Clustering for Hong Kong IPOs, are ride-hailing companies still profitable?

![]() 11/07 2024

11/07 2024

![]() 573

573

After Didi, the domestic travel industry IPO cooled down for a while. However, there have been new developments in the travel industry this year, with Qichi Travel and Dida Travel successfully listing, and Caocao Travel updating its prospectus on the evening of October 30. Various platforms in the travel industry are flocking to Hong Kong for IPOs.

On October 11, after Tesla's Robotaxi conference, the stock prices of Uber and Lyft, two major ride-hailing giants, surged in response. Recently, Didi Autonomous Driving also announced its latest funding news, completing a C-round financing of approximately $298 million. Didi Autonomous Driving stated that the funds raised will be primarily used to increase investment in autonomous driving technology research and development and accelerate the launch of its first Robotaxi mass production vehicle.

With the momentum of Robotaxi, will autonomous driving become a new capital story for travel industry platforms?

Increasing competition in the travel industry

Nowadays, ride-hailing has become a daily part of people's lives, but it seems increasingly difficult for ride-hailing platforms to make money. Some ride-hailing platforms that have been established for many years are still trapped in the quagmire of losses.

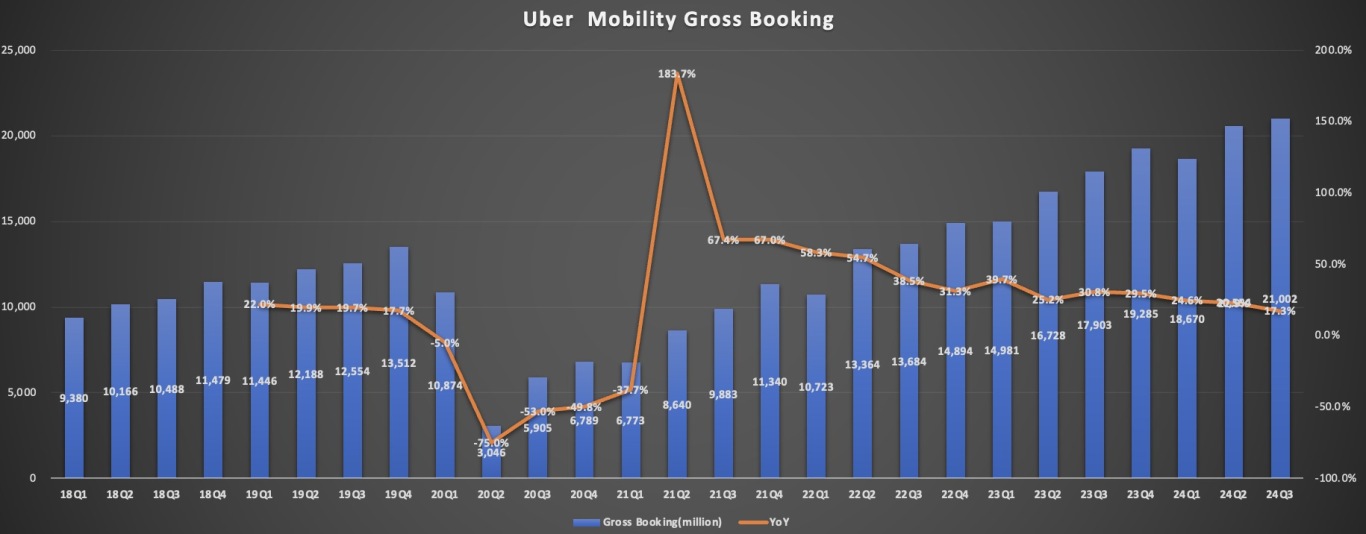

Internationally, Uber and Lyft are currently the two giants in the ride-hailing industry, but their different strategies and businesses lead to entirely different outcomes. Currently, Uber has achieved multi-quarter profitability, while Lyft, after being profitable in the previous quarter, swung back to a loss this quarter.

Financial reports show that Uber's third-quarter revenue was $11.2 billion, a year-on-year increase of 20%, with a net profit of $2.6 billion. In the same period last year, the net profit was $400 million, representing a 157% increase from the previous quarter's $1 billion.

Lyft's third-quarter revenue was $1.52 billion, a year-on-year increase of 31.5%, with a loss of $12.4 million for the quarter.

From the perspectives of revenue scale and profitability, Uber far surpasses Lyft, mainly due to their different revenue structures and strategic positions.

Uber is a globally developing company with business operations in North America, Latin America, Europe, the Middle East, Africa, and Asia-Pacific. Its business consists of ride-sharing, food delivery, freight, and other revenues, achieving diversification. Ride-sharing and food delivery businesses have become the "dual-wheel drive" for Uber's revenue growth.

In contrast, Lyft's revenue is too single-focused and mainly concentrated in North America. However, in Lyft's Q3 earnings report released this morning, the company announced a strategic partnership with DoorDash, offering exclusive discounts to passengers who link their DashPass and Lyft accounts. This may adversely affect Uber, weakening the "unique content" provided by Uber One.

What is the current state of the domestic travel industry?

From the perspective of the domestic travel industry, competition is intensifying. Besides Didi, the domestic travel giant, Gaode Maps has recently launched its ride-sharing service nationwide. The giants cannot let go of the ride-hailing business, and travel platforms in various vertical fields are also accelerating their IPOs. Qichi Travel and Dida Travel have successfully listed, Caocao Travel has also updated its prospectus, and Enjoy Travel CEO Ni Licheng has also stated that Enjoy Travel will prepare and initiate its IPO plan in the second half of 2024.

Domestically, Didi and Dida turned losses into profits last year, while Qichi Travel and Caocao Travel are still incurring losses.

Didi's travel services mainly cover express cars, premium cars, ride-sharing, taxis, etc. In 2023, Didi achieved a total revenue of 192.4 billion yuan, a year-on-year increase of 36.6%, with a net profit of 535 million yuan, marking the first time it achieved a positive annual net profit. In the first half of this year, Didi achieved a total revenue of 99.9 billion yuan, a year-on-year increase of 9%, with a net profit of 600 million yuan, compared to a net loss of 900 million yuan in the same period last year.

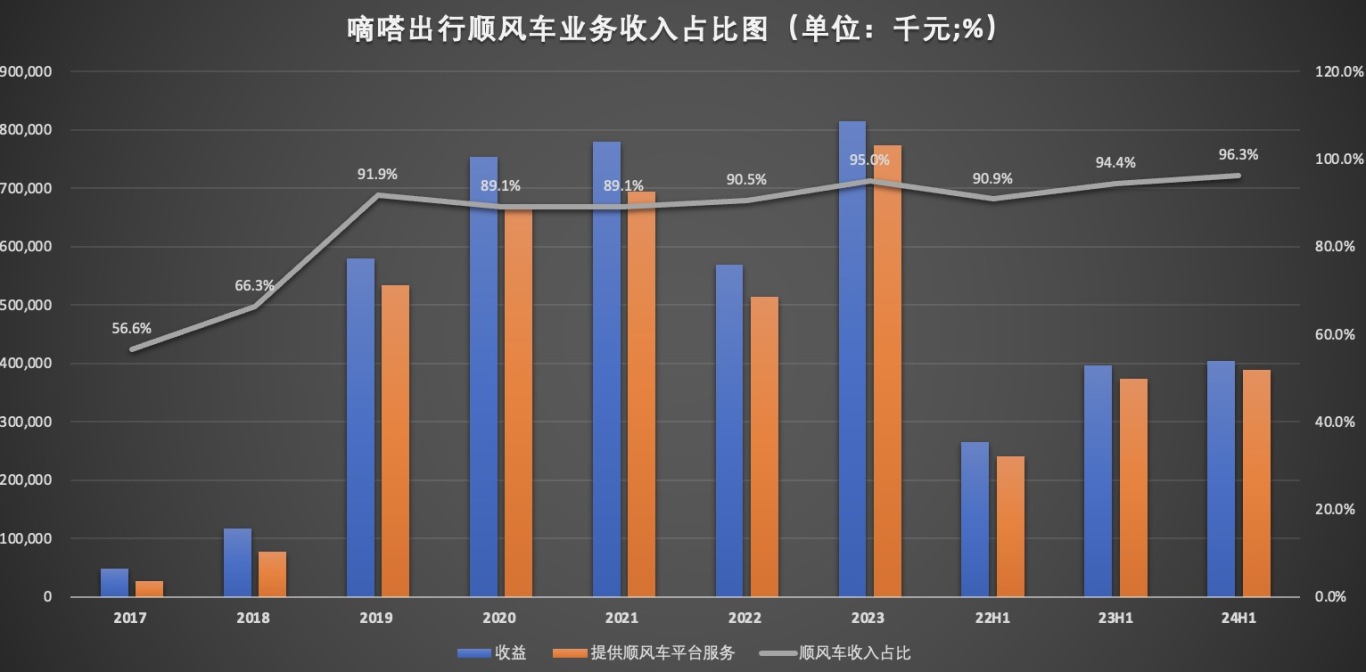

Compared to Didi, Dida's business is relatively single, focusing mainly on ride-sharing. In 2023, Dida achieved a net profit of 300 million yuan. In the first half of this year, Dida achieved a total revenue of 400 million yuan, a year-on-year increase of 2%, with a net profit of 950 million yuan, compared to a net loss of 220 million yuan in the same period last year.

In 2023, Dida generated 770 million yuan in revenue from ride-sharing platform services, contributing 95% of its total revenue. In the first half of this year, revenue from ride-sharing platform services was 390 million yuan, increasing its share of total revenue from 94.4% in the same period last year to 96.3%.

Although both Didi and Dida achieved profitability in 2023, they are not on the same scale. Dida's ability to achieve profitability stems partly from ride-sharing being an asset-light business and partly from cost reduction and efficiency improvement through reduced marketing expenses. In the first half of this year, Dida's sales and marketing expenses were 77.93 million yuan, a 49% decrease from the 150 million yuan in the same period last year.

It should be noted that the ride-sharing business has a relatively small market space. According to Frost & Sullivan's report, in 2022, the market shares (by total transaction value) of taxis, ride-hailing, and ride-sharing in China's passenger transport market were 58.5%, 37.8%, and 3.7%, respectively, with ride-sharing having the smallest share. Dida's ride-sharing business also faces competition from giants like Didi and Gaode, so its future growth potential is very limited.

Dida is also expanding into other businesses, but its development has not met expectations. From 2021 to 2023, Dida's smart taxi business revenue was 32.63 million yuan, 19.42 million yuan, and 11.33 million yuan, respectively, showing negative growth for three consecutive years. Its share of total revenue has also declined annually, from 4.2% in 2021 to 1.4% in 2023. In the first half of this year, smart taxi business revenue decreased by 57% year-on-year, accounting for less than 1% of total revenue.

Looking at advertising and other services, revenue has also declined. Revenue fell from 52.82 million yuan in 2021 to 29.75 million yuan in 2023. In the first half of this year, this revenue further declined by 22% to 11.81 million yuan from 15.04 million yuan in the same period last year, accounting for less than 3% of total revenue compared to 6.8% in 2021.

From the revenue structure perspective, both Qichi Travel and Caocao Travel's revenues come from travel services.

The prospectus shows that from 2021 to 2023, Caocao Travel achieved revenues of 7.15 billion yuan, 7.63 billion yuan, and 10.67 billion yuan, respectively, with travel service revenue accounting for 96.3%, 97.9%, and 96.6% of the company's total revenue, respectively. In the first half of this year, Caocao Travel achieved a revenue of 6.16 billion yuan, with travel service revenue accounting for 93.2% of total revenue.

From 2021 to 2023, Qichi Travel achieved revenues of 1.01 billion yuan, 1.37 billion yuan, and 2.16 billion yuan, respectively, with revenue from travel services accounting for 99.9%, 91.3%, and 84.0% of total revenue, respectively. In the first half of this year, Qichi Travel achieved a revenue of 1.04 billion yuan, with travel service revenue accounting for 84.8% of total revenue.

Currently, both Qichi Travel and Caocao Travel are still incurring losses. From the data disclosed by Caocao Travel, the losses are continuously narrowing. From 2021 to 2023, Caocao Travel incurred a cumulative loss of nearly 7 billion yuan. In the first half of this year, Caocao Travel lost 780 million yuan, a significant narrowing compared to the 1.27 billion yuan loss in the same period last year.

In contrast, there is no significant narrowing of losses for Qichi Travel. From 2021 to 2023, Qichi Travel incurred a cumulative loss of 2 billion yuan. In the first half of this year, Qichi Travel lost 330 million yuan, not much different from the 340 million yuan loss in the same period last year.

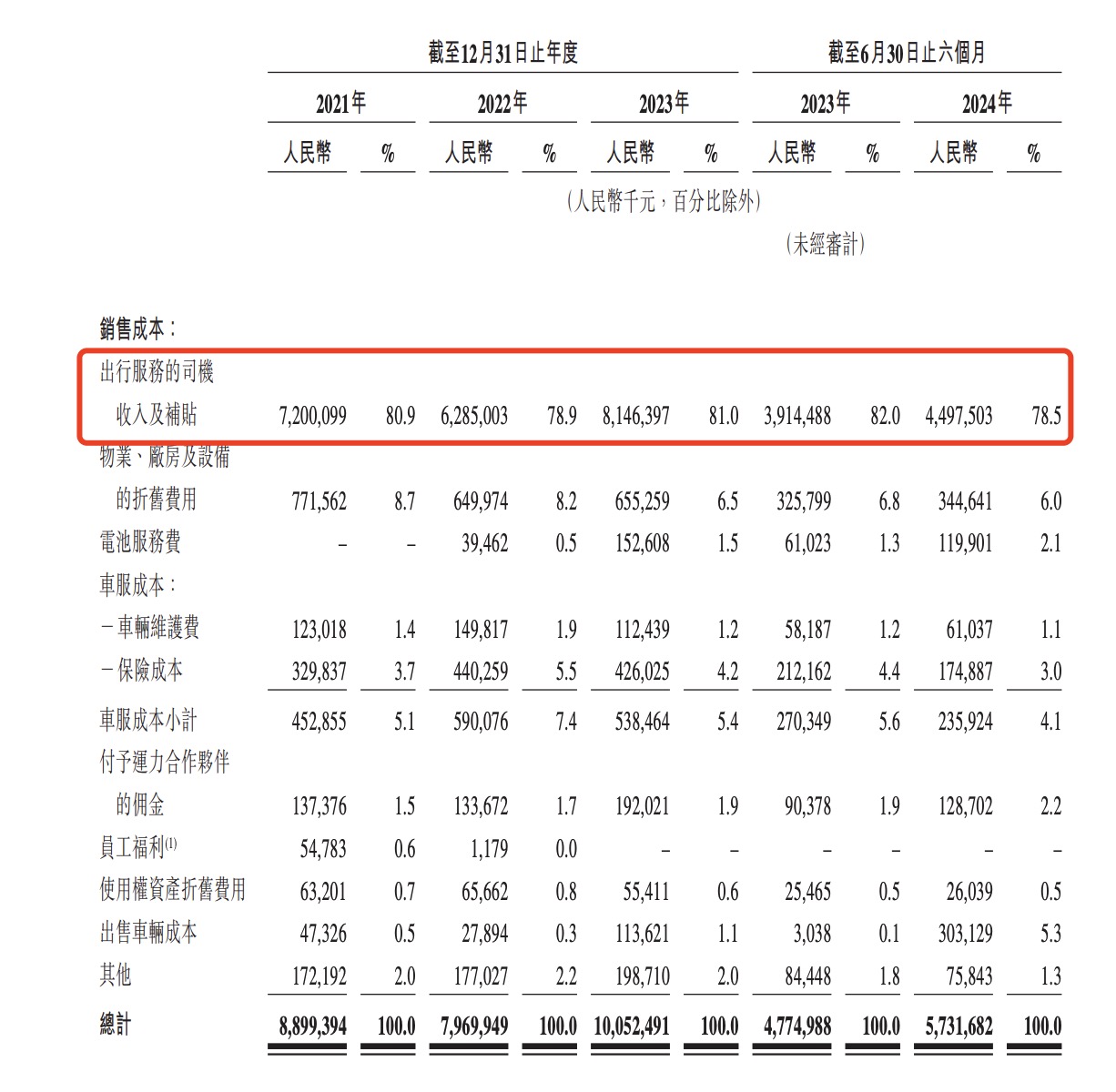

Behind the continuous losses of Qichi Travel and Caocao Travel lies the high cost of payments to drivers. Taking Caocao Travel as an example, its sales costs include driver income and subsidies for travel services, depreciation expenses, vehicle service costs, and commissions paid to transport capacity partners.

The prospectus shows that from 2021 to 2023, Caocao Travel's sales costs were 8.9 billion yuan, 7.97 billion yuan, and 10.05 billion yuan, respectively. The data for 2021 and 2022 exceeded the total revenue for those years, with 2023 accounting for approximately 94.2% of revenue. Sales costs in the first half of this year increased by 20% year-on-year to 5.73 billion yuan.

The largest portion of Caocao Travel's sales costs is driver income and subsidies for travel services. This expense was 4.5 billion yuan in the first half of this year, compared to 3.9 billion yuan in the same period last year. From 2021 to 2023, these expenses were 7.2 billion yuan, 6.29 billion yuan, and 8.15 billion yuan, respectively, accounting for about 80% of total sales costs.

It is becoming increasingly difficult for ride-hailing platforms to make money

It is becoming increasingly difficult for ride-hailing platforms to make money. On the one hand, industry competition is intensifying, and order volume is facing the challenge of slowing growth, indicating limited upside potential for the scale of ride-hailing orders.

In its third-quarter report, Uber stated that its ride-hailing order volume was lower than expected and provided a moderate level budget for holiday season performance, leading to a significant drop in its stock price. Behind this is the slowdown in order growth for its core ride-hailing business.

On the other hand, domestic ride-hailing platforms have become saturated. Under existing competition, mid-tier and lower ride-hailing platforms need to rely on third-party aggregation platforms to acquire customers. This means that the commission costs that ride-hailing platforms need to pay to third-party aggregation platforms will continue to increase.

Taking Caocao Travel as an example, from 2021 to 2023, the commissions paid by Caocao Travel to third-party aggregation platforms were 270 million yuan, 320 million yuan, and 670 million yuan, respectively, accounting for an increasing proportion of sales and marketing expenses from 54.7% to 79.7%. This expenditure continued to increase in the first half of this year, rising from 300 million yuan in the same period last year to 430 million yuan this year, setting a new high proportion of sales and marketing expenses at 83.6%.

The combined service fees paid to drivers and third-party aggregation platforms are continuously compressing the profit margins of platforms like Caocao Travel, posing significant challenges for these platforms to turn losses into profits.

Is autonomous driving the new solution for the travel industry?

The "fire" of Robotaxi has spread to the travel industry.

On October 11, after Tesla's Robotaxi conference, the stock prices of Uber and Lyft, two major ride-hailing giants, surged in response. However, Tesla stated that the company plans to launch ride-hailing services in California and Texas next year, and Uber's stock price has since fallen by about 15%.

Uber's collaboration with Waymo continues to grow, and they will launch their first joint service in Atlanta and Austin, Texas, next year.

Today, Lyft announced partnerships with autonomous driving companies such as Mobileye, May Mobility, and Nexar. Lyft's EVP Jeremy Bird stated, "In Atlanta, passengers will soon find it as simple and intuitive to ride in autonomous vehicles with May Mobility as using other Lyft modes. At Lyft, we make it easy for partners to integrate their resources into our network and fully utilize our market engine."

Domestically, Didi Autonomous Driving announced the completion of a C-round financing totaling $298 million. This round of financing was led by GAC Group, with Didi participating. Didi Autonomous Driving stated that the funds raised will be primarily used to increase investment in autonomous driving technology research and development and accelerate the launch of its first Robotaxi mass production vehicle.

Currently, perceptions of autonomous driving are polarized. The story of autonomous driving is not as straightforward as it seems.

Autonomous driving companies are plagued by profitability issues. Before achieving large-scale commercialization, autonomous driving companies require huge investments in technology research and development. "Burning money" is the key reason why autonomous driving companies struggle to achieve profitability.

Currently, the primary market's enthusiasm for autonomous driving has cooled, and many listed autonomous driving companies are also performing poorly. TuSimple, the global "first autonomous driving stock," listed on Nasdaq in April 2021, delisted on January 17, 2024.

Aurora, once the "global first Robotaxi stock," is now deeply trapped in a "dilemma" of zero revenue and widening net losses. In 2023, Aurora recorded zero revenue for the entire year and a net loss of $796 million. In the first two quarters of this year, Aurora still reported no revenue, with a loss of $165 million and a loss per share of 11 cents in the first quarter and a loss of $182 million and a loss per share of 12 cents in the second quarter.

Domestic autonomous driving companies such as Pony.ai and WeRide are also incurring losses. The autonomous driving industry is still in its early stages of development, with technology and business models not yet fully mature. There may be some valuation bubbles for autonomous driving companies in the market.

Amid macroeconomic fluctuations and insufficient confidence in the capital market, companies in any industry face the challenge of relying on their own cash flow generation capabilities to survive. Autonomous driving companies are no exception. After going public, companies face shareholder expectations for profitability and market pressure. If a company is overvalued at the time of its IPO and subsequent performance fails to support this valuation, it may lead to a decline in share price, causing losses for investors and adversely affecting the company's development.

Currently, players in the autonomous driving field are technology giants such as Tesla, Google, and Baidu, who have invested heavily and continuously in research and development. With travel platforms facing challenges in achieving their own profitability, deploying autonomous driving does not seem to be an easy task, with obvious shortcomings in funding. When both upstream and downstream companies in autonomous driving are overvalued, the story of autonomous driving told by travel platforms seems even more " chicken ribs " (a Chinese idiom meaning something of little value or use).

Perhaps the ultimate outcome of the autonomous driving story for travel industry platforms is to become the main aggregator of demand for autonomous driving companies, with their inherent value being lower than that of autonomous driving car companies.