TikTok launches 'Casual Group Purchase', allowing users to cancel orders as needed

![]() 11/03 2024

11/03 2024

![]() 588

588

On October 30, according to an exclusive report by Tech Planet, TikTok upgraded its original group buying and delivery service to the 'Casual Group Purchase' service. 'Casual Group Purchase' allows users to either verify and redeem their orders in-store or opt for home delivery for the same group buying item. The original 'Group Buying and Delivery' service will gradually transition to the 'Casual Group Purchase' service starting from November 1, 2024.

After exploring and then withdrawing from Meituan's territory last year, TikTok's food delivery business has fluctuated between e-commerce and local lifestyle segments. The launch of the new business brand 'Casual Group Purchase' may signify the finalization of this strategic fluctuation.

This business layout is not new. As early as July this year, Meituan Group Buying officially launched the 'Instant Pickup' service, allowing users to place orders at 'Instant Pickup Stores' and complete the entire process of voucher verification, ordering, and backstage pickup appointments at nearby stores in one-stop through the app, regardless of dine-in or takeout scenarios.

Obviously, TikTok's local lifestyle layout has once again followed a similar path as Meituan. With the integration of takeout and in-store scenarios, TikTok can learn from Meituan not only in 'Instant Pickup' but also in unifying the membership system.

This integration also aligns with the current overall commercialization trend of the TikTok platform, which is to coordinate and balance content and shelf fields.

01. The internal chess game ends, with 'Casual Group Purchase' completely separating e-commerce and local lifestyle

As everyone knows, TikTok's food delivery business has undergone multiple segment adjustments this year, like a hot potato. An earlier article in New Standpoint, "New Battlefront in Local Lifestyle: Meituan's Scene Integration and TikTok's Timeliness Integration," mentioned rumors at the end of last year that TikTok would abandon food delivery. In April this year, TikTok adjusted its food delivery business from local lifestyle to e-commerce business lines; by August, the food delivery business returned to TikTok's local lifestyle business line.

The fluctuations are understandable. Compared to Tmall, JD.com, and Meituan, TikTok is the only platform that simultaneously focuses on e-commerce, supermarkets, and food delivery. New Standpoint has previously expressed the view that the "fluctuations" between TikTok's food delivery in local lifestyle and e-commerce businesses are actually an attempt to find a compromise for the timeliness of fulfillment for businesses such as supermarkets and hourly delivery, which are relatively timely compared to e-commerce. After all, for TikTok, the logic of e-commerce and food delivery both apply to supermarkets and hourly delivery.

Focusing on TikTok's e-commerce segment, in the first and second halves of 2023, TikTok added entries for TikTok Supermarket and hourly delivery to its mall page. The main timeliness of TikTok Supermarket is next-day delivery, while hourly delivery can be regarded as a faster version of TikTok Supermarket.

Mu Qing, vice president of TikTok e-commerce, previously stated: "Platform services and logistics timeliness can meet the needs of some specific users, forming an effective supplement to our existing platforms and merchants."

Later, in August this year, TikTok e-commerce reached a strategic cooperation with Yonghui Supermarket. According to Huxiu, TikTok plans to enter over 100 Yonghui stores, aiming to quickly cover offline high-net-worth retail users and complete the penetration of its e-commerce offline shelf mindset.

In other words, looking solely at TikTok's e-commerce segment, a business logic that integrates scenarios and timeliness has already been formed. From express delivery to next-day delivery and then to hourly delivery, from online supermarkets to offline supermarkets, this is also the main business framework of JD.com and Tmall.

For TikTok's local lifestyle segment, rumors spread in mid-2023 that TikTok's food delivery would abandon its GMV target of 100 billion yuan. Until the first half of this year, its food delivery business has actually been lukewarm. Food delivery requires a strong shelf mindset, while TikTok's local lifestyle business, which primarily involves in-store visits, does not rely on shelves and can achieve a considerable layout by simply diverting traffic from the content segment.

Therefore, last year, TikTok's food delivery and in-store visits could not effectively collaborate like Meituan. Hence, it is a very reasonable choice to assign the food delivery business to the e-commerce segment with hourly delivery capabilities.

However, whether the e-commerce department is willing to accept the food delivery business or if it is reassigned back to local lifestyle, it is likely due to the same reason: both need more businesses as new growth points.

According to previous reports by LatePost, TikTok e-commerce's sales growth rate has dropped from over 60% at the beginning of the year to less than 20% in September. Local lifestyle businesses, which were already less profitable than e-commerce, are also experiencing slowing growth. When food delivery cannot effectively bring new growth points to the e-commerce segment, it is understandable to return to the local lifestyle business, where merchant types highly overlap.

Obviously, after seeing Meituan launch the 'Instant Pickup' business in July, integrating in-store and home delivery scenarios, TikTok's food delivery and local lifestyle businesses have undergone two months of readjustment from August to the present, leading to the emergence of 'Casual Group Purchase'.

This move also means that TikTok's food delivery, which was once like a hot potato, now has a clearer direction for business growth. It is highly unlikely to fluctuate again in the future, and TikTok has further clarified the division of business logic between local lifestyle and e-commerce.

02. TikTok's version of 'Instant Pickup', integrating shelf and content fields

Judging from the launch of 'Casual Group Purchase', it can be considered a brand-new business brand for TikTok.

According to the "TikTok Lifestyle Services Announcement on Adjustments to Food Delivery Business Operations," the original group buying and delivery service will no longer support new merchant entries or the creation of new products. Existing products will also not be displayed on the platform, and historical group buying and delivery orders will be refunded in batches. For merchants, the original group buying and delivery business cannot be automatically transferred to the new 'Casual Group Purchase' business.

Currently, 'Casual Group Purchase' primarily targets chain merchants, requiring at least three stores for full-service restaurants. For light and simple fast-food options, merchants must claim at least ten stores. These are essentially the core merchant types for TikTok's in-store group buying, indicating that 'Casual Group Purchase' also relies heavily on the foundation laid by the previous in-store group buying business. Moreover, the business logic of 'Casual Group Purchase' obviously places higher requirements on merchants for dine-in options, which is significantly different from TikTok's original food delivery business.

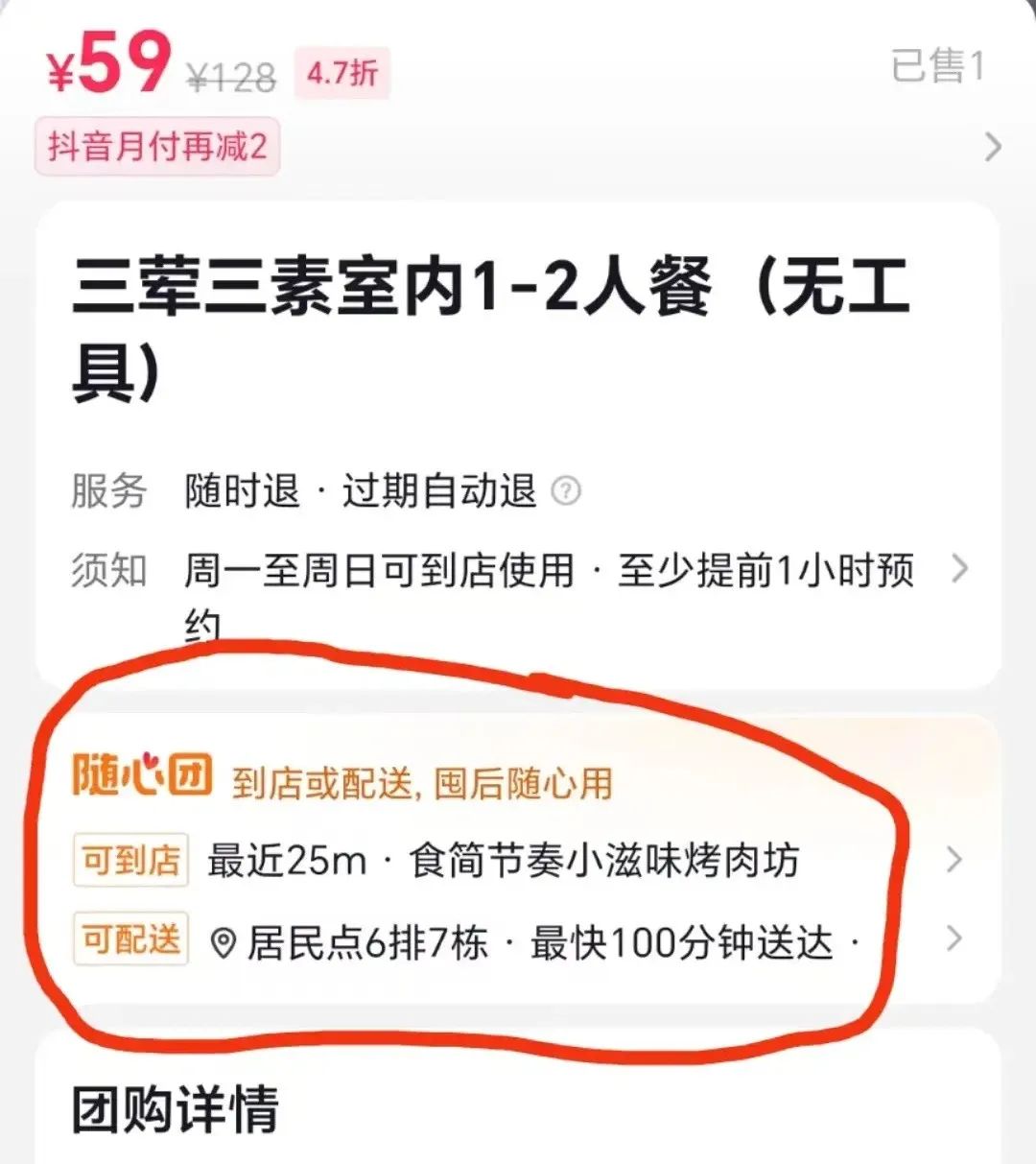

'Casual Group Purchase' allows users to place group buying orders and then autonomously choose to verify and redeem them in-store or schedule a delivery time for home delivery. TikTok can continue to unify the membership mindset between in-store and home delivery scenarios through this.

Before Meituan's 'Instant Pickup,' in February this year, Meituan had already adjusted its organizational structure, merging in-store and home delivery businesses. In May, it introduced the 'God Member' business, extending coupons previously only covering takeout orders to in-store businesses, which was a preliminary setup for integrating in-store and home delivery at the business level. Currently, TikTok's coupon system can also simultaneously cover both takeout and group buying businesses.

However, even for the same product in the same store, takeout and in-store scenarios often had different product links in the past. Now, whether it's 'Instant Pickup' or 'Casual Group Purchase,' it is obviously the same product link, just divided into different verification and redemption channels and subsequent fulfillment processes, which can significantly enhance the synergistic effect between in-store and home delivery.

Furthermore, TikTok's local lifestyle shelf mindset will also be strengthened.

In fact, at this stage, TikTok urgently needs a shelf mindset for both its e-commerce and local lifestyle segments. According to previous LatePost reports, by the end of last year, TikTok e-commerce's 'shelf field' sales accounted for 37% of the total, increasing to nearly 40% during this year's 618 promotion. TikTok e-commerce's monthly active user base increased from 380 million at the beginning of the year to over 400 million by the middle of the year. The team's review attributed this primarily to the driving force of the shelf field.

TikTok's local lifestyle segment's in-store business can temporarily capture a certain market size due to its content channel advantage. However, as mentioned above, TikTok's local lifestyle growth is also slowing down. Coupled with the fact that food delivery businesses inherently rely on a shelf mindset, TikTok's local lifestyle also needs to explore ways to enhance its shelf mindset.

'Casual Group Purchase' can simultaneously exert effort in both content and shelf fields.

Making a simple consumer perspective inference, for 'Casual Group Purchase' orders appearing in the content field, since one link can simultaneously support in-store or takeout options, the willingness to place orders will also be stronger. When users develop loyalty to TikTok's catering industry in the content field, they will also actively browse product content in the shelf field. The main mindset required for the food delivery business is also the shelf field, which will further promote TikTok's overall food delivery business.

Of course, whether the effect will be as smooth as predicted is another story, but it is undeniable that TikTok's current development theme for both its e-commerce and local lifestyle segments has come to the issue of balancing and coordinating content and shelf fields.

03. Conclusion

However, the biggest difference between TikTok's local lifestyle and Meituan's currently lies in the levels of 'planning' and 'immediacy.'

What TikTok currently lacks most in local lifestyle is precisely the mindset of immediate consumption. It is not difficult to see why Meituan's business is called 'Instant Pickup,' related to timeliness, while TikTok's 'Casual Group Purchase' is related to planning.

Relying on the mindset of immediate consumption, Meituan's 'Instant Pickup' has progressed smoothly. According to data released by Meituan, orders in the first month of 'Instant Pickup's' launch tripled year-on-year, and the verification rate of a certain brand store also increased from 60% to 78%.

Although the planned consumption mindset of 'Casual Group Purchase' can theoretically increase users' willingness to place orders in the content field, there is considerable uncertainty about how far it can support the business. After all, plans can't keep up with changes, and users might not want to eat after grouping and leaving it for a few days. 'Casual Group Purchase' may turn out to be a protracted business with many uncertainties.

*The lead image and images in the text are sourced from the internet.