Why does Double 11 feel less and less exciting?

![]() 10/25 2024

10/25 2024

![]() 645

645

Editor | Jiran

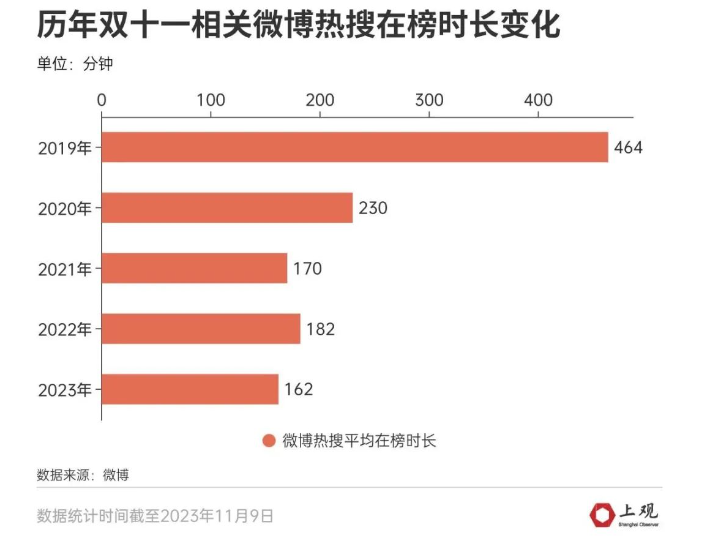

It's been two weeks since Douyin kicked off the 2024 Double 11 shopping festival, but the festive atmosphere remains muted, failing to evoke a strong sense of excitement.

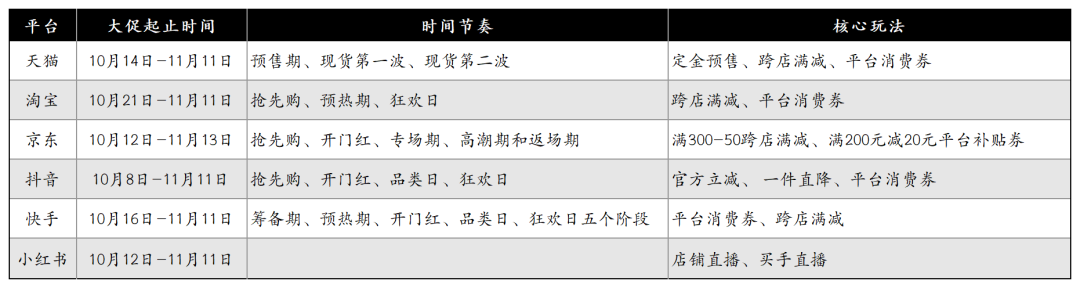

After 16 years, Double 11 has grown from a one-day event to an 11-day extravaganza and now spans over 20 days. This year, Tmall, JD.com, and RED offer promotions spanning 28, 33, and 30 days respectively, making it the longest Double 11 ever. Many netizens joke, "Why not just move Double 11 to the National Day holiday? It's getting longer every year!"

Source: Compiled from public information

In terms of gameplay, Double 11 has evolved from straightforward 50% discounts and direct price cuts to complex promotions involving deposit pre-sales, balance payments, cross-store discounts, and intricate calculations that have been widely criticized by consumers. The longer the event and the more complicated the promotions, the less engaged consumers become, making Double 11 seem increasingly unappealing. As a result, the 2023 Double 11 shifted to a straightforward price war.

Source: Shangguan News

"There are subtle differences in the strategies adopted by various e-commerce platforms this year. For example, Tmall has revived its pre-sale model, while JD.com is offering subsidies of RMB 20 off purchases of RMB 200 or more to all merchants, aiming for wide user coverage, a large product base, and strong cross-selling effects. Furthermore, after the success of last year's live streaming during Double 11, JD.com has introduced 'limited-time live streaming prices' for this year's event. Overall, however, the core focus of e-commerce platforms remains on traditional 'big three' promotions: cross-store discounts, individual item discounts, and platform-wide coupons," shared Zhang Shuai (pseudonym), who has worked in the e-commerce industry for many years.

Zhang Shuai added that with e-commerce platforms reaching their traffic limits and integrating various business models (shelf e-commerce, influencer-driven e-commerce, and live streaming e-commerce), consumers' interest in Double 11 is declining. As a result, platforms face significant limitations in developing innovative and engaging promotional strategies that can stimulate consumer purchases.

To encourage merchant participation in Double 11, major platforms have increased support and subsidies. For instance, Douyin offers reduced or waived commission rates for daily necessities and fresh produce, while Taobao provides various store operation solutions, and RED invests billions in traffic and subsidies to support buyers and merchants through traffic incentives, product upgrades, and new matching tools. Nevertheless, most people still feel indifferent towards this year's Double 11.

01

This Double 11, Heavy Investments in Hong Kong

In fact, this year's Double 11 differs from previous years in some significant ways.

Taobao and JD.com have prioritized the Hong Kong market for Double 11. Following the establishment of its first supply chain industrial base in Hong Kong during the 618 shopping festival, JD.com invested an additional RMB 1.5 billion in September, with no upper limit, focused on enhancing Hong Kong consumers' online shopping experience through product and logistics subsidies and service optimization.

Unlike JD.com, Taobao has had an earlier presence in the Hong Kong market. For this Double 11, Taobao is emphasizing shipping and returns. Currently, Hong Kong is designated as a free shipping zone by Ali Group. Consumers can enjoy free cross-border shipping by selecting official direct or consolidated shipping for items marked with 'HK¥99 Free Shipping' and placing orders over RMB 99 on the Taobao app.

However, Hong Kong and Mainland China represent two vastly different 'e-commerce worlds.' Public data shows that nearly 90% of Hong Kong residents prefer using cash, 97% use Octopus cards, 53% use credit cards, and only 20% use mobile payments. Limited mobile payment options contribute to Hong Kong's retail sales reaching HKD 34.2 billion in July, but online sales accounted for only 7.8% of the total. Local e-commerce platforms like HKTV mall, PARKnSHOP, and U Buy We Sell (Yoho) hold a combined market share of 21.5% in the CR5 ranking, raising questions about how much incremental growth JD.com and Taobao can expect in the Hong Kong market.

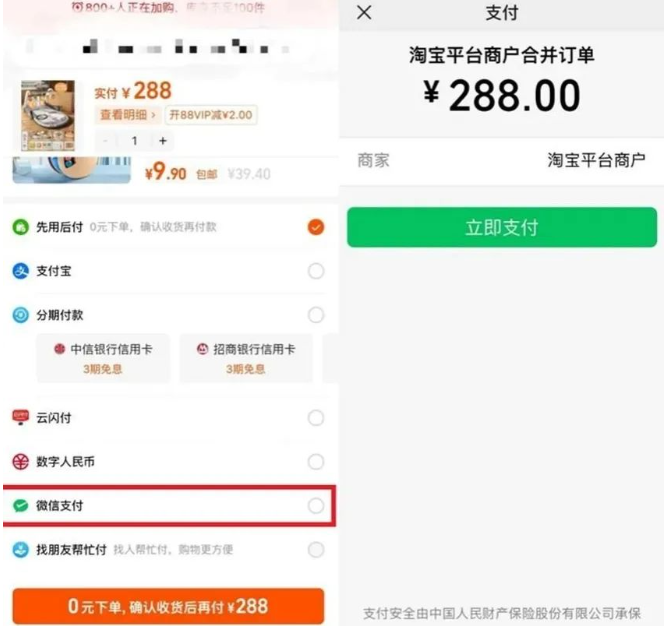

Apart from focusing on the Hong Kong market, interconnectivity has emerged as a significant change for this year's Double 11. On the payment front, Taobao users can now use WeChat Pay and WeChat's 'Buy Now, Pay Later' service, similar to Pinduoduo's model. According to related media reports, JD.com will also integrate Alipay in the future.

Source: Taobao

On the logistics front, Taobao and Tmall plan to integrate with JD Logistics, providing merchants with an additional shipping option expected to be available in mid-October. JD.com, on the other hand, will integrate with Cainiao Express and Cainiao Post, Alibaba's logistics arm, to facilitate seamless services such as package collection, shared shipping entry points, and package storage.

Unlike traditional businesses in the capital market, which are evaluated based on revenue, profit, and debt, the internet industry essentially revolves around traffic and user scale. Key metrics for assessing internet companies in the capital market include user scale, growth rate, market share, future market potential, and strategies for adapting to market changes.

Given this context, in the era of single e-commerce platform competition, platforms must establish a competitive advantage and thwart competitors across key links in the e-commerce value chain to increase user numbers and market share. Examples include the 'Cat vs. Dog' battle and the 'Mobile War,' where JD.com invested heavily in self-built logistics to form a 'logistics wall' against Alibaba's logistics network, and the payment segmentation caused by the rivalry between 'WeChat-based' and 'Alibaba-based' e-commerce platforms.

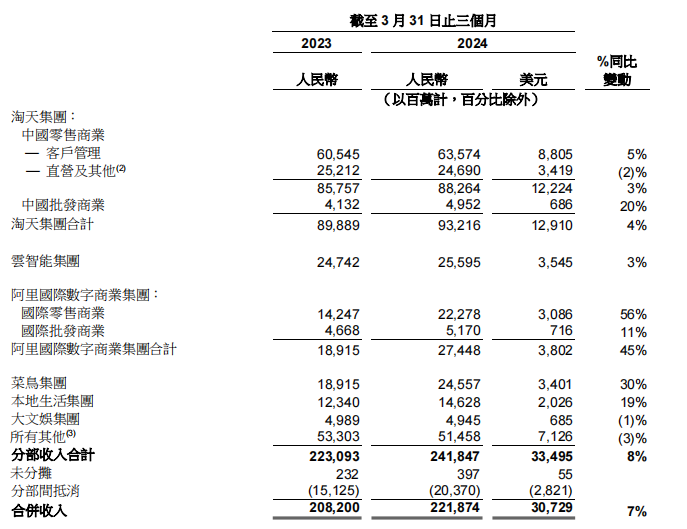

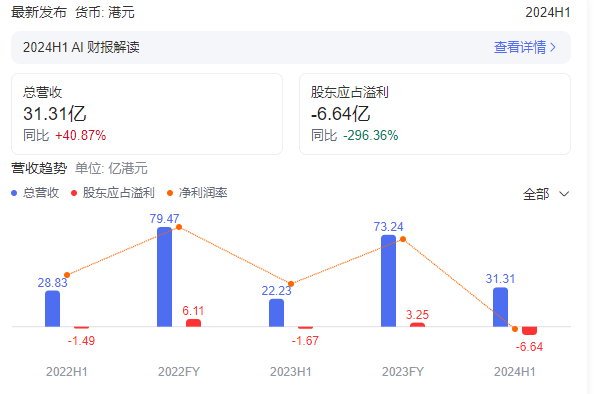

However, whether it's Tmall Group's 4% revenue growth in Q1 2024, which was nearly the lowest among Alibaba's various businesses, JD.com's 3.87% revenue growth in H1 2024, its lowest growth rate since 2020, or Douyin E-commerce's 46% YoY GMV growth in the past year (down from 320% and 80% in 2023 and 2022, respectively), all major e-commerce platforms are facing a noticeable slowdown in growth. To sustain user engagement, expand market share, and maximize capital efficiency through synergies, e-commerce platforms must shift towards competing within a larger ecosystem encompassing more users, merchants, and services.

Source: Alibaba Financial Report

However, while the lower-tier market is vast, it also poses significant barriers, including a relatively closed social network, diverse educational backgrounds among middle-aged and elderly individuals, and fear of unfamiliar technology, creating a significant 'digital divide.' As a result, they tend to rely more on recommendations and guidance from acquaintances when adopting new tools, transferring risk to 'opinion leaders' within their trusted circles. When key figures in their trust networks use WeChat Pay, older individuals view this payment method as trustworthy.

According to QuestMobile's 2021 'China Mobile Internet Development Report,' WeChat's penetration rate in the lower-tier market is significantly higher than Alipay's, especially among individuals over 40 years old, where WeChat's adoption rate exceeds 80%. In other words, Taobao's integration with WeChat Pay can not only help expand its user base among middle-aged and elderly consumers in the lower-tier market but also contribute to WeChat Pay's revenue growth.

Similarly, logistics drives commerce, which in turn supports logistics. The integration of Alibaba and JD.com's logistics systems can enhance Taobao and Tmall users' experience, boosting JD Logistics' performance. More importantly, by sharing user resources and amplifying network effects, this integration can reduce marginal costs associated with independent platform operations, maximizing capital efficiency and synergies.

Additionally, e-commerce companies have recently intensified their forays into niche markets. For instance, Tianyancha App reveals that Tmall has recently established 20 new companies, including Guangzhou Jiaxiang E-commerce, spanning daily necessities, new energy vehicle sales, and home furnishings.

02

Price Wars, High Investment in Traffic, and High Return Rates Diminish Merchants' Enthusiasm for Double 11

While platforms may have noble intentions, the reality is often harsher.

'Just breaking even during Double 11 is good enough.'

'Nowadays, Double 11 feels no different from an ordinary day, and orders are even fewer.'

'I'm already numb to Double 11 promotions…'

These are common refrains among merchants we've spoken to.

Food merchant Hu Yang (pseudonym) shared that although major e-commerce platforms are no longer aggressively promoting 'lowest prices on the internet' during this year's Double 11 like last year, they have intensified full price discounts, essentially another form of 'price war.' To participate, merchants must offer coupons like RMB 300 off RMB 50 or even RMB 300 off RMB 70, in addition to category-specific coupons like RMB 200 off RMB 20 and RMB 99 off RMB 10, which can be stacked with general coupons.

However, due to severe product homogenization in the food industry, the price war on e-commerce platforms favors low-priced products, offline snack discount stores divert sales, and the industry lacks strong brands. As a result, food manufacturers operate with gross margins around 40%, while contract manufacturers earn around 15%, and snack discount stores like Lingshibumen operate with combined gross margins of approximately 19%.

With e-commerce platforms offering discounts like RMB 300 off RMB 50 stacked with RMB 99 off RMB 10 during Double 11, merchants often operate at a loss. Consequently, many hope for fewer orders during Double 11 to minimize losses. When consumers complain about price hikes before discounts during Double 11, merchants too have their grievances.

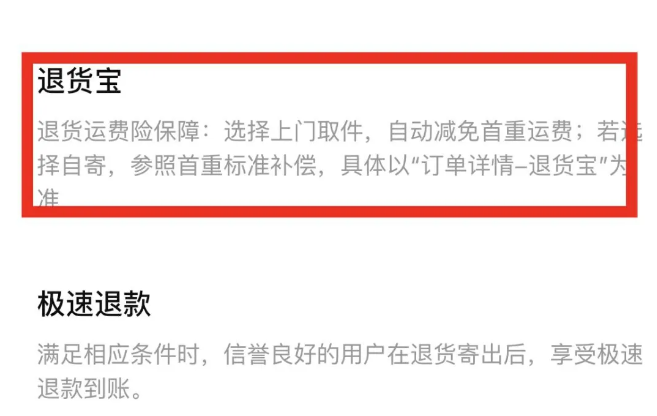

Apart from mandatory full price discounts during promotional periods, merchants are also required to offer shipping insurance, another standard requirement for participating in e-commerce promotions. While shipping insurance was intended to enhance the user experience, consumers' exploitation of insurance loopholes and merchants' issues with misrepresentation and poor product quality have led to soaring return rates and increased shipping insurance costs for merchants in 2024.

Liu Na (pseudonym), an operation manager at a domestic e-commerce agency, shared that return rates for medical device clients have soared from 2-5% a few years ago to over 30% this year, while furniture clients' return rates have reached a critical 50% threshold. Women's clothing, in particular, has been severely impacted, with return rates skyrocketing from around 30-40% for shelf e-commerce to a ceiling of 50% this year and 65-70% for live streaming e-commerce, or even higher.

Fang Jianhua, founder of the women's clothing brand Inman, once calculated the cost of returns in the apparel industry. Even without generating revenue, a returned order can cost an additional RMB 15, equivalent to the merchant's advertising, packaging, and shipping expenses going to waste. Assuming a monthly sales volume of RMB 10 million with an average order value of RMB 200 and a conservative 40% return rate, the loss would exceed RMB 300,000, with associated monthly losses exceeding RMB 1 million.

Amid already high return costs, Taobao introduced 'ReturnBao' during this year's Double 11. Liu Na noted that since ReturnBao offers consumers a 90-day return window, many women's clothing merchants anticipate an over two-fold increase in shipping insurance premiums on top of existing costs.

Source: Taobao

Considering the fast-turnover nature of women's clothing, with small inventories and frequent new arrivals, high return rates can be devastating. Many merchants maintain high inventories, leading to further costs for subsequent discounts and promotions. Operating in the women's clothing segment on e-commerce platforms can be incredibly challenging.

As merchants struggle with the burden of shipping insurance and full price discounts, they also face exorbitant traffic acquisition costs. Zhang Rui (pseudonym), a Douyin merchant, shared that while his food category clients previously achieved ROIs above 6, this year's ROIs have fallen below 3. During Double 11, top Douyin influencers have diverted significant traffic, and recent controversies involving Little Yang Brother and Northeast Sister Yu have forced Douyin to balance content, e-commerce, and its algorithm, potentially leading to further declines in ROI during Double 11.

As Zhang Rui explained, taking the June 30 live stream collaboration between Blue Moon and the Mr. & Mrs. Guangdong couple as an example, while sales reached between RMB 75 million and RMB 120 million, media estimates suggest that Blue Moon invested RMB 40 million in traffic acquisition for the event. In addition to the Mr. & Mrs. Guangdong couple, Blue Moon has collaborated with other top Douyin influencers like Mr. Zhu, Zhu Xiaohan, Shu Chang, and Shen Tao, resulting in skyrocketing traffic acquisition costs. These high investments severely eroded Blue Moon's profits, contributing to its worst financial performance in three years.

Source: Baidu

The essence of business is profit. With brands and merchants struggling to maximize profits during Double 11, how can future Double 11 events and other promotional activities continue to motivate merchant engagement?

03

Normalization of Promotions and Consumers' Return to Offline Shopping

'If you love sushi, would you still enjoy it if you had to eat it every day? Similarly, if you're constantly bombarded with promotions from e-commerce platforms every month, would you still be excited about Double 11?' asked consumer Zhou Yangyang (pseudonym) rhetorically.

Source: Castle Peak Capital's "Labor in the New Era of Consumption"

Zhou Yangyang said that he used to enjoy shopping on e-commerce platforms and live streams, mainly hoping to buy high-quality and cost-effective products. However, with issues like poor product quality on e-commerce platforms, frequent fake product sales by top live streamers, and brands pursuing parity between online and offline prices, why would one still shop on e-commerce platforms or even pay attention to their big sales promotions? It's better to just go to a physical store and buy directly. "I can physically feel the quality," he said.

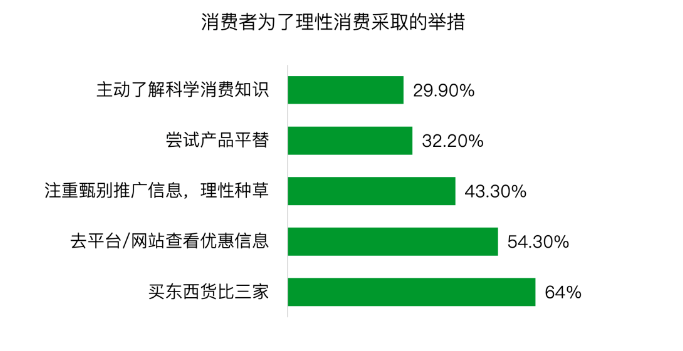

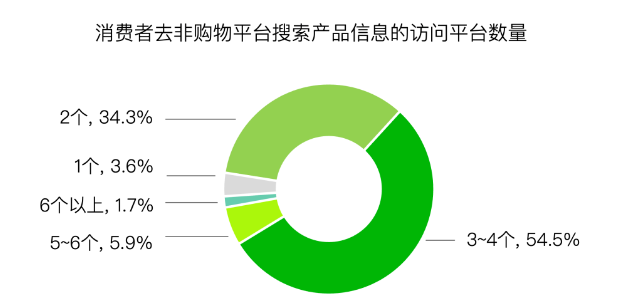

As Zhou Yangyang pointed out, the purpose of extending the duration of e-commerce platform sales promotions is to drive platform GMV growth. However, the constant barrage of promotional messages and complex promotion rules leave consumers feeling exhausted and gradually losing enthusiasm and interest in these promotions. This not only leads to a severe overexploitation of consumption potential but also makes consumers more rational in their shopping habits. Impulsive spending, crazy shopping sprees, and clearing carts during Singles' Day are gradually becoming a thing of the past, replaced by comparing prices across multiple platforms and even verifying information on several platforms. This makes it more difficult for e-commerce platforms to close deals and intensifies competition.

Source: Castle Peak Capital's "Labor in the New Era of Consumption"

Source: Castle Peak Capital's "Labor in the New Era of Consumption"

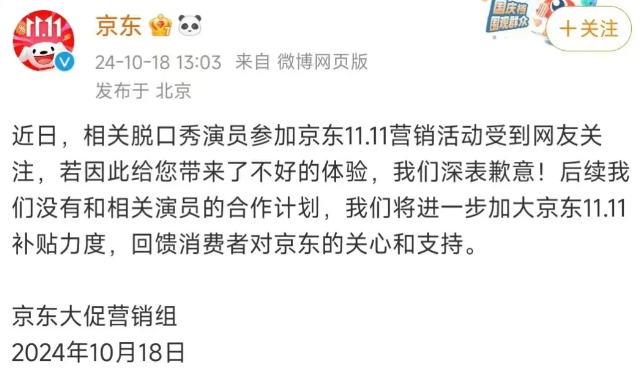

Moreover, prolonged sales promotions not only require e-commerce platforms to bear high marketing costs (e.g., Pinduoduo, Douyin, Kuaishou, and Taobao frantically placing information stream ads before the start of October sales promotions), but various unexpected incidents during these promotions also drive up the platforms' overall operational costs. JD.com released a "Singles' Day" advertisement featuring Yang Li on social media, but Yang Li gained fame by insulting men, while the majority of JD.com's users are male. This sparked a wave of JD Plus membership refunds, prompting JD.com to apologize.

Source: App Growing

Source: JD.com's Official Weibo

Furthermore, long-term promotions or heavy discounts may signal to consumers that brand products are "overpriced," weakening the premium image of the brand. This depreciation of brand image can cause severe long-term damage to high-end brands. In other words, it seems that during major sales promotions, neither merchants, platforms, nor consumers emerge as winners.

A more pressing question is, what are e-commerce platforms actually selling during Singles' Day sales promotions nowadays? Consumer Hu Wei (pseudonym) told us that purchasing products is essentially to satisfy his needs, whether material or spiritual. However, nowadays, shopping on e-commerce platforms requires a lot of effort just to identify one's needs.

For example, when buying a common men's facial cleanser, one must first determine their skin type and desired effects, such as powder, cream, or gel.

After that comes the lengthy process of finding products, selecting platforms, comparing prices, reading reviews, and checking evaluations. If encountering faulty products, it also involves a lot of after-sales service. At some point, shopping during e-commerce platform sales promotions stopped being a joyful and rewarding experience and became both expensive and mentally draining instead.

Nowadays, shopping on e-commerce platforms is less about shopping and more about "labor" - working for a company and getting paid for one's labor. But what do you truly gain by investing so much "labor" during Singles' Day on e-commerce platforms? Even more so, is the production-to-investment ratio really high when paying so much "labor" to save just a few dozen yuan?

Hu Wei's words perhaps highlight the issues that e-commerce platforms need to contemplate deeply: fulfilling consumer needs to generate transactions between supply and demand. The fundamental logic of a consumer society has remained unchanged since ancient times. The simpler the transaction model, the more likely it is to facilitate transactions. For instance, the emergence of Jiaozi (an early form of paper money) in the Song Dynasty of China addressed the inconvenience and scarcity of traditional currency forms like copper coins and gold, making large transactions simple and efficient, thereby accelerating transaction speeds. This significantly contributed to the prosperity of commerce in the Song Dynasty. In modern times, the advent of electronic payments like WeChat Pay and Alipay has simplified transaction processes, reduced friction during transactions, and improved transaction convenience and speed.

However, the increasingly complex Singles' Day promotions today are gradually deviating from the essential nature of transactions. How much can we truly look forward to in future Singles' Day promotions?