Chinese tech giants expand into the Middle East: hot spot, opportunities, and challenges

![]() 10/25 2024

10/25 2024

![]() 767

767

In the "Hadith" of Arabic countries, Muhammad once said, "Even if knowledge is in China, one should seek it out." This quote underscores the long history of friendly exchanges and mutual appreciation between China and the Middle Eastern countries.

Today, the Middle East has emerged as one of the most important potential markets for Chinese enterprises in their overseas expansion. According to public reports, major Chinese internet companies such as Meituan, Alibaba, ByteDance, JD.com, and Shein have accelerated their presence in the Middle East this year, embodying the spirit of "Even if wealth is in the Middle East, one should seek it out."

So, how did the Middle East, a land of gunfire and roses, poverty and wealth, conflict and change, become a hot spot for Chinese investment?

Chinese giants converge in the Middle East

In September of this year, Meituan launched its overseas version, "Keeta," in Saudi Arabia, drawing attention to this unique region with the novel concept of "delivering food in the desert."

Image source: Keeta official website

Prior to this, Meituan had repeatedly emphasized the importance of its international business during internal organizational restructuring, with founder Wang Xing personally leading a team to Saudi Arabia to assess the feasibility of launching a food delivery pilot program there.

Similarly, in March of this year, TikTok CEO Shouzi Chew also appeared in Riyadh, the capital of Saudi Arabia. During on-site exchanges, Chew stated, "We will work with NGOs to produce videos, ultimately empowering 2 million young people."

Image source: Xiaguangshe

Meanwhile, in the e-commerce space, TikTok launched a beta test of its e-commerce shelf in the Middle East in February of this year and initiated merchant recruitment efforts.

Apart from TikTok, the remaining three of the "cross-border e-commerce Four Dragons": Temu, AliExpress, and SHEIN, are also not to be outdone:

After entering Israel in August of last year, Temu launched in Saudi Arabia and the United Arab Emirates this year. Relying on low-price promotions, Temu topped local app download charts for a time, replicating its earlier success in the North American market.

"AliExpress," the international version of Taobao, first signed two Saudi Arabian soccer stars and then launched a large-scale marketing campaign around Ramadan in the region. Meanwhile, Trendyol, which was acquired in Turkey, continues to grow rapidly.

SHEIN received approximately $2 billion in investment from sovereign wealth funds in the United Arab Emirates and Saudi Arabia in 2023 and became the most visited fashion and clothing shopping site in Saudi Arabia this summer, significantly outperforming other similar websites.

It is evident that whether in food delivery, short videos, or e-commerce, "selling goods to the Middle East" has been a common goal for Chinese giants in their overseas expansion in recent years.

Prior to this, the earliest Chinese internet companies to explore the gold mines of Saudi Arabia can be traced back to 2017, when a Zhejiang-based company called Zhideyu launched the e-commerce platform JollyChic in the Middle East, marking the beginning of the Middle East e-commerce era.

Subsequently, the Middle East market underwent a chaotic period from 2017 to 2021. After the chaos, the once-prosperous Zhideyu faltered, marking the end of the earliest batch of cross-border e-commerce enterprises in the Middle East. Today, among the earliest foreign e-commerce platforms to enter the Middle East, only Amazon and SHEIN remain.

The "chaos" of 2017-2021 also contributed to the development of logistics, payment, and other infrastructure in the Middle East. Taking logistics as an example, J&T Express entered Dubai in 2021 and has since covered the entire United Arab Emirates; ByteDance, on the other hand, acquired iMile, a local e-commerce logistics enterprise known as the "Middle East SF Express," focusing on solving the "last mile" problem in Middle East e-commerce logistics.

This means that with the gradual improvement of infrastructure construction, the hidden value of the Middle East market can truly be unlocked. This is precisely why, at this juncture in 2024, so many Chinese giants have converged their gaze on the Middle East.

With so many options for overseas expansion, why the Middle East?

In fact, the giants have not put all their eggs in one basket. Taking AliGroup International as an example, they have Trendyol in the Middle East, AliExpress in Europe and America, and Lazada and Daraz in Southeast Asia. These cover both B2B and B2C, as well as cross-border and local e-commerce.

However, among all these "baskets," Trendyol in the Middle East has performed the best:

According to AliGroup International's fourth-quarter 2022 financial report, the overall order volume of Lazada, AliExpress, and Trendyol increased by 3% year-on-year during the quarter, with the robust growth in Trendyol orders being the primary driver of revenue growth.

In 2023, Trendyol became the fastest-growing business within AliGroup International's overseas operations. In the first quarter of 2024, Trendyol continued to maintain double-digit order growth.

There are three main reasons why the Middle East market has maintained such high growth rates:

Image source: Dashu Cross-border

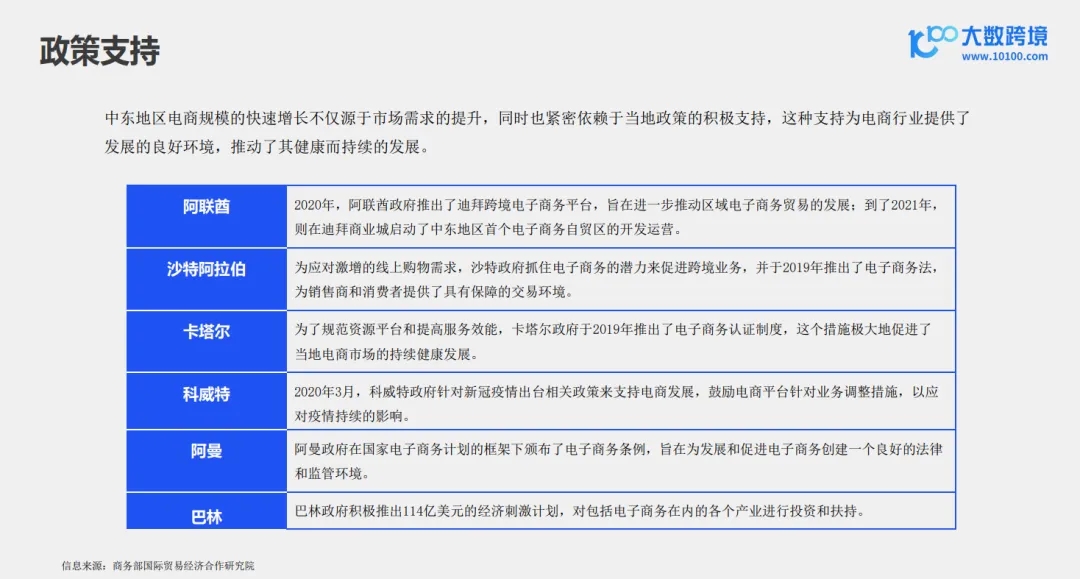

In 2016, Saudi Arabia launched its "Vision 2030," outlining a series of national transformation goals, including economic diversification away from oil, political centralization, religious moderation, and social secularization. The following year, the United Arab Emirates launched its "Centennial 2071 Plan."

One of the key policies of these reforms is the introduction of foreign investment. According to Saudi Arabia's Investment Minister, as of last November, Saudi Arabia had issued licenses to 180 international companies, including American internet giants such as Apple, Google, Microsoft, and Meta.

With this "spring breeze," Chinese enterprises have been able to enter the Middle East market more quickly. According to DMCC data, approximately 6,000 Chinese enterprises are currently operating in the United Arab Emirates. In the first half of 2023 alone, 664 Chinese enterprises successfully established themselves in Dubai alone.

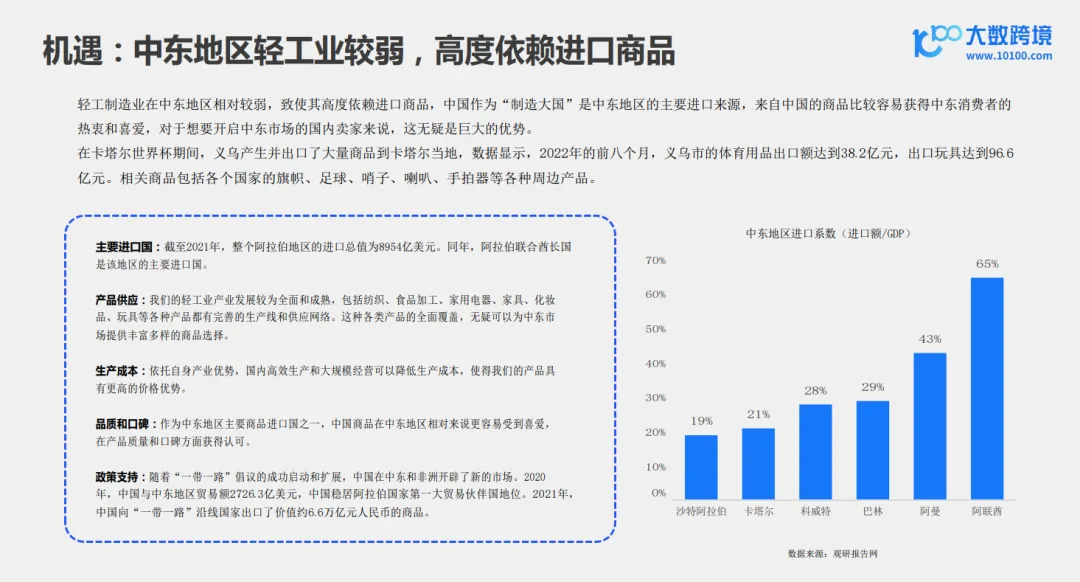

Taking the e-commerce industry as an example, the average order value per user in the United Arab Emirates and Saudi Arabia is approximately $150, and in Qatar, it is even higher at $260, approaching or even surpassing that of developed countries in Europe and North America. According to official Saudi data, the minimum monthly income for Saudi households is 12,800 Saudi Riyals, equivalent to approximately 23,000 Chinese yuan, and those under 30 years old account for 45% of the total population.

High income translates to high spending power, while a younger demographic translates to higher acceptance of new things. The combination of these two factors creates significant profit margins in the Middle East market.

Image source: Dashu Cross-border

Compared to its developed oil industry, the light manufacturing industry in Middle Eastern countries is relatively weak, with a high reliance on imported goods. As a "manufacturing powerhouse," China is a major source of imports for the region. With the rollout of the Belt and Road Initiative, an increasing number of Chinese goods have gained popularity among Middle Eastern consumers, which is undoubtedly a significant advantage for domestic sellers looking to tap into the Middle East market.

Considering the above points, when compared to Europe, the United States, and Southeast Asia, which may present policy risks, intense competition, or a preference for low-cost goods, the Middle East clearly stands out as a more promising market.

What challenges remain in this desert business?

Market potential represents an opportunity for enterprises, and opportunities often coexist with challenges.

Today, while the challenges facing Chinese enterprises are far less daunting than in the past, they are still not trivial:

Firstly, compared to Europe and North America, the infrastructure for payment and delivery in countries like Saudi Arabia, the United Arab Emirates, and Turkey still needs improvement. According to Luan Tian, CEO of Kedi Overseas, who has lived in Dubai for a long time, most addresses in Middle Eastern countries are not managed according to a postal code or house number system. This results in persistent issues with the "last mile" of delivery, low delivery efficiency, and increased logistics costs.

Secondly, due to the unique family structure in the Middle East, while there are many family members, often only the male head of the household who works outside the home has a credit card. This means that women and unemployed young people in the family often have to settle payments in cash. As of 2024, more than 60% of online purchases are still settled through cash on delivery, resulting in low delivery efficiency and difficulties with returns and exchanges.

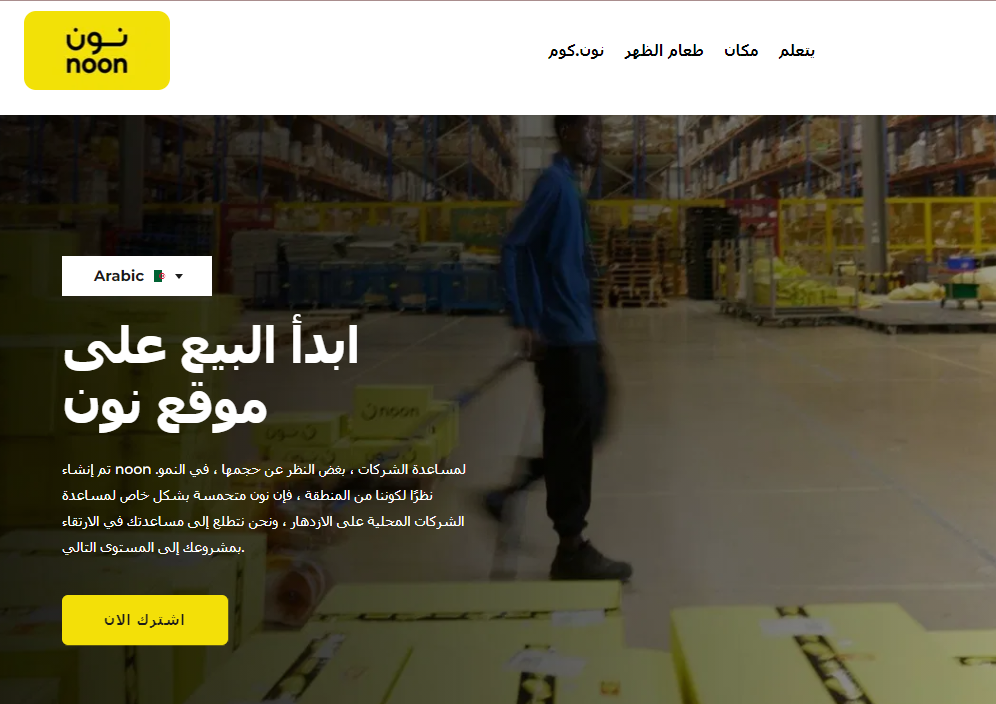

Thirdly, Chinese giants are not the only ones eyeing the "pie" of the Middle East market. Back in March 2017, Amazon acquired the local shopping site SOUQ for a whopping $650 million. Today, Amazon Middle East remains the largest comprehensive e-commerce platform in the region, with over 70 million monthly visits, more than 20,000 active sellers, and nearly 10 million products across 21 categories, giving it a significant first-mover advantage. Additionally, local e-commerce platforms like Noon also enjoy inherent advantages due to their local presence.

When Chinese cross-border players arrived, they did not sit idly by but instead launched proactive attacks. According to a Wall Street Journal report, Amazon is previewing a new channel for sellers that will specialize in low-cost white-label products, targeting popular products sold by Temu.

From this perspective, Chinese enterprises must not only overcome the difficulties of "acclimatization" but also compete with other enterprises. The road ahead for Chinese enterprises is bound to be bumpy.

However, one thing is certain: addressing these challenges is not only a significant test for Chinese giants but also another brilliant demonstration of Chinese wisdom on the global stage. Time will tell the outcome.

Source: HKG Research Community