Yostar, persistent in pursuing buy-to-play model

![]() 11/01 2024

11/01 2024

![]() 459

459

In October, Steam launched a seven-day Early Access Festival for new games.

Starting from 2024, major domestic game companies have shown unprecedented enthusiasm for participating in Steam's Early Access Festival, seeing it as an opportunity to promote their games' reputation. During the October Early Access Festival, Tencent's "Delta Force" and iDreamSky's anime-style hero shooter "Strinova" ("Calabiyau" overseas version) were among the participants.

However, among them, Yostar was the only major game company to exhibit a buy-to-play single-player game.

As early as February this year, the company released its second game, "Stardust Memories," which also adopted a buy-to-play model. However, due to deficiencies in game maturity and completeness, its reputation did not meet expectations, leaving a mess behind.

Yostar's new game, "Poom Poom," is a multiplayer cooperative adventure game. During the Steam Next Fest, the game received widespread praise from players and successfully ranked among the top three "Most Played" games. Nevertheless, Yostar's persistent pursuit of buy-to-play games still puzzles the market.

Previously, Yostar became the highest-earning anime game company in China after miHoYo, but from 2019 to 2024, its revenue almost entirely relied on "Arknights." During this period, the company only released two buy-to-play games, "Stardust Memories" and "Poom Poom," raising concerns about the singularity of its product line.

More concerningly, Yostar's "Arknights: Terminal" passed the review in August this year but still has no clear launch date, undoubtedly increasing market uncertainty. With the existing single revenue source already unstable, the failure of "Stardust Memories" further exacerbates market panic.

Why is Yostar persistent in pursuing buy-to-play?

Arknights IP, still the future

Firstly, it needs to be clarified that Yostar has always regarded the large-scale game built around the "Arknights" IP as the company's core project, with an irreplaceable strategic position.

Specifically, Yostar has long planned for "Arknights: Terminal" to succeed "Arknights" as the company's cash flow pillar in the future. However, the launch of this product is approached with great caution, driven by multiple considerations.

The primary factor lies in Yostar's development strategy for the "Arknights" IP, which is markedly different from the "wide net casting" model adopted by other game companies.

Since the launch of "Arknights," the game has been a huge success, with its "story content" being a key attraction for players. Therefore, Yostar has invested heavily in content development for the "Arknights" IP, engaging in in-depth content construction.

This includes extensive layouts in the animation field, such as the production and release of the three seasons of main story animations "Arknights: Prelude to Dawn," "Arknights: Hidden Path of Winter," and "Arknights: Dawn of Embers," as well as side story animations like "The Carp Detective Agency." For this purpose, Yostar has specifically established the "Gravity Well Studio."

Additionally, Yostar has collaborated with the Ninth Procuratorate of the Shanghai Municipal People's Procuratorate and the Xuhui District People's Procuratorate of Shanghai to create the animated short "Popuka's Internet Adventures," promoting the "Protection of Minors Law" in an entertaining and educational manner.

It also encompasses unremitting efforts in the music field. Yostar has established the music subsidiary "Ukuta Boundary," focusing on music production, distribution, and performances to expand the musical landscape of the "Arknights" IP.

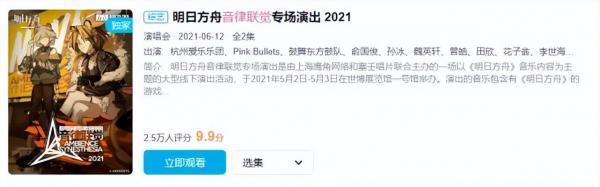

Inspired by the largest music distributor in the game's original world, "Hyperion Records," Yostar created this virtual distribution agency in reality. In 2021, the "Arknights Music Concert" jointly held by Yostar and "Hyperion Records" not only ranked among the top ten domestic box offices but also received a nomination for the Hollywood Music in Media Awards' "Live Concert in Visual Media" category.

Besides, Yostar has also launched various "Arknights" derivative comics, including "Action Prep Unit A1," "Rode Island Kitchen," "Infected Chronicles: Blacksteel," and "Rode Island Originstone Chronicles: Rhein Lab."

In the broader entertainment field, Yostar has developed derivative products around the "Arknights" IP, including but not limited to themed carnivals, tours, figurines, clothing, and other forms of lifestyle and entertainment content, successfully extending the game IP into broader areas. This content investment, far exceeding industry standards, has not only significantly enhanced the loyalty of "Arknights" players, keeping the game, which has been operating for over six years, firmly at the forefront of the market's game revenue rankings, but has also continuously pushed up the commercial value of the "Arknights" IP.

However, the continuous rise in IP value has also become a heavy burden for sequel development. For "Arknights: Terminal," it is not just an IP sequel but a product that cannot afford to fail.

The problem is that, in the current overly competitive environment of secondary games, the development team of "Arknights: Terminal" has decided to transition from 2D to 3D based on deep considerations of game graphics and gameplay, undoubtedly setting a higher challenge threshold for itself.

Back in October last year, before the release of "Stardust Memories," the second-in-command of Yostar, "Haimao," spoke at the "Tour of Cores Ceremony" and candidly stated, "'Stardust Memories' marks our entry into 3D game development from scratch. For a team that has traditionally focused on 2D games, this transition is fraught with difficulties and challenges."

Unfortunately, this prophecy seemed to come true. "Stardust Memories," officially released in February this year, encountered significant issues at multiple levels, including graphics quality, model construction, copywriting, and new player guidance, causing widespread dissatisfaction among players. Especially noteworthy is the game's pricing strategy of 68 yuan, which has been dubbed Yostar's "faith bond," highlighting market dissatisfaction with its performance.

Although Yostar's second work, "Stardust Memories," as a preliminary attempt at the buy-to-play model, fell short of expectations, its setback was manageable, given its exploratory nature. However, for "Arknights: Terminal," the sequel to the company's core project, the "Arknights" IP, its success is crucial, and any misstep is unacceptable.

This may explain why, despite passing the review as early as August this year, the game has neither announced a clear launch date nor hinted at an internal test.

Against this backdrop, Yostar has begun actively exploring more diverse development paths.

Is the path of buy-to-play getting easier?

Currently, Yostar has released or started trials for three games – "Arknights," "Stardust Memories," and "Poom Poom" – developed by its Montagna Studio, Awake Wave Studio, and Retrace Mountain Studio, respectively.

"Arknights" and "Stardust Memories" target the in-app purchase mobile game and buy-to-play mobile game markets, respectively. Meanwhile, "Poom Poom," based on the license information obtained in January 2024, has obtained a dual-platform license for clients and game consoles (including PS4 and PS5), potentially targeting the PC and console markets.

This was corroborated by the survey questionnaire distributed by Yostar to players during the Steam Next Fest.

After informing users that the full version of "Poom Poom" will have "about 10-15 hours of main storyline, about 5-10 hours of multiplayer cooperative levels, and about 3 hours or less of mini-games," Yostar asked players how much they would consider the game too expensive when it officially launches on Steam. This move undoubtedly aims to conduct research for the subsequent Steam launch of the game.

It is clear that Yostar is pursuing a development path combining multiple platforms and models.

Earlier, leading companies in the domestic game industry did not overlook the development of single-player games, but their focus was significantly different from current market trends. Taking Tencent and NetEase, the two giants, as examples, both have attempted mobile single-player games.

Tencent launched a flight combat game called "Shadow of the Skies," unique in that it relies entirely on hearing rather than vision, designed specifically for blind players. Meanwhile, NetEase independently developed an indie-style mobile game called "Qing Li," where players play as a swordsman escorting an injured and amnesiac lover on a journey of escape, with the game's ultimate message focusing on natural environment protection.

In addition, the market has seen several similar games, such as "See," which allows players to experience blindness, "The Last Secret," which immerses players in the culture of the Red Army's Long March, and "The Ninth Institute," a sandbox construction game that recreates China's technological pioneering history. However, most of these works are for public welfare purposes and are not considered commercializable projects.

The reason behind this has become a consensus in the industry: compared to a highly acclaimed mobile game, the revenue generated by single-player games pales in comparison.

Moreover, the player payment logic differs significantly between buy-to-play games and free-to-play games with in-app purchases. The former requires players to pay for the entire gaming experience, while the latter allows players to gain a sense of superiority within the game by purchasing specific values or privileges. Based on this consumption concept, players have stricter quality requirements for single-player games and are more price-sensitive.

Taking Yostar's "Stardust Memories" as an example, the game is priced at 68 yuan, which is already on the higher end for buy-to-play mobile games but only one-tenth of the common large in-app purchases of 648 yuan in free-to-play games.

Therefore, for some time, buy-to-play games have not gained widespread recognition in the domestic game market.

However, since this year, the market trend has shifted, and Yostar's strategy happens to coincide with this opportunity.

On the one hand, at the end of August this year, the domestic 3A masterpiece "Black Myth: Wukong" surpassed ten million sales, setting a benchmark for domestic single-player buy-to-play games. Although "Black Myth: Wukong's" sales success is influenced by multiple factors, and its final sales figures are not directly comparable to other domestic buy-to-play games, it has significantly expanded the domestic single-player gamer community, opening up new growth space for the buy-to-play game market.

On the other hand, a more notable change in the game market this year stems from the stagnation of mobile game user growth and the increasingly fierce competition in the free-to-play in-app purchase market. Many domestic top game companies, including Tencent and NetEase, have focused on developing "large DAU" products. In a market with existing users, competing for "large DAU" undoubtedly exacerbates market competition, leading to multiple "marketing wars" and "price wars" this year. The core reason behind these conflicts is the "pursuit of a large user base amidst saturated user resources."

Against this backdrop, the game model reliant on in-app purchases within a free main body will face a severe shakeup. In contrast, the gradually recovering domestic buy-to-play game market is poised to become a new blue ocean area.

Of course, Yostar did not foresee these market changes in advance. Since its establishment in 2017, the company has invested in over a hundred game companies, most of which are startup teams with similar development circumstances. Through this strategy, Yostar has successfully incubated multiple outstanding teams, including Black Light Studio, Monkey King Studio, and Fisherman's Wharf Studio.

This investment strategy may have initially been based more on a love and original intention for the game industry. However, it did capture market opportunities for Yostar. Regardless of how the future of buy-to-play games unfolds, Yostar has become a pioneer in exploring this field in China.