US stock 'Big Seven' earnings reports are coming: An AI tool has become the new king of competition

![]() 11/05 2024

11/05 2024

![]() 460

460

Text and Image | Tangjie

After Amazon released its earnings report after the market close on October 31 (local time), all three major global cloud service providers have disclosed their third-quarter results. As the most significant "gold sponsors" in the entire AI trend, these three companies directly determine the fate of the entire AI chain.

Some people may believe that large AI stocks have been overbought for too long, and as the US election approaches, uncertainties are increasing, leading to potential significant declines in tech stocks that may never recover. However, others argue that AI will remain the most critical theme for a long time, impacting various sectors such as electricity, chips, cloud services, and AI applications, all of which will see growth.

Regardless of the speculation, a fundamental premise remains: AI enthusiasm requires buyers, and the most important buyers today are cloud service providers. They spend vast amounts of money on electricity, chips, and building massive computing centers, and they invest in AI applications, aiming to make them a core societal force as soon as possible.

Therefore, understanding the signals from their earnings reports can provide clearer insights into the continuation of the AI era.

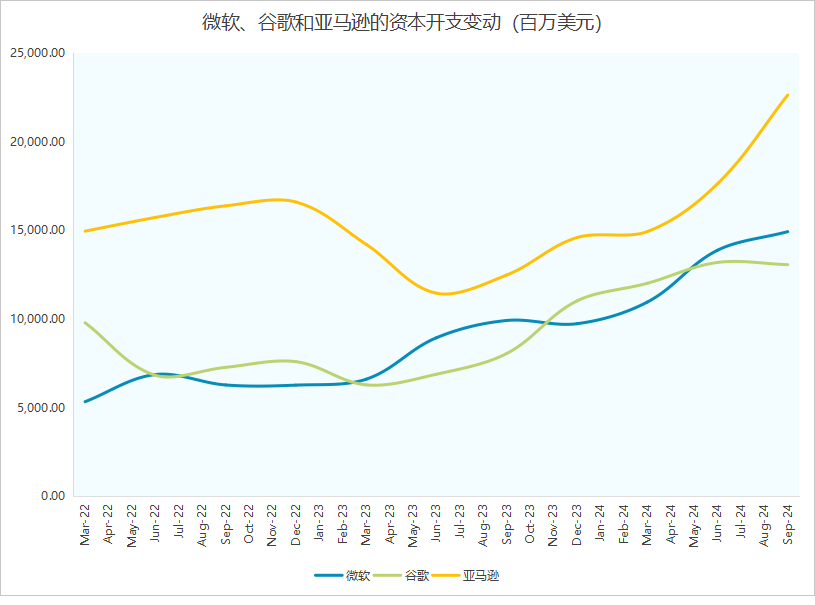

01 Signal 1: Capital expenditures will continue to expand

Before examining this year's Q3 earnings reports, it's essential to clarify the issue of capital expenditures by major technology companies. During the Q2 earnings season, Pichai's vague yet negative response to the question of AI-driven capital expenditures startled the market:

'I think the way I think about this is that when we experience such curves, the risk of underinvestment is much greater than the risk of overinvestment for us, even if the final results show that we have invested too much.'

Such an ambiguous yet negative response from an industry leader was devastating for the entire sector. It sparked concerns about the risk of overinvestment in AI by tech giants, leading to a sell-off in Google's stock and affecting companies like Microsoft and Amazon, whose stock prices plummeted after the second quarter and have yet to recover.

Today, a quarter later, discussions and doubts about capital expenditures persist. This intense, almost manic expansion of capital expenditures remains the biggest question mark hanging over tech giants. As seen in Microsoft's post-earnings experience, despite delivering results that surpassed expectations across the board, its stock price plummeted 6% on the first trading day after earnings, hitting a two-month low.

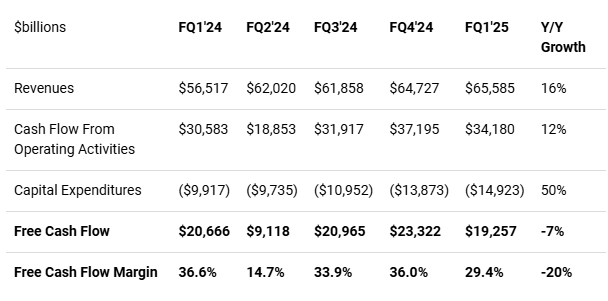

Source: Company earnings reports, compiled by Tangping Index

In the third quarter, Microsoft's revenue and earnings grew at double-digit rates, with EPS earnings and net profit setting new quarterly records in the company's over 50-year history. Similar to Google, Microsoft's Azure cloud service grew by 33% year-on-year, driving total revenue in Microsoft's Intelligent Cloud segment to $24.092 billion, up 20% year-on-year.

In contrast, the Productivity and Business Processes segment, which includes Microsoft 365 tools, generated revenue of $28.317 billion, up 11% year-on-year. While it remains Microsoft's largest business segment, the gap with its cloud services is narrowing.

From any perspective, these are outstanding results. The primary reasons for Microsoft's post-earnings stock price plunge are the continued expansion of capital expenditures and the negative impact of slowing growth in cloud services.

Source: Seeking Alpha

Due to the increasing capital expenditures, Microsoft's free cash flow in this quarter declined by 7% year-on-year to $19.3 billion, the first time it fell below the $20 billion mark this year. As one of the US stock companies with the most significant free cash flow, investors value Microsoft's free cash flow, which enables the company to acquire AI startups and generate potential shareholder returns through buybacks or dividends.

During the earnings call, Microsoft reiterated to investors that it would continue investing in AI infrastructure, and capital expenditures would also continue to expand. The growth rate of cloud services, currently the core driver of growth, is expected to slow down in Q4 2024 but rebound to over 32%-33% in the first half of 2025. Capital expenditures will continue to expand.

Similar statements were made during Google and Amazon's earnings calls, with all giants indicating that capital expenditures will continue to expand. In this context, the quality of revenue generated by AI becomes particularly crucial.

02 Signal 2: Expanding AI application scenarios

Unlike when large AI models first emerged, AI product forms and application scenarios have undergone tremendous evolution. Many previously difficult or even unimaginable functions are now commonplace.

Our readers are aware that we have covered US stocks extensively over the past year and received many inquiries about information acquisition methods. Due to time zone differences, language barriers, and other factors, most US stock investors find it challenging to obtain timely and efficient first-hand information from companies. However, earnings calls are crucial as the disclosed content largely determines a company's stock price movements for an extended period. Even though it requires significant time, keeping up with these contents is essential.

Similarly, we need to closely monitor the dynamics of these major technology companies. During previous earnings seasons, when key companies released their earnings consecutively, we often had to stay up late to organize earnings data. Just listening to earnings calls and summarizing key points took a lot of time. Therefore, after the advent of AI-related applications, we began exploring various channels to find software that could truly enhance efficiency.

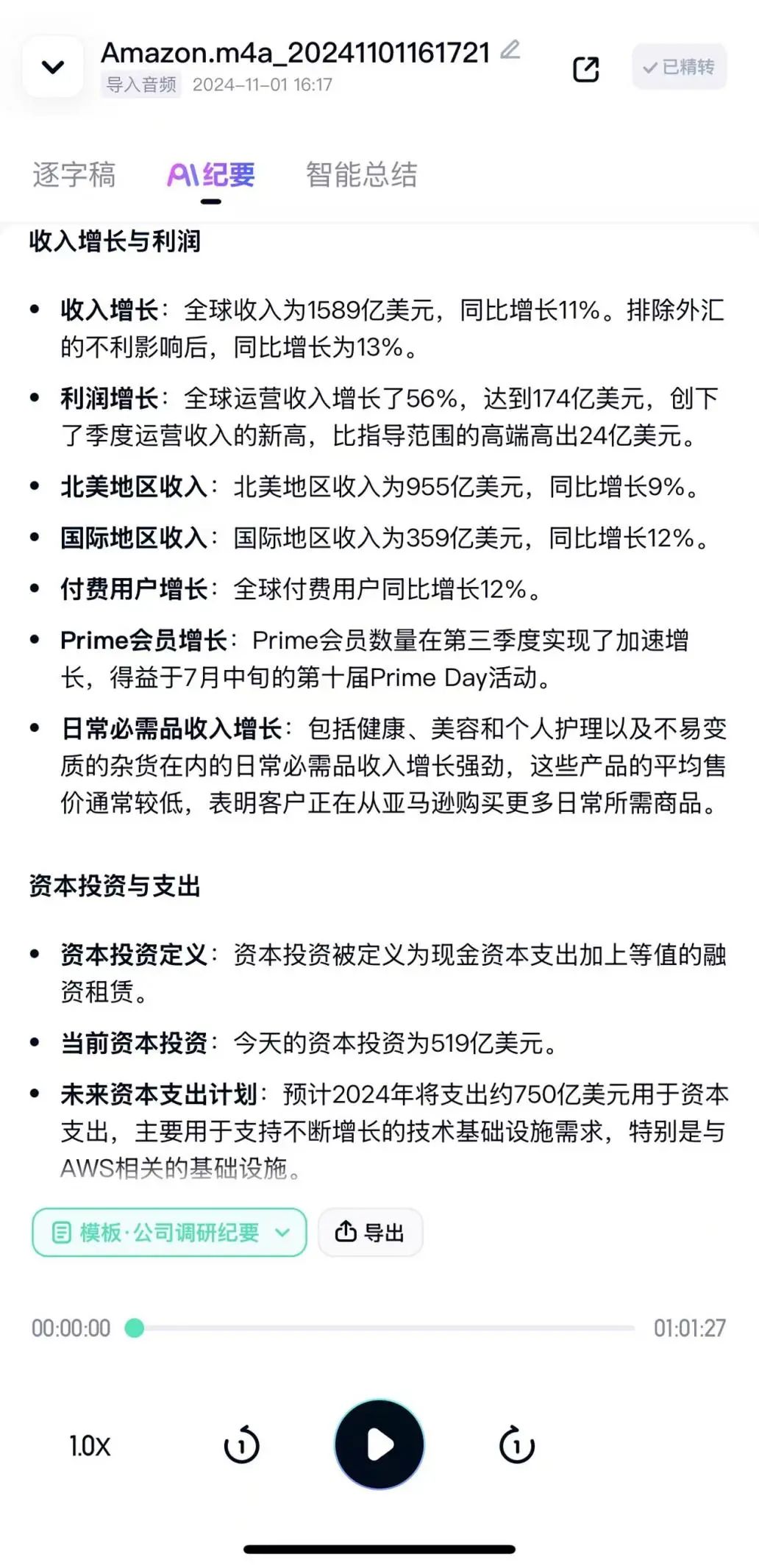

Recently, we discovered a feature called "Simple Note-Taking" in Baidu Netdisk. It can quickly organize recorded content from up to one-hour earnings calls and generate AI summaries within five minutes, adapting to various summary templates and making key information immediately apparent, thus effectively compensating for information gaps.

Specifically, when we can't attend a company's earnings call in real-time, we can log in to the company's IR page the next day to extract the webcast audio file from the webpage.

Then, upload the file to Baidu Netdisk, open the Simple Note-Taking function, import the audio or video for AI transcription, and directly obtain a verbatim transcript, AI summary, and intelligent summary, facilitating quick organization of key points and timely grasp of important company dynamics.

Another "smart" feature of Simple Note-Taking is its ability to intelligently distinguish human voices, accurately identify speakers, and segment them in the verbatim transcript, significantly enhancing the efficiency and accuracy of information recording and enabling quick grasp of key insights from different speakers. It can process hours of earnings call recordings in just a few minutes.

Supporting multiple work and usage scenarios, Simple Note-Taking allows seamless switching of voice-to-text content between mobile phones, computers, etc. Whether lying in bed, sitting in a car, or commuting, you can view transcriptions and summaries in real-time, quickly and accurately grasping changes in company fundamentals during fragmented time.

In addition, there are many other scenarios where Simple Note-Taking can excel. For example, it can be used to summarize recordings from investment expert sharing sessions, policy interpretations, and strategic conference presentations in WeChat or QQ groups. Daily work efficiency is significantly enhanced, and first-hand information is obtained instantly, making it a "work assistant."

As a content creator who needs to stay sharp and acquire information at a high density, I fully utilize fragmented time. I listen to podcasts for knowledge input, but many podcasts lack verbatim transcripts, and merely relying on shownotes is insufficient, easily leading to missed important information. Now, Simple Note-Taking can be used to enhance efficiency. By directly copying the podcast link into Simple Note-Taking, automatic transcription can be achieved.

Whether it's meeting minutes, podcasts, or group files, the verbatim transcript can be exported to Word or PDF format and forwarded with one click for more efficient sharing and archiving.

Previously, achieving such precise, efficient, and diverse functionality required significant effort. Now, with the iteration of AI applications, content that once required substantial time to obtain is readily accessible. This demonstrates the power of continuous AI advancement, which can replace traditional functions like audio transcription and significantly enhance user experience and efficiency.

03 Signal 3: AI has driven significant revenue growth

As AI applications gradually expand, increasing revenue levels is not difficult.

Taking Google as an example, before the Q3 earnings report, there were two primary concerns in the market: First, although Google is the most critical technical source for large models, it is visibly lagging behind startups like OpenAI. Its model has experienced several setbacks since its release and has not performed as expected. Second, Google's primary revenue source is advertising, and the implementation of generative AI search is seen as negative news for revenue.

While concerns about advertising space being crowded out are valid, the evolution of AI-driven product features, including multimodality (such as image search), has significantly enhanced user experience and increased search frequency. According to the earnings call, the Circle to Search feature has been rolled out on 150 million Android devices, with one-third of users using it weekly. Lens visual search processes over 20 billion visual searches per month, becoming the fastest-growing search type, with most results assisting users in shopping.

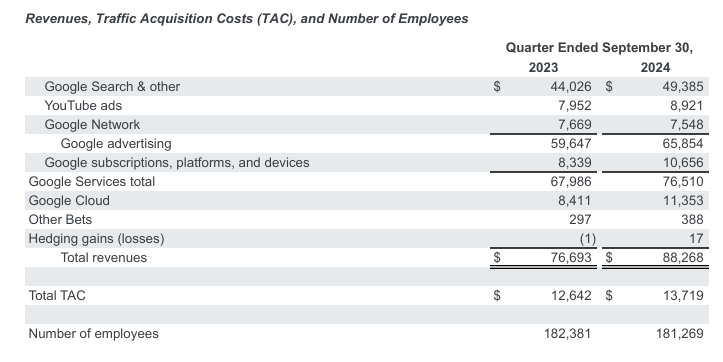

Both of these search features are heavily reliant on AI, and after the Q3 earnings report, doubts subsided significantly. Google's Q3 revenue was $88.27 billion, up 15% year-on-year; diluted earnings per share were $2.12, up approximately 37% year-on-year, comprehensively surpassing market expectations. Core advertising revenue was $65.85 billion, up 10.4% year-on-year, with both search business and YouTube advertising revenue maintaining double-digit year-on-year growth rates.

Source: Google earnings report

It turns out that the advancements in algorithm evolution and delivery efficiency brought about by AI for the advertising business outweigh the decline due to ad space crowding. Moreover, applications with a large user base can undergo complete product iterations and innovative changes through AI-native reshaping, fostering new vitality.

According to public data, Baidu Netdisk had over 1 billion registered users in 2024, accounting for over 80% of the Chinese personal cloud storage market, maintaining a leading position for a long time. Relying on such a vast user base and a deep understanding of market creation demands, Baidu Netdisk has keenly perceived users' consumption value for personal data. The Simple Note-Taking feature further enhances the use value of the netdisk, becoming an everyday necessity for practitioners in various industries and significantly boosting creative space.

As new AI features connect users' storage, management, consumption, and sharing needs for personal content, the "dusty" content in netdisks will have the opportunity to be revitalized based on new AI features, becoming an essential tool for content creators.

Just like now, whether in investment groups or in the WeChat Moments of various securities traders and investment tycoons, SimpleNote has become a very popular app that appears frequently. Investors we usually come into contact with tend to be older and have larger amounts of capital, and they are not familiar with some overseas transcription software; but Baidu Netdisk is different, it is easy to use and to a large extent meets the research needs of investors of all ages.

From the perspective of existing business, the role of AI is not to revolutionize or replace, but to accelerate and empower. In the future, everyone can use such tools to become more professional stock analysts and researchers. With its powerful functions, SimpleNote has emerged as a "dark horse" during the earnings season, not only meeting demand but also providing innovative supply and increasing the imagination space for the application of note-taking tools.

The future ceiling for AI is immeasurable, and both C-end applications like SimpleNote and large B-end applications like cloud services will expand at an unimaginable speed. As Google CEO Pichai mentioned in the earnings call, "Our long-term focus and investment in AI are paying off and driving success for both the company and our users."

Disclaimer: This article is for learning and exchange purposes only and does not constitute investment advice. We welcome likes, views, and shares, and your support is our motivation to update!