Deep analysis of the warehouse membership store model, examining the competitive aces of players like Costco, Sam's Club, Fudi, and others

![]() 10/29 2024

10/29 2024

![]() 446

446

Under the shadow of Sam's Club's "starfish model" and Costco's "coral reef model," can Fudi successfully "expand its territory"?

Membership stores and discount stores have become two mainstream formats explored by retail enterprises in recent years as they undergo transformation. With the heated competition, there are always new developments. Not long ago, Aldi opened its largest store in China in Jinshan, Shanghai, while Fudi Warehouse Membership Store, with its viral appeal, announced its expansion into Shanghai from Beijing, initiating a nationwide layout.

The membership store model has become a new focal point in China's new retail market. Not only established players like Costco and Sam's Club but also newcomers like M Member Store, riding on the shoulders of Sun Art Retail Group, as well as cross-border players like Eastbuy and Leyifen have entered the fray.

Standing at the intersection of foreign and domestic brands subtly competing with each other, we must ponder: What is the core essence of the membership store model? Does Fudi's nationwide expansion signify a second takeoff for the membership store model? Which players with specific traits can truly triumph in this wave of membership store popularity?

01 Core Essence of the Membership Store Model

In addition to the hard discount model, the membership store model has been the hottest trend in the retail industry in recent years. Its industry representatives, Sam's Club and Costco, both have annual sales exceeding USD 200 billion. Why can this model stand out? Why can it maintain sustained and steady growth and profitability? The author attempts to dissect the core essence of this model.

Image: Costco and Sam's Club

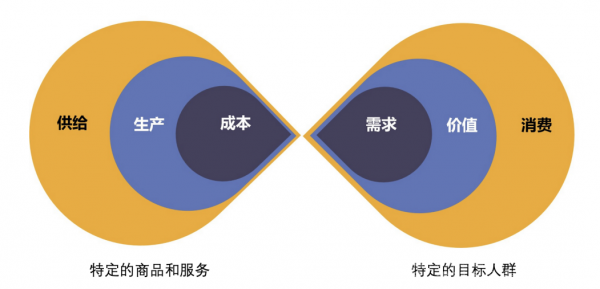

Firstly, the essence of the membership store model lies in continuously satisfying as many needs as possible for a specific target consumer group through specific products and services.

Image: The Essence of the Membership Store Model

The first "specific" refers to the differentiation of products and services. It requires enterprises to possess strong product selection capabilities, or even product creation capabilities, namely, the R&D capabilities for private label products (PB). Only with this capability can retailers offer consumers "high-quality and low-priced" products, thereby ensuring member repurchase rates. Simultaneously, in terms of services, they can strive for excellence, introduce new ideas, and consistently provide customers with an ultimate shopping experience.

The second "specific" refers to the selection of the target consumer group. "Among thousands of rivers, I only take one scoop of water," locking in a limited target consumer group through paid membership rather than being openly accessible. With a defined target group, retailers can better understand and satisfy their needs, and leverage consumer preferences to create a better shopping experience, further ensuring service quality.

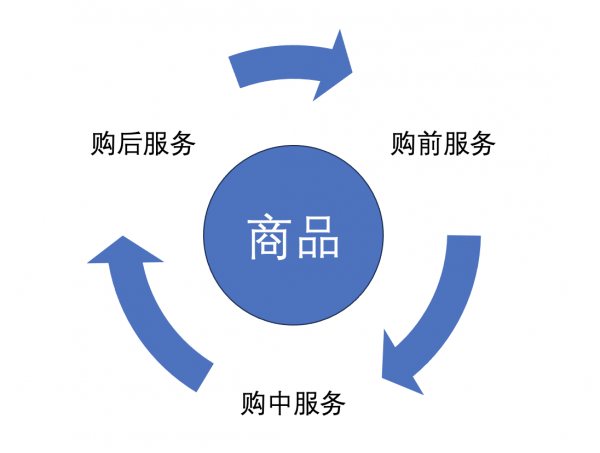

Secondly, the core elements of the membership store model are products and services.

Unlike generalized demands faced by the general public, the demands of "specific" target consumer groups are more concrete for retailers. Products and services are the two direct touchpoints for targeting consumers and providing them with profound experiences.

For the product aspect, the membership store model requires retailers to consider various factors, including categories, appearances, tastes, prices, and packaging (scenarios), based on target consumers. Choosing which categories to satisfy consumer needs in a specific scenario and presenting products in an acceptable manner and suitable packaging is a meticulous task that poses a significant challenge for many retailers.

Image: The Entire Process of Product Services

For the service aspect, as one of the core competencies of the membership model, meticulous design throughout the entire process is also crucial for increasing membership fees and renewal rates.

Pre-purchase membership benefit design: How can retailers efficiently convince consumers to trust and willingly pay for membership? Additionally, effectively reaching consumers with daily product or store marketing activities, including how to ensure consumers think of you first when they have a need.

Consumers have multiple channel options for shopping, including online and offline. Online, retailers must make it easier for consumers to find desired products or leverage large model capabilities for precise push notifications based on user profiles, reducing randomness in the shopping process. Offline, the focus is more on scenario experiences, inviting tastings and trials, and seamlessly engaging sales assistants, all of which require thoughtful design.

Post-purchase aspects mainly involve in-store and after-sales services. The membership store model requires retailers to consider how to plan their logistics systems, whether to build in-house or outsource, and delivery times (e.g., half an hour or one hour). Additionally, the rise of e-commerce is largely attributed to the reassurance of "7-day no-reason return," allowing consumers to shop worry-free. For membership stores with offline store advantages, providing similar service levels and ensuring consumers genuinely perceive them are considerations.

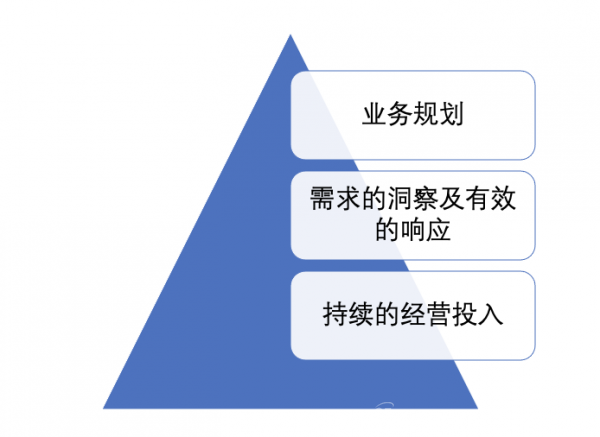

Finally, the necessary conditions for the success of the membership store model. The author believes there are three main ones: business planning, insight into needs, effective response, and sustained operational investment.

Image: Necessary Conditions for the Success of the Membership Store Model

Business planning primarily refers to site selection. Since the membership store model is primarily offline with online as a supplement, site selection significantly determines the store's profitability. Effective site selection can bring natural traffic, and the size of the funnel's opening determines both the upper limit of the target consumer group and the absolute number of effective conversions.

For new players in the membership store model, in addition to customer flow, site selection should also prioritize vehicle access and parking convenience. The failure of Carrefour's Yanggao South Road membership store is largely attributed to a lack of consideration in this regard.

Insight into needs and effective response. Specialized tasks require specialized personnel, preferably those who directly face consumers on the front lines. Traditional retail enterprises lack dedicated market researchers and rarely send personnel to conduct front-line research. Product selection and creation often rely on second- or even third-hand information.

Therefore, the membership store model requires retailers to establish a professional consumer needs insight team that can anticipate consumer needs before their served members. Simultaneously, there must be an effective response to these needs, meaning having suitable products or services to promptly satisfy discovered needs, which requires organizational support.

Sustained operational investment. The membership store model emphasizes word-of-mouth marketing, leveraging product and service capabilities to provide consumers with exceptional experiences, leading to repeated purchases and recommendations.

"Rome wasn't built in a day," and the same applies to a good reputation. It requires retailers to make sustained operational investments in talent, store expansion, supply chains, etc. They must view this model as a five- to ten-year business, with the first two or three years primarily a period of momentum building. Only after three to five years of effort can they hope to achieve significant results. In the current economic environment, any new player needs considerable courage to achieve this.

02 Sam's Club and Costco

Converging Paths under Different Models

As representatives of the membership store model, Sam's Club and Costco have taken two distinct paths.

Firstly, the Sam's Club model, especially in China, adopts a "big store + dark store" starfish model for business expansion. According to official sources, Sam's Club China has opened nearly 50 big stores and 500 dark stores, with annual sales exceeding RMB 80 billion, of which online sales account for 50%. The average operating area of big stores exceeds 20,000 square meters, while that of dark stores is within 500 square meters.

Image: Sam's Club's "Starfish" Model

The former provides consumers with a comprehensive selection of products and a plethora of offline experiences, including tastings and trials. The latter offers a curated selection of high-quality products, complemented by efficient hourly delivery services, allowing consumers to complete their shopping journey online.

The average order value for big stores can reach RMB 1,000, while that for dark stores is significantly higher than platforms like Pupu Supermarket and Dingdong Maicai, reaching RMB 200 per order. Quality, price, and experience – the "impossible triangle" of retail – are breakthroughs achieved by the Sam's Club model.

The underlying reason is Sam's Club's profound understanding of consumption scenarios. In-store shopping often involves advance planning, with "browsing and eating" being the primary focus of offline experiences. Targeting these consumers, Sam's Club offers over 4,000 SKUs, emphasizing "regular stockpiling shopping."

Online shopping primarily caters to instant consumer needs, allowing goods to arrive at home without leaving the house. For these consumers, Sam's Club carefully selects 1,000 SKUs, emphasizing "daily convenient shopping."

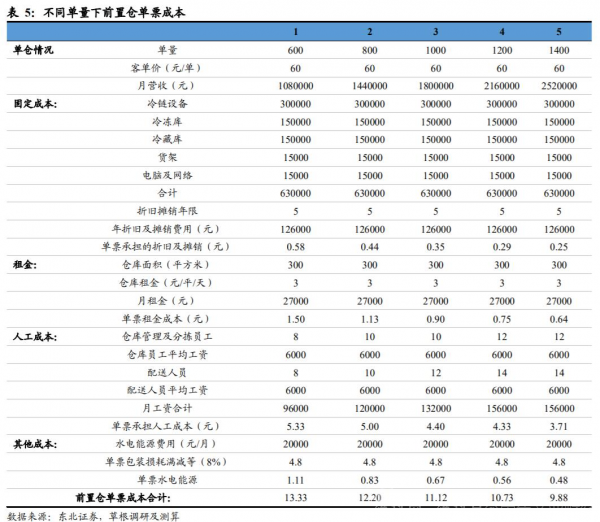

Dark stores, like starfish tentacles, extend the service radius of Sam's Club stores at a fraction of the cost of big stores, broadening their service scenarios. Leveraging the momentum of big stores and high online order values, Sam's Club has carved out a path in the dark store model, which was previously considered unviable in the industry. It is estimated that Sam's Club dark stores achieve a sales per square meter of over RMB 100,000, far exceeding any domestic retail enterprise.

Image: Dark Store Cost Calculation

Now, let's turn to the Costco model. Borrowing from Apple's advertising slogan, the Costco model is "more than just big."

Firstly, it's about big stores and big product packaging. Large stores provide ample shopping space for consumers while also accommodating mechanized operations like shelf stocking, replenishment, picking, and packing for employees. Large packaging reduces packaging and waste costs, making unit costs highly competitive.

Beyond just big stores and packaging, Costco's unique "3T" business philosophy – Taste (try before you buy), Touch (feel the product), and Take (purchase) – allows consumers to gain more insights into products and reduces the risk of post-sale returns. Additionally, its diverse product categories and services, ranging from gold jewelry to watches and handbags, eyewear and cosmetics to windshield wipers and tires, include hearing centers and self-service gas stations. To some extent, the Costco model resembles a "coral reef" model, where each individual store functions as an ecosystem, satisfying members' multifaceted needs.

Image: Costco's "Coral Reef" Model

Lastly, the underlying business logic behind "bigness." Beyond the aforementioned sense of space, there are three additional points:

First, "bigness" can lead to price concessions, enabling consumers to enjoy high-quality products at affordable prices. Second, "bigness" can increase the average order value, maximizing cost savings per order. Third, "bigness" caters to household shopping needs, fostering repeat purchases and fostering consumer loyalty through frequent interactions.

Moreover, the Costco model is remarkable for its extremely low gross profit margin and operating expense ratio. With a gross profit margin of less than 14%, Costco achieves a net profit margin exceeding 2%, outperforming global retail enterprises in operational capabilities.

To offer members the lowest possible prices, Costco chooses to self-develop properties, ensuring controllable overall costs. It simplifies facility configurations based on actual store needs, minimizing construction costs. Costco expands stores through this approach, albeit at a slower pace (averaging two to three years per project), resulting in exceptionally low annualized site costs.

Employee salaries, another significant portion of operating expenses, are above industry averages at Costco. By maximizing human potential through competitive salaries, Costco achieves significantly higher per capita sales contributions than peers. Regarding marketing expenses, Costco rarely advertises, relying instead on high-quality and affordable products, coupled with one-stop services, as the most effective "advertising" for members.

03 Can the Fudi Model "Expand Its Territory"?

The top two players in the warehouse membership store sector appear to have taken two distinct development paths but ultimately converge. Both excel in the two core elements of products and services, making them difficult for most peers to compete with. Domestic players like Jiajiayue Membership Store and Yonghui's Warehouse Membership Store are largely "enlarged versions" of their original stores, lacking substantial operational changes in these core elements, with predictable results.

However, domestic Fudi Membership Store seems to have found a "hidden path." The author believes this is primarily due to three reasons.

Firstly, effective positioning.

Targeting young consumers who "love beauty, seek novelty, and pursue fashion," Fudi emphasizes a core business philosophy of "freshness, health, and high quality," with a vision to lead future urban dining lifestyles.

Image: Fudi Warehouse Membership Store

Unlike traditional retail supermarkets with their "bright red, yellow, and blue" decor, Fudi adopts a refreshing and bright pistachio green as its primary color scheme. Through meticulous store space design and decor, it creates a relaxing and enjoyable shopping atmosphere, effectively garnering heated attention and check-ins from young people. With its "internet celebrity persona" marketing approach, Fudi quickly stands out in the membership store competition.

Secondly, gross profit margin control.

Attracting traffic is meaningless without effective engagement. Fudi chooses to attract consumers with extremely low gross profit margins on products. Of course, impulse purchases driven by the "internet celebrity" effect are not sustainable. Only high-quality and affordable products justify continued consumption. As a newcomer to the domestic membership store scene, Fudi is the first in the industry to commit to a comprehensive gross profit margin of "no higher than 10%." Lower prices lead to positive feedback, and increased product sales volumes enhance upstream bargaining power, potentially leading to even lower prices. The low-cost strategy also reflects Fudi's overall operational expense control capabilities.

Finally, a stable supply chain system.

Unlike most retail enterprises, Fudi relies on the mature supply chain system of "Fresh Fruits and Vegetables", namely its own upstream agriculture, animal husbandry, and fisheries farms, etc. It can directly enjoy the resource synergy effect within the group in terms of commodity procurement, logistics and distribution, reducing costs and ensuring product quality. For processed products, Fudi makes the overall delivery quality of goods reliable and stable through in-depth control from raw materials to product research and development, production, procurement, logistics, and other links.

Since the opening of the first store on the southeast 4th Ring Road in Chaoyang, Beijing, in May 2021, Fudi has only opened 4 warehouse membership stores and 2 fudi+ select community stores, with an extremely restrained overall store opening pace.

Image source: Fudi Membership Store official Weibo

The reason behind this is likely due to the incomplete operation of the model and relatively unpromising profitability. Therefore, Fudi's biggest challenge is to fully operationalize its model and expand beyond Beijing, thereby replicating its successful business model on a larger scale.

Influenced by Sam's Cloud Warehouse (front warehouse) model, according to Li Xue, Vice President of Fudi Membership Store, Fudi has started site selection nationwide. Considering the potential difficulties in expanding to other cities, such as supply chain and logistics warehousing, Fudi will also prioritize front warehouses as a key business format for market expansion. The development and innovation of front warehouses will be an important strategy for Fudi in the future.

The author believes that the success of Sam's Club's "starfish model" for front warehouses is based on the success of its large stores. As mentioned above, front warehouses are more like tentacles extending its service radius. If one simply believes that the front warehouse model is viable due to its controllable costs and ability to better expand its service area, they will be following the same old path and success will remain elusive.

04 Challenges Facing the Domestic Membership Store Model

Whether it is the Sam's Club model or the Costco model, the author believes that both are worthy of in-depth study by domestic retail enterprises. Of course, the following aspects should also be considered:

First, market positioning and differentiation.

Membership stores need clear market positioning and provide differentiated products and services to attract consumers. If retailers cannot clearly define their market positioning or provide products and services that cannot be distinguished from existing membership stores, they will struggle to succeed without a core competitiveness.

Second, membership awareness and education.

Consumer awareness and acceptance of membership need to be gradually cultivated, especially in a relatively novel market environment for membership. Although more and more people are starting to accept the concept of membership and are willing to pay the corresponding annual fee, a considerable portion of consumers still prefer traditional shopping methods. Therefore, designing effective membership benefits will be a good starting point.

Third, supply chain and logistics challenges.

The membership store model requires a robust supply chain and logistics system to support it, ensuring high-quality products at lower costs. This poses a challenge for many local retailers, especially during the initial investment phase. The membership store model needs efficient supply chain management to reduce costs and offer competitive prices. Achieving this requires establishing long-term partnerships with suppliers and effectively managing inventory and logistics. For retailers without sufficient scale advantages, this is a challenge.

Fourth, capital investment.

Membership stores typically require large storefronts and significant initial capital investment, which not all retailers can afford. Additionally, long-term investment is necessary to maintain operations and service quality. Successful membership stores require substantial upfront investments, including building large warehouses, optimizing supply chains, and developing private labels. This is a significant expense for many retailers, especially those with tight capital chains.

Fifth, brand building and consumer trust.

Sam's Club and Costco enjoy a good reputation globally, helping them establish trust in the Chinese market. New retailers may need to spend more time and resources building brand recognition and trust. With the rise of e-commerce and other retail formats (such as convenience stores and discount stores), market competition is becoming increasingly fierce. Retailers attempting to enter the membership sector must not only compete with existing membership retailers but also with challenges posed by other retail formats.

In summary, the membership model poses significant challenges, but there is no doubt that it will be an important or even primary format in the future retail supermarket industry. If retail enterprises can fully consider and prepare for the above aspects, enter the market early, and continuously invest in operations, they will surely carve out their own niche.