Seven Fresh is running out of time if it doesn't accelerate.

![]() 11/07 2024

11/07 2024

![]() 592

592

Text/Guo Jiayi

Editor/Zhang Xiao

In mid-2015, at an external cooperation ceremony of JD.com, a reporter asked Liu Qiangdong how he viewed O2O.

Liu Qiangdong replied: JD.com has been in e-commerce for 12 years, doing very well in electronics, clothing, daily necessities, packaged foods, cosmetics, and mother and baby products. "However, there is one category that we've been trying to improve for 12 years with various methods, but have yet to succeed—fresh produce."

He said at the time that O2O was a way to solve the "difficult" problem of the fresh produce category.

But even today, so many years later, from O2O to fresh produce e-commerce and then to community group buying, JD.com has hardly missed any wave in this sector but still cannot claim to have mastered this category.

Seven Fresh, JD.com's self-operated supermarket focusing on fresh produce, opened its first store in 2018 and currently has only 70+ stores. Its first supermarket in Shanghai opened in September this year.

In contrast, among Seven Fresh's competitors, Meituan's "Xiaoxiang Supermarket" (formerly Meituan Fresh) has opened over 680 self-operated dark stores since 2019, Hema Supermarket has exceeded 400 stores nationwide, and Sam's Club has opened nearly 500 dark stores.

However, JD.com is now embracing a new wave of instant retail. Since the beginning of this year, with the accelerated pace of industry layout and model validation in the instant retail sector, JD.com's layout around fresh produce has once again accelerated.

The strategic position of instant retail within JD.com has been further elevated. In 2024, "content ecosystem, open ecosystem, and instant retail" are called the "three must-win battles" internally at JD.com.

JD.com is also learning from its competitors by opening dark stores. According to e-commerce news reports, in June last year, JD.com established the "Innovative Retail Department," which includes Seven Fresh, dark stores, technology research and development, and supply chain operations, focusing on offline and instant retail scenarios. Recently, JD.com's Seven Fresh completed the merger with its first dark store, featuring the "store-warehouse integration" model.

Simultaneously with the completion of the merger with the first dark store, on November 1, Seven Fresh also launched a "price war" with the "Unbeatable Prices, True Bargains, No Fear of Comparison" campaign, seen by the outside world as JD.com initiating an instant retail price war against Hema and Xiaoxiang Supermarket during Double 11. Later, Seven Fresh responded to the media, saying, "We didn't deliberately target anyone in this price war."

Can Seven Fresh help JD.com finally crack the "tough nut" of fresh produce this time?

01

Attacking O2O, Focusing on Fresh Produce

Over the past few years, e-commerce has completed the online transformation of most retail categories, but fresh produce has always been a difficult one—its decentralized supply, low standardization, and perishability in circulation have greatly increased the difficulty of combining fresh produce with e-commerce.

However, its high frequency and rigid demand characteristics determine the huge market size of the fresh produce market. According to iResearch data, China's fresh produce market exceeded 4 trillion yuan in 2016.

Image/iResearch

This is also why the battle in the fresh produce sector has never stopped over the past decade, and model exploration has never ceased.

Among them, JD.com has hardly missed any wave in this sector, although the final results have always been unsatisfactory.

JD.com's earliest foray into fresh produce began around 2013, based on the O2O strategy, collaborating with offline convenience stores and supermarkets. Consumers could find the nearest offline convenience store on JD.com, and these stores could also open online marketplaces and fresh produce supermarkets on the JD.com platform.

In JD.com's plan, this network would cover all provincial capitals and prefecture-level cities in China by the end of 2014, with Hou Yi, who later joined Alibaba to found Hema, in charge.

At the time, the fresh produce category was not separated, but it had a high priority in JD.com's O2O strategy.

At JD.com's semi-annual summary meeting in August 2014, Liu Qiangdong pointed out that JD.com's three major future growth points were cross-border e-commerce, fresh produce e-commerce, and O2O. Then, in 2015, Deng Tianzhuo, then the head of JD.com's O2O business and vice president of JD.com, revealed in a sharing that in 2014, JD.com even stopped all other O2O business lines to focus on fresh produce.

With this determination and ambition, JD.com carried out a series of intensive layouts from 2015 to 2016.

In 2015, JD.com launched "JD Daojia" in April, led a US$70 million Series C funding round for the fresh produce retail platform Tiantianguoyuan in May, acquired a 10% stake in Yonghui Superstores for 4.31 billion yuan in August, and established JD Supermarket separately in October.

In 2016, JD.com established an independent Fresh Produce Business Department at the beginning of the year; in April, "JD Daojia" and "Dada" completed a merger, with the latter being China's largest crowdsourced logistics platform at the time; in June, JD.com acquired "1haodian," a supermarket brand mainly focusing on fast-moving consumer goods owned by Walmart, leading to a strategic alliance with Walmart; in October, Walmart's Sam's Club and Walmart International Flagship Store went live on JD.com, with delivery fully integrated into JD.com's self-operated logistics.

In this process, of course, Liu Qiangdong's goal was not just to develop fresh produce. From a more objective perspective, JD.com aimed to compete with Alibaba in this new retail battle.

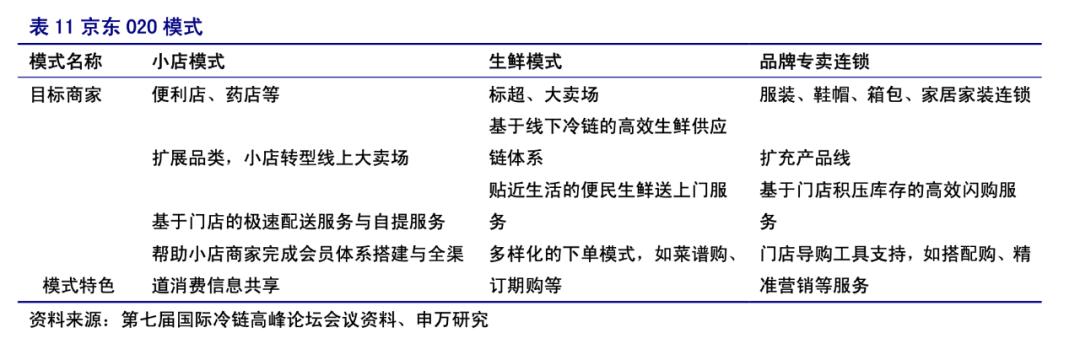

Image/Shenyin Wanguo Securities

Despite this, the importance of fresh produce in JD.com's above layouts is also prominent.

For example, at the funding conference for Tiantianguoyuan, Chang Bin, then vice president of JD.com, said that JD.com's upstream supply of fresh fruit would be entirely entrusted to Tiantianguoyuan; when investing in Yonghui Superstores, the latter's fresh produce category accounted for up to 60%; the merger of "JD Daojia" and Dada supported JD Daojia's distribution system.

However, soon after, the fresh produce e-commerce model began to diverge, and JD.com encountered newer, more vertical models, forcing it into an even fiercer competition.

During the same period, JD.com's O2O attempts around the fresh produce category were also not successful. For example, just a year after leading the investment in Tiantianguoyuan, the latter began to close its offline stores on a large scale, entering a contraction phase.

As mentioned in the book "Boiling New Decade," at the time, JD.com could only achieve direct shipping of some products in some cities, with a very low proportion. Although some large and medium-sized supermarkets participated in the distribution of fresh produce on JD Daojia, starting from a higher level than convenience stores, it still did not change the problems of decentralized supply, low standardization, and uneven service levels.

02

Benchmarking Hema, 7FRESH's High Start and Decline

In January 2018, JD.com's first offline fresh produce supermarket, 7FRESH, officially opened in Yizhuang Dazu Plaza, Beijing. This was JD.com's new attempt in the fresh produce sector.

Initially, 7FRESH was separate from JD.com's Fresh Produce Business Department and independent of the JD.com system. Wang Xiaosong, then vice president of JD.com and president of 7FRESH, said, "Lao Liu (Liu Qiangdong) is very concerned but will not interfere or intervene in decision-making."

At this time, Alibaba's highly anticipated Hema Supermarket had been operating for two years, seen as a bridgehead for Alibaba's exploration of new retail, with 25 stores opened. Within the Alibaba system, Hema also maintained relative independence, allowing it to freely and aggressively explore new formats in those years.

To some extent, Hema's accelerated growth in those years was one of the key factors driving JD.com to launch 7FRESH.

Hema's founder, Hou Yi, came from JD.com. When operating JD Daojia, Hou Yi led the cooperation with Tangjiu Convenience Store (the first supermarket brand in JD.com's O2O strategic cooperation), adopting the lightest convenience store dark store model. Later, Hou Yi found that this light model was difficult to solve inventory and experience issues, so he proposed a heavy model solution similar to Hema Supermarket, but did not receive support from Liu Qiangdong.

On the day 7FRESH's first store opened, Hou Yi also posted on his social media, saying that JD.com was doing new retail with a 3C approach and questioning, "How can such a money-burning approach empower merchants? If we stop burning money one day, will we still know how to do business?..."

For 7FRESH, JD.com was also initially very confident, planning to open over 1,000 stores nationwide within 3-5 years, with a long-term goal of having 7FRESH visible in major first- and second-tier cities in China. At the time, Wang Xiaosong also said that not all planned stores needed to be self-operated, and they would discuss various cooperation methods such as joint ventures and equity participation with partners.

Image/JD.com Official Weibo

7FRESH's strategic position within JD.com was also soon elevated.

First, in January 2018, JD.com established the Greater FMCG Business Group, running the "Fresh Produce Business Department" in parallel with the "New Channel and Consumer Goods Business Department," making JD.com's Fresh Produce Business independent as a first-tier business department; then, in the organizational structure adjustment at the end of the year, JD.com integrated the Fresh Produce Business Department into 7FRESH.

From the perspective of model and format exploration, 7FRESH and Hema were very similar at the time—

Both focused on first- and second-tier cities, adopted the "store-warehouse integration" model, and attempted to explore different formats for different consumption scenarios. For example, later, 7FRESH's formats included Seven Fresh Supermarket in the supermarket format, "Qi Fan'er" focused on office buildings, and "Seven Fresh Life," positioned as a fresh food and gourmet collection store.

However, in those years, the rapid expansion plan in 7FRESH's plan was not smoothly implemented, with progress lagging.

By September 2018, 7FRESH had only opened two stores in Beijing. Wang Xiaosong said at the time, "The reason for not quickly opening new stores nationwide is to ensure that the model is mature before replication. We firmly believe that opening good stores is more important than opening many stores."

Since then, 7FRESH has changed three leaders in the three years since its establishment, from Wang Xiaosong to Wang Jing and then to Zheng Feng. During this period, when Wang Xiaosong was transferred in April 2019, there were also rumors in the industry about layoffs at 7FRESH, the separation of JD.com's Fresh Produce Business and 7FRESH, and the possible sale of 7FRESH.

Amidst frequent turmoil, 7FRESH's positioning was also unclear. Many people did not understand whether 7FRESH was meant to be a gourmet supermarket or a fresh produce supermarket.

Until the end of 2021, when interviewed by 36Kr and asked about 7FRESH's positioning, Zheng Feng said, "Quality retail and quality life" are the logic behind our selection of products, with 100% packaged foods, a large number of 3R foods, and dining services that provide what you see is what you get.

By this time, 7FRESH was no longer a fresh produce supermarket to some extent, with fresh produce accounting for about 50% of the product mix.

Of course, one fact that cannot be ignored is that after 2019, the fresh produce e-commerce industry entered its darkest moment. Neither the warehouse model dominated by Hema and 7FRESH nor the dark store model of startups like Missfresh could achieve large-scale coverage in the lower-tier markets. Faced with unviable business models, many players in the sector collapsed.

It was also in this year that Hema closed its first store since opening, and its overall store opening speed slowed down synchronously; Meituan made new strategic adjustments, with Xiaoxiang Fresh, which benchmarked Hema, becoming less important, and resources being tilt to its grocery delivery business.

However, JD.com's exploration of fresh produce did not stop there. Apart from 7FRESH, which progressed slowly and was almost silent after that, community group buying became Liu Qiangdong's another attempt to layout fresh produce.

03

Intense Battle in Community Group Buying: JD's Late Entry, Brief Trial and Unexpected Restart

In the middle of 2020, catalyzed by the pandemic, community group buying quickly ignited an even more brutal battle.

The appeal of community group buying, especially for internet giants like Meituan, Alibaba, and JD.com, lies in the following:

Initially, almost everyone thought that startups like Xingsheng Youxuan had already established a successful model in the lower-tier markets. Their entry presented an opportunity to scale up and gain access to these markets, feeding back to their main platforms.

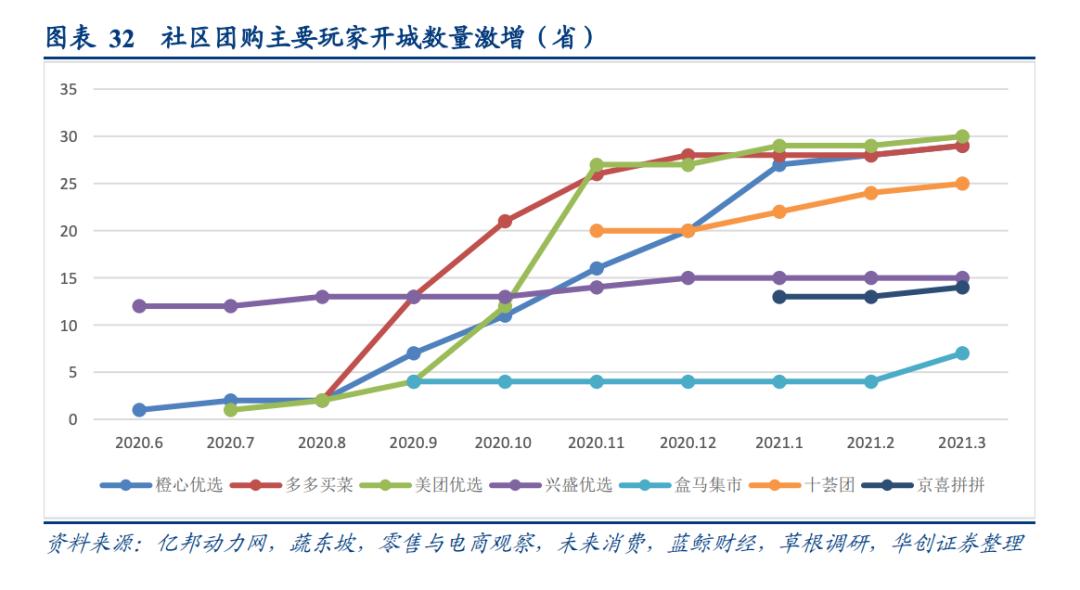

Since June 2020, Didi, Meituan, Alibaba, and Pinduoduo have all entered the fray with aggressive postures: Meituan Youxuan opened stores in six provinces within eight days, Pinduoduo initially provided cash subsidies of 1 billion yuan to group leaders, and Didi relied on heavy subsidies to achieve 1 million daily orders...

Image/Huachuang Securities

In contrast, JD.com became the slower player. In fact, before this wave officially hit, JD.com had already tried three community group buying businesses—Youjia Puzi, JD Ququgou, and Xiaoqi Pin, but did not truly commit.

It was not until the end of the year that JD.com, the last among the giants to enter, also adopted an aggressive stance.

According to a report by LatePost, at JD.com's executive morning meeting on November 30, 2020, Liu Qiangdong proposed that he would personally lead the team to win the battle in community group buying.

During the same period, JD.com completed a round of organizational restructuring, with Jingxi, focusing on the lower-tier markets, being upgraded from a business department under the original Retail Group to the Jingxi Business Group, integrating the New Channel Business Department, Community Group Buying Business Department, and 1haodian Business under the original Greater Supermarket and Omnichannel Business Group, as well as the original JD.com Mall Marketing Department.

Then, on December 11, JD.com announced its investment of US$700 million in Xingsheng Youxuan—multiple JD.com strategic investment personnel revealed to the media that this project was personally negotiated by Liu Qiangdong, and the strategic investment department executed it swiftly after confirmation, completing the project in just three weeks; a few days later, there were rumors in the market that JD.com had acquired Meijia Maicai for less than US$200 million, as reported by the Time Weekly at the time.

In January 2021, JD.com's community group buying brand "Jingxi Pinpin" finally went live, with Liu Qiangdong overseeing the Jingxi Business Group's leader.

Another detail that highlights Liu Qiangdong's emphasis on Jingxi Pinpin is that during the initial period after Jingxi Pinpin's launch, he held morning meetings every day with leaders of various regions. To boost morale, Liu Qiangdong also proposed that provinces and regions that could become the local market share leader would receive a reward of 20 million yuan.

However, after its high-profile entry, JD.com's investment in community group buying only lasted a year or even less.

According to a report by LatePost, just four months after Jingxi Pinpin's launch, JD.com began closing its operations in six underperforming provinces, including Qinghai, Gansu, and Fujian.",

In retrospect, JD Joybuy's timely withdrawal may not be a bad thing for JD.com.

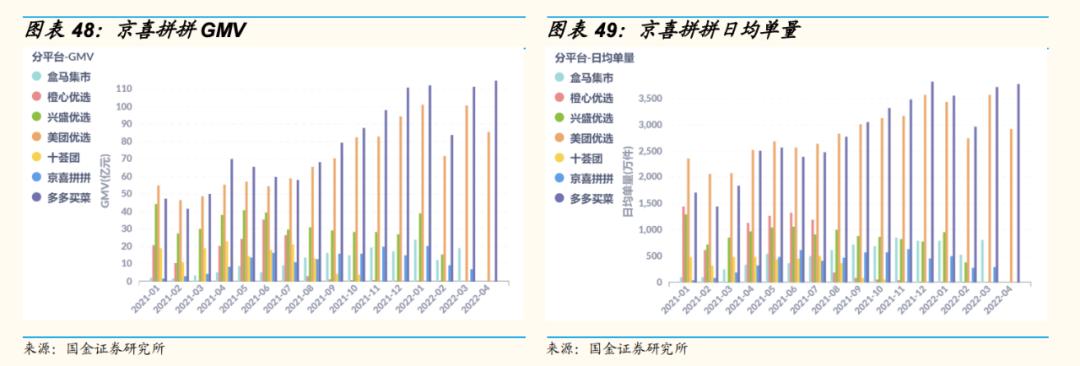

In terms of time, city expansion speed, resource investment, and order volume, JD Joybuy did not have a significant advantage. Continuously burning money had become difficult to exchange for market share.

In 2021, JD.com accumulated a loss of nearly 10.6 billion yuan. In the fourth quarter alone, new businesses, including JD Real Estate, JD Joybuy, overseas business, and technological initiatives, lost 3.2 billion yuan. CITIC Securities estimated that the majority of JD.com's losses came from JD Joybuy and its related businesses.

However, in exchange, during the peak period in 2021, JD Joybuy's average daily order volume did not exceed 7 million orders. The average daily order volume of Meituan Youxuan and Pinduoduo's Community Group Buying, both in the first tier, have exceeded 40 million orders.

Image/Guojin Securities

Has Liu Qiangdong given up on community group buying? Or has JD.com given up on fresh produce?

Of course not.

Last July, there was news in the market that JD.com had restarted community group buying. JD.com officially announced that it had upgraded the previous "JD Joybuy" to "JD Pinpin" and said it would further iterate in various aspects such as products, fulfillment, and operational services.

However, the term "restart community group buying" may not be accurate.

Last June, Yan Xiaobing, a JD.com veteran in home appliances, returned after leaving the company for several years to head JD.com's newly established Innovative Retail Department, which will integrate previous offline fresh produce businesses such as 7FRESH and community group buying businesses like Pinpin. Offline businesses are even independent of retail e-commerce businesses, and Yan Xiaobing reports directly to Xu Ran, who succeeded Liu Qiangdong as CEO of the group.

At this point, the positioning of the new JD Pinpin has changed:

Unlike in 2021, when it had a high strategic position, it has now become one of the businesses within JD.com's "Innovative Retail Department." In other words, JD.com no longer pins its hopes on capturing the sinking market through a single community group buying entry point. JD Pinpin needs to continue helping JD.com compete offline and find opportunities in the sinking market within JD.com's "Innovative Retail System."

04

Instant retail sparks a new wave of enthusiasm: 7FRESH needs to accelerate

Based on the above, let's briefly summarize:

Two years after community group buying faltered, focusing on fresh produce categories, JD.com has been actively seeking change since 2023 – the establishment of the Innovative Retail Department, the integration of 7FRESH and JD Pinpin, the determination of instant retail's strategic position, the accelerated integration of dark stores and 7FRESH, and the sudden price war in recent days all illustrate this point.

How should we understand JD.com's these initiatives?

The key lies in understanding the changes in the market environment faced by JD.com in the past two years and its strategic shift.

There are essentially three keywords: low prices, the sinking market, and Pinduoduo.

We previously analyzed in the article "Liu Qiangdong Hurries to Learn from Huang Zheng" that now, except for revenue volume, where it lags behind Alibaba and JD.com, in terms of revenue growth, profitability, and capital market performance, Pinduoduo is clearly the better-performing Chinese e-commerce company, putting significant pressure on JD.com and Alibaba.

In fact, at the end of 2022, when Liu Qiangdong internally stated that "low prices are the most important weapon of our past success and will remain the only fundamental weapon in the future," JD.com had already begun to confront competition from Pinduoduo head-on. During this process, JD.com also began to learn from this competitor, such as by introducing the "Billion Subsidy Plan" and launching the "Only Refund" service.

Since then, almost every move by JD.com has pointed towards "low prices.""Behind this, from Liu Qiangdong's return to JD.com in the past two years, to management adjustments, organizational structural innovations, and Liu Qiangdong's "iron-fisted approach," the essence has been striving towards one goal: Finding new growth for JD.com beyond traditional B2C e-commerce.

Live streaming e-commerce is an increment for JD.com because JD.com has not done well in this area in the past, so the "content ecosystem" has become one of JD.com's "three must-win battles" this year;

The sinking market is certainly one of them. Even without Pinduoduo, JD.com would still need to target the sinking market;

Another potential growth market is instant retail.

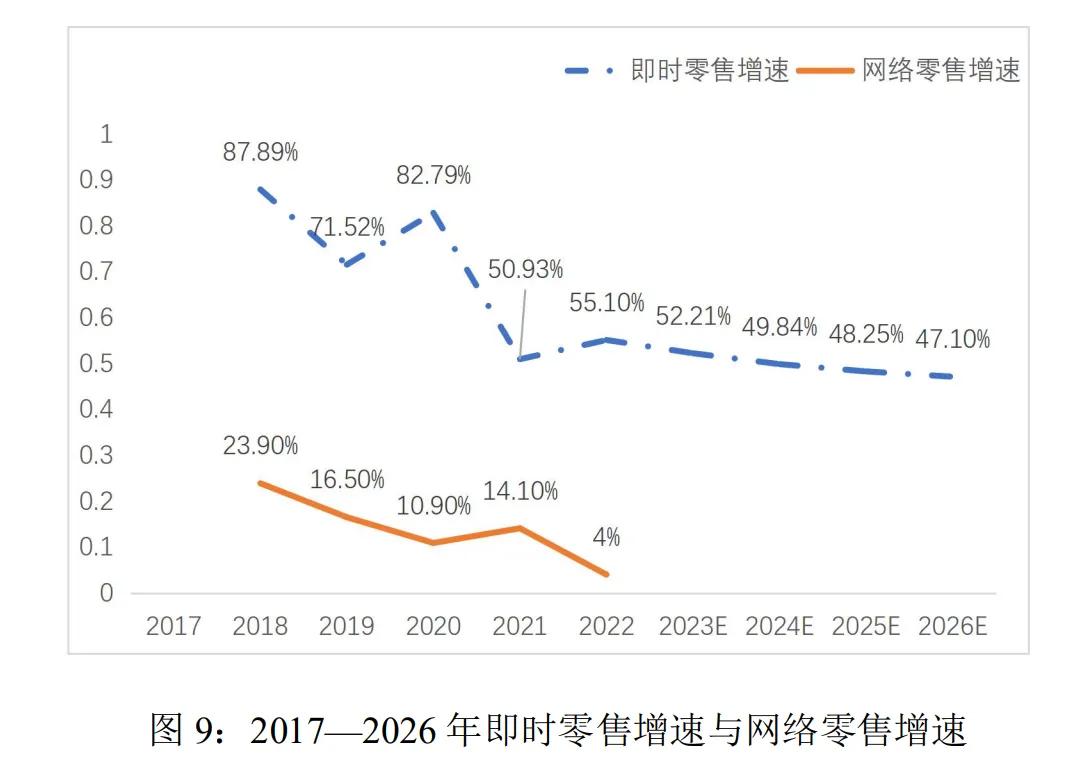

The "2023 Instant Retail Industry Development Report" points out that since 2018, the average annual growth rate of the instant retail industry has exceeded 50%. It is estimated that by 2026, the annual growth rate of instant retail may still be as high as 47.1%. Compared with the growth rate of total online retail sales during the same period, the growth rate of instant retail was 71.89 percentage points higher in 2020, 36.83 percentage points higher in 2021, and 51.1 percentage points higher in 2022.

Moreover, this statistical caliber does not include food delivery and instant services – in other words, nowadays, more and more people not only like having "food delivery" at home but also enjoy having "everything delivered to their doorstep" because buying various products in daily life through food delivery is convenient enough.

Amid this trend, the instant retail industry is currently facing increasingly fierce market competition.

Meituan and Alibaba have intensified their layouts and accelerated their pace. Recently, they have set relatively aggressive expansion targets for the next three years. It is expected that by 2027, the number of Meituan's flash warehouses will exceed 100,000, and the number of Ele.me's "nearby brand official flagship stores" is also planned to reach 100,000.

JD.com has not yet proposed similar goals, but its pace is also accelerating. Last September, JD.com's instant retail service was uniformly renamed "Hourly Delivery." Then, in May this year, JD.com's instant retail business brand was integrated and upgraded from the original JD Hourly Delivery and JD Daojia to "JD Instant Delivery." The JD App has also opened a primary traffic entry, among other initiatives.

Although there are differences in the progress and models of their major layouts, a commonality among them is that fresh produce categories remain an important part, with dark stores still being the main model, and they are still mainly concentrated in first- and second-tier cities.

Last December, Meituan officially renamed Meituan Maicai to "Xiaoxiang Supermarket," upgrading from a fresh produce e-commerce platform to a full-category retail platform. It currently operates over 680 dark stores; Alibaba's Hema recently restarted the dark store model in Shanghai, and the official response was that "it is neither a new format nor a new model.""However, against the backdrop of the instant retail industry's rapid sprint, their attitudes and actions towards fresh produce categories remain rational and restrained.

LatePost previously reported that in terms of expansion pace, Xiaoxiang Supermarket chose to utilize the existing central warehouse capacity in first-tier cities to expand into surrounding second- and third-tier cities, that is, using existing large warehouses to support more dark stores in lower-tier cities, but would gradually expand under the premise of cost control; Hema is also not aggressive and is still in the pilot stage, hoping to densify its service radius through dark stores; as for JD.com's 7FRESH, it has only recently completed its merger with its first dark store.

It is not difficult to find that, whether it is the concept of fresh produce e-commerce or the concept of instant retail, to this day, it is still difficult to establish a good online-offline connection for fresh produce categories, and model exploration is still ongoing.

However, one notable change is that although dark stores are still used, more and more players realize that to achieve a profitable business model for dark stores in fresh produce categories, it is necessary to reduce the proportion of fresh produce categories –

This is the case with the upgrade of "Meituan Maicai" to Xiaoxiang Supermarket. Sam's Club, which is recognized within the industry for its successful dark store model, also has a fresh produce category proportion of only about 30%.

Based on this, an increasingly clear fact is that in the ideal vision of instant retail's "everything delivered to your doorstep," most categories may be able to densify network points and quickly scale up through open cooperation and low-cost expansion methods such as "flash warehouses." However, this is not the case for fresh produce.

Yet, for any player aiming to capture a larger share of the instant retail pie, abandoning fresh produce is also not feasible because it represents a significant scale and the sinking market that all major companies want to reach. Around 2016, Xu Xin of Capital Today stated, "If we can capture high-frequency supermarkets and then fresh produce, online retail may achieve the 50% market share that Ma Yun mentioned (the proportion of e-commerce in overall retail consumption)."

Now, another opportunity is presented in front of Liu Qiangdong.

However, JD.com obviously needs to accelerate, whether it is instant retail or 7FRESH. When it launched 7FRESH years ago, it was two years slower than Hema; later, when it ventured into community group buying, it was almost slower than everyone else; and even now, it is still not considered fast.