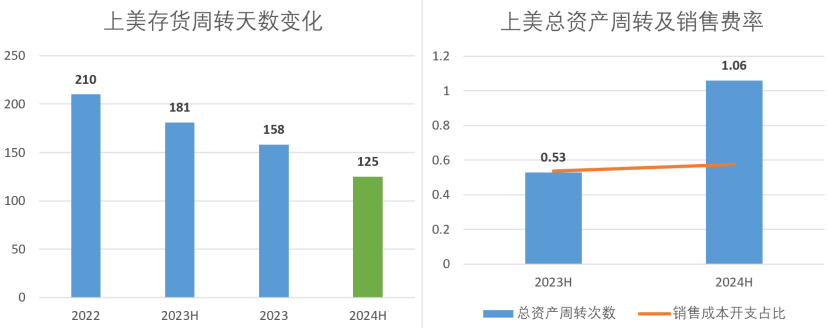

Figure: Number of entries in Tmall's annual rule dictionary. Source: Tmall official website, compiled by Jinduan. Professional KOLs and MCN agencies become lifelines, despite controversies over their fees. For merchants weighing pros and cons, top content and marketing channels may be optimal solutions. For instance, Jahwa, a cosmetics company that regained popularity through Douyin, reduced inventory turnover from 210 to 158 days in 2022-2023 and further to 126 days in Q2 2024. Total asset turnover doubled year-on-year due to faster inventory turnover, with only a 4 percentage point increase in selling expenses (from 53.6% to 57.6%), insignificant compared to overall operational efficiency and ROI.

Figure: Comparison of Jahwa's operational data before and after its livestream success. Source: Choice Finance Client. Without new technologies or channels, e-commerce and content platforms heavily rely on KOL fan bases for low-cost marketing and operations. Platform commercialization and KOLs are two sides of the same coin. Scale is crucial for profit leverage in modern economics, applicable to manufacturers, channels, and platforms alike. Many believe a lack of content slows community or traditional e-commerce platform commercialization, but this isn't the case. The challenge lies in unbalanced content structures, where abundant UGC masks a lack of PGC, limiting professional commercial demand fulfillment. This is why platforms like Xiaohongshu transitioned from branding to monetization, promoting KOLs like Dong Jie and Li Dan. For traditional e-commerce platforms, lack of KOLs stifles demand creation, leading to traffic issues as demand narrows.

Finally, let's delve into the logic behind reduced human-to-goods matching efficiency. Returning to our earlier question: can efficiency gains from shortened trade chains in the KOL model offset reduced matching efficiency? We've analyzed trade chain shortening's advantages. Now, let's address reduced matching efficiency. Viewers skeptical of livestream shopping often wonder why anyone would waste time on what could be a swift transaction, especially when price advantages aren't exclusive to livestream e-commerce. We overlook two factors: underestimating consumers' free time and their emotional and cognitive needs. While average work hours increase, only half of online shoppers have regular jobs, leaving ample time for content consumption. Livestream e-commerce surpasses TV shopping in emotional output. Tragic drama is more impactful than comedic, providing long-term emotional value.

Most content offers cognitive (tragic) value over emotional (comedic) value. Livestream e-commerce follows this logic, with KOLs like Li Jiaqi, Dong Yuhui, and Jiao Pengyou offering cognitive value beyond entertainment. For content consumers, choosing different content based on needs isn't time-wasting but fulfilling individual needs.

In summary: 1) KOLs are currently the most cost-effective solution for platform customer acquisition, providing traffic leverage. 2) KOLs optimize supply chains, offering cost leverage. 3) KOLs fulfill viewers' emotional and cognitive needs, providing content leverage. 4) Core is the dilution logic: larger fan bases yield stronger KOL leverage effects. Thus, platforms rely on KOLs, and top influencers will always be present.

03 Conclusion: A generation will grow old, but others will always be young

Of course, KOLs have vulnerabilities, particularly weak resilience. Credit systems built around individuals or agencies can collapse due to a single misstep.

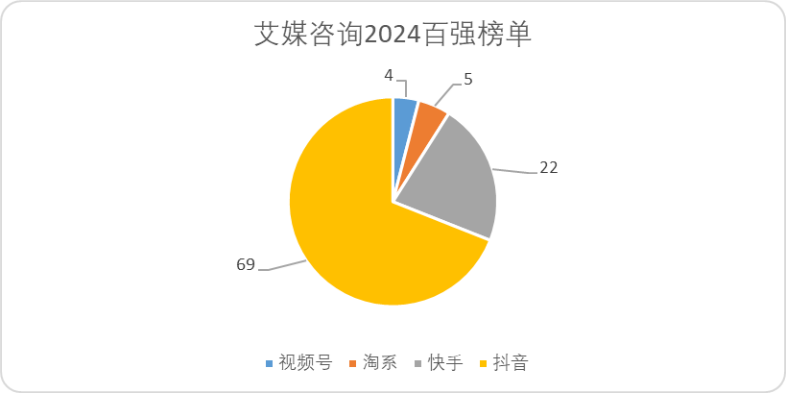

This vulnerability fuels the "leverage war." The solution? Perhaps none exists. Core to resilience is recognizing crisis potential and taking defensive action, which few achieve. Top livestreamers often have strong personal brands but limited education. They attribute success to vision and hard work, unaware of the cyclical nature of fame. However, the KOL economy isn't flawed. For platforms generating demand through content (like Douyin, Kuaishou, and future Xiaohongshu), KOLs can be mass-produced by selecting and nurturing creators. According to iResearch's "2024 China's Top 100 Live Streaming Sellers Ranking," Douyin leads with 69 spots, followed by Kuaishou (22), Taobao Live (5), and WeChat Video Accounts (4).

Figure: Ranking and source classification of top 100 live streaming anchors in 2024 by iMedia Research, Source: iMedia Research

Therefore, before significant advancements in technology and business models, regardless of which celebrity or internet celebrity collapses, it will not affect the demand for KOLs in live streaming e-commerce, nor will it alter the platform's strategy of continuing the KOL economy. In other words, even if more top anchors become embroiled in controversy, "KOL Economics" remains the optimal solution for the e-commerce industry at this stage - KOLs, have been, are, and will continue to be, the primary "lever" that shapes the competitive landscape of e-commerce.

After all, past mistakes serve as lessons for the future, and one generation will eventually age, but there will always be new, young people coming up.