New force at Canton Fair, traditional foreign trade embracing new momentum

![]() 11/01 2024

11/01 2024

![]() 451

451

Editor | Liu Jingfeng

The 136th Canton Fair arrived as scheduled, with bustling crowds revealing the current boom.

In autumn Guangzhou, global businessmen speaking different languages and having different skin tones poured into the Canton Fair exhibition halls with the surging crowds. They hoped to discover the most cost-effective Chinese products in the global buying and selling business.

The Canton Fair is currently China's longest-running, largest-scale, most comprehensive, and best-attended international trade event, featuring the widest range of products, the largest number of buyers from the broadest sources, and the best transaction results and reputation.

The total exhibition area of this autumn's Canton Fair is 1.55 million square meters, with a total of 74,000 booths and over 30,000 participating enterprises for the offline exhibition. Compared to the largest Canton Fair in history, which had 28,500 participating enterprises, this edition still demonstrates a growing momentum in scale.

According to the latest preliminary calculations by the General Administration of Customs, China's cross-border e-commerce imports and exports amounted to 1.88 trillion yuan in the first three quarters of 2024, a year-on-year increase of 11.5%, 6.2 percentage points higher than the overall growth rate of China's foreign trade during the same period. In other words, the rapid development of cross-border e-commerce has brought new momentum to foreign trade.

Precisely because of this opportunity, the Canton Fair set up a cross-border e-commerce exhibition area for the first time during this year's spring edition. At this Canton Fair's cross-border e-commerce exhibition area, we also saw the booth of Amazon Global Selling for the first time. This is the first time Amazon Global Selling has appeared at the Canton Fair, signifying that traditional foreign trade enterprises have seen the larger market space for cross-border e-commerce, and Amazon is further exploring possibilities for global end-buyers.

Vigorously expanding cross-border e-commerce has become a new trend. So, is it a must for foreign trade merchants to expand into cross-border e-commerce? Where lie the challenges and opportunities?

According to World Bank data, China's manufacturing industry has ranked first in the world for 13 consecutive years since 2010. As the only country in the world with a complete range of industrial categories, China ranks first in production volume for over 40% of 500 major industrial products.

Possessing a globally leading industrial chain network with significant scale advantages and vertical integration is our absolute advantage in facing world commodities.

In April 2023, the General Office of the State Council issued the "Opinions on Promoting the Stability and Optimization of Foreign Trade," proposing to encourage all localities to leverage their industrial and endowment advantages, innovatively establish comprehensive pilot zones for cross-border e-commerce, and actively develop the "cross-border e-commerce + industrial cluster" model, driving export growth for traditional enterprises through cross-border e-commerce.

Since then, various regions have actively built special industrial clusters for cross-border e-commerce. For traditional foreign trade merchants, cross-border e-commerce has broadened the path to the global market in a new business format.

Cross-border e-commerce is not new but is a new field of study for manufacturers in industrial clusters.

Around 2004, cross-border e-commerce initially took shape through the B2B development model. Early cross-border e-commerce platforms mainly focused on information display and matchmaking, exploring the full-chain digitization of offline transactions, payments, logistics, and other processes through B2B platforms.

It was not until 2015 that Amazon Global Selling began operations in China, leading to the rapid development of B2C cross-border e-commerce. However, the explosive growth of cross-border e-commerce occurred after the COVID-19 pandemic, a black swan event.

After 20 years of development, cross-border e-commerce is now being recognized by more traditional foreign trade merchants as a new opportunity.

The reason for this change is that as the path widens, capabilities are also gradually becoming stronger.

Qiu Sheng, Vice President of Amazon China and Head of Market and Partnership Expansion for Amazon Global Selling in the Asia Pacific region, succinctly stated, "Traditional foreign trade involves large volumes and small batches, but cross-border e-commerce requires small volumes and large batches. This necessitates cross-border e-commerce B2C enterprises to produce flexibly and intelligently, and many industrial clusters now possess such capabilities."

'Special industrial clusters such as hairpieces in Xuchang, Henan, steel lockers in Luoyang, women's pants in Zhengzhou, and textile and apparel in Wuhan, Hubei, demonstrate huge potential for going global,' said Qiu Sheng. Merchants from mainland cities in the Guangdong-Hong Kong-Macao Greater Bay Area, the Yangtze River Delta region, North China, and other places are transforming into cross-border e-commerce through Amazon Global Selling.

This is an opportunity for new beginnings.

However, for traditional foreign trade merchants, seizing this opportunity is not easy. Although both involve export trade, there are significant differences between the traditional foreign trade model and cross-border e-commerce.

On the one hand, cross-border e-commerce can directly reach global end-buyers, realizing global buying and selling, closely aligned with market demand. The distance between foreign trade merchants and consumers has been shortened by cross-border e-commerce.

However, from the perspective of supply chains and operations, the chains that merchants need to engage with have actually become longer: from factory production to cross-border transportation, warehousing and distribution in between, and final-mile logistics delivery to consumers, managing inventory and returns, involving every detail of small-batch sales and having insight into the global logistics network. On the operational level, merchants need to find clearer solutions in market insight, e-commerce strategies, marketing, and branding.

To truly reach global consumers, merchants need to address their shortcomings to build a bridge to consumers.

Traditional foreign trade merchants have more experience with products in cross-border e-commerce, knowing which products should be sold to corresponding markets. This is their advantage compared to most novice merchants. However, it is also a disadvantage; long-term communication with large B-end customers can easily make merchants lose sensitivity to C-end consumers and brand awareness.

In other words, just because an opportunity exists does not mean it can be smoothly seized; the right tools must be chosen.

Amazon is undoubtedly the most efficient entry point for traditional foreign trade to expand into cross-border e-commerce.

On the one hand, Amazon's C-end consumer base is extensive. Currently, Amazon's 19 global sites are fully open to Chinese sellers, allowing direct access to over hundreds of millions of active users worldwide. Similarly, on the B-end, merchants can also reach over 6 million high-quality corporate and institutional buyers through Amazon Business, providing merchants with the first step out of their comfort zone due to its vast market.

On the other hand, even at its current scale, Amazon still demonstrates rapid growth. As of September 2023, the number of Chinese sellers with sales exceeding USD 1 million on Amazon's global sites increased by over 25% year-on-year; the number of Chinese sellers with sales exceeding USD 10 million increased by nearly 30% year-on-year.

The absolute advantages of market breadth and growth rate mean that merchants can simultaneously reach the largest B2C+B2B market possibilities through Amazon.

For traditional foreign trade practitioners who are just starting with cross-border e-commerce, the most direct pain point is that the destination is too far away.

From the merchant's factory to global consumers, multiple links must be traversed, including domestic pickup, export customs clearance, cross-border transportation, import customs clearance, overseas warehousing, distribution and transfer, final-mile delivery, and returns. The supply chain becomes longer.

The distance also means facing more challenges in unfamiliar markets, and the complexity of cross-border supply chains is increasing. On the one hand, compared to the traditional foreign trade model of make-to-order, the speed of delivery and sales conversion are more critical in cross-border e-commerce; the faster the delivery, the higher the sales conversion rate. Simultaneously, inventory management is particularly important, requiring ensuring an appropriate inventory level in the sales destination country to avoid stockouts or overstocking.

On the other hand, supply chain expenses account for 15%-20% of the total operating costs in cross-border e-commerce, second only to product costs, highlighting the importance of logistics management.

Therefore, reasonably controlling the supply chain is the first step traditional foreign trade practitioners need to learn when expanding into cross-border e-commerce.

As an e-commerce platform with extensive global sites, Amazon is well aware that logistics determines user experience.

Based on this, Amazon provides merchants with a Supply Chain by Amazon solution, offering end-to-end supply chain management. This service covers multiple Amazon advantageous products, including Amazon Global Logistics (AGL) and Amazon SEND for first-mile logistics, Amazon Warehousing and Distribution Network (AWD) for warehousing and distribution, and Fulfillment by Amazon (FBA) for final-mile delivery. Amazon leverages its advanced technology and supply chain capabilities to help sellers quickly and efficiently deliver products to overseas consumers.

The advantages of the overall supply chain solution can be summarized as speed, cost-effectiveness, operational simplification, and diversified channel coverage.

At the 2023 logistics level, Amazon Prime members enjoyed the fastest delivery ever, with over 7 billion items delivered on the same or next day.

Not only is it fast but also cost-effective. Compared to other next-day delivery services in the US, FBA fees are on average 70% lower.

In addition, products delivered using FBA bear the Prime logo, making them more accessible to over 200 million premium Prime members worldwide, helping to increase exposure and sales. According to Amazon's official data, sellers using FBA achieve an average sales increase of 20%-25%.

Amazon is also aware of the complexity of supply chain operations, especially inventory management. Therefore, last year, Amazon launched the Amazon Warehousing and Distribution Network (AWD), equivalent to Amazon's overseas warehouses. AWD uses advanced machine learning for automatic replenishment, greatly simplifying inventory management and ensuring the right inventory levels to avoid missed sales opportunities due to stockouts or profit impacts from overstocking. Amazon hopes to free sellers from complex supply chain operations, allowing them to focus more on product development or sales.

Meanwhile, with sales channels becoming increasingly diversified today, Amazon gives merchants more choices. Amazon's overall supply chain solution not only supports order transactions on Amazon.com but also covers warehousing and distribution for non-Amazon sales channels.

Amazon Multi-Channel Fulfillment (MCF) can store products in AWD warehouses and replenish inventories for warehouses of other sales channels, enabling a single inventory pool management channel for supply. Amazon MCF can also directly distribute products to consumers on other channels, reducing barriers and truly addressing merchants' needs.

Besides supply chain differences, cross-border e-commerce places more emphasis on operations compared to traditional foreign trade.

For overseas markets, the foundation of good operations is in-depth localized services. In terms of localization, Amazon is continuously upgrading its regional capabilities. For example, in the Chinese market, Amazon Global Selling has established four regional centers in East China, South China, West China, and North China, with a newly added Central China regional center, including new service teams in Wuhan and Zhengzhou. Relying on these five regional centers, Amazon will continue to deepen various measures under the "Amazon Global Selling Industry Cluster Launch Plan" and closely cooperate with local governments to jointly promote the integrated development of "cross-border e-commerce + industrial clusters."

In terms of business integration, Amazon has added a local support team for the overall supply chain solution (SCA) to better meet supply chain needs, including first-mile logistics, warehousing and distribution, and final-mile delivery.

Compared to traditional foreign trade, cross-border e-commerce requires merchants to consider more operational aspects such as compliance, taxation, and marketing. Therefore, foreign trade merchants often encounter difficulties in finding professional support and differentiating service providers during their expansion into cross-border e-commerce.

Based on this, Amazon Global Selling has launched the "Third-Party Cross-Border Solutions" tool, namely the Amazon Service Provider Network (SPN). It primarily covers services such as logistics, overseas warehousing, compliance and taxation, operational support, marketing and promotion, finance, branding, and product display. Through strict screening, it brings together third-party service providers from various fields to provide full lifecycle service support to hundreds of thousands of Amazon China sellers.

In fact, for merchants who have long been engaged in foreign trade, they already have a thorough understanding of product demand in overseas markets. However, since the trade chain cannot directly reach C-end consumers, they still cannot respond promptly to market changes or capture consumer demands quickly.

This is where Amazon excels. Big brands/manufacturers are like "racers," and every decision in this "rally" affects the pros and cons, impacting all aspects of the enterprise like a row of dominoes. Amazon Global Selling's key account development and operations team serves as the "co-pilot" for big brands or manufacturers on their cross-border journey, using a calm mind, keen judgment, and professional guidance to help "racers" navigate complex terrains and provide full-chain guidance and advice during the initial stages of going global.

To better play the role of co-pilot and help racers go faster and smoother, Amazon Global Selling has also upgraded its seller training capabilities and exclusive seller services.

In terms of course upgrades, content has been enhanced to further expand the coverage of training topics, meeting the learning needs of sellers at different development stages throughout their lifecycle. Simultaneously, training resources have been expanded to more regions, with customized solutions tailored to the diverse learning needs of local sellers.

In terms of services, diversified products such as standard and flagship versions have been introduced for sellers of different sizes, types, and development stages. Additionally, the service scope will be further expanded next year, providing sellers with more support in cross-border compliance, Amazon Business, and global business expansion. At the same time, optimizations have been made to improve service response speed and deepen existing service content.

Especially for large manufacturing enterprises, Amazon's key account development and operations team will also provide customized assistance to help manufacturing enterprises overcome the five major challenges of "Made in China" going global, such as supply chains and cost planning, aiming to help manufacturing enterprises expand broader global C-end incremental opportunities based on their existing B-end business.

At the Canton Fair, a Foshan kitchenware manufacturing enterprise with an annual sales volume of about 600 million yuan indicated that although its B2B business is still growing, it is mainly concentrated in underdeveloped countries and regions. The enterprise hopes to establish its own brand in Europe and the United States through Amazon, increase sales channels for high-priced quality products, and achieve a 10% sales increase in the first year. Another enterprise with an annual sales volume of about 200 million yuan in the South African market values the market size and growth prospects of the European and American markets, hoping to achieve brand transformation from merely selling low-profit products to providing high added value and differentiated products through cooperation with Amazon.

The cross-border business is never smooth sailing due to the unpredictable wind on the sea.

Since China's accession to the WTO in 2001, it has undergone nearly 25 years of development. From a period of wild growth to gradual compliance, it has taken root in various markets and product categories. Along the way, cross-border merchants have experienced the benefits of stockpiling products and also tasted the bitter fruits of compliance management.

Today, the combination of the keywords "industrial belt" and "cross-border e-commerce" seems to provide a correct answer to the past 25 years—facing global consumers and creating truly international brands with manufacturing strength.

However, brands at different stages will encounter different problems. If we look towards the future, we can confidently state that branding and compliance are the trends. But to make the future path smoother, we must also consider the balance achieved through continuous interaction between platforms, brands, and services.

Creating a product is going from 0 to 1, while building a brand is going from 1 to 100. Brand building requires comprehensive thinking such as consumer loyalty, operational mindset, and long-term commitment, but new brands are often too immature to see the way forward clearly. From the platform's perspective, Amazon can also see merchants' aspirations and confusion regarding branding.

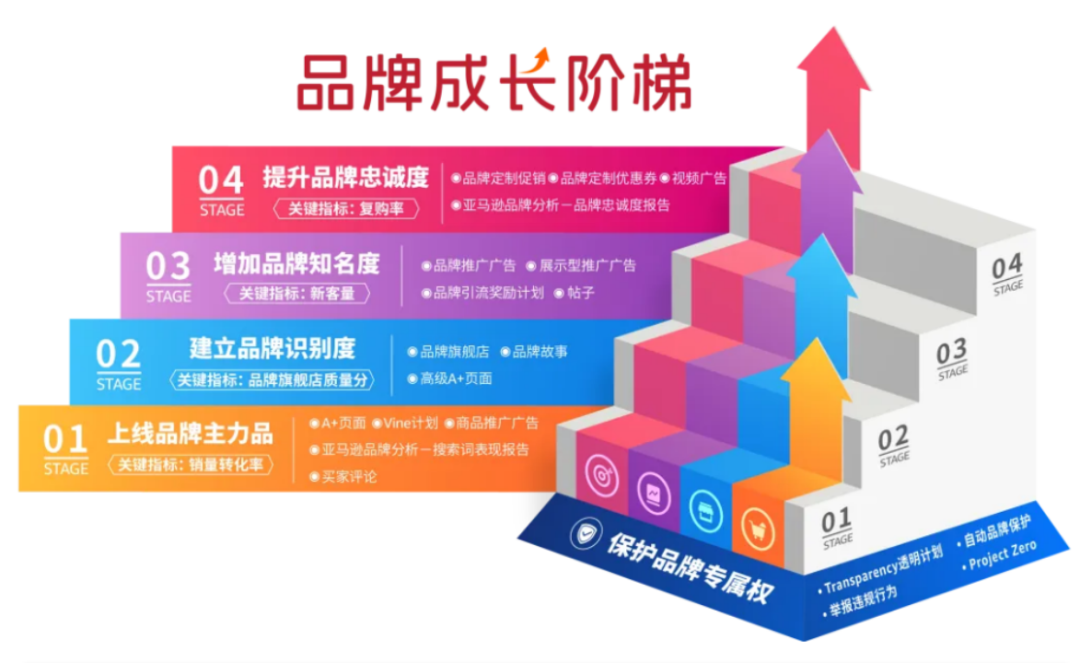

To provide a bridge to the future, Amazon has studied global brand seller data and summarized four stages of brand growth. It has outlined the core objectives, key performance indicators, and recommended tools and solutions for each stage to help brands advance to the next level.

In the trademark and brand registration stage, Amazon will continue to strengthen resources in the Intellectual Property Accelerator (IPA) and provide customized support and training.

For product cold start and conversion, Amazon will continuously upgrade tools such as the Vine program, A+ content, Enhanced Brand Content, and Manage Your Experiments (MYE), helping sellers efficiently improve conversion rates through various new feature upgrades and expanded user reach.

To assist brands in acquiring customers and building loyalty, Amazon will introduce a series of practical data analysis reports and tools, and upgrade innovative tools such as Brand Tailored Promotions (BTP), Posts, and Stores.

In terms of advertising, Prime Video ads will be launched in select countries in 2024, providing brands with an opportunity to gain visibility through Prime Video and connect with target consumers. Meanwhile, Amazon will continue to expand channels for brand-consumer connections and interactions, innovating comprehensive solutions from sales promotion to brand building.

Finally, in terms of brand protection, Amazon will continue to strengthen brand protection tools such as the Transparency program and Project Zero, enhancing protection for both brands and consumers.

The empowerment of dozens of brand tools provides foreign trade merchants with a comprehensive reference guide for their brand journey. In the future exploration of global brands, there will be a co-pilot to illuminate the way for drivers.

There is no shortcut to success, but there are methods. The combination of industrial belts and cross-border e-commerce is currently an inevitable trend, and opportunities for foreign trade enterprises transforming into cross-border e-commerce stem from this.