"Less than two years, 'loss of blood' of 3.5 billion, where is the road to transformation for UFIDA Network?

![]() 11/04 2024

11/04 2024

![]() 691

691

Source | BohuFN

Once the third-quarter performance of UFIDA Network was released, it triggered widespread discussion. Only three quarters of the year have passed, but the cumulative net profit loss has reached 1.455 billion yuan. Compared with last year's full-year data, UFIDA's cumulative losses in the first three quarters of this year have already exceeded the total losses for all of 2023.

The most obvious problem is reflected in cash flow. At the end of 2022, there was approximately 8.3 billion yuan in cash holdings, which has now dwindled to only 4.8 billion yuan so far. This raises the question: Where did the huge discrepancy of 3.5 billion yuan go?

01 Revenue declined by 17.3% year-on-year, a disheartening third-quarter data

Looking back at UFIDA Network's financial data over the years, it can be said that the past five years have shown a year-on-year decline.

The financial report shows that UFIDA Network achieved revenue of 5.738 billion yuan in the first three quarters, a year-on-year increase of 0.53%. Looking at the third-quarter revenue data alone, revenue during the reporting period was 1.933 billion yuan, a year-on-year decrease of 17.3%, showing obvious weakness. Considering that there was only a 0.5% year-on-year increase in the first three quarters, it is not difficult to predict that full-year revenue in 2024 may decline year-on-year. Compared to 2023, when operating revenue still showed a slight increase of 5.8%, this year's financial performance appears even more dire.

If revenue can still be considered satisfactory, UFIDA Network's decline in net profit is unprecedented. In the first three quarters, UFIDA Network's net profit loss was 1.455 billion yuan, compared to a loss of 1.03 billion yuan in the same period last year, representing a 41.24% year-on-year increase in losses; non-operating profit loss was 1.484 billion yuan, compared to a loss of 1.136 billion yuan in the same period last year; and net cash flow generated from operating activities was -2.046 billion yuan, compared to -1.882 billion yuan in the same period last year.

Regarding the losses in the past two years, UFIDA officials have attributed them mostly to one-time adjustments and seasonal factors, as well as the company's continuous investment in strategic transformation and product upgrades, leading to increased research and development (R&D) and sales expenses. The 2023 annual report also shows that the company's R&D investment reached 2.106 billion yuan, a year-on-year increase of 20.1%. At the same time, sales expenses were 2.743 billion yuan, an increase of 22.7%, indicating an increase in the cost of channel and market coverage.

However, the question arises: Can such a huge investment really translate into long-term market competitiveness?

02 Is the 'Cloud SaaS' transformation and business model sustainable?

UFIDA has invested heavily in its cloud service transformation, but from a financial performance perspective, the profitability of its cloud business has yet to materialize.

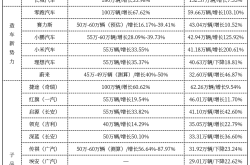

Comparing the changes in net profit rate between UFIDA and the industry average, it is not difficult to see the problem more intuitively from the statistical chart. Before 2022, UFIDA's net profit rate was basically in line with the industry level, but it has deviated significantly since 2023. Considering that its long-time rival Kingdee International is still maintaining growth, with a 23% increase in annual recurring revenue (ARR) in the third quarter, UFIDA's performance can only indicate that it is encountering unresolved challenges in its own transformation process.

From the balance sheet, we can see some clues. Specifically, UFIDA emphasizes the development of 'subscription' business, but this has not been truly reflected in the financial data. For example, in the third quarter of 2023, UFIDA's accounts receivable continued to increase, with a quarter-on-quarter growth of 8.3% from the end of 2023, reaching 2.723 billion yuan; contract assets (similar to accounts receivable but not yet meeting recognition criteria) increased by 24.5% from the end of 2023, reaching 1.1 billion yuan. This means that the total accounts receivable increased by 12%, reaching 3.82 billion yuan.

At the same time, although UFIDA has publicly stated that subscription contract liabilities have increased, this data is derived from the company's own breakdown of total contract liabilities. In fact, total contract liabilities in the third quarter decreased by nearly 10 million yuan compared to the end of 2023, remaining at 2.65 billion yuan, not showing any change in contract liabilities due to the rapid growth of subscriptions.

It can be said that for UFIDA Network, the bigger problem lies in its increasingly unfavorable contract terms with customers, rather than the decline in revenue and profit. The fundamental reason lies in the fact that its 'cloud business' has not effectively changed the business model of the traditional software industry. Especially in the current context where all departments are being called upon to 'tighten their belts,' the business model of large customers, mainly state-owned enterprises and central enterprises, is more susceptible to direct impact.

03 Substantial layoffs to reduce costs, opportunities and risks coexist

Judging from the current data, UFIDA's cash is already stretched thin. In Q3, it decreased by 560 million yuan to 3.61 billion yuan, and with financial products, it is approximately 4.8 billion yuan. UFIDA's short-term borrowings are 3.92 billion yuan, long-term borrowings are 1.67 billion yuan, and interest-bearing liabilities are as high as 5.6 billion yuan, equivalent to negative net cash. Considering that its annual operating cash flow is already a large negative number, the company may face certain debt repayment pressure in the future.

The current situation is still based on the premise that UFIDA conducted a 5 billion yuan private placement at the beginning of 2022. It can be said that this company has its ingenuity in capital operation. Without this timely 'blood transfusion,' UFIDA would likely be facing existential issues today.

Now, with private placements in A-shares no longer easy, UFIDA can only settle for second best and begin to take cost-cutting measures such as layoffs. In the third quarter alone, the number of employees decreased by 1,287 compared to the end of H1 2024.

While this approach can indeed reduce expenses, it also brings new problems for the company in balancing cost control and customer delivery quality. The average annual salary of UFIDA employees is approximately 250,000 yuan, and this round of layoffs has resulted in a direct expenditure of 140 million yuan, equivalent to an average layoff cost of over 100,000 yuan per person. It is conceivable that many of the laid-off employees will be veterans with more than 3-5 years of service. As everyone knows, software is a knowledge-intensive industry that generates revenue through people, and talent loss may affect the quality and innovation capability of the company's services. With UFIDA signing so many new major customers, how can it ensure the quality of customer service and delivery? This will ultimately be reflected in the renewal rate of UFIDA's newly signed customers.

Of course, the development of any enterprise will inevitably encounter setbacks. On the one hand, there is a consensus in the industry that the SaaS industry is still in its 'golden decade,' and there are still plenty of opportunities to explore in new businesses such as AI and going abroad. On the other hand, UFIDA must also further clarify its future strategic direction, whether it is to continue strengthening its cloud transformation or optimizing its traditional business.

After all, the decline in performance over the past two years has brought numerous challenges to both business operations and capital markets. The time and space left for this established software vendor may no longer be as abundant as in the past.