Focus Media: The Hot Expectations and Cold Reality of the “Advertising King”

![]() 10/30 2024

10/30 2024

![]() 622

622

Hello everyone, I'm Dolphin!

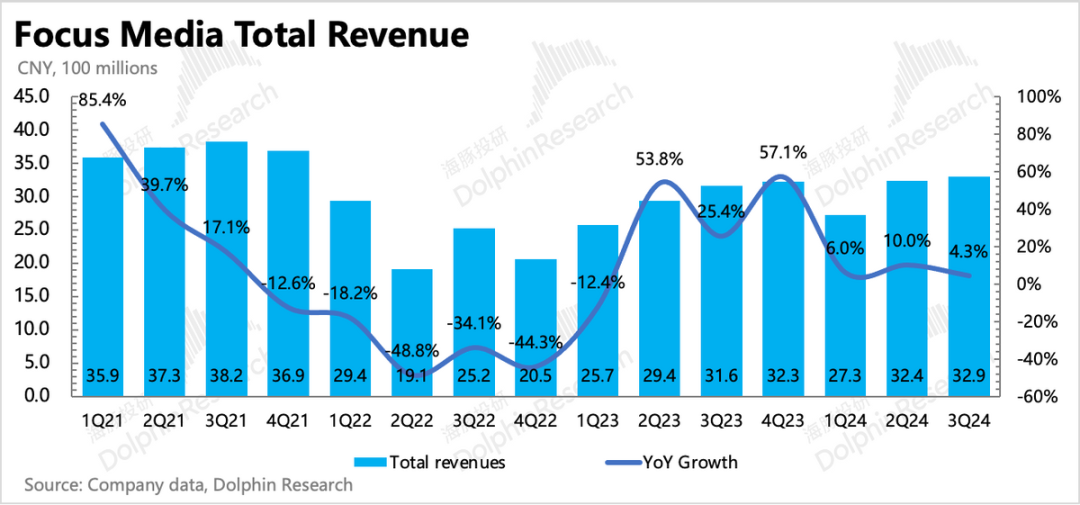

Focus Media released its third-quarter report for 2024 on October 28, Beijing time. Although the policy shift at the end of September had already driven expectations ahead of time, with the share price rebounding by 37%. However, before policies aimed at promoting consumption actually take effect, Dolphin believes it is necessary to perceive the reality through financial reports and calculate what kind of recovery expectations are implicit in the current valuation.

Specifically:

1. Overall Impression: Beautiful Expectations, but Tremendous Reality Pressures

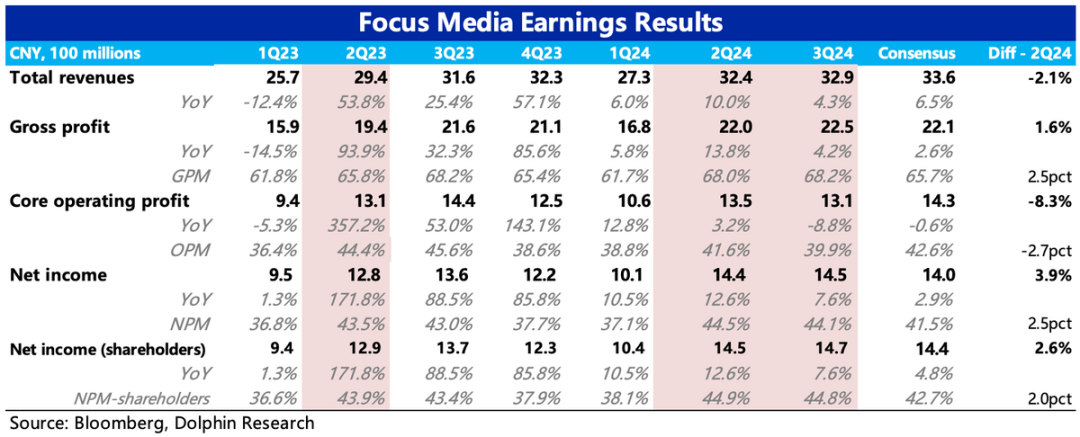

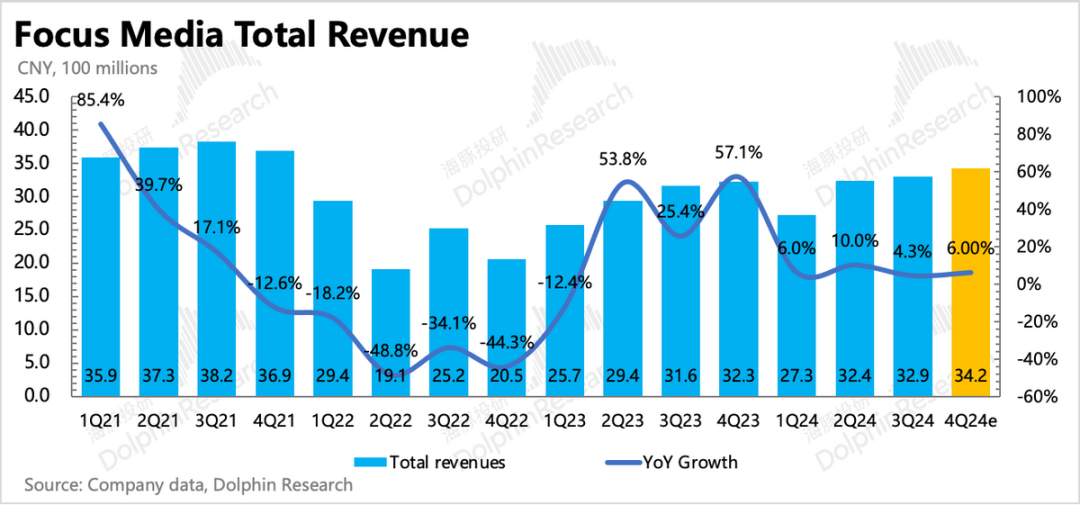

In the third quarter, Focus Media's revenue grew by 4.3%. Although there are some differences in expectations among leading institutions, overall it was still within expectations (RMB 3.2 to 3.4 billion).

Last quarter, Dolphin mentioned the strong seasonal effect caused by changes in advertisers' placement strategies, which was also reflected in the third quarter. The third quarter was not entirely a slack season, but rather a period of slow start and strong finish, with September typically being the new product launch cycle for 3C electronics and automobiles, as well as the seasonal demand for clothing.

Furthermore, this year also saw the Olympic Games (beverages, clothing), short-term stimulus in some consumption areas such as gaming and entertainment (summer chaos), and growth in home appliances (trade-in programs). However, to be honest, due to the overall macroeconomic pressures, some institutions' expectations were not particularly high to begin with.

The current rebound in valuation significantly implies expectations for a recovery in the broader consumption environment following policy stimulus. Dolphin still wants to remind that short-term pressures will not dissipate so quickly. Nonetheless, the fourth quarter is Focus Media's traditional peak season, and driven by events like Singles' Day, we expect full-year revenue to achieve a 7% growth rate, reaching RMB 12.8 billion.

2. Slower Customer Payment Schedules

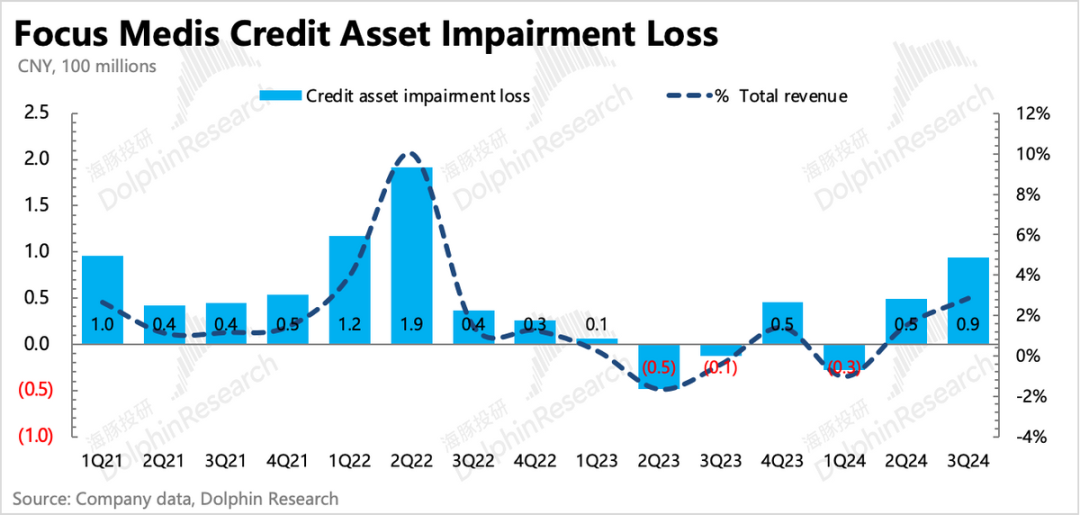

In the third quarter, on the one hand, credit impairment/asset impairment losses rose to RMB 94 million quarter-on-quarter. Compared to total revenue, this increased to 2.9%, a level that is only slightly lower than the pandemic-affected 1Q22 in the past two years.

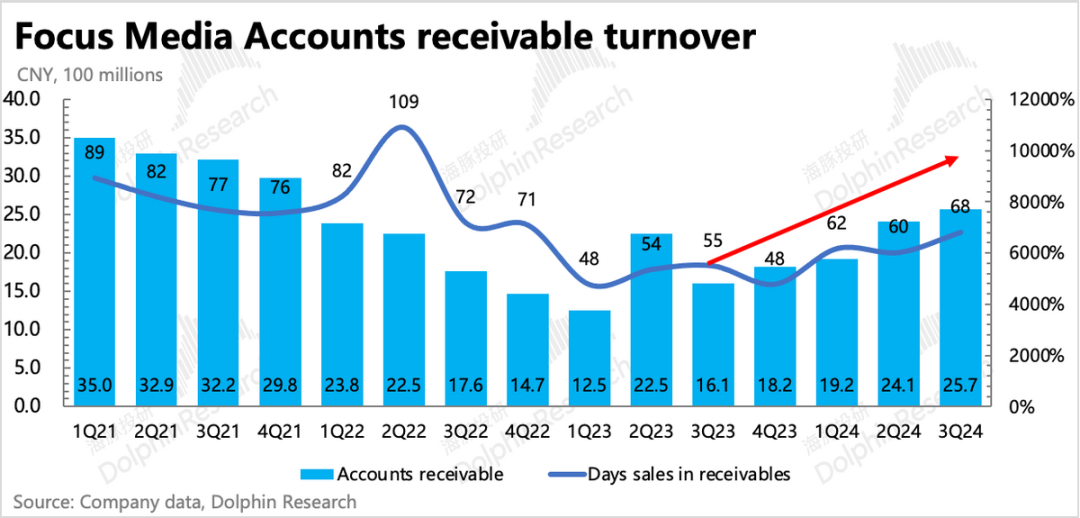

In addition, another indicator that can reflect Focus Media's customer payment ability—days sales outstanding (DSO)—rose from 60 days in the second quarter to 68 days in the third quarter, higher than in 2023 and similar to the second half of 2022.

With these two indicators showing marginal deterioration, the difficulty of the macroeconomic environment is evident.

3. Profit Growth Reliant on Non-Core Business Income

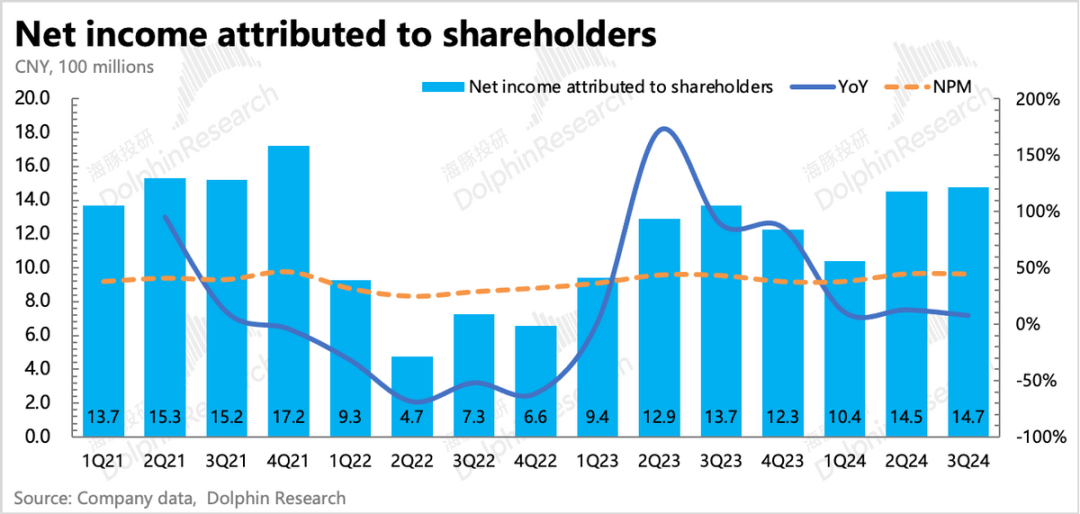

In the third quarter, net profit was RMB 1.48 billion, with a year-on-year growth rate of 7.6%, slightly exceeding expectations, but mainly driven by investment income and other items unrelated to the core business.

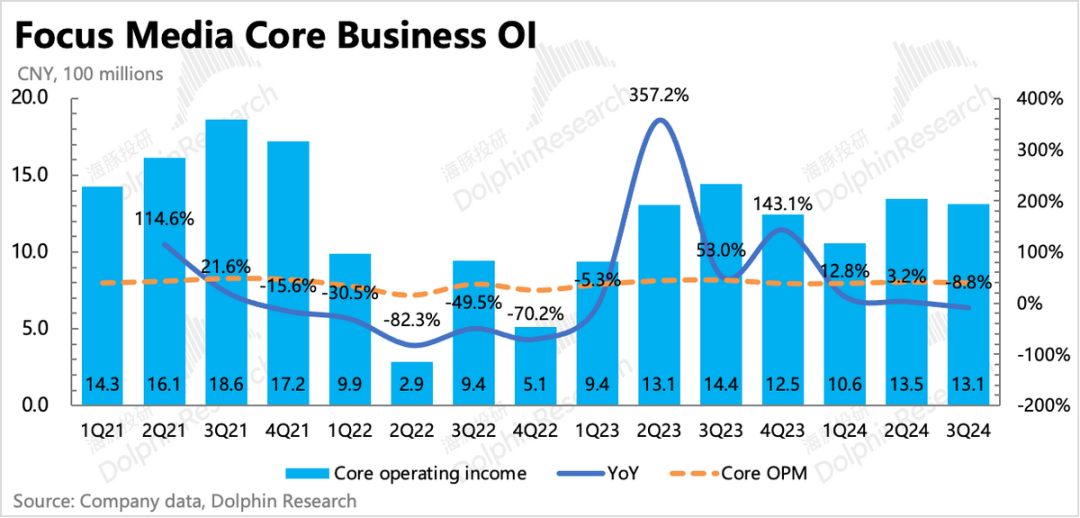

Looking solely at the operating profit of the core business, it actually declined by 9% year-on-year, slightly below market expectations. Similarly, comparing net profit attributable to shareholders after deducting non-recurring items, the growth rate also slowed to 4.5% (differences in effective tax rates led to discrepancies between net profit growth and core operating profit growth).

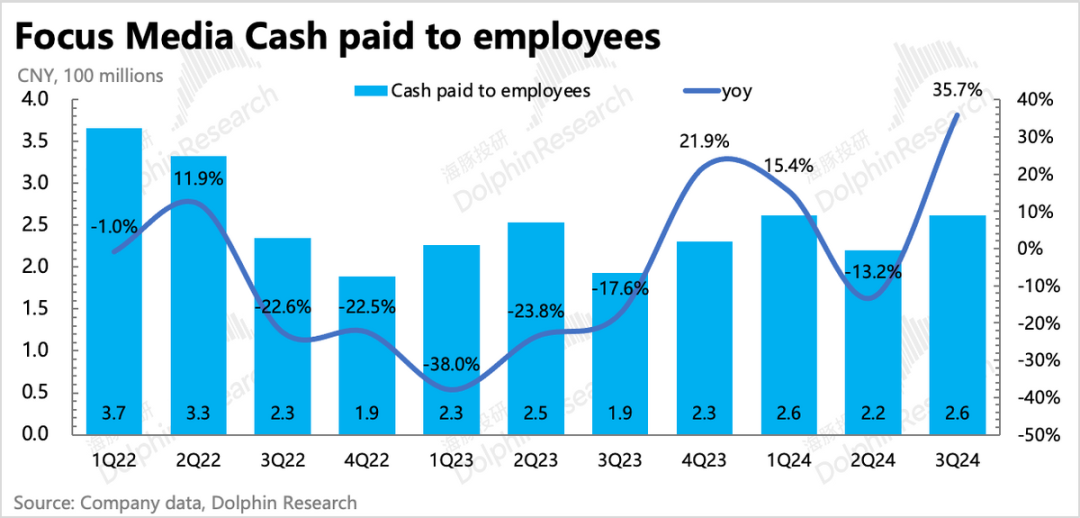

The decline in core business profitability is primarily due to rising credit impairment losses and, secondarily, marketing expenses that are significantly higher than revenue growth. Combined with an increase of 17% in fixed assets compared to the end of the previous quarter and a 35% year-on-year increase in cash expenditures for employee-related costs, it indicates that Focus Media is actively expanding its media locations while also expanding its sales team to seek more customers.

4. Encouraging Aspect—Steady Increase in Gross Margin

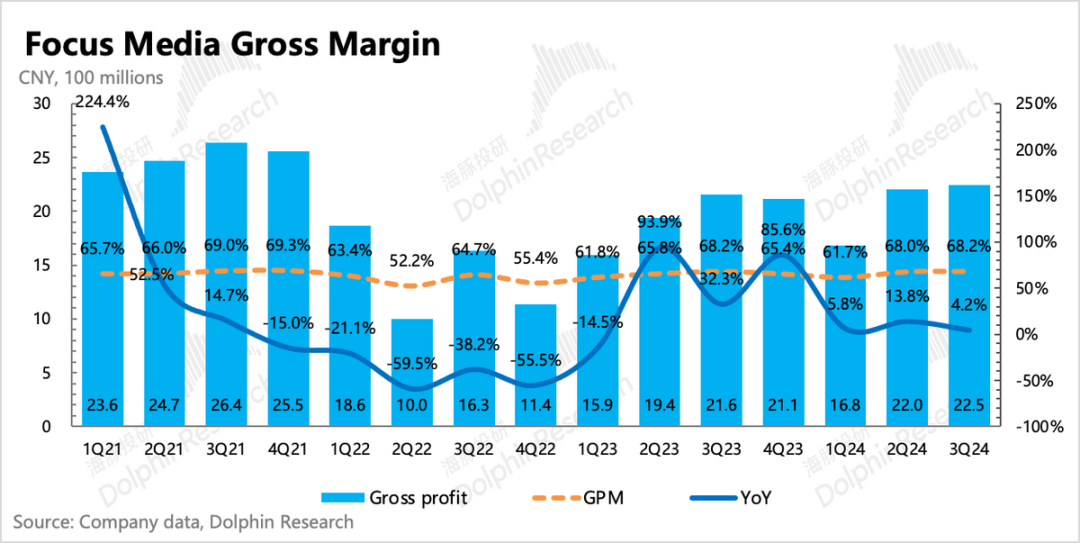

Although the third-quarter report primarily reflects macroeconomic pressures, Focus Media's stable gross margin deserves special praise.

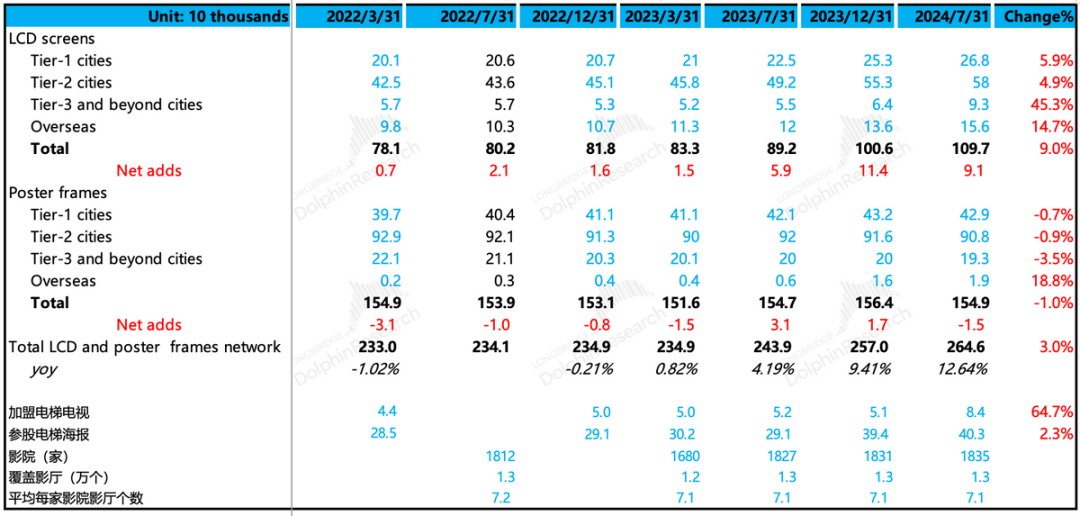

Combining the location distribution information disclosed in the interim report and the gross margin by business, Dolphin believes that despite revenue pressures and active expansion of locations, Focus Media's gross margin can still remain stable at a high level, indicating that the long-term effects of location optimization have already emerged.

At the same time, newly added lower-tier locations have lower rental costs, and local businesses rely more on location-based advertising for traffic. Therefore, the unit economics (UE) model for a single location may not necessarily be lower than that of higher-tier cities. However, during rapid expansion, gross margins will inevitably be affected to some extent, which in turn means that there is still room for Focus Media to improve its gross margins in the future.

5. Slight Decline in Cash Flow

In the third quarter, net cash flow from operating activities was RMB 1.7 billion, down 8% year-on-year. On the one hand, despite higher revenue this year, the cash received from sales was lower than last year. On the other hand, in terms of cash expenditures, especially employee-related expenditures, the third quarter alone increased by 35% year-on-year.

6. Comparison of Key Performance Indicators and Market Expectations:

(Since few institutions separately disclose quarterly expectations in public reports, there may be some deviations between the Bloomberg consensus estimates and actual expectations excerpted in the figure below. Dolphin will focus on comparing and analyzing the actual Q3 performance against the expectations of 2-3 leading institutions.)

Dolphin's Perspective

Focus Media's third-quarter report quite concretely reflects the current difficult macroeconomic environment while also demonstrating its efficient operations, indicating that the company still has the ability to improve its gross margin.

However, the third-quarter performance is now in the past. Given the significant changes in policy and the advance of expectations, the valuation has already rebounded by nearly 40%. Therefore, Dolphin believes that discussing the third-quarter performance is less meaningful at this point, and more attention should be paid to the future.

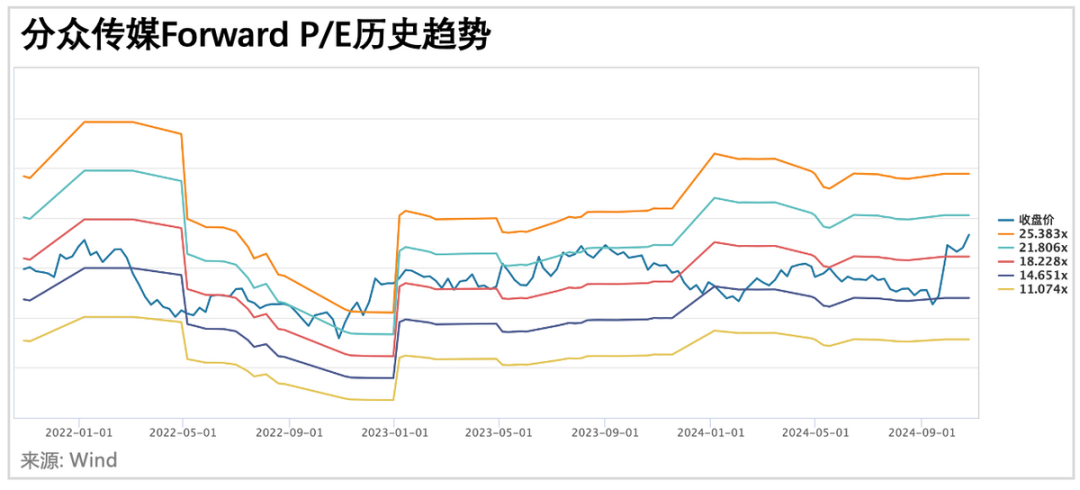

But to be honest, so far, no policies that can truly stimulate consumption have emerged. The current valuation, combined with the consensus expectations of institutions, has actually just recovered to the historical central level of 18x P/E, but corresponding to next year's revenue and net profit expectations (around RMB 14 billion/RMB 6 billion, respectively, with year-on-year growth rates of 9%/12%) and the CAGR for the next three years, it may only be around 10%. Even with a 4-5% dividend yield added, the 18x central valuation still appears relatively high from a neutral perspective in terms of PEG.

But what level is the expected growth rate for 2025?

2025 will be the first year after Focus Media has recovered from the disturbance caused by the pandemic and its base has returned to normal. Dolphin believes that the consensus expectations of institutions are likely based on the company's customary annual price increase of 10%. However, in reality, if advertisers' consumption expectations do not reverse, leading to actual sales growth, it will be difficult to maintain advertisers' current willingness to invest (sales and marketing expense ratio).

So is it possible for Focus Media to secure a larger share within the existing marketing budget?

Dolphin believes that this also depends on different environmental expectations. In a weak consumption environment/mindset, the proportion of brand advertising that is difficult to quantify and track ROI will continue to shrink in actual advertising placements by businesses. At the same time, within the limited brand advertising budget, Focus Media will also compete with KOL marketing, short video marketing, and emerging online platforms such as Xiaohongshu. Therefore, maintaining market share will also be challenging.

However, on the bright side, Focus Media remains the top choice among advertisers in traditional offline media. Therefore, the majority of Focus Media's potential market share gains will likely come from television advertising, traditional outdoor advertising, and other competitors in the elevator media sector (such as NewMedia).

Overall, Focus Media is a more typical "cyclical stock." When the economy is doing well, advertisers have extra money to invest in brand building, which in turn drives Focus Media's performance and valuation to soar. Conversely, when the economy is under pressure, Focus Media is more affected than online channels. Although the current valuation has just recovered to the historical central level, it actually implies a certain degree of optimism (emotional recovery). If there is no significant change in consumer expectations, this valuation central point is by no means truly reasonable. Not to mention that the current policies do not directly stimulate consumption, even if they are truly introduced, it will take some time for policies to be issued, implemented, and actually take effect, requiring repeated verification.

Detailed Interpretation of This Quarter's Financial Report

I. Revenue: Short-term Pressures Remain Difficult to Hide

In the third quarter, Focus Media's revenue was RMB 3.29 billion, up 4.3%, falling within the expectations of several leading institutions (RMB 3.2-3.4 billion). The macroeconomic pressures in the second half of the year were evident, leading to corresponding downward adjustments in market expectations.

Last quarter, Dolphin mentioned the strong seasonal effect caused by changes in advertisers' placement strategies, which was also reflected in the third quarter. The third quarter was not entirely a slack season, but rather a period of slow start and strong finish, with September typically being the new product launch cycle for 3C electronics and automobiles, as well as the seasonal demand for clothing. Additionally, this year also saw the Olympic Games (beverages, clothing), short-term stimulus in some consumption areas such as gaming and entertainment (summer chaos), and growth in home appliances (trade-in programs).

The current rebound in valuation significantly implies expectations for a recovery in the broader consumption environment following policy stimulus. Dolphin still wants to remind that short-term pressures will not dissipate so quickly. Nonetheless, the fourth quarter is Focus Media's traditional peak season, and driven by events like Singles' Day, full-year revenue is still expected to achieve a 7% growth rate, reaching RMB 12.8 billion.

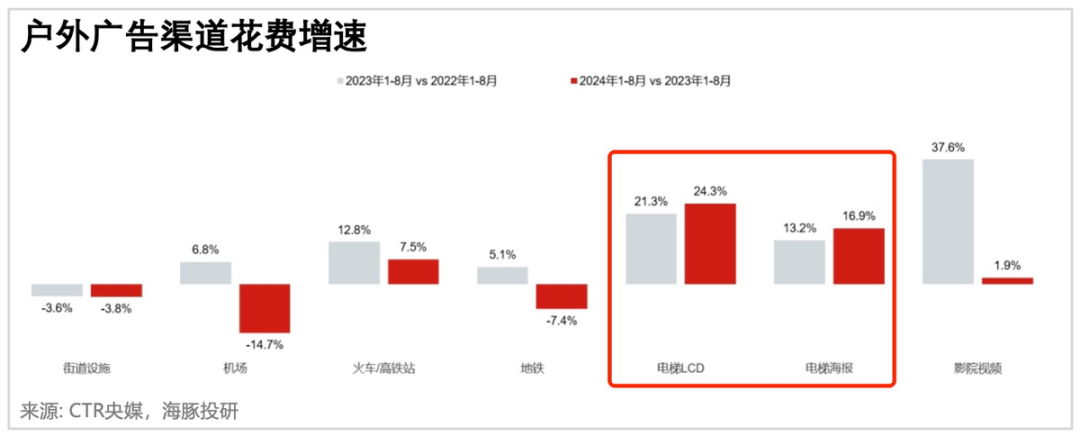

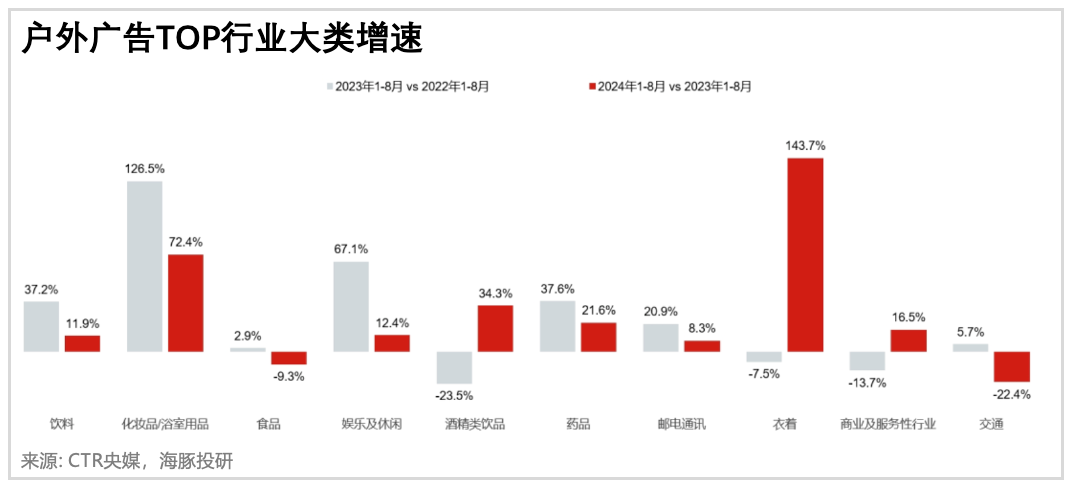

From an industry perspective, advertising rebounded ahead of social retail sales from July to September, likely due to increased advertiser spending during the Olympic Games. In terms of specific media, the growth performance of elevator media (LCD & posters) remained ahead of the industry. Among specific advertisers, clothing saw the most significant increase in advertising placements.

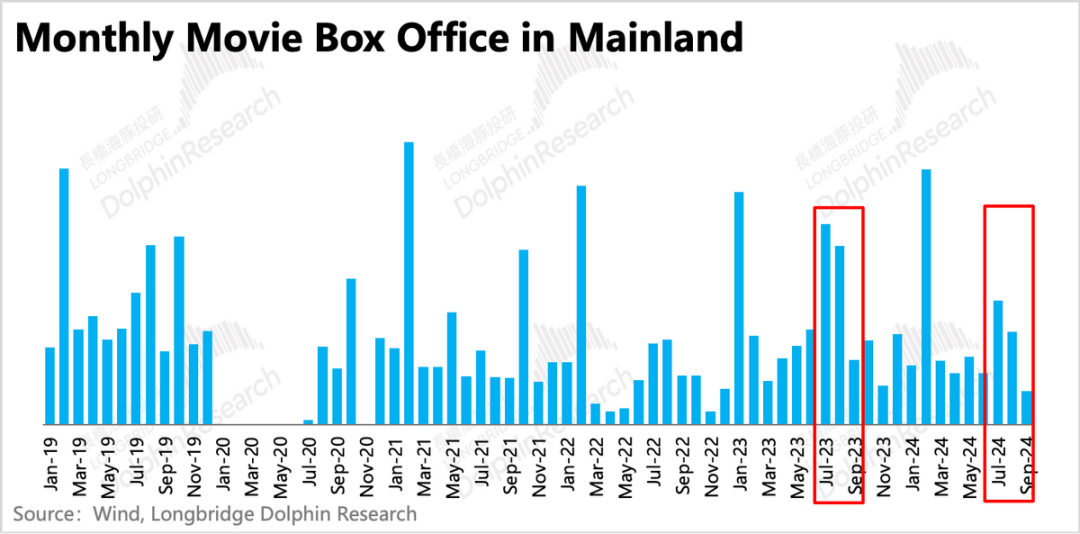

As for Focus Media's other advertising media revenue, cinema advertising revenue may have performed poorly in the third quarter. Although the third-quarter report did not disclose the breakdown of business segments, there were fewer high-quality films during this summer's movie season, with only "Catch the Doll," "Silent Murder," and "Alien: Covenant" performing notably well at the box office. Unlike last summer, which saw multiple blockbusters grossing over RMB 2 billion, including "All In," "Disappeared Her," and "Feng Shen: Legend of Demigods I."

Overall, third-quarter box office receipts were down 43% year-on-year, with attendance also down 43%. Under such circumstances, it was difficult for cinema advertising to sell well. This situation, exacerbated by a lack of supply, is expected to continue into the fourth quarter:

During the National Day holiday period, only one film, "The Battle at Lake Changjin," grossed over RMB 1 billion. Although there are many films in the pipeline, there are few potential blockbusters, and their release dates do not coincide with major holidays, making it difficult for them to achieve outstanding performance.

II. Revenue Outlook: Pressures Remain, Slow Customer Payment Schedules

Looking ahead to the fourth quarter, events like Singles' Day are still expected to drive advertisers' "strong seasonal effect" placement strategies. Coupled with some relative policy expectations, Dolphin does not make overly pessimistic assumptions about the fourth quarter.

However, it is also necessary to face up to the current short-term pressures. For example, during periods of severe macroeconomic conditions or problems in its own operations, Dolphin will also observe the actual situation and future trends through changes in downstream customer payments:

(1) Credit Impairment: Credit asset impairments further increased in the third quarter, reflecting intensifying macroeconomic pressures. Compared to total revenue, this increased to 2.9%, a level that is only slightly lower than the pandemic-affected 1Q22 in the past two years.

(2) Days Sales Outstanding (DSO): The increase in DSO in the third quarter indicates that the current payment speed continues to slow down, suggesting that the current payment pressure is higher than in 2023 and similar to the second half of 2022.

Overall, Dolphin expects fourth-quarter revenue growth of 5%, reaching RMB 3.4 billion. This expectation implies a quarter-on-quarter growth rate of 3.9%, indicating a stronger seasonal effect than in previous years. As a result, full-year revenue is expected to reach RMB 12.7 billion, up 7% year-on-year.

III. Profit Growth Reliant on Investment Income, with Stable Gross Margin Increases as the Only Comfort

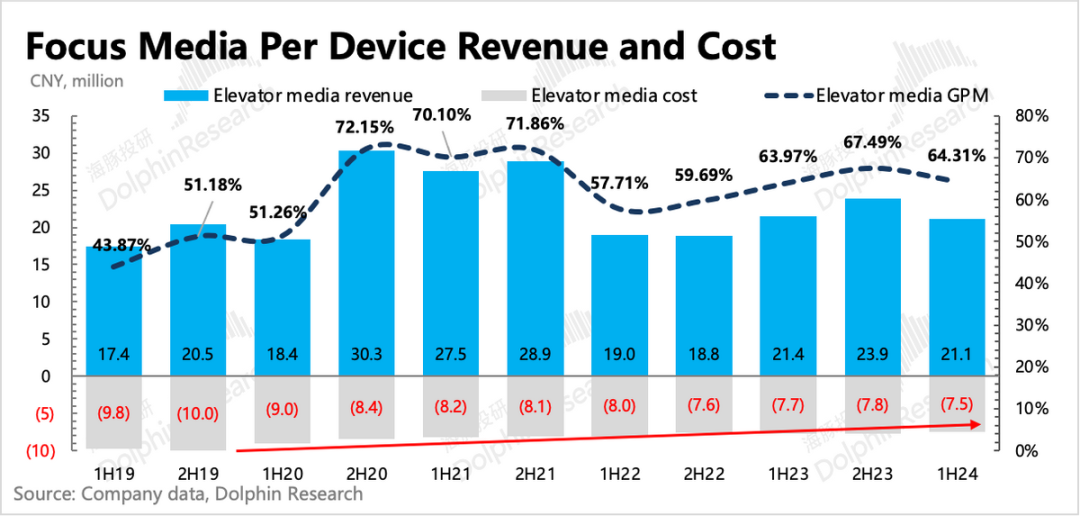

Since last year, Focus Media has been expanding its locations, particularly in second- and third-tier markets, in line with the broader trend of consumption downgrading and sinking. The third-quarter announcement of a partnership with Meituan also reflects Focus Media's current sinking strategy.

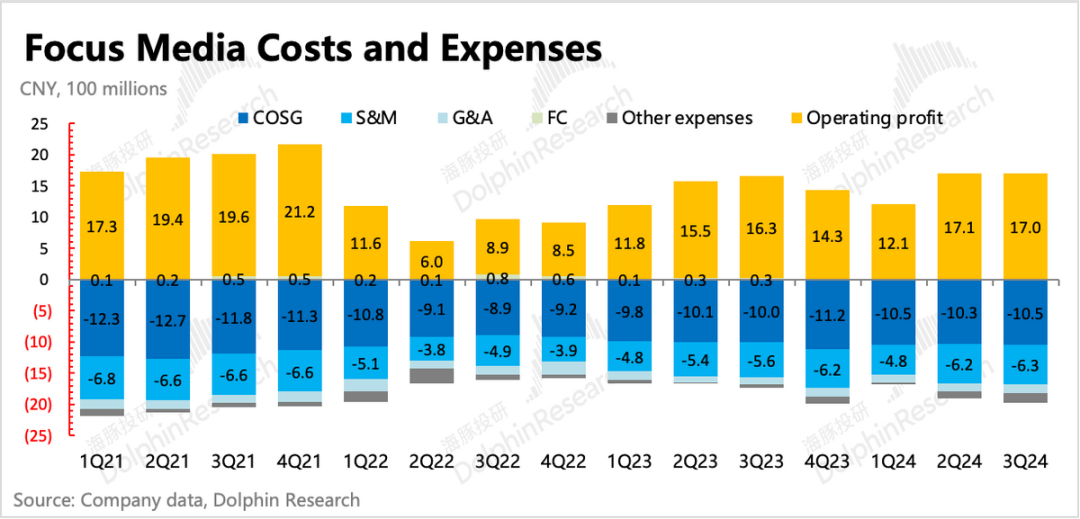

Generally speaking, the biggest impact during the investment period is on profitability. Gross margin may be affected by the temporary lack of fully booked advertising space in newly developed locations during the ramp-up phase, while the need to acquire new customers during this period also leads to higher marketing expenses.

In Dolphin's interpretation of the previous quarter's financial report, we mentioned that Focus Media's difference lies in the limited impact on gross margin during the ramp-up phase, but there is indeed a significant increase in marketing expenses.

This trend continued and was strengthened in the third-quarter report:

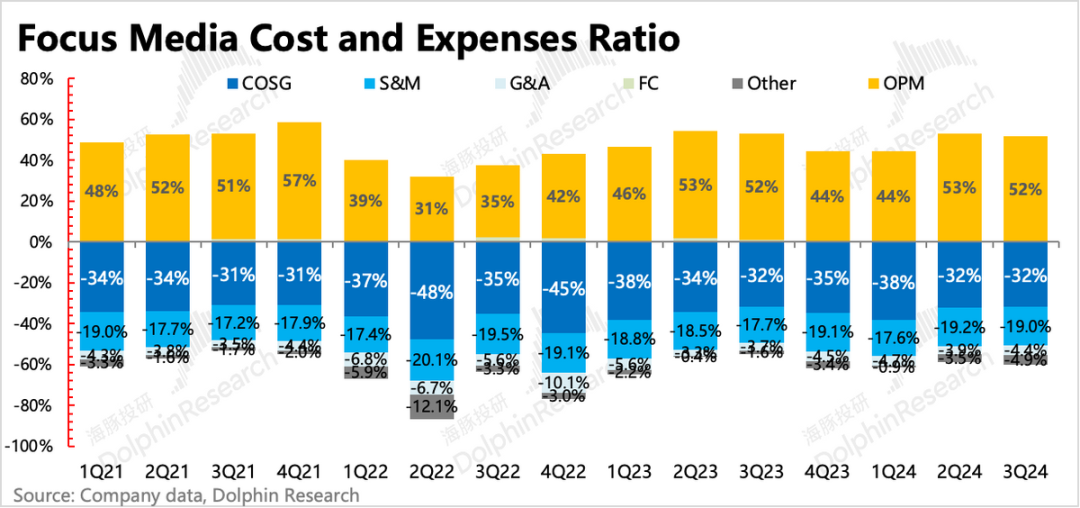

1) Limited Impact of Gross Margin Ramp-Up: Focus Media's overall gross margin in the third quarter was 68.2%, a slight increase of 0.2 percentage points from the previous quarter and flat year-on-year. Considering that the utilization rate of cinema advertising should have been low in the third quarter, leading to a drag on cinema advertising gross margin, this in turn implies that the gross margin for elevator media in the third quarter was actually higher than the 64.3% in the first half of the year.

Dolphin believes that combining the location distribution information disclosed in the semi-annual report and the gross margin of each business, it can be seen that Focus Media's gross margin can remain stable and high despite revenue pressure but aggressive expansion of locations, indicating that the location optimization efforts Focus Media has been making have shown long-term results.

At the same time, the newly added lower-tier locations have lower rental costs (in a year-beginning conference call, the company estimated that it would add 100,000 building TVs in lower-tier markets this year, but the total incremental cost would be only tens of millions of yuan. The average cost per location calculated based on the semi-annual report data in the chart below also shows a downward trend in average costs as the company expands into lower-tier markets). Local businesses also rely more on location-based advertising and traffic diversion, so the UE model for a single location may not necessarily be lower than that in high-tier cities.

Meanwhile, considering that the gross margin will inevitably be affected during the period of rapid location expansion, this in turn implies that there is still room for improvement in Focus Media's future gross margin.

2) Continued high growth in marketing expenses: The main change in operating expenses lies in marketing expenses. As locations expand and operations return to normal, customer activities will also increase, including customer acquisition and maintenance of existing customers, corresponding to the expansion of the sales team.

In the third quarter, marketing expenses reached 630 million yuan, a year-on-year increase of 12% on top of a high base last year. At the end of the third quarter, fixed assets increased by 17% quarter-on-quarter, reflecting Focus Media's increased investment in media equipment assets in line with its aggressive expansion of media locations. Additionally, cash outflows for employee expenses increased by 35% year-on-year, which is likely primarily driven by the expansion of the sales team.

Despite stable gross margins, high-growth marketing expenses, coupled with significantly higher credit impairment losses year-on-year, ultimately led to an operating profit of only 1.31 billion yuan for the core business in the third quarter, a year-on-year decline of 8.8% despite a 4% increase in revenue. However, net profit attributable to shareholders reached 1.48 billion yuan, a year-on-year increase of 7.6%, due to increased non-operating gains such as investment income and fair value changes.

Despite stable gross margins, high-growth marketing expenses, coupled with significantly higher credit impairment losses year-on-year, ultimately led to an operating profit of only 1.31 billion yuan for the core business in the third quarter, a year-on-year decline of 8.8% despite a 4% increase in revenue. However, net profit attributable to shareholders reached 1.48 billion yuan, a year-on-year increase of 7.6%, due to increased non-operating gains such as investment income and fair value changes.

- END -

// Reprinting Authorization

This article is an original piece by Dolphin Investment Research. For reprinting, please obtain authorization from Dolphin Investment Research.

- END -

// Reprinting Authorization

This article is an original piece by Dolphin Investment Research. For reprinting, please obtain authorization from Dolphin Investment Research.